Cross-Border Taxation Documents

Cross-Border Taxation

Pelaporan SPT Tahunan PPh OP 1770 via e-Form

This file contains important information and instructions for the annual tax reporting for individual taxpayers via e-Form. It provides guidelines on filling out the 1770 tax form and its requirements. Users can utilize this document to ensure accurate and timely submission of their tax obligations.

Cross-Border Taxation

ACES GST Integration Registration Process

This document outlines the step-by-step procedure for new Central Excise taxpayers to register in the Integrated CBIC-GST Taxpayer Portal. Detailed instructions help to ensure successful registration and compliance. The integration simplifies the taxpayer experience with Central Excise and GST functionalities.

Cross-Border Taxation

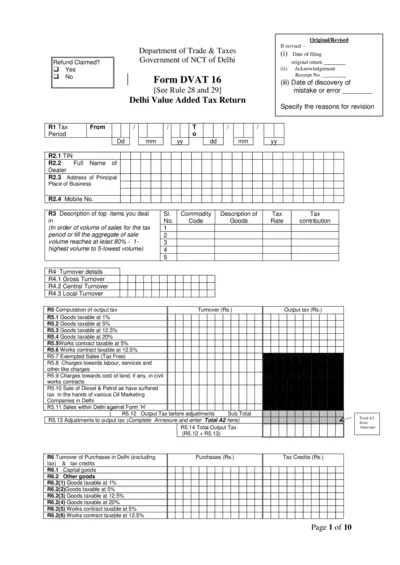

Delhi Value Added Tax Return Form DVAT 16

The DVAT 16 form is essential for dealers in Delhi to file their Value Added Tax returns. It facilitates the reporting of sales, purchases and tax credits. Accurate completion is required for compliance with the Department of Trade and Taxes.

Cross-Border Taxation

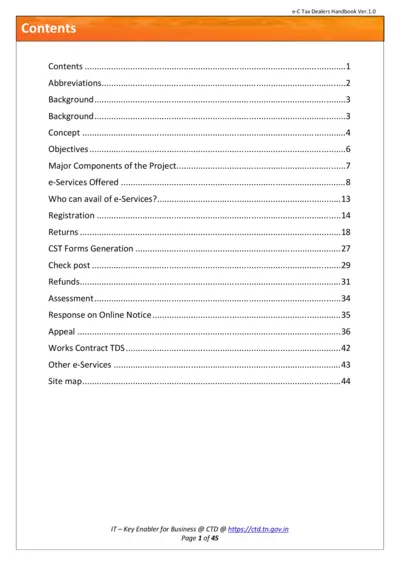

e-C Tax Dealers Handbook Ver.1.0 - Complete Guide

This comprehensive handbook offers detailed instructions and guidelines for e-C Tax operations in Tamil Nadu. Ideal for dealers needing to understand procedures and compliance. Stay updated with the latest regulations and e-services provided by the Commercial Taxes Department.

Cross-Border Taxation

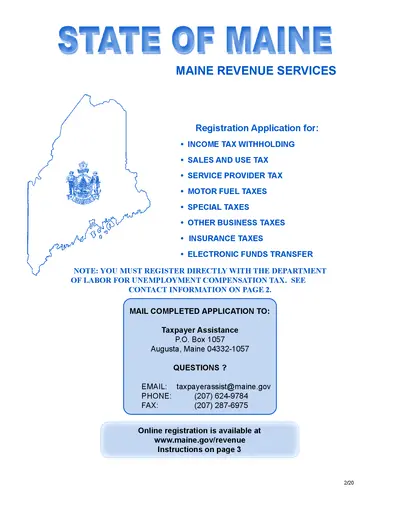

Maine Revenue Services Registration Application

This file is a registration application for various tax accounts including income tax withholding and sales tax in Maine. It provides essential information and instructions for businesses needing to register for specific taxes. Users can find contact details and online registration options within this document.

Cross-Border Taxation

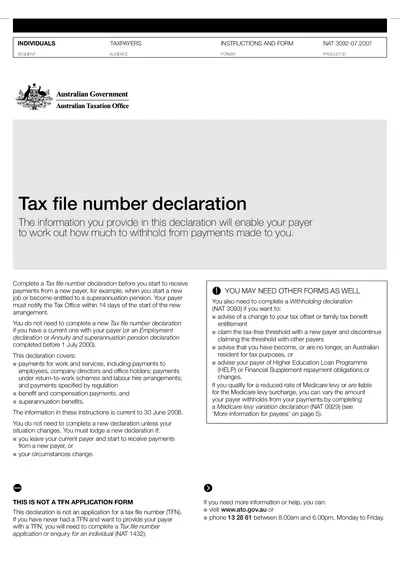

Tax File Number Declaration Instructions

This file provides essential instructions for completing a Tax File Number (TFN) declaration. It outlines who needs the form and how to properly fill it out. Users can ensure correct tax withholding by following the guidelines provided.

Cross-Border Taxation

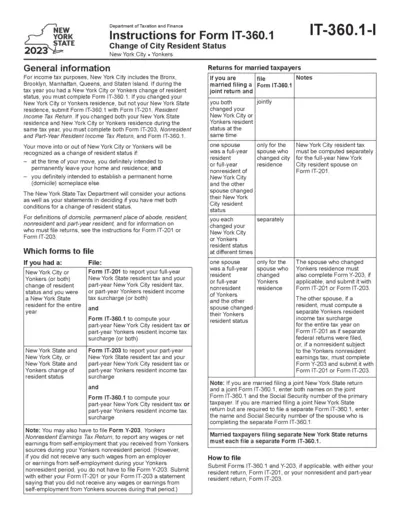

NYC and Yonkers Change of Resident Status Instructions

This file provides step-by-step instructions for completing Form IT-360.1 for New York City and Yonkers change of resident status for tax purposes. It includes essential guidance on necessary forms, eligibility, and filing procedures. Ideal for taxpayers navigating residency status changes in NYC or Yonkers.

Cross-Border Taxation

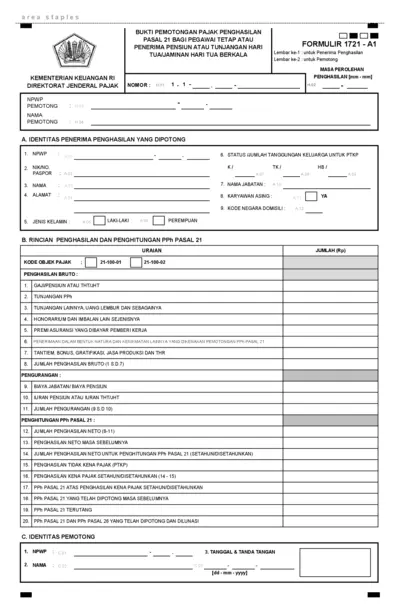

Bukti Pemotongan Pajak Penghasilan Pasal 21

This file contains essential information regarding income tax withholding as specified in Article 21. It is intended for employees, pension recipients, and relevant authorities. Proper completion of this form ensures compliance with tax regulations.

Cross-Border Taxation

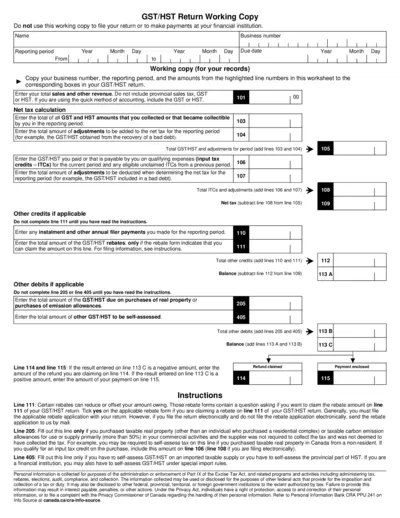

GST/HST Return Working Copy Instructions

This document serves as a working copy for filling out the GST/HST return. It provides essential details and instructions for accurately reporting your sales tax. Ensure you review the highlighted sections for correct entries.

Cross-Border Taxation

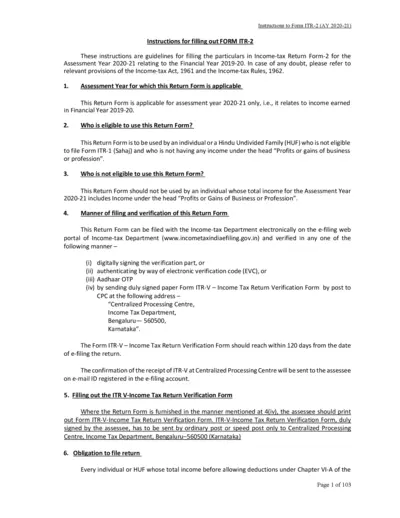

Instructions for ITR-2 Filing AY 2020-21

This file provides comprehensive guidelines for filling out the Income-tax Return Form ITR-2 for the Assessment Year 2020-21. It includes eligibility criteria, filing procedures, and essential details. Perfect for individuals and Hindu Undivided Families navigating the ITR-2 form.

Cross-Border Taxation

Instructions for Form 1042-S - IRS Guidelines

The Instructions for Form 1042-S provide essential information for reporting U.S. source income for foreign persons. This file outlines the necessary steps and requirements for filing the form accurately. It is a crucial resource for withholding agents and tax practitioners dealing with international income.

Cross-Border Taxation

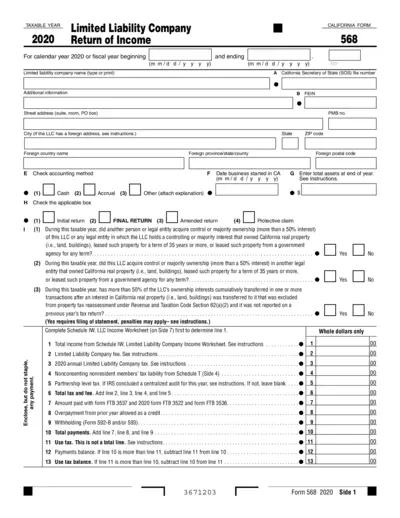

California Form 568 LLC Return of Income 2020

The California Form 568 is utilized by limited liability companies to report their income and taxes. It is essential for compliance with state tax regulations and ensuring accurate income reporting. This form is required for both calendar and fiscal year filings.