Cross-Border Taxation Documents

Cross-Border Taxation

Minnesota Property Tax Refund Instructions

This document provides essential information regarding the Minnesota Property Tax Refund programs available for homeowners and renters. It outlines eligibility requirements and application processes. Users can find crucial details to ensure they claim their refunds accurately.

Cross-Border Taxation

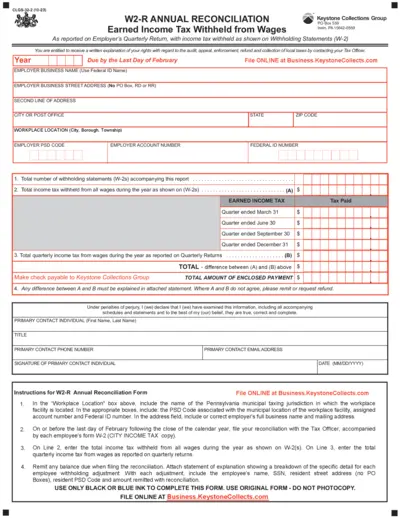

W2-R Annual Reconciliation Form Instructions

The W2-R Annual Reconciliation form is essential for employers to report earned income tax withheld from wages. It is used to reconcile annual income taxes and ensure compliance with local tax regulations. Employers must submit this form by the last day of February following the close of the calendar year.

Cross-Border Taxation

Tax Withholding and Reporting Enhancements

This file provides an in-depth analysis of improvements needed for tax withholding and reporting processes. It outlines significant taxpayer challenges and legislative recommendations. A valuable resource for taxpayers and legislators alike.

Cross-Border Taxation

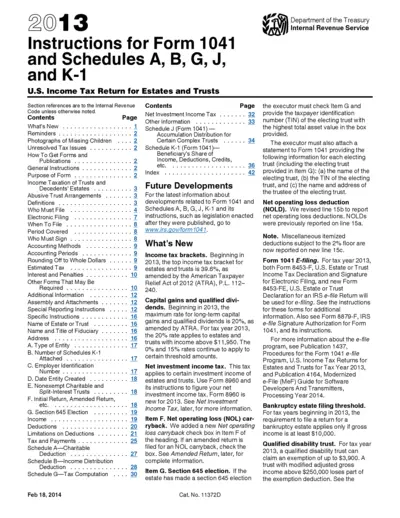

2013 Form 1041 Instructions for Trusts and Estates

This file provides detailed instructions for filling out Form 1041, the U.S. Income Tax Return for Estates and Trusts. It includes information on necessary schedules, filing requirements, and important updates for the tax year 2013. Ideal for fiduciaries managing estates or trusts needing clarity on their tax obligations.

Cross-Border Taxation

2012 Year-End Client Guide for RUN Powered by ADP

The 2012 Year-End Client Guide provides essential information and key dates to help clients using RUN Powered by ADP with their year-end payroll and tax filing tasks. This comprehensive guide is essential for ensuring compliance and a smooth year-end process. It is designed for new and returning users to navigate their year-end obligations effectively.

Cross-Border Taxation

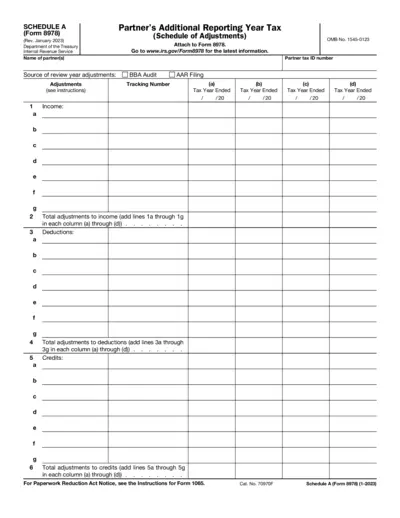

Schedule A Form 8978 Instructions and Overview

This file contains the instructions for Schedule A of Form 8978. It's essential for partners reporting additional tax information. Use this guidance to ensure accurate tax filing and compliance.

Cross-Border Taxation

EU VAT Refund eLearning Module

This eLearning module provides comprehensive guidance on VAT refund procedures for taxable persons in the EU. It is an essential resource for understanding the provisions outlined in the VAT Directive. Gain knowledge about deadlines and responsibilities in the refund process.

Cross-Border Taxation

IRS Relief for Late Entity Classification Elections

This document provides guidance for eligible entities seeking relief for late entity classification elections with the IRS. It outlines the procedures, requirements, and relevant sections required for filing. Users will find valuable information for tax-related classifications.

Cross-Border Taxation

Understanding Philippine Withholding Tax Compliance

This document provides essential information on withholding tax requirements in the Philippines. It outlines necessary forms, compliance guidelines, and deadlines to help individuals and companies meet their tax obligations. Learn how to streamline your withholding tax processes efficiently.

Cross-Border Taxation

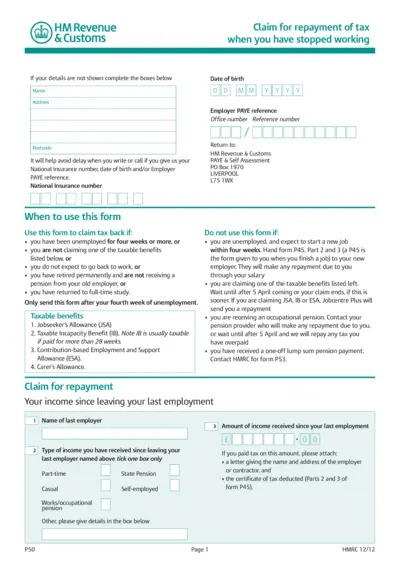

Claim Tax Back Form - HM Revenue and Customs

This form is used to claim tax back through HM Revenue & Customs. If you've been unemployed for four weeks or more, or do not receive certain taxable benefits, this form aids in requesting a tax refund. Ensure to complete it accurately to facilitate the processing of your claim.

Cross-Border Taxation

Instructions for Form SS-4: EIN Application Guide

This file provides detailed instructions on applying for an Employer Identification Number (EIN). It is essential for businesses, trusts, estates, and various entities for tax purposes. Follow the guidelines accurately to establish your business tax account.

Cross-Border Taxation

TRACES TDS Reconciliation Analysis System Guide

This file provides detailed instructions for using the TRACES system for TDS reconciliation. It is designed for both deductors and taxpayers to streamline the process. Access essential information about submission and corrections within this document.