International Tax Documents

Cross-Border Taxation

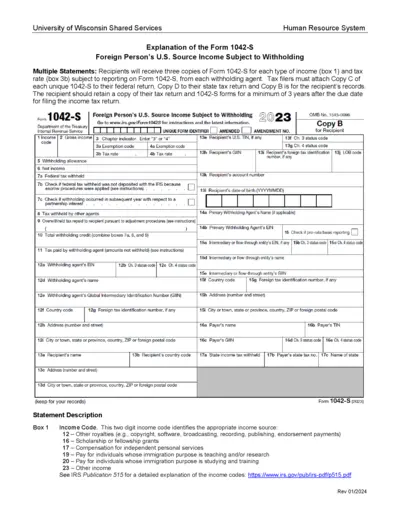

Wisconsin 1042-S Form Instructions for Foreign Income

This document provides crucial information on Form 1042-S for foreign persons receiving U.S. source income. It includes details on how to fill out the form, as well as guidelines for tax submission. Essential for non-resident aliens and other foreign entities to ensure tax compliance in the U.S.

Cross-Border Taxation

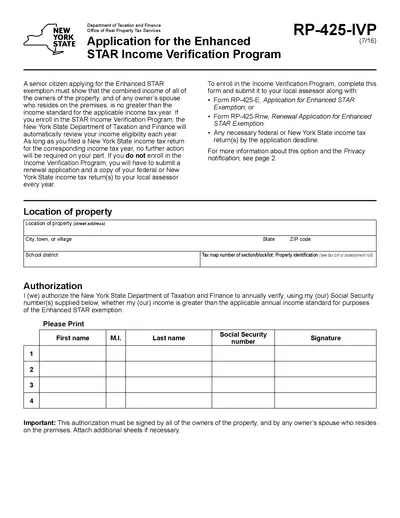

Enhanced STAR Income Verification Program Application

This file contains the application for the Enhanced STAR Income Verification Program in New York State. It details the eligibility criteria and necessary documents for senior citizens applying for tax exemptions. The file also provides instructions on how to fill out and submit the application.

Cross-Border Taxation

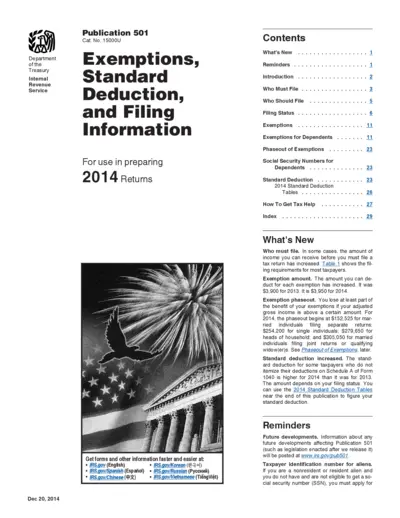

IRS Publication 501 Exemptions Standard Deduction

IRS Publication 501 provides essential details on exemptions, standard deductions, and filing information for the 2014 tax year. This guide is important for taxpayers to understand their filing requirements and benefits. Access crucial IRS resources and information to simplify your tax preparation process.

Cross-Border Taxation

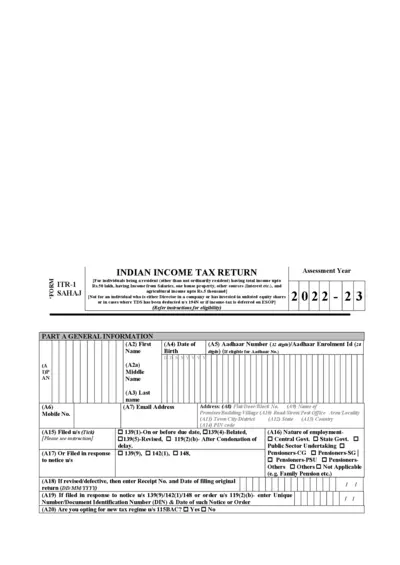

ITR-1 SAHAJ Income Tax Return Form 2022-2023

The ITR-1 SAHAJ is a simplified Income Tax Return form for Indian residents with total income up to Rs. 50 lakh. This form is designed for individuals earning income from salaries, one house property, and other sources like interest. Use this form to comply with tax filing requirements for the assessment year 2022-2023.

Cross-Border Taxation

TRRA Portal User Guide for Taxpayer Registration

The TRRA Portal User Guide provides essential instructions for taxpayers seeking to register or update their information. This guide covers the submission of applications electronically via email. Users will find detailed transactions and access instructions to navigate the TRRA Portal efficiently.

Cross-Border Taxation

Instructions for Application for Refund Sales Use Tax

This file provides detailed instructions for filing a refund application for sales and use tax in Florida. It outlines eligibility criteria, required documentation, and common refund claims. Users can find essential information to ensure a successful refund application process.

Cross-Border Taxation

Combined Business Tax Registration Application

This file serves as the official Combined Business Tax Registration Application for the District of Columbia. It includes necessary instructions and forms for various tax registrations. Businesses seeking to register in D.C. should utilize this comprehensive document for compliance.

Cross-Border Taxation

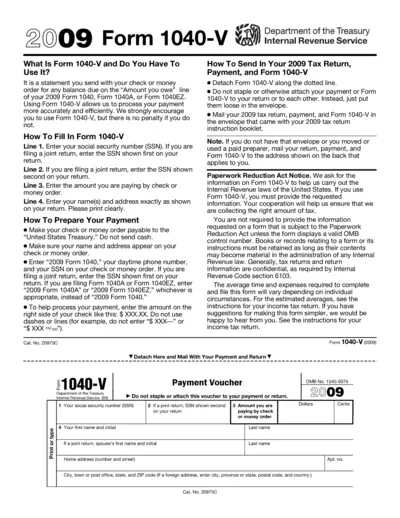

2009 Form 1040-V Instructions and Details

Form 1040-V helps you send your payment to the IRS alongside your tax return. This file contains necessary steps and information for correctly filing your 2009 taxes. Ensure that you follow the instructions to avoid payment processing delays.

Cross-Border Taxation

New York City Parking Tax Exemption for Residents

This document provides detailed information on the New York City Parking Tax Exemption for Manhattan residents. It outlines criteria, procedures, and eligibility requirements for obtaining the exemption. It is crucial for residents seeking tax relief on parking services within Manhattan.

Cross-Border Taxation

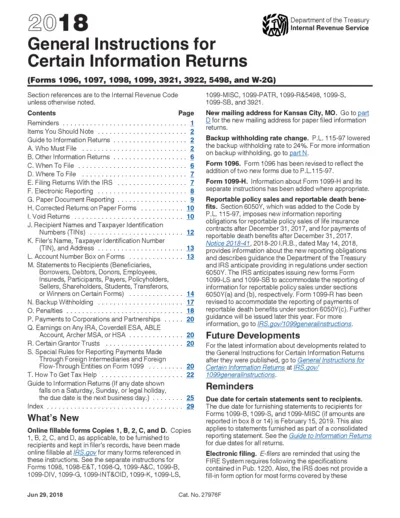

General Instructions for Information Returns 2018

This file provides essential guidelines for completing various IRS information return forms, including 1096 and 1099 series. It's crucial for filers to understand the requirements and due dates to ensure compliance with tax obligations. The instructions help navigate the complexities of U.S. tax reporting.

Cross-Border Taxation

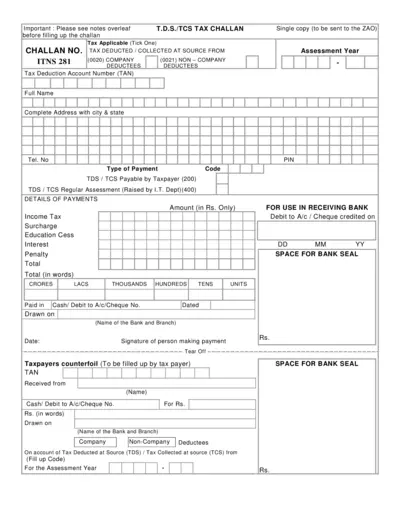

TDS/TCS Tax Challan Payment Instructions

This file contains essential instructions for filling out the TDS/TCS tax challan. It includes details on tax applicable, payment types, and important fields. Users can refer to this document for guidelines to ensure accurate submissions.

Cross-Border Taxation

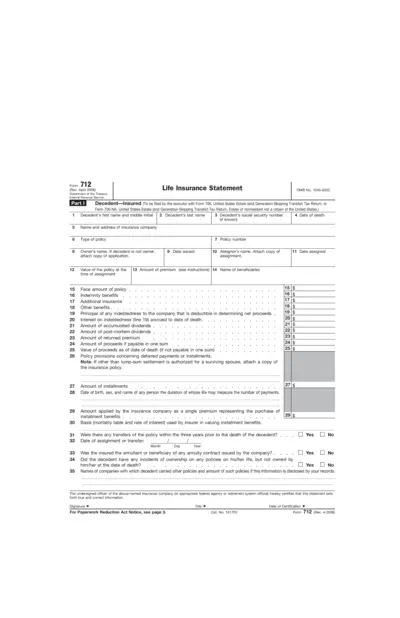

Life Insurance Statement Form 712 - IRS Guidelines

Form 712 is essential for reporting life insurance policies for estate tax purposes. Executors of estates must file this form with Form 706 or 706-NA. This form collects vital information about the insured's policies and is crucial for accurate tax assessments.