International Tax Documents

Cross-Border Taxation

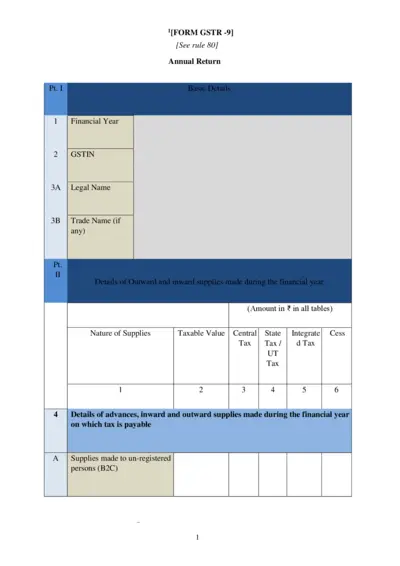

GSTR-9 Annual Return Filing Guide

The GSTR-9 is an annual return that aggregates all the data from GSTR-1 and GSTR-3B. This comprehensive guide will help users navigate through the form easily. Understand the components, instructions, and submission processes to ensure compliance.

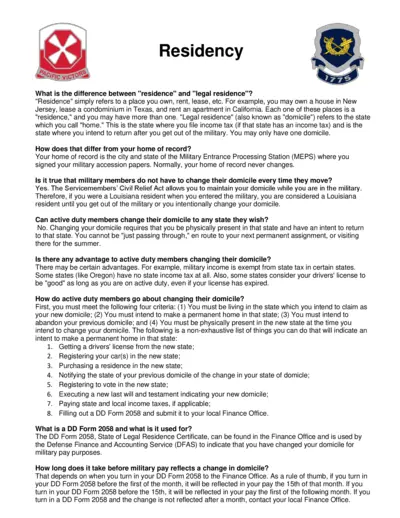

Tax Residency

Understanding Residency and Legal Residence for Military

This document provides key insights about residence and legal residence for military members. It outlines essential information about domicile and related processes. Ideal for service members seeking clarity on residency regulations.

Cross-Border Taxation

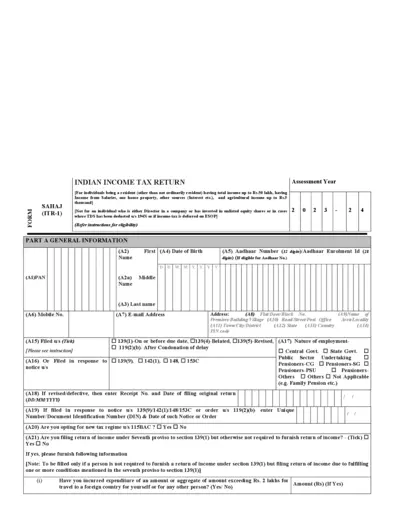

Indian Income Tax Return ITR-1 Form Overview

The ITR-1 form is specifically designed for individuals with a total income up to Rs.50 lakh. It includes income from salaries, one house property, and other sources like interest. Use this form to ensure accurate and timely filing of your income tax return.

Cross-Border Taxation

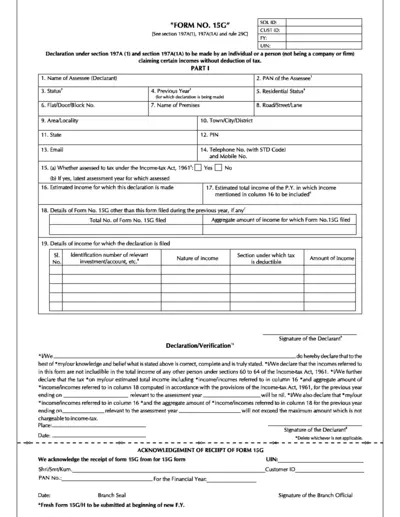

Form No 15G Declaration for Income-Tax Exemption

This file is a Form No. 15G declaration for individuals claiming certain incomes without tax deduction. It provides essential sections for filling out personal information, estimated income, and declarations related to tax. Use this form to submit income declarations to avoid tax deductions on certain incomes.

Cross-Border Taxation

2024 Texas Franchise Tax Electronic Filing Guide

This comprehensive guide offers detailed instructions on how to navigate the Texas Franchise Tax electronic filing system. It is designed for businesses and individuals who need to file their franchise taxes efficiently. In this manual, users will find everything from registration to submission processes.

Cross-Border Taxation

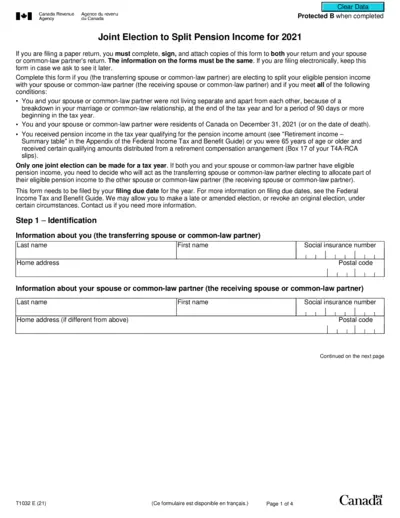

Joint Election to Split Pension Income for 2021

This form is used to elect to split pension income between spouses for tax purposes in Canada. It is essential for couples wanting to optimize their tax benefits related to pension income. Ensure completion and submission according to outlined guidelines.

Cross-Border Taxation

Alabama Form 40A Short Return Instructions

This file provides essential instructions for filling out the Alabama Form 40A for full-year residents. It details pertinent information for tax reporting and compliance. Users will find guidelines on submissions, deadlines, and required forms for the tax year.

Cross-Border Taxation

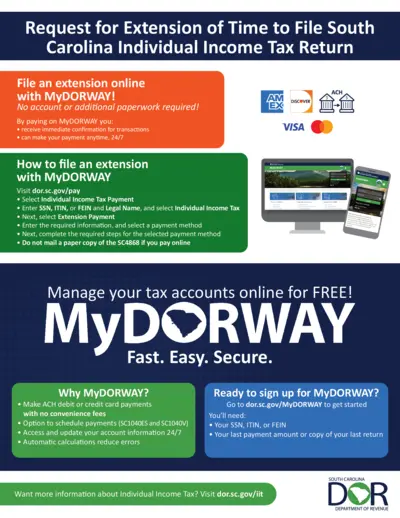

Request for Extension of Time for SC Income Tax Return

This form allows South Carolina taxpayers to request an extension for filing their Individual Income Tax Returns. Using MyDORWAY, users can easily submit their extension request online without additional paperwork. Ensure timely payments to avoid penalties and maintain compliance.

Cross-Border Taxation

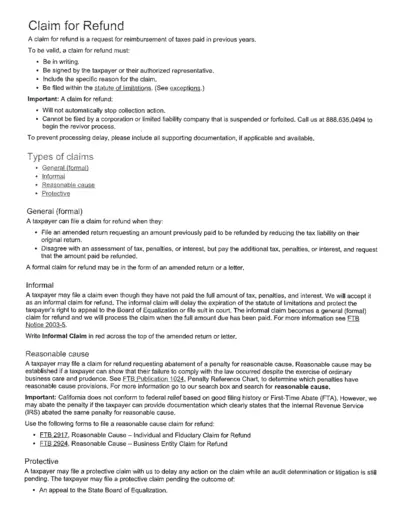

Claim for Refund Instructions and Guidelines

This file contains important information about filing a claim for refund on previously paid taxes. It outlines the requirements, types of claims, and instructions to successfully submit your request. Users can utilize this resource to understand the process and necessary steps for tax reimbursement.

Cross-Border Taxation

New York State STAR Credit Registration Instructions

This document provides essential information on registering for the STAR Credit in New York State. It includes details about eligibility, registration process, and required documentation. Homeowners can learn how to receive their STAR savings through this guide.

Cross-Border Taxation

New York State 2018 Estimated Tax Payment Instructions

This document provides detailed instructions for filling out the New York State Estimated Tax Payment Voucher Form IT-2105 for individuals. It includes important updates for 2018 tax rates and payment deadlines. Ensure compliance with both state and local tax obligations with these guidelines.

Cross-Border Taxation

Nebraska Individual Income Tax Booklet 2022

This file provides essential information and instructions for Nebraska individual income taxes for 2022. It includes details on e-filing, eligibility, and new tax credits. Use this guide to ensure accurate and timely tax filing.