International Tax Documents

Cross-Border Taxation

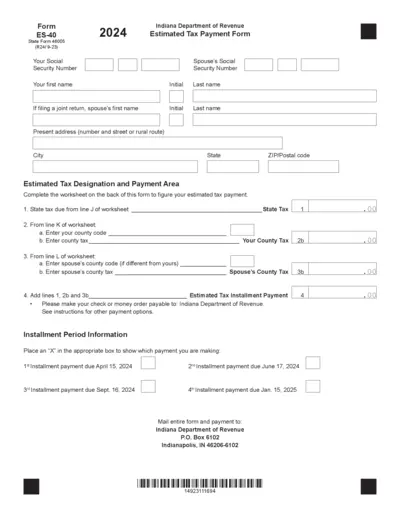

Indiana Estimated Tax Payment Form ES-40 2024

The Indiana Estimated Tax Payment Form ES-40 is designed for individuals who need to pay their estimated state income taxes. This form allows taxpayers to submit their tax installment payments to the Indiana Department of Revenue. Ensure you follow the provided instructions for accurate completion and timely submission.

Cross-Border Taxation

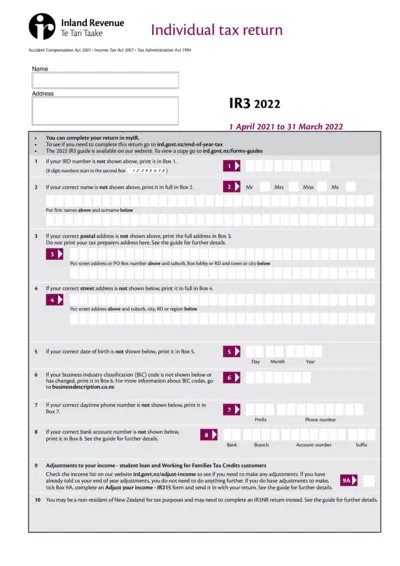

Individual Tax Return Instructions - IR3 2022

This file provides comprehensive details regarding the IR3 individual tax return in New Zealand. It includes instructions for completing the return and important information regarding tax obligations. This document is essential for residents needing to report income and calculate their taxes for the 2022 tax year.

Cross-Border Taxation

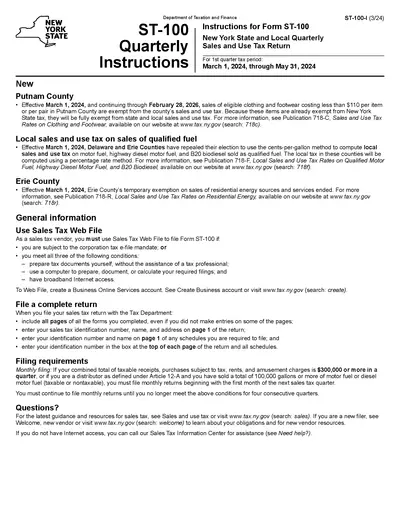

New York State ST-100 Quarterly Sales Tax Instructions

The ST-100 file provides instructions for New York State and local quarterly sales tax returns. This guide includes important information about filing requirements, deadlines, and exemptions for eligible clothing and footgear. Ensure compliance by following the outlined procedures to avoid penalties and fines.

Cross-Border Taxation

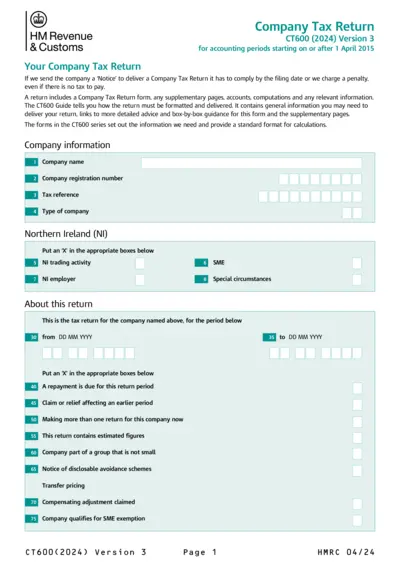

HM Revenue and Customs CT600 Company Tax Return 2024

The HM Revenue and Customs CT600 Company Tax Return form is essential for companies filing their tax returns. It includes guidelines for submission and important financial information. Ensure compliance to avoid penalties.

Cross-Border Taxation

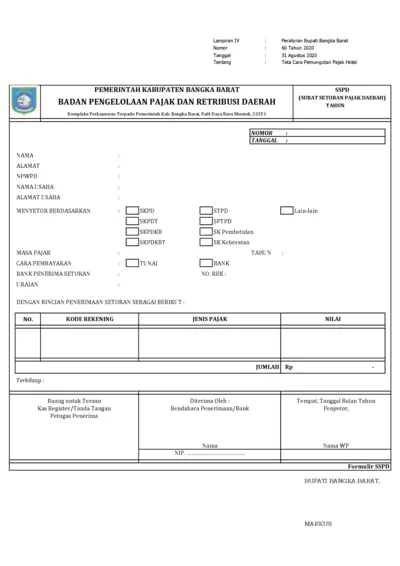

Tata Cara Pemungutan Pajak Hotel

This file provides the regulations and procedures for hotel tax collection in Bangka Barat. It is essential for business owners in the hospitality industry. Use this document to ensure compliance with local tax laws.

Cross-Border Taxation

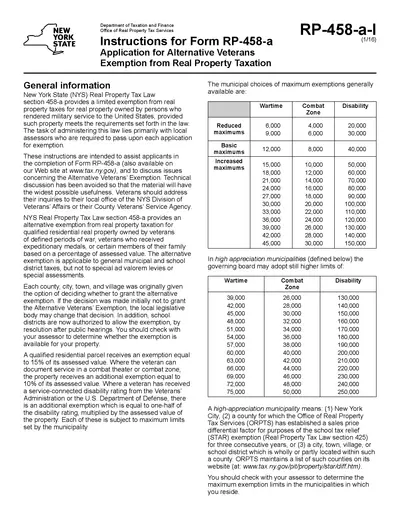

New York State's Alternative Veterans Exemption Guide

This document provides essential instructions and guidelines for veterans applying for the Alternative Veterans Exemption in New York State. It outlines eligibility criteria, application procedures, and important deadlines. Veterans and their families will find crucial information to help them navigate the exemption process effectively.

Cross-Border Taxation

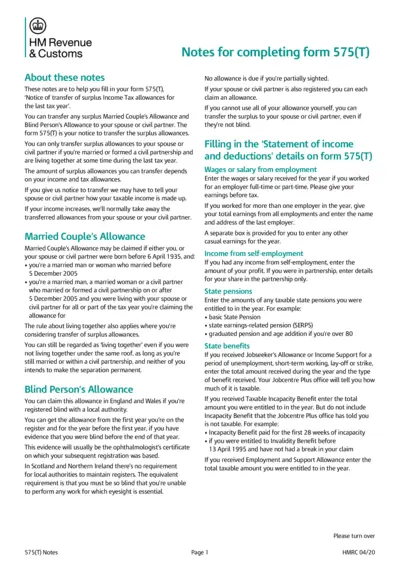

Form 575T Guidance for Income Tax Allowances

Form 575(T) provides the necessary guidance for transferring surplus Income Tax allowances. It outlines the eligibility criteria and instructions for completion. This form is essential for married couples and civil partners looking to manage their tax allowances effectively.

Cross-Border Taxation

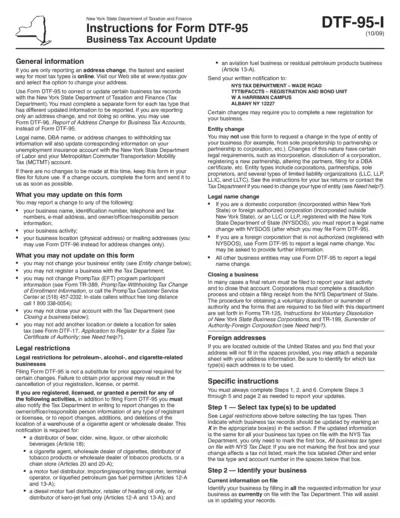

New York State Tax Business Account Update Instructions

This document provides essential instructions for updating your business tax account with the New York State Department of Taxation and Finance. It guides users on how to correctly fill out Form DTF-95 for various updates. Follow the steps outlined to ensure accurate submission and compliance.

Cross-Border Taxation

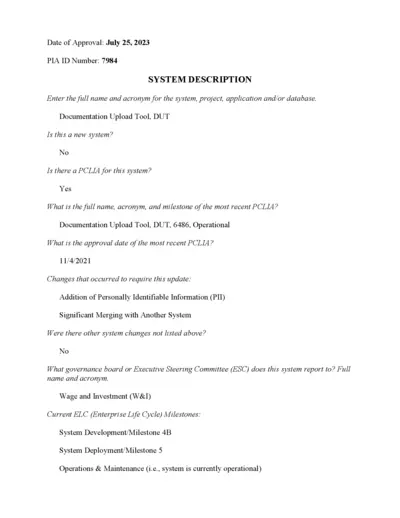

Documentation Upload Tool User Instructions

This document provides details about the Documentation Upload Tool (DUT) system. It explains how to navigate and utilize the file effectively. Users will find important information about the system's function and submission guidelines.

Cross-Border Taxation

IRS Tax Publications Employee vs Independent Contractor

This file provides important distinctions between employees and independent contractors for federal tax purposes. It outlines classification criteria affecting taxes and benefits. Use this brochure to determine your work status.

Cross-Border Taxation

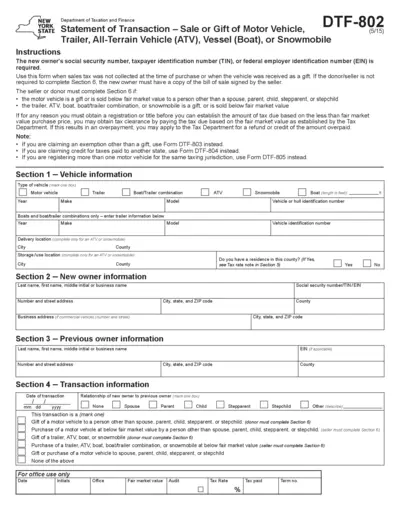

NY State Motor Vehicle Sale or Gift Transaction Form

This form is required for the sale or gift of motor vehicles in New York State. It captures essential information like the new owner's details, the previous owner, and transaction information. Ensure to complete all necessary sections to avoid delays.

Cross-Border Taxation

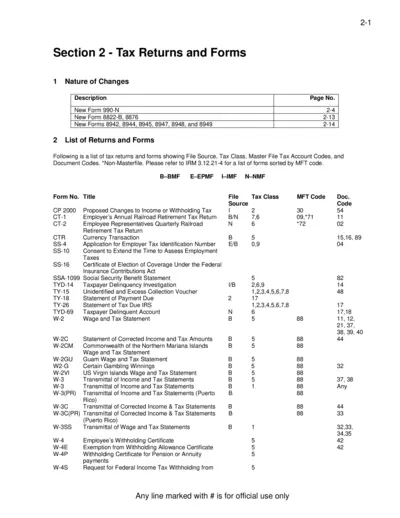

Tax Returns and Forms Overview 2024

This file contains critical information on various tax returns and forms required for compliance in 2024. It provides detailed descriptions of new forms and changes to existing ones. Users can refer to this file for understanding the necessary documentation for tax filing.