International Tax Documents

Cross-Border Taxation

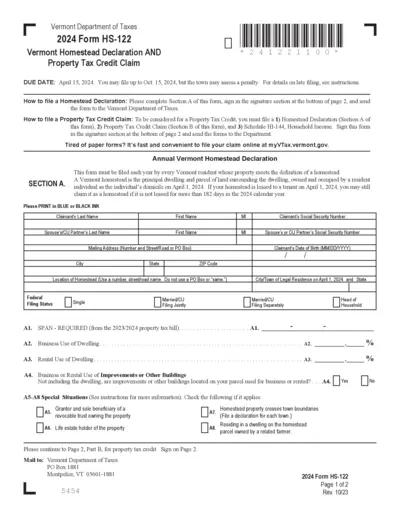

Vermont Homestead Declaration & Property Tax Credit

The Vermont Homestead Declaration and Property Tax Credit Claim form allows residents to declare their property as a homestead. This form must be submitted annually to ensure eligibility for property tax credits. Be sure to follow the instructions carefully to avoid penalties.

Cross-Border Taxation

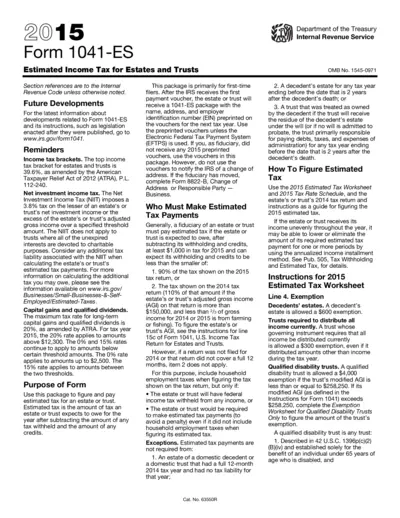

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is used for estimating income tax obligations for estates and trusts. This form assists fiduciaries in calculating and paying estimated taxes owed. It is essential for proper tax management and compliance.

Cross-Border Taxation

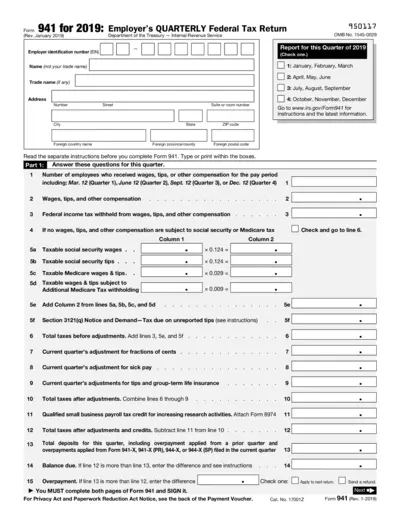

Employer's Quarterly Federal Tax Return Form 941

Form 941 is used by employers to report employee wages and payroll taxes withheld each quarter. It ensures compliance with federal tax obligations. Complete this form accurately to avoid penalties and ensure timely tax payments.

Cross-Border Taxation

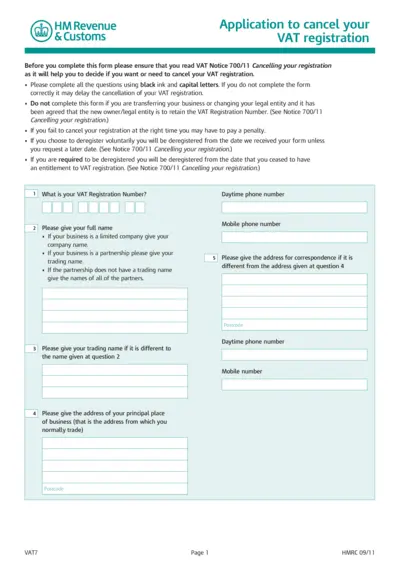

VAT Registration Cancellation Application Form

This document is the HMRC application form for cancelling VAT registration. It provides essential guidance on completing the form accurately. Ensure compliance to avoid potential penalties.

Cross-Border Taxation

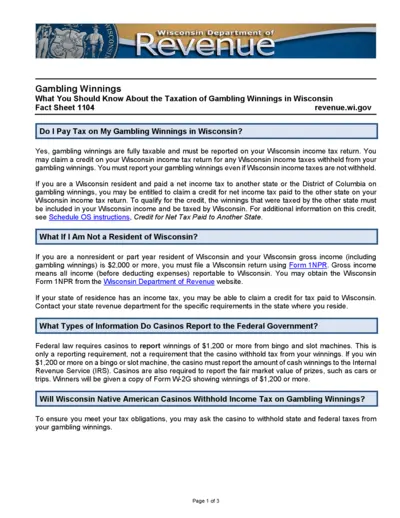

Understanding Gambling Winnings Tax in Wisconsin

This document provides essential information regarding the taxation of gambling winnings in Wisconsin. It outlines what residents and non-residents need to know about reporting winnings and claiming credits. Key regulations and filing instructions are also included to ensure compliance with state tax laws.

Tax Residency

Digital Nomad Residence Permit Guide

This guide provides essential information for digital nomads seeking a temporary visa and residence permit in Brazil. It outlines the application process and necessary documentation. Whether you are applying from abroad or within Brazil, this guide will help you navigate your requirements.

Cross-Border Taxation

Missouri Employer's Tax Guide

This document provides essential information and instructions for employers starting a business in Missouri. It includes filing requirements, tax payment options, and important deadlines. Utilize this guide to ensure compliance with Missouri tax laws.

Cross-Border Taxation

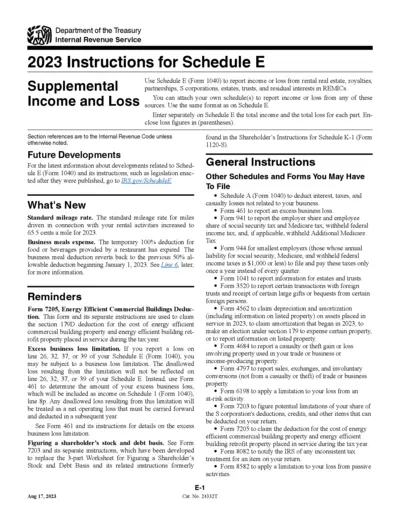

2023 Schedule E Instructions for Income and Loss

This document provides detailed instructions for filling out Schedule E (Form 1040) for 2023. It is essential for reporting income or loss from various sources including rental real estate and partnerships. Make sure to follow the specified guidelines to avoid potential issues with your tax filings.

Cross-Border Taxation

Maryland 2023 1099 Reporting Instructions

This document provides detailed instructions for Maryland employers on 1099 reporting for tax year 2023. It includes filing requirements, specifications, and updates. Essential for accurate tax reporting in Maryland.

Cross-Border Taxation

1040EZ Tax Filing Instructions and Guidelines

This file provides comprehensive instructions for preparing and filing your 1040EZ tax form. It includes filing requirements and helpful tips to ensure accuracy. Get your taxes done quickly and efficiently with this guide.

Cross-Border Taxation

California Sales Tax Guide for Veterinarians

This publication serves as a comprehensive guide to understanding California's Sales and Use Tax Law for veterinary practices. It is essential for veterinarians and related businesses needing clarity on tax regulations. Contact our Customer Service for further assistance.

Cross-Border Taxation

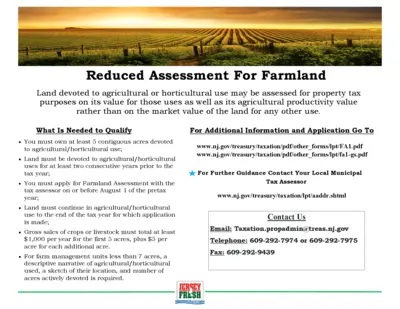

Reduced Property Tax Assessment for Farmland

This file provides detailed information on reduced property tax assessments for farmland and woodland management. It outlines qualifications, application procedures, and helpful resources. Learn how to profit from agricultural use and secure tax benefits.