International Tax Documents

Cross-Border Taxation

KPMG Tax Flash Report on Form No. 16

This document provides essential information regarding the generation and download of Part B of Form No. 16 through the TRACES portal. It outlines the correct procedures for deductors to report tax deductions from April 2018 onwards. Key highlights include the timely issuance of TDS certificates to employees.

Cross-Border Taxation

Tax Withholding and Estimated Tax Guidelines 2024

This file provides essential information on tax withholding and estimated tax for the year 2024. It outlines the methods of payment, important updates, and necessary forms. Users will find guidance on how to correctly complete tax-related documentation and avoid penalties.

Cross-Border Taxation

Instructions for Form IT-204-LL - Filing Fee Payment

This file provides essential instructions for completing Form IT-204-LL, required for certain LLCs and partnerships in New York State. It outlines filing requirements, deadlines, and provides computation guidelines for fees associated with filing. Understanding these details ensures compliance with New York State tax regulations.

Cross-Border Taxation

Property Tax Circuit Breakers Informational Brief

This policy brief explores circuit breaker programs for property tax relief. It discusses the advantages and disadvantages of these targeted tax relief measures. Ideal for state lawmakers and analysts seeking to understand property tax legislation.

Cross-Border Taxation

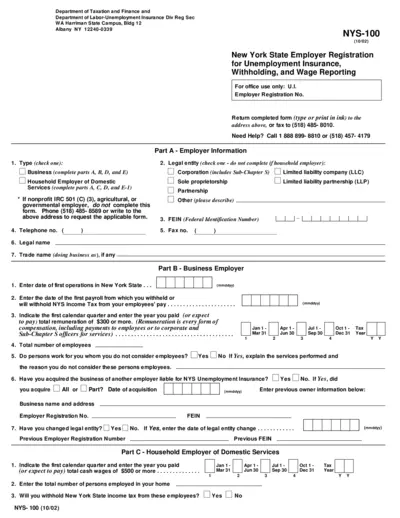

New York State Employer Registration for Unemployment Insurance

This file provides the registration form for New York State employers seeking to register for Unemployment Insurance, Withholding, and Wage Reporting. Users can find detailed instructions for filling out the form and submit it to the relevant department. Ensure compliance with state laws by completing this important document.

Cross-Border Taxation

NSDL e-Gov RPU Download and Installation Guide

This document provides a comprehensive guide on downloading and installing the NSDL e-Governance RPU. It includes essential instructions for preparing TDS/TCS returns. Ideal for users needing assistance with TDS/TCS statements preparation.

Cross-Border Taxation

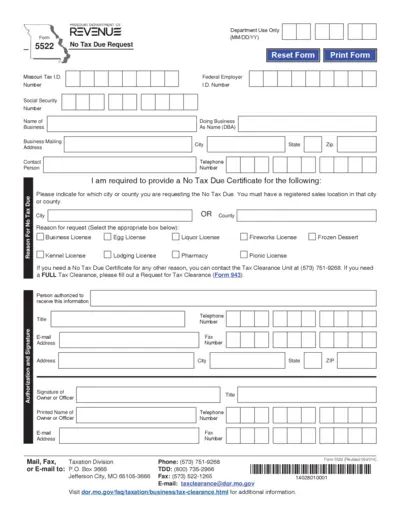

Missouri No Tax Due Request Form 5522 Instructions

The Missouri No Tax Due Request Form 5522 allows businesses to request a certificate confirming no outstanding tax liability. Completing this form helps in obtaining various licenses and permits. It is essential for maintaining compliance with state tax regulations.

Cross-Border Taxation

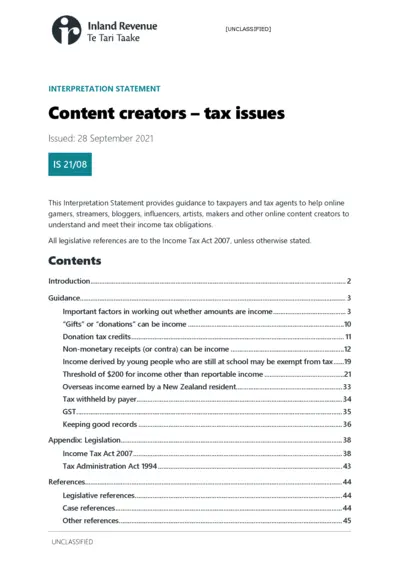

Tax Guidance for Online Content Creators - IS 21/08

This Interpretation Statement provides valuable tax guidance for online content creators, including gamers, bloggers, and influencers. It addresses common tax obligations and income sources. Essential for understanding income tax compliance.

Cross-Border Taxation

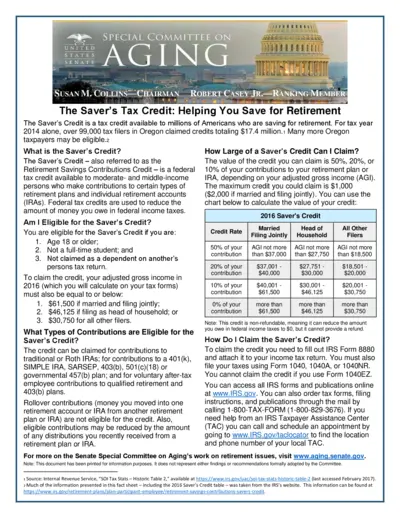

Saver's Tax Credit Overview for Retirement Savings

This document provides essential details about the Saver's Tax Credit available for retirement savings. It outlines eligibility criteria, types of contributions, and instructions for claiming the credit. Perfect for anyone looking to maximize their savings and understand tax benefits.

Cross-Border Taxation

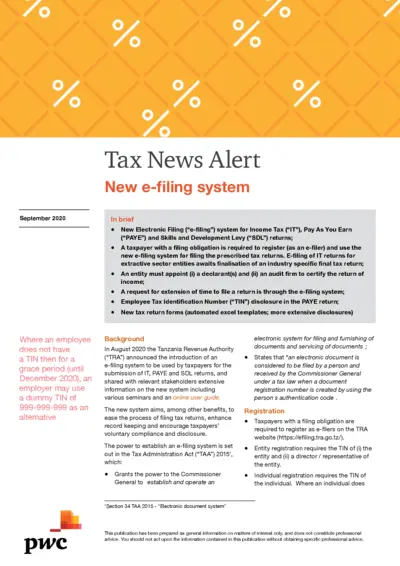

New E-filing System for Tax Returns in Tanzania

This file provides comprehensive details about the new electronic filing system for Income Tax, PAYE, and SDL returns in Tanzania. It outlines registration requirements, filing instructions, and the importance of compliance. Users will find valuable information on optimizing their tax return process with the new system.

Cross-Border Taxation

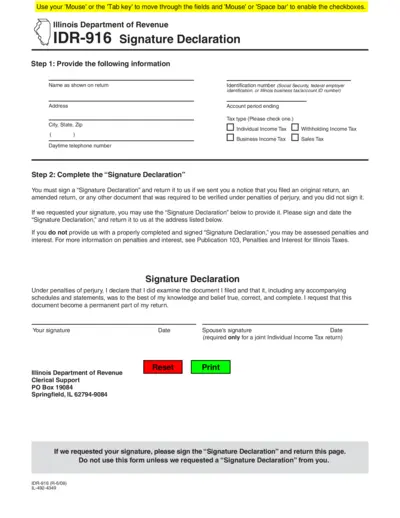

Illinois Department of Revenue Signature Declaration

This file is the Illinois Department of Revenue Signature Declaration form. It is necessary for individuals and businesses to verify certain tax filings. Ensure you follow the instructions for submitting your signature declaration accurately.

Cross-Border Taxation

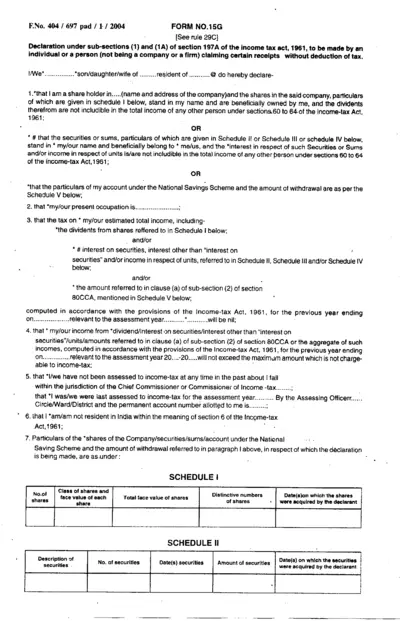

Income Tax Declaration Form 15G Instructions

The Income Tax Declaration Form 15G is used by individuals or non-corporate entities to claim certain receipts without tax deduction. This file provides detailed guidance on how to fill out the form accurately. Use it to declare that your income is below the taxable limit, ensuring compliance with the Income Tax Act, 1961.