International Tax Documents

Cross-Border Taxation

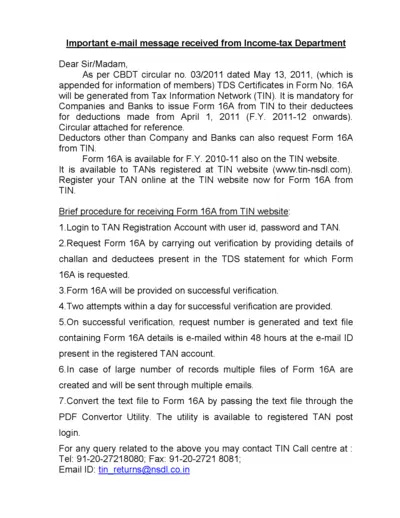

TDS Certificate Form No. 16A Instructions and Guidance

This file provides essential details and instructions for obtaining TDS certificates in Form No. 16A from TIN. It outlines mandatory regulations set by the Income Tax Department. Companies, banks, and deducators must follow the guidelines for smooth processing.

Cross-Border Taxation

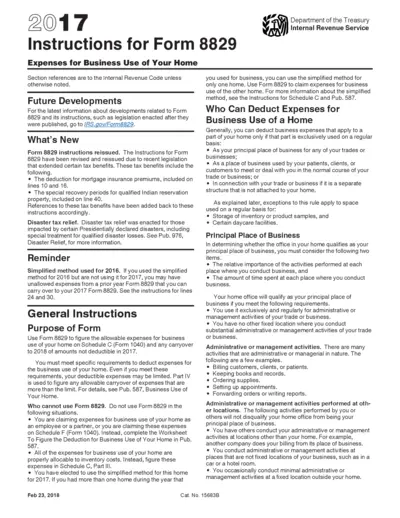

Instructions for Form 8829 Business Use of Home

This file provides detailed instructions for completing Form 8829, Expenses for Business Use of Your Home. It outlines eligibility criteria and deductions applicable to business owners. Follow these guidelines to ensure accurate reporting and maximize your home-based deductions.

Cross-Border Taxation

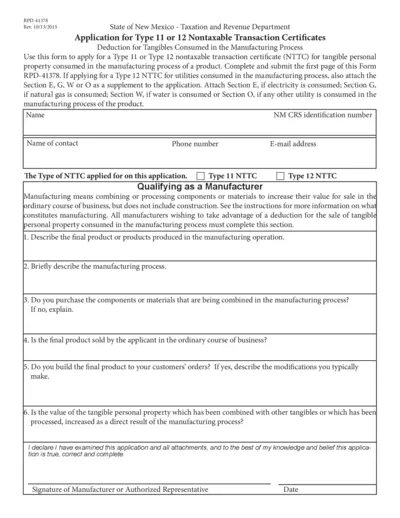

Nontaxable Transaction Certificate Application

This file contains the application for Type 11 or Type 12 nontaxable transaction certificates used in New Mexico. It outlines the necessary details and requirements for manufacturers. Follow the instructions carefully to ensure proper submission.

Cross-Border Taxation

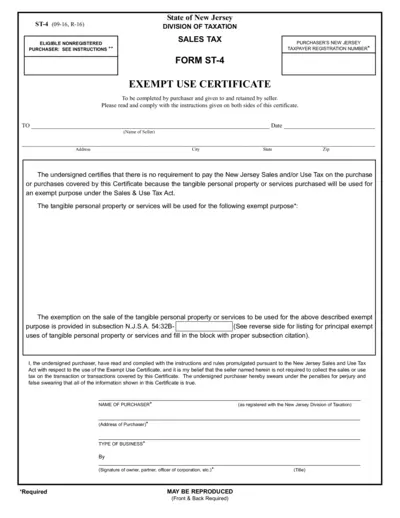

New Jersey Sales Tax Exempt Use Certificate ST-4

This file contains the New Jersey Sales Tax Exempt Use Certificate ST-4. It is designed for purchasers to certify the exemption from sales tax. Follow the instructions to properly fill out and submit the form for exempt purchases.

Cross-Border Taxation

IRS Schedule B Form 941 Instructions for 2024

The IRS Schedule B (Form 941) is used to report tax liabilities for semiweekly schedule depositors. This document provides essential instructions for completing the form accurately. It is crucial for employers to understand their obligations regarding tax reporting for wages paid.

Cross-Border Taxation

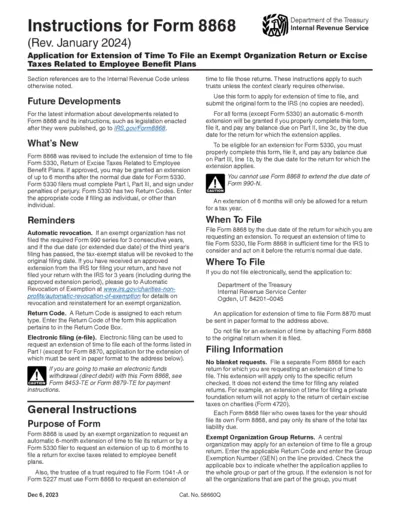

Form 8868 Instructions for Exempt Organizations Filing

Form 8868 provides guidelines for exempt organizations to request an extension of time to file their returns. This document outlines the filing process, eligibility, and significant penalties involved. Ensure compliance by following the instructions detailed herein.

Cross-Border Taxation

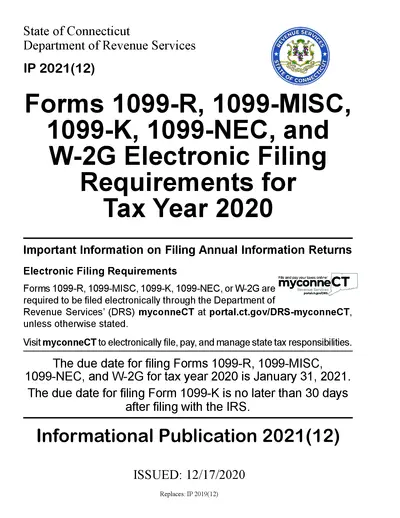

Connecticut 1099-R, MISC, K, NEC, W-2G Filing Guide

This document provides detailed instructions for filing Forms 1099-R, 1099-MISC, 1099-K, 1099-NEC, and W-2G in Connecticut. It outlines important deadlines, electronic filing requirements, and penalties for late submission. Perfect for tax professionals and businesses needing compliance information.

Cross-Border Taxation

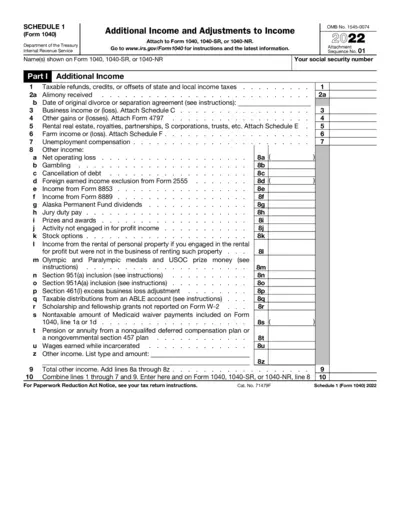

Schedule 1 Form 1040 Additional Income Adjustments

This file is Schedule 1 (Form 1040) for reporting additional income and adjustments to income. It is essential for individuals who need to report various types of income and adjustments as part of their tax return. Ensure accurate completion of this form for a compliant tax filing.

Cross-Border Taxation

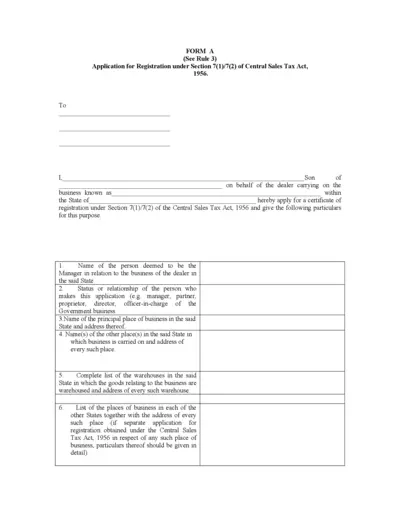

Application for Registration under Central Sales Tax

This file is an application form for registration under the Central Sales Tax Act. It requires various details about the business and its owners. Completing this application enables dealers to comply with tax regulations.

Cross-Border Taxation

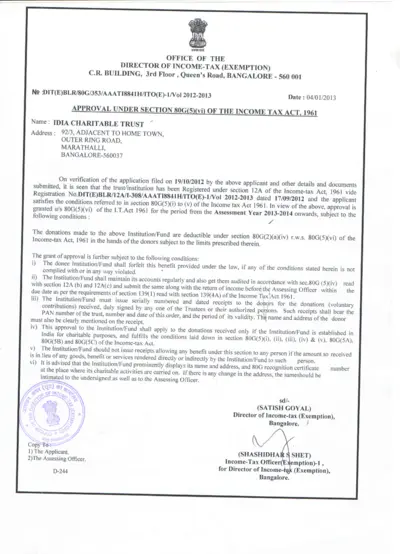

Approval Letter Under Section 80G of Income Tax Act

This file outlines the approval granted to IDIA Charitable Trust under section 80G of the Income Tax Act. It contains vital information regarding donation deductions and compliance requirements. Users can find detailed instructions on maintaining eligibility for tax deductions.

Cross-Border Taxation

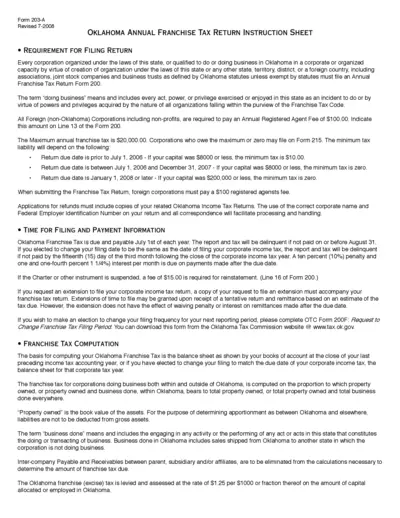

Oklahoma Annual Franchise Tax Return Instruction Sheet

This document provides essential instructions for filing Oklahoma's Annual Franchise Tax Return Form 200. It outlines requirements, due dates, and tax computation methods essential for compliance. Corporations, regardless of their origin, must adhere to these guidelines to avoid penalties.

Cross-Border Taxation

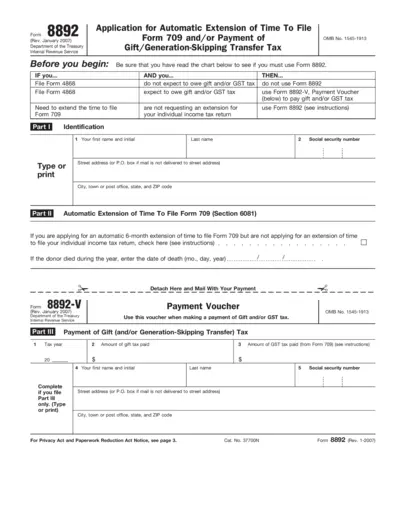

Form 8892 Automatic Extension for Gift Tax Filing

Form 8892 allows taxpayers to request an automatic 6-month extension for filing Form 709. It is essential for individuals who anticipate owing gift or generation-skipping transfer taxes. Completing this form timely can help mitigate penalties and interest.