International Tax Documents

Cross-Border Taxation

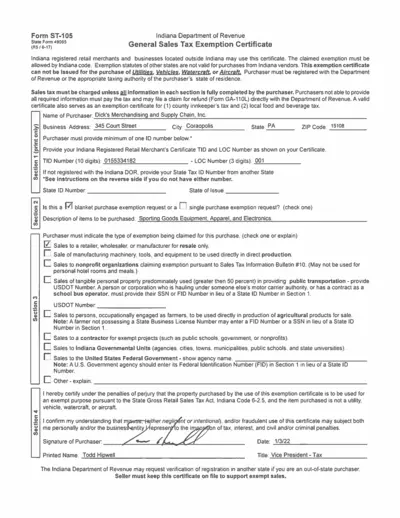

Indiana Sales Tax Exemption Certificate Form ST-105

The Indiana Sales Tax Exemption Certificate (Form ST-105) allows registered merchants to make exempt purchases. This form is essential for businesses to claim tax exemptions under Indiana law. Ensure all information is accurately completed to validate your exemption status.

Cross-Border Taxation

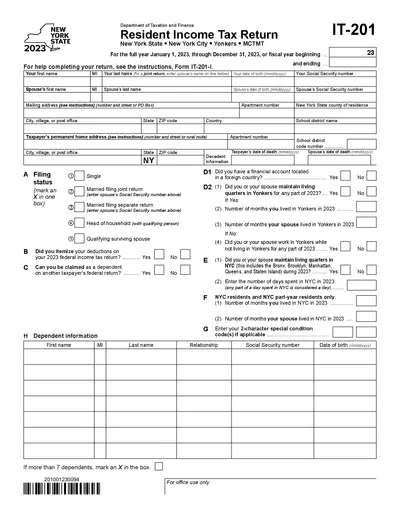

New York State Resident Income Tax Return 2023

This document is the New York State Resident Income Tax Return form for 2023. It is essential for individuals filing their state income taxes. This form includes detailed instructions and sections for reporting income and deductions.

Cross-Border Taxation

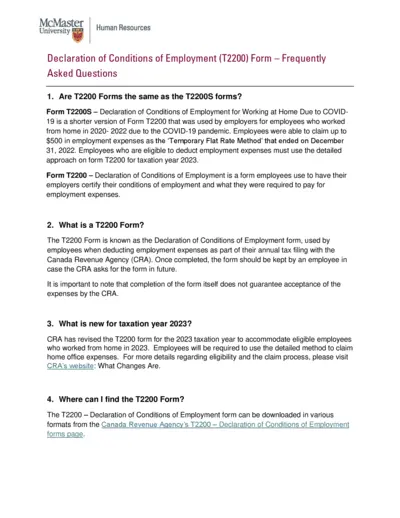

T2200 Employment Expense Claim Guidelines

This file provides essential information about the T2200 form, including how to complete it and who is eligible to use it. It also outlines the rules regarding home office expenses and offers guidance for employees during tax filing. Users will find answers to common questions about the form and its requirements.

Cross-Border Taxation

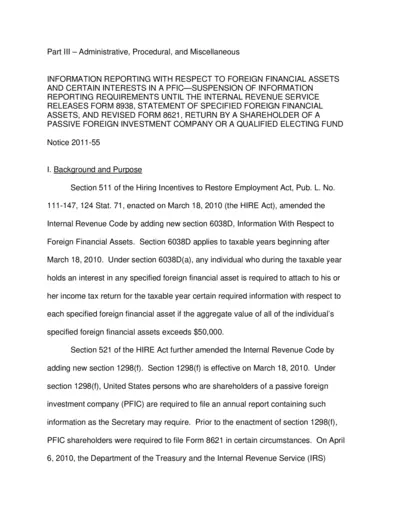

Information Reporting for Foreign Financial Assets

This document outlines critical information reporting requirements for U.S. individuals with foreign financial assets and passive foreign investment companies (PFICs). It contains necessary instructions and forms for compliance with tax regulations. Use this file to understand your reporting obligations and ensure timely submissions.

Cross-Border Taxation

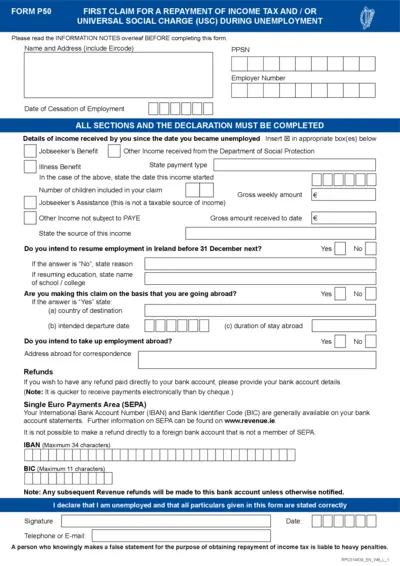

First Claim for Income Tax and USC Repayment

This file contains the FORM P50, essential for claiming refunds of income tax and Universal Social Charge during unemployment. It provides necessary guidelines on filling out the form correctly to ensure timely processing. Follow the instructions carefully to avoid delays in your claim.

Cross-Border Taxation

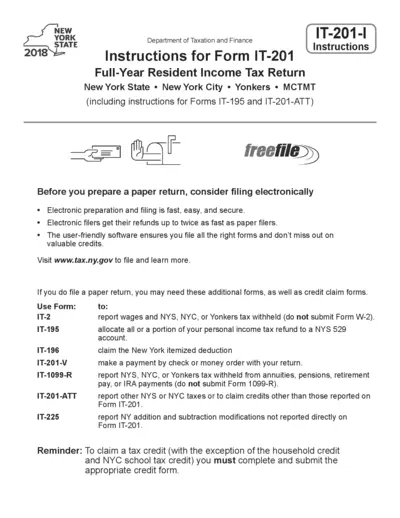

New York State 2018 IT-201-I Tax Filing Instructions

This document provides detailed instructions for filing the 2018 New York IT-201-I tax form. It includes essential information about credits and forms required for full-year resident taxpayers. Ideal for individuals seeking guidance on electronically or paper filing their tax returns.

Cross-Border Taxation

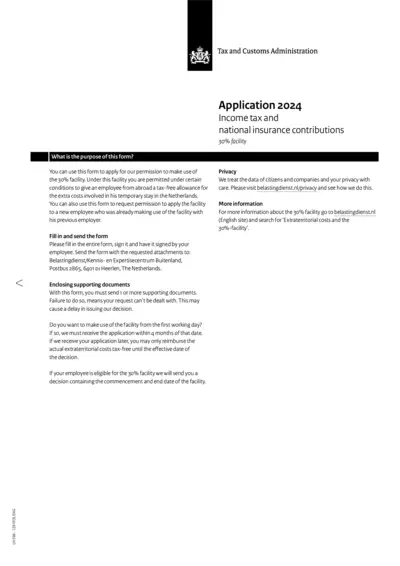

LH 598 30% Facility Form Instructions and Details

This form allows employers to apply for the tax-free 30% facility for expatriate employees in the Netherlands. It includes guidelines and requirements for submissions. Ensure that all supporting documents are included to avoid delays in processing.

Cross-Border Taxation

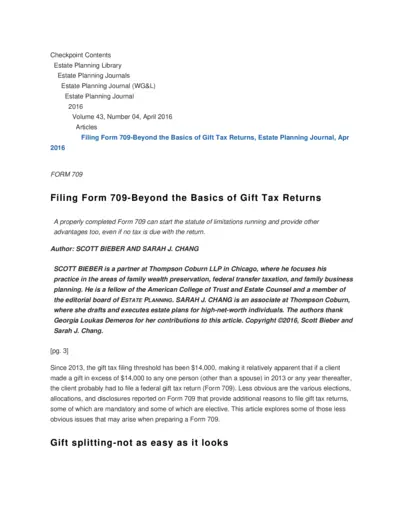

Essential Gift Tax Return Filing Insights

This file provides comprehensive guidance on filing Form 709, including crucial insights about gift splitting and tax implications. It is designed for tax professionals and individuals involved in estate planning. Enhance your understanding of gift tax returns and ensure compliance with tax regulations.

Cross-Border Taxation

New Dealer Guide to Working with Florida Revenue

This guide provides essential information for newly registered dealers in Florida regarding their sales and use tax obligations. It includes contact details, important documents, and specific responsibilities to ensure compliance with tax laws. The guide serves as a resource for understanding registration requirements and filing processes.

Cross-Border Taxation

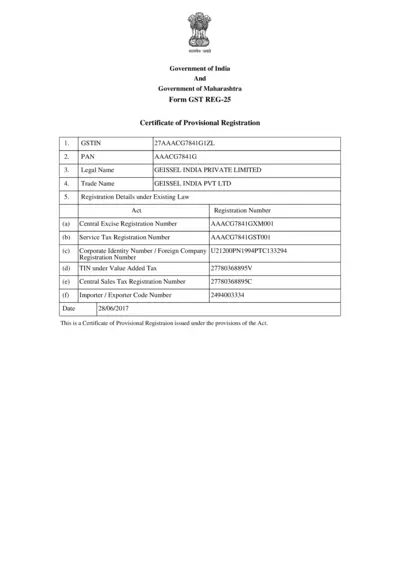

Certificate of Provisional Registration GST REG-25

This file is a certificate for provisional registration under GST. It includes essential details such as GSTIN and PAN. Businesses applying for GST registration must use this file.

Cross-Border Taxation

FAQs for Filing Form 3CA-3CD Tax Audit Report

This document provides detailed FAQs on filing Form 3CA-3CD for tax audit reports. It assists taxpayers and chartered accountants in understanding the filing process. Essential for anyone involved in Indian income tax e-filing.

Cross-Border Taxation

Maine Revenue Services Resale Certificate Guidelines

This file provides essential guidance about resale certificates issued by Maine Revenue Services. It includes information on how to properly use and renew these certificates. Taxpayers can find terms and responsibilities related to obtaining resale certificates here.