International Tax Documents

Cross-Border Taxation

Authorities Provided by Internal Revenue Code

This report outlines the inefficiencies in addressing erroneous refundable credits by the IRS. It evaluates the use of available tools to combat fraudulent claims. The findings call for improvements in IRS processes to protect taxpayer funds.

Cross-Border Taxation

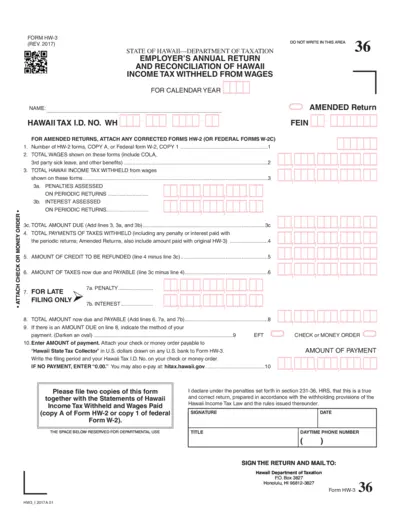

Hawaii Employer's Annual Tax Return Form HW-3

The HW-3 form is used by employers in Hawaii to report withheld income tax from their employees' wages. It captures total wages paid and tax withheld for the calendar year. This form must be filed annually to ensure compliance with Hawaii tax laws.

Cross-Border Taxation

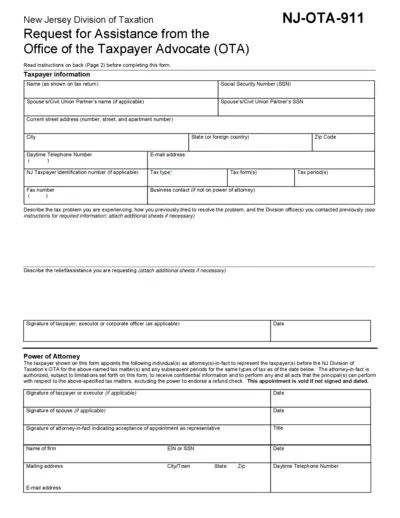

New Jersey Request for Assistance Form NJ-OTA-911

The New Jersey Division of Taxation's Request for Assistance is a form to seek help from the Office of the Taxpayer Advocate (OTA). It is designed for taxpayers facing unresolved issues or hardships related to state tax matters. Follow the detailed instructions to ensure your request is properly filled out for assistance.

Cross-Border Taxation

Guide to Wisconsin Wage Statements and Information Returns

This publication provides essential guidance for preparing Wisconsin wage statements and information returns for 2024. It outlines new requirements, filing deadlines, and necessary forms. Employers and payers will find the information crucial for compliance with Wisconsin's tax regulations.

Cross-Border Taxation

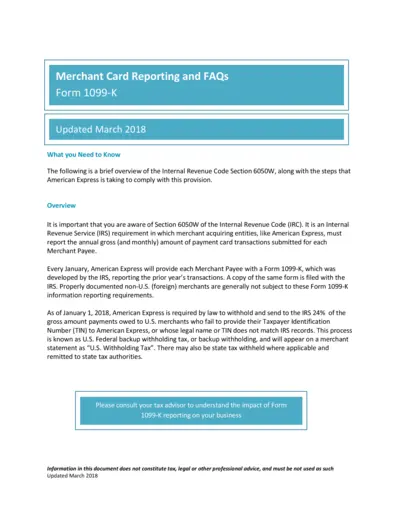

Merchant Card Reporting and FAQs Form 1099-K

This document provides essential information regarding Form 1099-K and the obligations of merchant acquiring entities. Understand your reporting requirements and avoid potential penalties. Consult your tax advisor for legal and tax advice.

Cross-Border Taxation

BIR Form 1701 - Annual Income Tax Return Guide

This guide covers the essentials of filling out BIR Form 1701 for self-employed individuals, estates, and trusts. It includes step-by-step instructions on using the interactive forms. Aimed at simplifying the tax return process in the Philippines.

Cross-Border Taxation

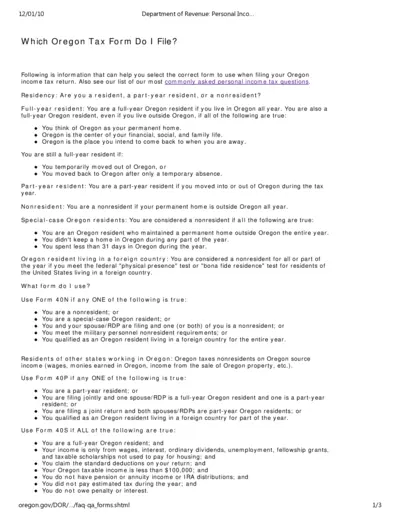

Oregon Department of Revenue Personal Income Tax Forms

This document provides essential information for filing personal income tax forms in Oregon. It includes guidelines for residents and nonresidents, along with important form selection criteria. Understanding your residency status and the appropriate forms is crucial for accurate tax filing.

Cross-Border Taxation

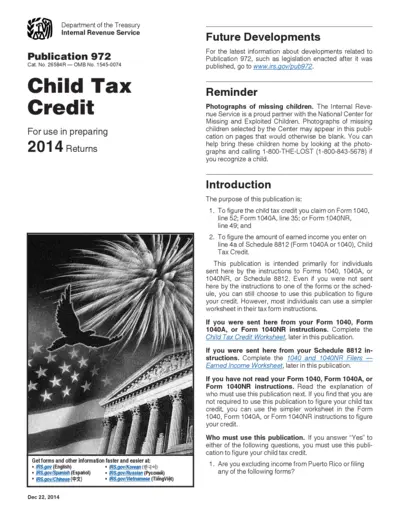

Child Tax Credit Publication 972 2014 Instructions

This publication provides details on how to claim the Child Tax Credit. It explains eligibility and gives instructions on fulfilling tax forms. Ideal for taxpayers seeking clarity on their tax benefits.

Cross-Border Taxation

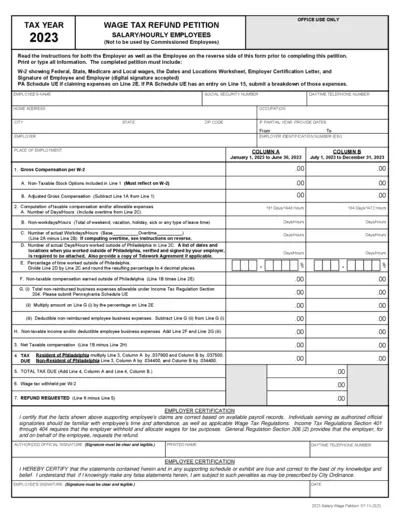

2023 Wage Tax Refund Petition Instructions

This document provides essential instructions for filling out the 2023 Wage Tax Refund Petition. It is designed for salary and hourly employees who are seeking a refund of over-withheld wage taxes. Follow the detailed guidelines to ensure your petition is completed correctly.

Cross-Border Taxation

Improvement Needed in Foreign Tax Credit Compliance

This report evaluates compliance efforts regarding unsupported claims for Foreign Tax Credits (FTC). It highlights findings from an audit conducted to assess IRS controls over FTC claims. Taxpayers should understand the implications of FTC to ensure accurate tax filings.

Cross-Border Taxation

Employment Issues Course Overview for 501(c)(3) Organizations

This document provides comprehensive instructions and information about taxation responsibilities for 501(c)(3) organizations. It covers employment classifications, tax withholdings, and employment tax forms. Ideal for organizations looking to remain compliant with tax regulations.

Cross-Border Taxation

Guidance on Employee Retention Credit Notice 2021

This file provides essential guidance on the Employee Retention Credit under Section 3134 of the Internal Revenue Code. It details the eligibility criteria, the extension of the credit, and instructions for employers. The document is vital for understanding tax credits and compliance for wages paid during specified periods.