International Tax Documents

Cross-Border Taxation

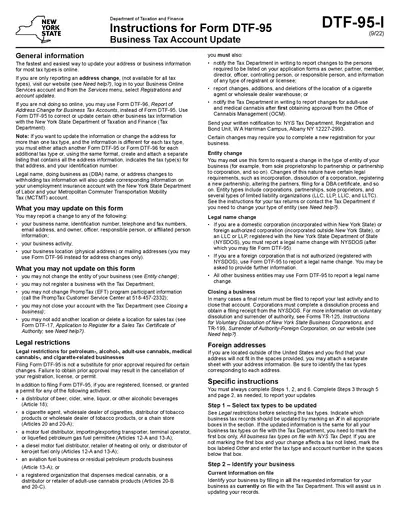

Instructions for New York Business Tax Account Update

This document provides instructions for updating business tax account information in New York State. It outlines how to correct or update various business details, including address changes. Use this guide to ensure your information remains accurate with the Tax Department.

Cross-Border Taxation

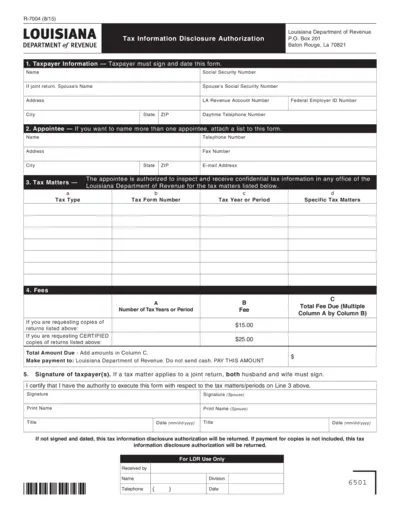

Louisiana Tax Information Disclosure Authorization

Form R-7004 allows taxpayers to authorize someone to receive their confidential tax information. This form is essential for requesting copies of your tax returns. Ensure that you complete all required sections accurately.

Cross-Border Taxation

Instructions for Form 8960 Net Investment Income Tax

This document provides essential instructions for completing Form 8960, which calculates the Net Investment Income Tax. It is useful for individuals, estates, and trusts subject to this tax. Familiarize yourself with the guidelines to ensure accurate filing.

Cross-Border Taxation

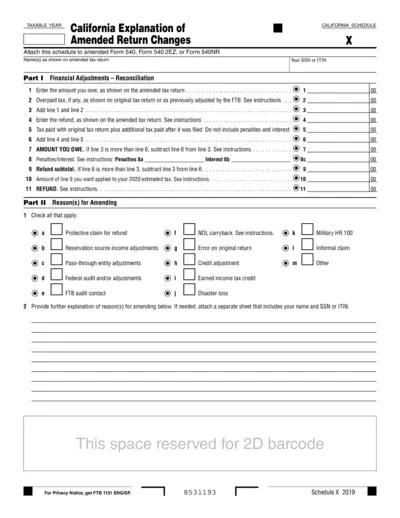

California Schedule Amended Tax Return Instructions

This document provides essential instructions for filling out the California Amended Return. It outlines necessary financial adjustments and reasons for amendments. Users can reference this for accurate tax filing and to understand their eligibility for refunds.

Cross-Border Taxation

Form 2848 and Form 8821 Instructions and Details

This file provides essential information regarding Form 2848 and Form 8821. It details the preparation, use cases, and significance of both forms. Users will find guidance on completion and submission procedures.

Cross-Border Taxation

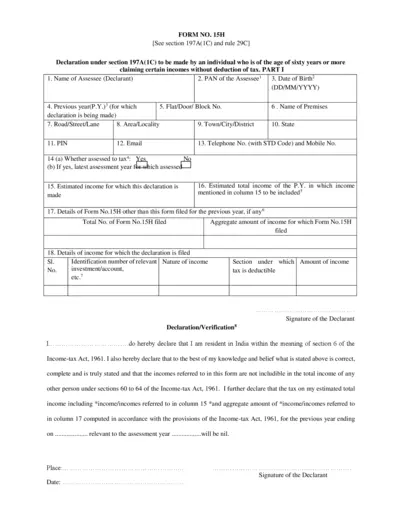

Form No. 15H Declaration for Income Tax Exemption

Form No. 15H is a declaration for individuals aged sixty or more claiming certain incomes without tax deduction. This form helps in ensuring that no tax is deducted from specified income sources. Use this document to declare your estimated income for tax purposes effectively.

Cross-Border Taxation

Pennsylvania Property Tax Rent Rebate Program 2022

This file contains essential information for the Pennsylvania Property Tax and Rent Rebate Program. It provides details on eligibility, application instructions, and important deadlines for rebates. Ideal for seniors, widows, and individuals with disabilities seeking financial assistance.

Cross-Border Taxation

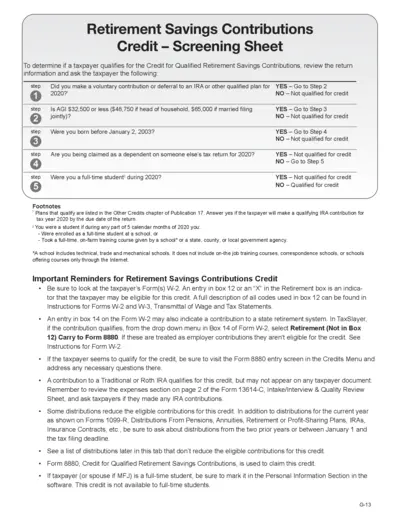

Retirement Savings Contributions Credit Instructions

This file contains instructions for taxpayers on qualifying for the Credit for Qualified Retirement Savings Contributions. It guides users through eligibility criteria and steps to claim the credit. Use this resource to navigate tax credits effectively.

Cross-Border Taxation

DC Withholding Tax Reporting Instructions for 2023

This file contains the employer/payor withholding tax reporting instructions for the year 2023. It includes essential details on filing the FR-900Q form each quarter. Employers should refer to this file for guidelines to ensure compliance with DC tax laws.

Cross-Border Taxation

2022 W-2 and 1099 Electronic Filing Instructions

This file outlines the requirements and deadlines for filing W-2s and 1099s electronically for the tax year 2022. It provides step-by-step filing instructions and important information for businesses. Ensure compliance with Iowa Department of Revenue regulations.

Cross-Border Taxation

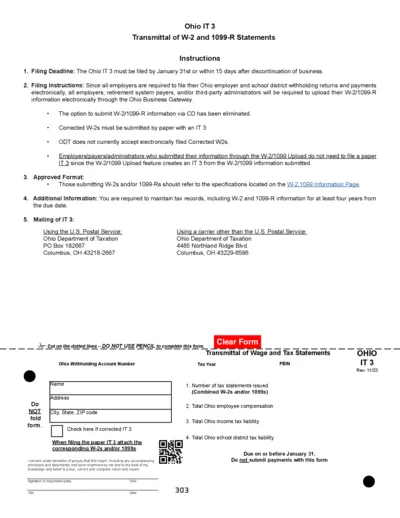

Ohio IT 3 W-2 and 1099-R Filing Instructions and Details

This document provides comprehensive instructions for filing the Ohio IT 3 form, including W-2 and 1099-R statements. It outlines filing deadlines, electronic submission processes, and additional information for employers. Ensure compliance with Ohio tax regulations using this essential guide.

Cross-Border Taxation

IRS Tax Tip 2003-25 Guide for Missing Form 1099

This file provides essential information on what to do if you haven't received a Form 1099. It includes instructions on contacting the payer and the IRS, along with insights on reporting the income accurately. Users will find useful guidelines to ensure they meet tax filing requirements properly.