International Tax Documents

Cross-Border Taxation

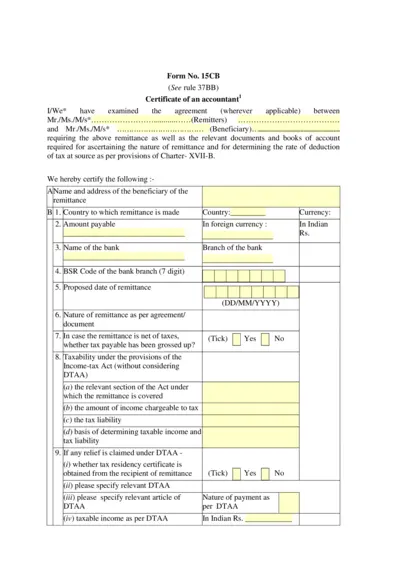

Form 15CB: Certificate for Remittance Tax Compliance

Form 15CB is a certificate required for foreign remittances involving tax deductions. It details the nature of the remittance and tax liabilities as per the Income Tax Act. Accountants must complete this form to certify tax compliance before remittance.

Cross-Border Taxation

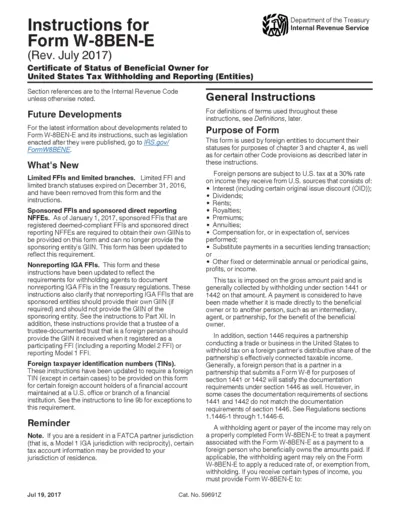

W-8BEN-E Form Instructions for Tax Compliance

This document provides comprehensive instructions for completing Form W-8BEN-E, which certifies the status of beneficial owners for tax reporting. It includes information on applicable rules and regulations for foreign entities. Ensure compliance with U.S. withholding tax requirements by following the guidelines provided.

Cross-Border Taxation

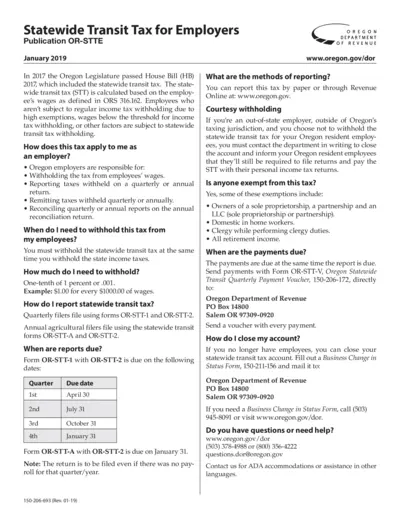

Statewide Transit Tax Employer Instructions Oregon

This document provides essential details about the Statewide Transit Tax in Oregon for employers. It outlines tax withholding responsibilities, reporting methods, and exemptions. Employers must stay compliant with these instructions to avoid penalties.

Cross-Border Taxation

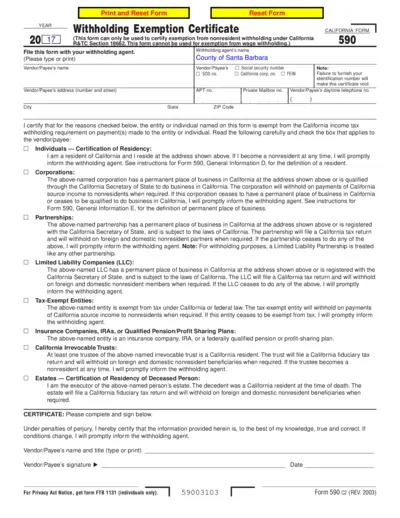

California Form 590 Withholding Exemption Certificate

California Form 590 is used to certify exemption from nonresidential withholding. Ensure that the appropriate sections are filled out accurately. This is essential for residents and entities wishing to avoid unnecessary tax withholdings.

Cross-Border Taxation

Virginia Income Tax Withholding Guide for Employers

This guide provides essential information for Virginia employers on income tax withholding. It covers who must register, forms, and filing requirements. A must-have resource for compliance and tax assistance.

Taxation of Digital Services

ClickUp Cheat Sheets for Homeschool CEO Society

This file provides essential ClickUp cheat sheets designed for the Homeschool CEO Society. It outlines roles, tasks, and useful tools for effective workspace management. Perfect for both new and experienced users looking to streamline their ClickUp experience.

Cross-Border Taxation

Instructions for Form EL-1040X East Lansing Tax Return

This file provides comprehensive instructions for filing the EL-1040X, an amended individual income tax return for East Lansing residents. It guides users through correcting previously filed returns and outlines necessary documents for submission. Essential for residents and nonresidents alike who need to amend their income tax returns effectively.

Cross-Border Taxation

AICPA Proposed FAQs for IRS Digital Asset Reporting

This document outlines proposed FAQs for the IRS regarding the 2022 Form 1040's digital asset question. It assists taxpayers and preparers in compliance. The AICPA aims to provide clarity for digital asset reporting.

Cross-Border Taxation

Employer's Guide to Pay As You Earn Kenya

This file provides a comprehensive guide for employers regarding the Pay As You Earn (PAYE) tax system in Kenya. It outlines key amendments to the Income Tax Act and procedures for compliance. Essential for understanding tax deductions from employees' emoluments.

Cross-Border Taxation

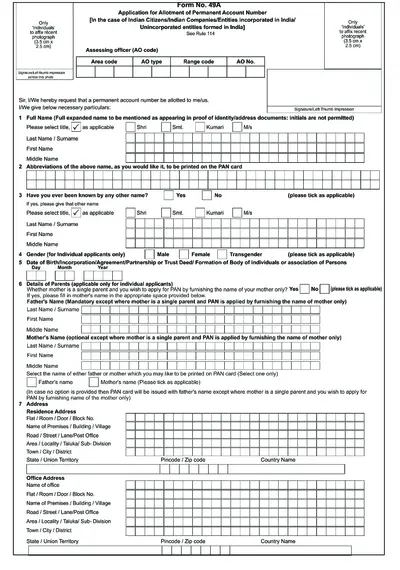

Application for Allotment of Permanent Account Number

This file is an application form for individuals to allot a Permanent Account Number (PAN) in India. It contains essential details and instructions on how to fill out the form accurately. Individuals are required to provide personal information, identification proof, and supporting documents.

Cross-Border Taxation

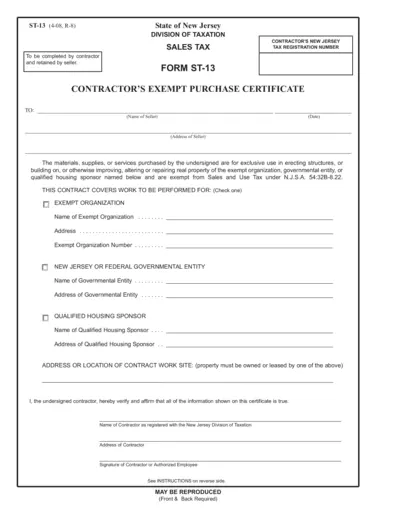

New Jersey Contractor's Exempt Purchase Certificate

The New Jersey Contractor's Exempt Purchase Certificate is a crucial document for contractors working with exempt organizations. This form allows contractors to purchase materials and services without paying sales tax for projects involving exempt entities. Understanding how to fill it out correctly is essential for compliance and tax exemption.

Cross-Border Taxation

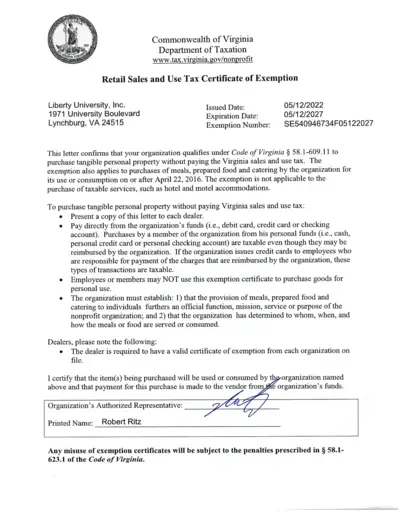

Virginia Retail Sales and Use Tax Exemption Certificate

This document serves as a retail sales and use tax exemption certificate for nonprofit organizations. It confirms the qualification for tax-exempt purchases. Ensure compliance with the specified instructions for valid use.