Tax Documents

Cross-Border Taxation

Refundable Tax Credits Overview and Instructions

This file provides essential information regarding refundable tax credits, including eligibility requirements and necessary forms. Users will learn how these credits can impact their tax return. This is a must-read for taxpayers looking to maximize their benefits.

Cross-Border Taxation

IRM Procedural Update on Credit Procedures

This file offers a comprehensive update on credit procedures with specific clarifications. It includes essential changes to the IRM sections. Users can benefit from detailed instructions regarding questionable credits and amended returns.

Cross-Border Taxation

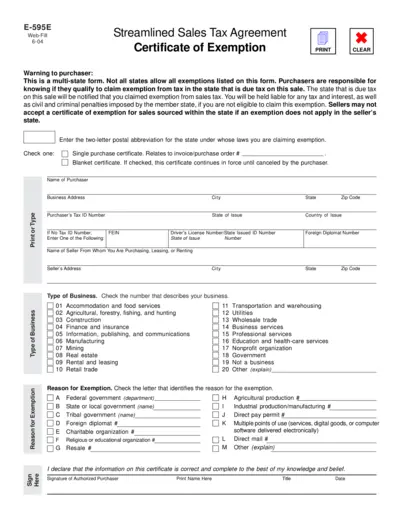

Sales Tax Exemption Certificate Guidelines

This document provides comprehensive instructions for completing the Streamlined Sales Tax Agreement Certificate of Exemption. It details the required fields and responsibilities of purchasers and sellers. Essential for anyone claiming a sales tax exemption, ensuring compliance with state laws.

Cross-Border Taxation

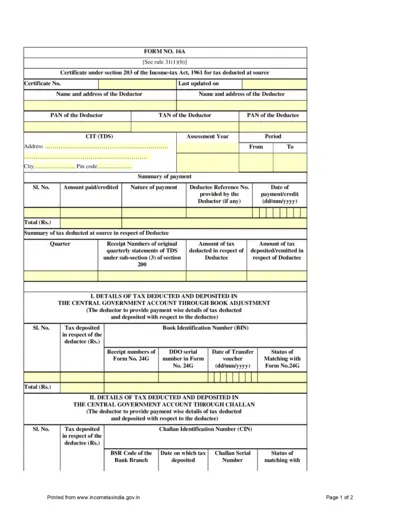

Form 16A: TDS Certificate Under Income Tax Act

Form 16A is an essential document for taxpayers who have had tax deducted at source. It certifies the amount of tax and provides necessary details of the deductor and deductee. This form is crucial for filing income tax returns accurately.

Cross-Border Taxation

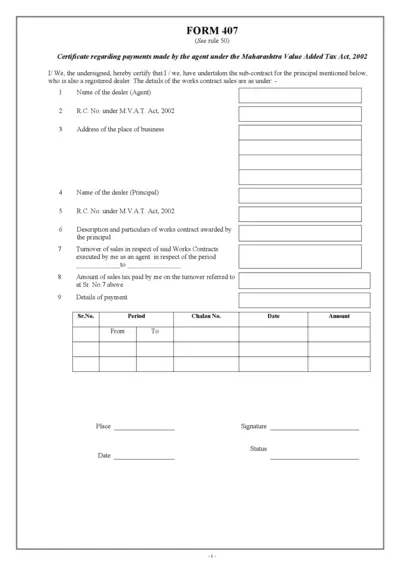

Maharashtra Value Added Tax Certificate Form 407

FORM 407 is used for certifying payments made by agents under the Maharashtra Value Added Tax Act, 2002. This form contains essential details regarding works contracts and associated sales tax payments. It is crucial for compliance and verification of transactions in the state of Maharashtra.

Cross-Border Taxation

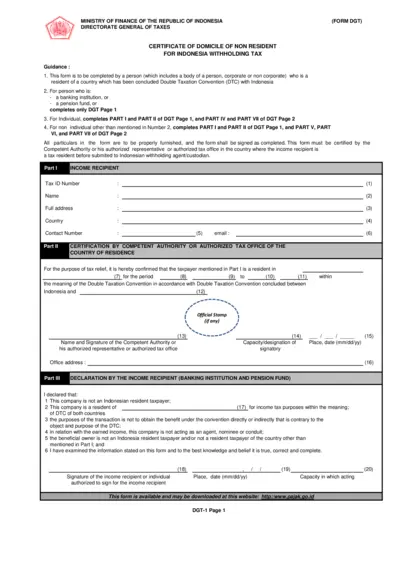

Certificate of Domicile for Non-Resident Tax Relief

This file provides a comprehensive guide for non-residents seeking withholding tax relief in Indonesia. It includes detailed instructions and sections to be filled out by individuals and entities. Use this form to ensure compliance with the Double Taxation Convention and facilitate tax relief efficiently.

Cross-Border Taxation

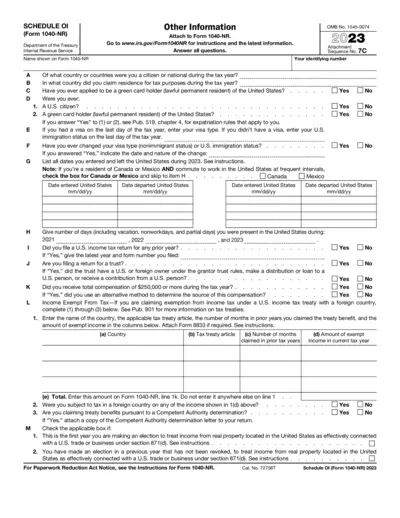

Schedule OI Form 1040-NR Instructions and Details

This file contains the Schedule OI for Form 1040-NR, detailing important information on residency, citizenship, and income tax treaty benefits. It serves as a guide for users needing help with their tax filing in the U.S. and outlines the necessary steps to complete the form accurately.

Cross-Border Taxation

Arizona Property Tax Exemptions Assessment Procedures

This document outlines the property tax exemptions and assessment procedures in Arizona. It provides comprehensive guidance for taxpayers and assessors. Updated regularly, it ensures compliance with state laws and best practices.

Federal Tax Forms

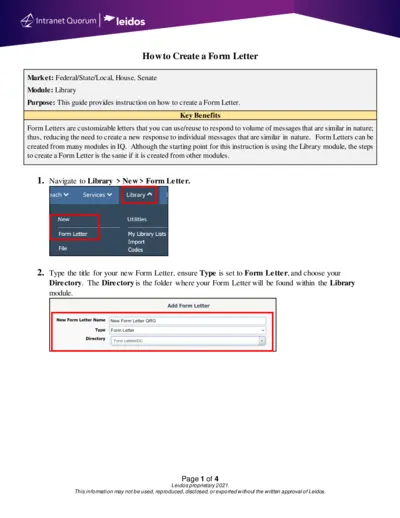

Instructions for Creating a Form Letter in IQ

This guide provides essential instructions on how to create a customizable Form Letter in Intranet Quorum. It simplifies the process of responding to similar messages efficiently. Ideal for users needing to craft standardized letters quickly.

Tax Returns

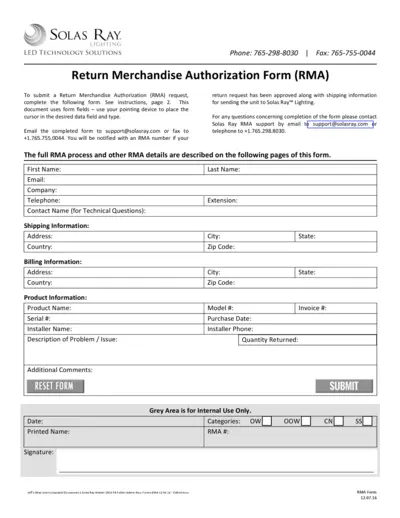

Solas Ray Lighting RMA Request Form Submission

This file is a Return Merchandise Authorization (RMA) form for Solas Ray Lighting. Users must fill out this form to return products for repair or credit. Detailed instructions for filling out the form are included within.

Cross-Border Taxation

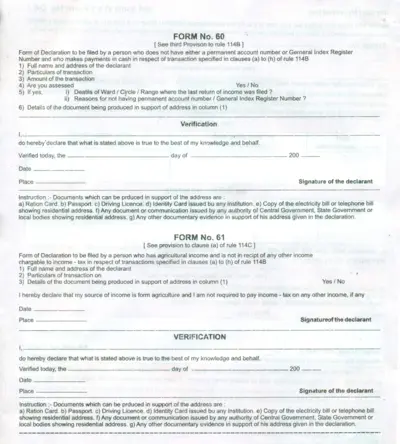

Declaration Forms for Tax Compliance Guidelines

This file contains essential declaration forms required for individuals without a permanent account number. It outlines instructions for filling out Form No. 60 and Form No. 61. Ideal for those making cash transactions and agricultural income declarations.

Cross-Border Taxation

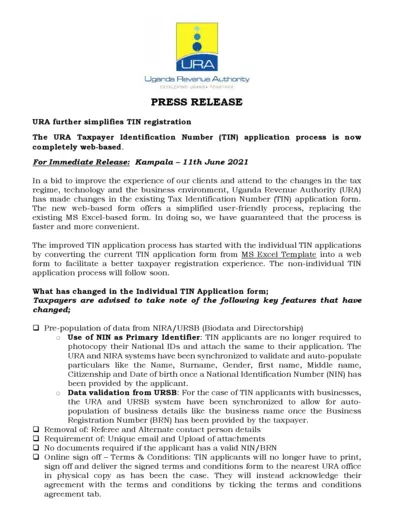

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.