Tax Documents

Tax Returns

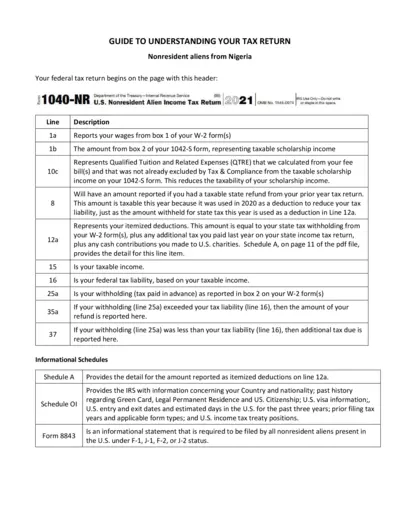

Guide to Understanding Your Tax Return

This file provides detailed explanations of the U.S. nonresident alien income tax return and Connecticut resident tax return. It outlines the requirements and instructions for completing forms 1040-NR and CT-1040. Ideal for nonresident aliens from Nigeria and Connecticut residents.

Tax Returns

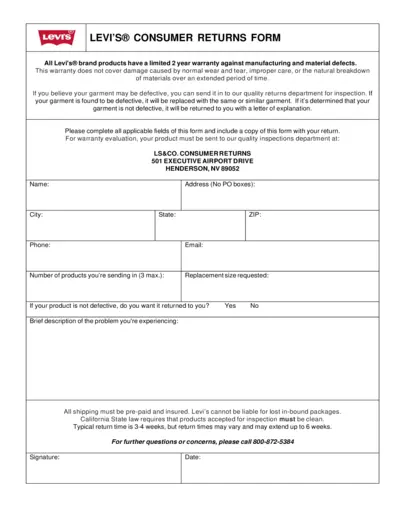

Levi's Consumer Returns Form Instructions

This file contains important information about Levi's consumer returns process. It details the warranty policy and provides a returns form for products. Users can find instructions on how to complete and submit the form.

Cross-Border Taxation

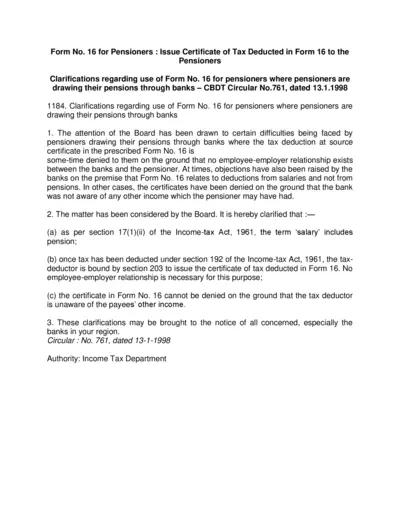

Form No. 16 for Pensioners Tax Deduction Certificate

Form No. 16 for Pensioners is essential for tax certification. This document clarifies tax deduction procedures for pensioners. Obtain crucial guidance regarding Form 16 to ensure compliance.

Cross-Border Taxation

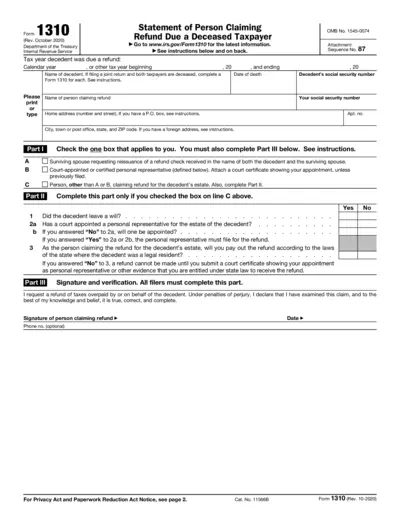

Claim Refund After Deceased Taxpayer Form Instructions

This document provides detailed instructions for claiming a tax refund due to a deceased taxpayer. It guides users through the process of completing Form 1310 effectively. Ensure compliance with IRS requirements by following this comprehensive guide.

Tax Returns

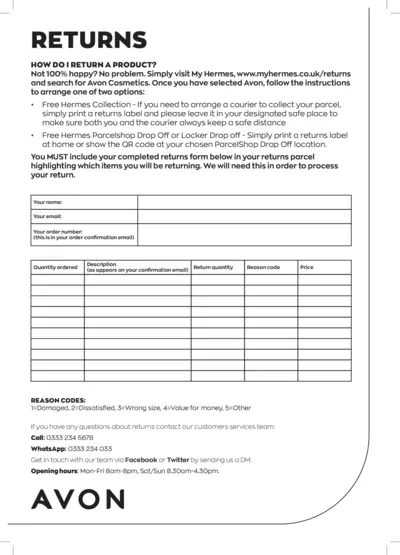

Return Instructions for Avon Cosmetics Products

This file provides comprehensive instructions on how to return Avon Cosmetics products. It includes details about filling out the returns form and the various return options available. Utilize this guide to ensure a smooth return process.

Cross-Border Taxation

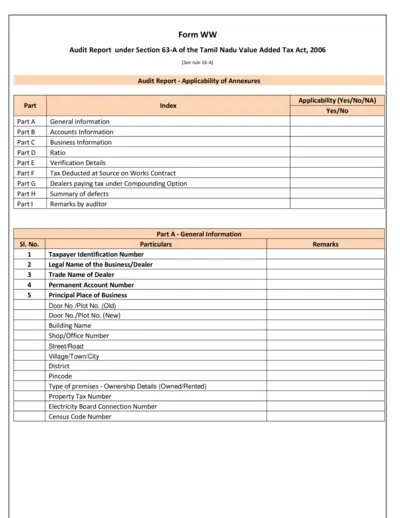

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

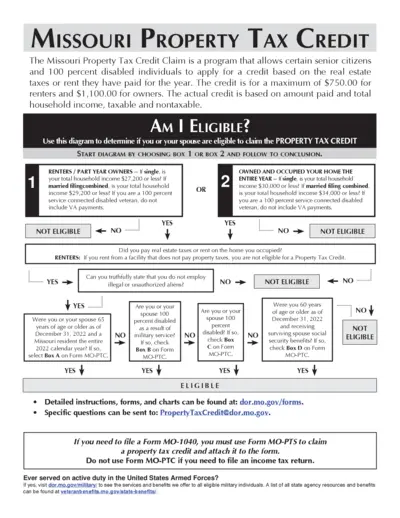

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

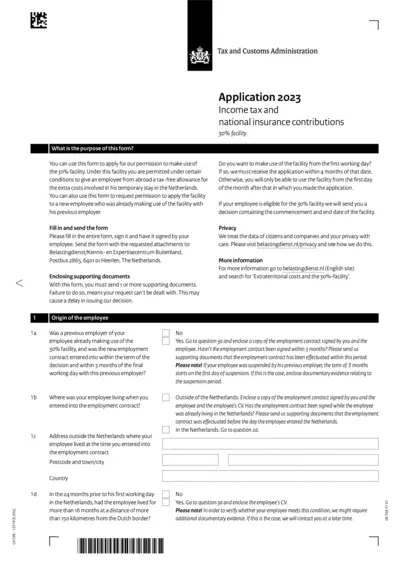

Tax and Customs Administration Application 2023

This file contains the application process for the Income Tax and National Insurance contributions concerning the 30% facility. It provides essential guidelines for employers seeking tax relief for expatriate employees in the Netherlands. Follow the detailed instructions to ensure proper completion and submission of this form.

Cross-Border Taxation

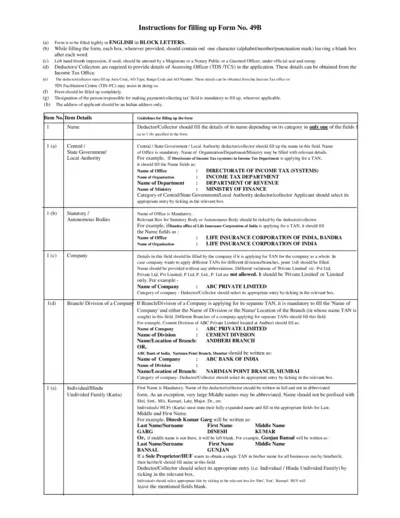

Instructions for Filling Form No. 49B - TDS/TCS Application

Form No. 49B is essential for taxpayers needing to obtain a Tax Deduction and Collection Account Number. This document provides detailed instructions for completing the form accurately to ensure compliance with tax regulations. It is critical for entities required to deduct or collect tax at source.

Cross-Border Taxation

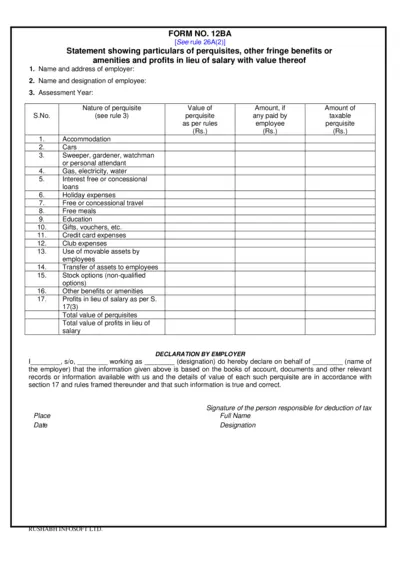

FORM NO. 12BA Statement of Perquisites and Benefits

FORM NO. 12BA provides an overview of the particulars of perquisites, fringe benefits, and amenities related to salary for taxation purposes. It assists employers in documenting employee perks and calculating their monetary value. This file is essential for tax assessment and compliance.

Tax Returns

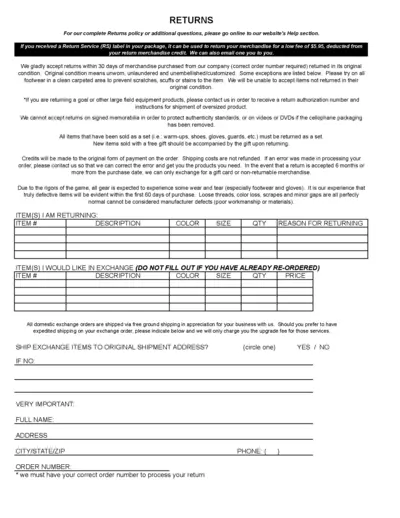

Comprehensive Returns Instructions and Policies

This document provides detailed information about our return policies, including how to initiate a return and what items are eligible. It outlines the conditions for returning merchandise and provides a form for processing exchanges or returns. Customers can find all the necessary steps to ensure a smooth return process.