Tax Documents

Taxation of Digital Services

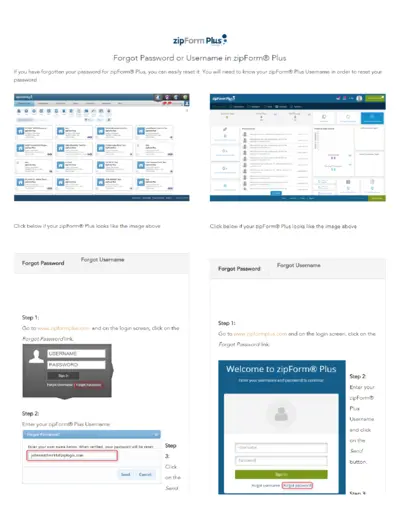

zipForm Plus® Password or Username Recovery Guide

This guide helps users recover their zipForm Plus® password or username. It provides step-by-step instructions on resetting your password. Ensure you know your username for a successful reset.

Cross-Border Taxation

VAT Cancellation Application Form Guide

This file provides a comprehensive guide to cancelling your VAT registration. It includes essential instructions for filling out the application. Follow the outlined steps to ensure a smooth registration cancellation process.

Agricultural Property Tax

Inflation Reduction Act Direct Loan Information

This document outlines key information regarding the Inflation Reduction Act Direct Loan and its associated processes. It provides guidance on payments and new 1099 forms to assist various stakeholders. Users will find essential contact details and educational resources within this file.

State Tax Forms

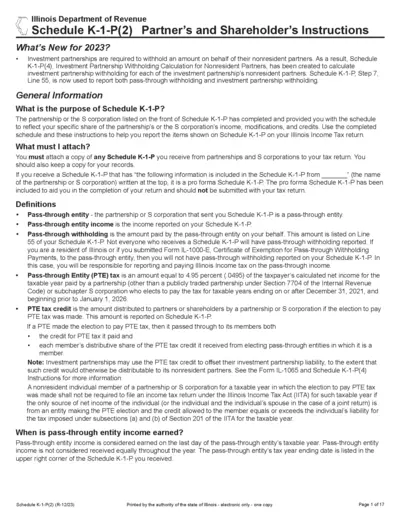

Illinois Schedule K-1-P Instructions for 2023

This document provides comprehensive instructions for Schedule K-1-P, which reflects your share of income, modifications, and credits from partnerships or S corporations. It includes essential information for both residents and non-residents of Illinois. Use this guide to ensure accurate completion of your Illinois income tax return.

Cross-Border Taxation

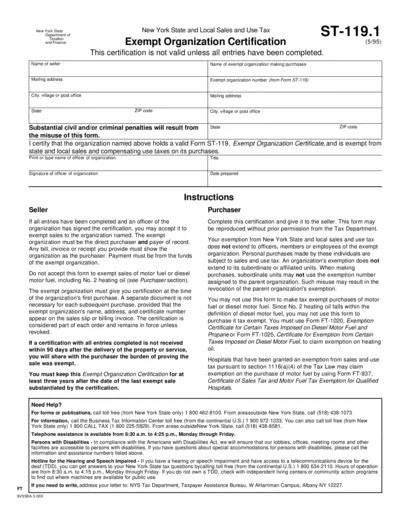

New York State Exempt Organization Certification

This document is the New York State Exempt Organization Certification form. It certifies that an organization is exempt from state and local sales and compensating use taxes. This certification must be filled out completely to be valid.

Cross-Border Taxation

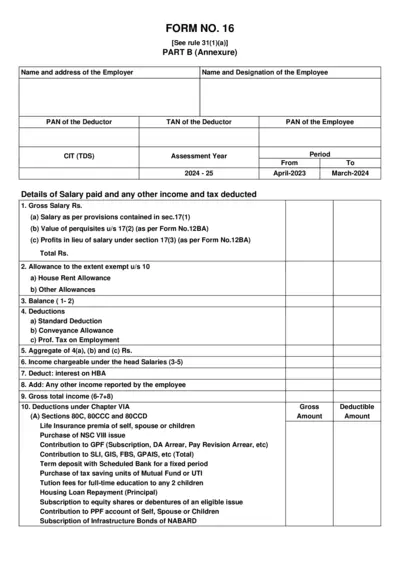

FORM NO. 16 Details and Instructions

This PDF contains essential information and instructions for completing FORM NO. 16. It provides details on salary, deductions, and tax calculations for the assessment year 2024-25. Users can utilize this guide to ensure accurate completion of the form.

Cross-Border Taxation

Tax Penalties Analysis and Instructions

This document provides a comprehensive analysis of tax penalties related to failure to file, failure to pay, and estimated tax penalties under the Internal Revenue Code. It reviews case decisions issued by federal courts and outlines taxpayer rights impacted by these penalties. Users will find legislative recommendations and most litigated issues concerning tax penalties.

Cross-Border Taxation

Sales and Use Tax Workshop Guide by NCDOR

This document outlines the Sales and Use Tax Workshop provided by the NC Department of Revenue. It serves as a valuable resource for understanding tax laws and application procedures. Discover various topics covered including business registration, online filing, and common tax issues.

Cross-Border Taxation

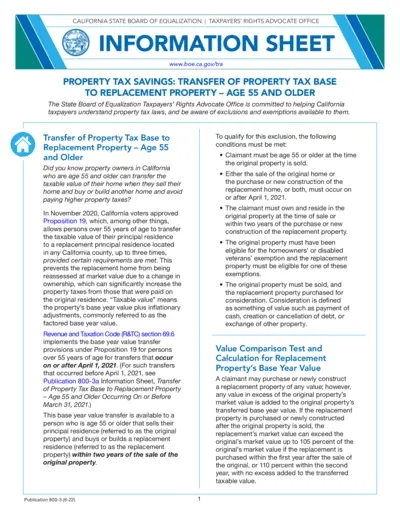

California Property Tax Savings Base Year Transfer 55+

This file provides property tax savings guidelines for California residents aged 55 and older. Learn how to transfer your property's taxable value to a new home and minimize tax increases. The document includes eligibility criteria and application instructions.

Cross-Border Taxation

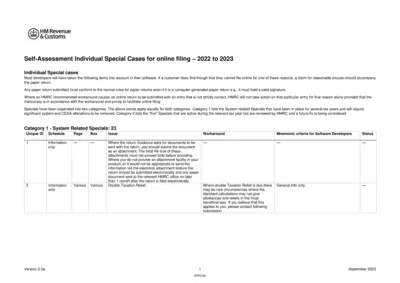

HMRC Self-Assessment Individual Filing Guide 2022-2023

This file provides essential guidelines for online filing of self-assessment forms for individuals. It details special cases and instructions for developers to ensure compliance. Users can find valuable information regarding filing exceptions and necessary attachments.

Cross-Border Taxation

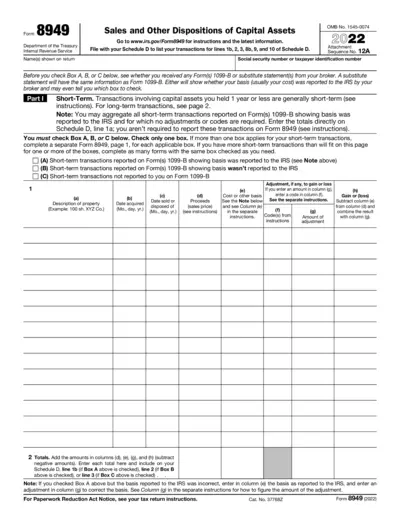

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and other dispositions of capital assets. It is essential for accurately reporting gains and losses during tax filing. This form assists both individuals and businesses in detailing their capital asset transactions for IRS compliance.

Cross-Border Taxation

Instructions for Form 8912 - Tax Credit Bonds

This document provides essential instructions for using Form 8912 to claim tax credits for various tax credit bonds. It outlines eligibility, necessary steps, and specific instructions for accurate completion.