Tax Documents

Cross-Border Taxation

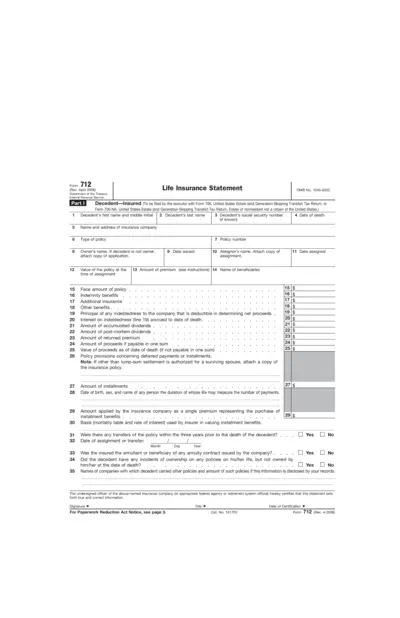

Life Insurance Statement Form 712 - IRS Guidelines

Form 712 is essential for reporting life insurance policies for estate tax purposes. Executors of estates must file this form with Form 706 or 706-NA. This form collects vital information about the insured's policies and is crucial for accurate tax assessments.

Tax Returns

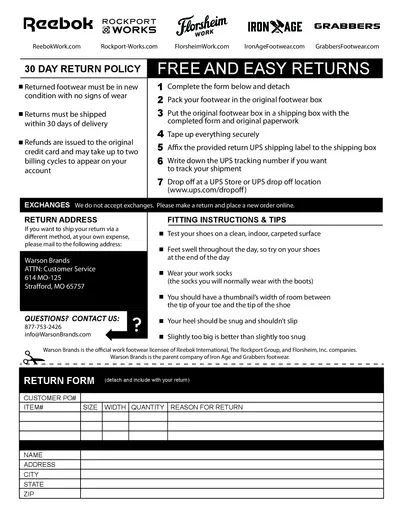

Reebok and Rockport Returns & Instructions

This file outlines the return policy and fitting instructions for Reebok and Rockport footwear. It guides users through the return process and provides important contact information. Perfect for customers looking to return their shoes or find fitting tips.

Cross-Border Taxation

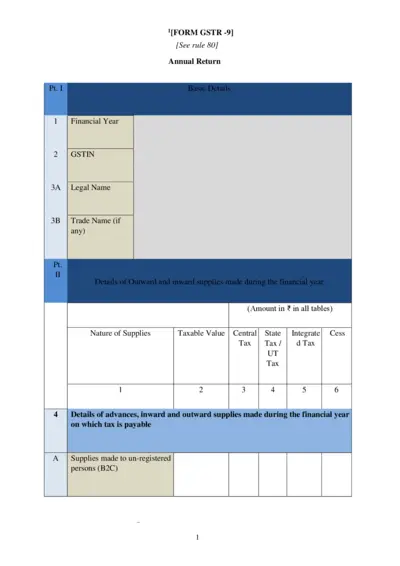

GSTR-9 Annual Return Filing Guide

The GSTR-9 is an annual return that aggregates all the data from GSTR-1 and GSTR-3B. This comprehensive guide will help users navigate through the form easily. Understand the components, instructions, and submission processes to ensure compliance.

Tax Residency

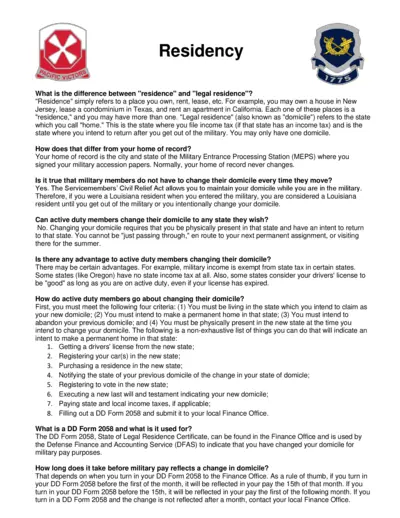

Understanding Residency and Legal Residence for Military

This document provides key insights about residence and legal residence for military members. It outlines essential information about domicile and related processes. Ideal for service members seeking clarity on residency regulations.

Cross-Border Taxation

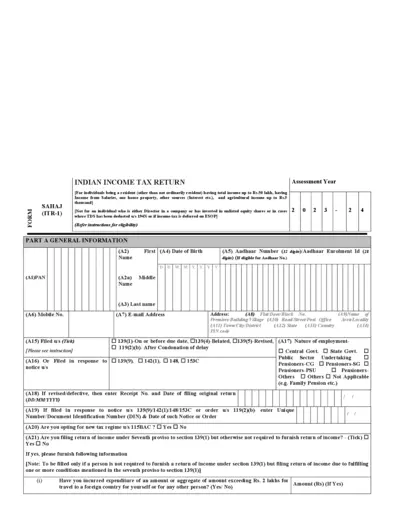

Indian Income Tax Return ITR-1 Form Overview

The ITR-1 form is specifically designed for individuals with a total income up to Rs.50 lakh. It includes income from salaries, one house property, and other sources like interest. Use this form to ensure accurate and timely filing of your income tax return.

Cross-Border Taxation

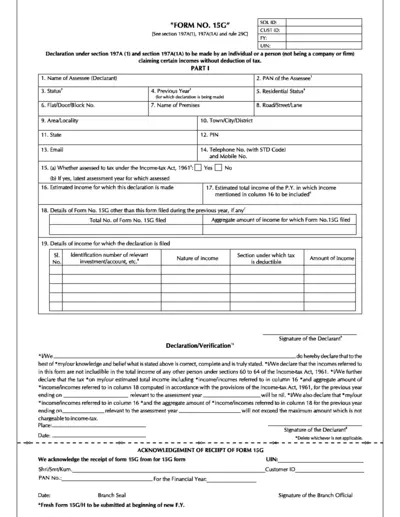

Form No 15G Declaration for Income-Tax Exemption

This file is a Form No. 15G declaration for individuals claiming certain incomes without tax deduction. It provides essential sections for filling out personal information, estimated income, and declarations related to tax. Use this form to submit income declarations to avoid tax deductions on certain incomes.

Cross-Border Taxation

2024 Texas Franchise Tax Electronic Filing Guide

This comprehensive guide offers detailed instructions on how to navigate the Texas Franchise Tax electronic filing system. It is designed for businesses and individuals who need to file their franchise taxes efficiently. In this manual, users will find everything from registration to submission processes.

Cross-Border Taxation

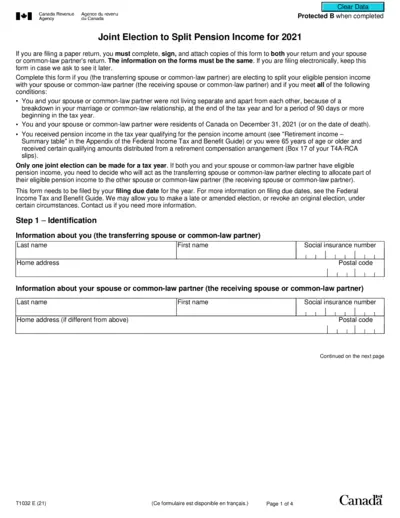

Joint Election to Split Pension Income for 2021

This form is used to elect to split pension income between spouses for tax purposes in Canada. It is essential for couples wanting to optimize their tax benefits related to pension income. Ensure completion and submission according to outlined guidelines.

Tax Returns

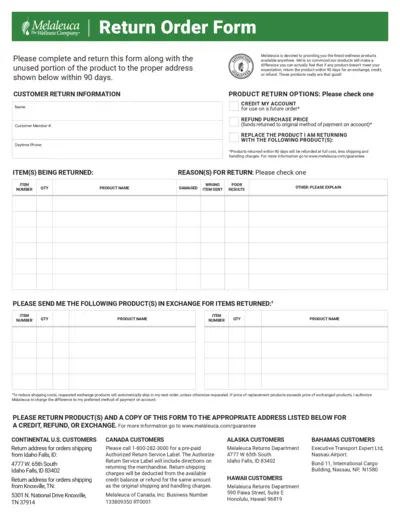

Melaleuca Return Order Form Instructions

This document provides detailed instructions for returning products to Melaleuca. It outlines the return process, required information, and addresses for shipments. Use this form to facilitate your product returns within the allotted time frame.

Cross-Border Taxation

Alabama Form 40A Short Return Instructions

This file provides essential instructions for filling out the Alabama Form 40A for full-year residents. It details pertinent information for tax reporting and compliance. Users will find guidelines on submissions, deadlines, and required forms for the tax year.

Cross-Border Taxation

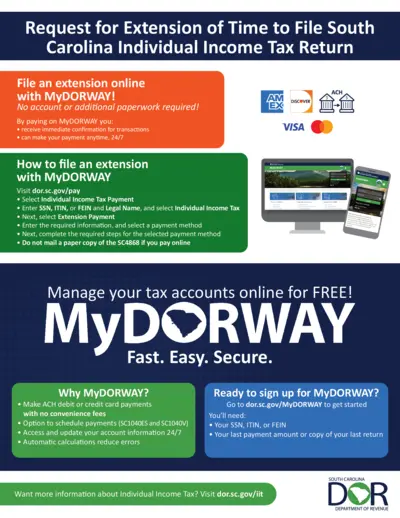

Request for Extension of Time for SC Income Tax Return

This form allows South Carolina taxpayers to request an extension for filing their Individual Income Tax Returns. Using MyDORWAY, users can easily submit their extension request online without additional paperwork. Ensure timely payments to avoid penalties and maintain compliance.

Cross-Border Taxation

Claim for Refund Instructions and Guidelines

This file contains important information about filing a claim for refund on previously paid taxes. It outlines the requirements, types of claims, and instructions to successfully submit your request. Users can utilize this resource to understand the process and necessary steps for tax reimbursement.