Tax Documents

Payroll Tax

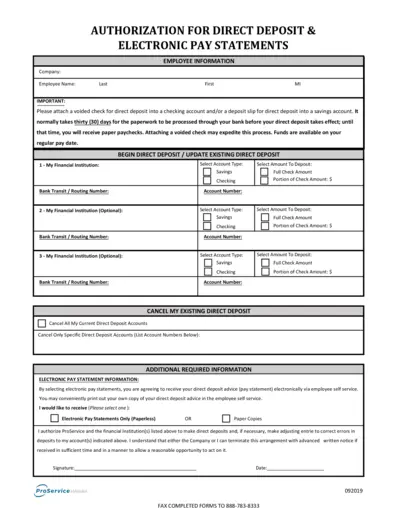

Authorization for Direct Deposit Form Instructions

This document provides instructions for filling out the authorization for direct deposit and electronic pay statements. Users can learn how to securely submit their information for direct deposits into their checking or savings accounts. Follow the steps carefully to ensure correct processing of your direct deposit enrollment.

Cross-Border Taxation

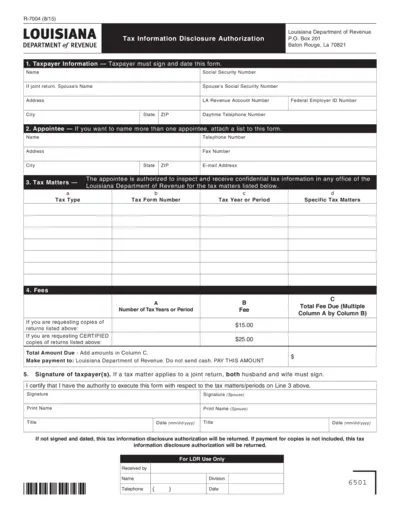

Louisiana Tax Information Disclosure Authorization

Form R-7004 allows taxpayers to authorize someone to receive their confidential tax information. This form is essential for requesting copies of your tax returns. Ensure that you complete all required sections accurately.

Cross-Border Taxation

Instructions for Form 8960 Net Investment Income Tax

This document provides essential instructions for completing Form 8960, which calculates the Net Investment Income Tax. It is useful for individuals, estates, and trusts subject to this tax. Familiarize yourself with the guidelines to ensure accurate filing.

Payroll Tax

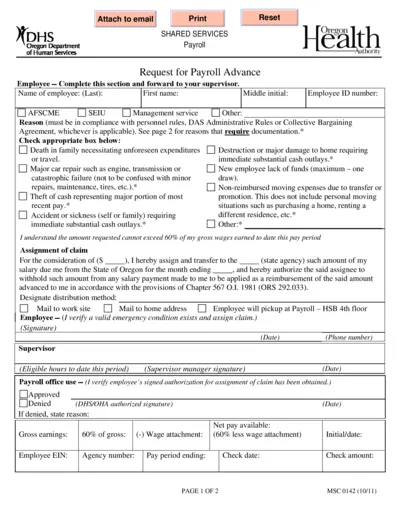

Request for Payroll Advance Form Oregon DHS

This form is used by employees to request a payroll advance due to emergency situations. It ensures that employees can access funds quickly when necessary. Please fill out the necessary fields and provide documentation as required.

Agricultural Property Tax

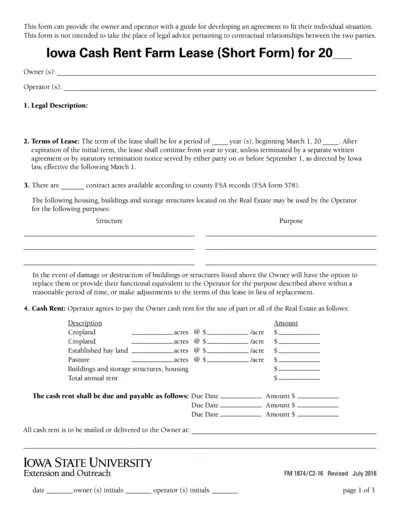

Iowa Cash Rent Farm Lease Short Form Instructions

This document provides a structured outline for creating a cash rent farm lease in Iowa. It helps both owners and operators establish terms and agreements tailored to their needs. Use this form as a guide to ensure comprehensive legal coverage.

Cross-Border Taxation

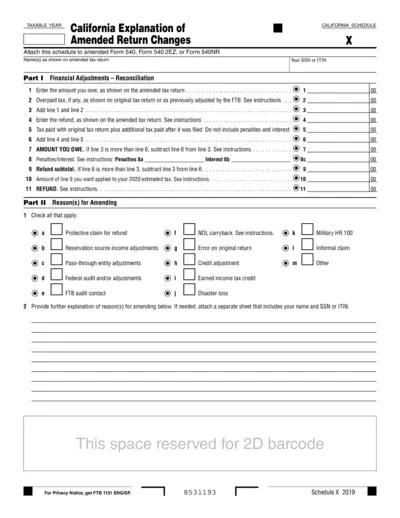

California Schedule Amended Tax Return Instructions

This document provides essential instructions for filling out the California Amended Return. It outlines necessary financial adjustments and reasons for amendments. Users can reference this for accurate tax filing and to understand their eligibility for refunds.

Cross-Border Taxation

Form 2848 and Form 8821 Instructions and Details

This file provides essential information regarding Form 2848 and Form 8821. It details the preparation, use cases, and significance of both forms. Users will find guidance on completion and submission procedures.

Tax Returns

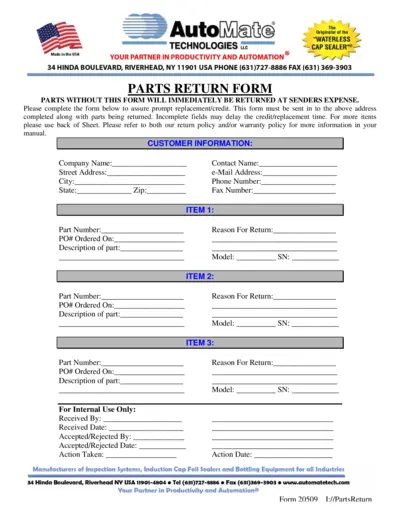

Parts Return Form - AutoMate Technologies

This Parts Return Form from AutoMate Technologies is essential for initiating the return process of parts. Users must complete the required fields to ensure prompt replacement or credit. Please refer to our guidelines for an efficient return experience.

Tax Returns

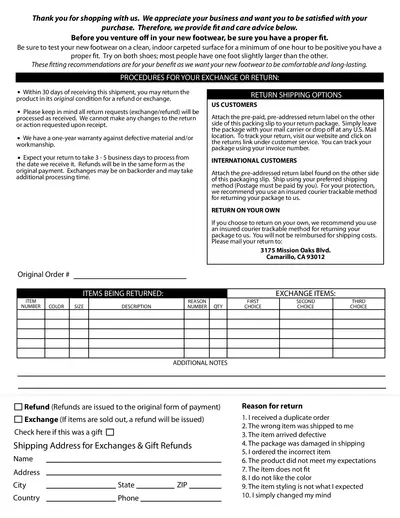

Footwear Purchase Return and Exchange Instructions

This document provides detailed instructions for returning and exchanging purchased footwear. It includes fit and care advice, return procedures, and shipping options. Follow these guidelines to ensure a smooth return or exchange for your footwear.

Cross-Border Taxation

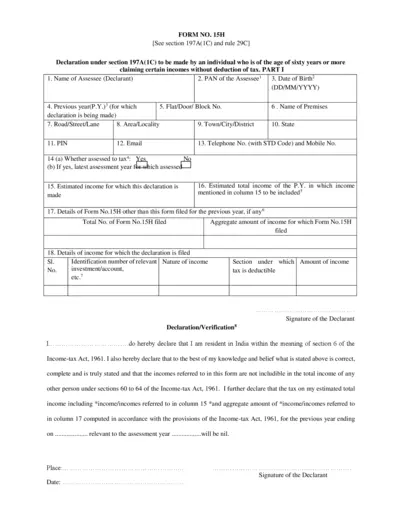

Form No. 15H Declaration for Income Tax Exemption

Form No. 15H is a declaration for individuals aged sixty or more claiming certain incomes without tax deduction. This form helps in ensuring that no tax is deducted from specified income sources. Use this document to declare your estimated income for tax purposes effectively.

Tax Returns

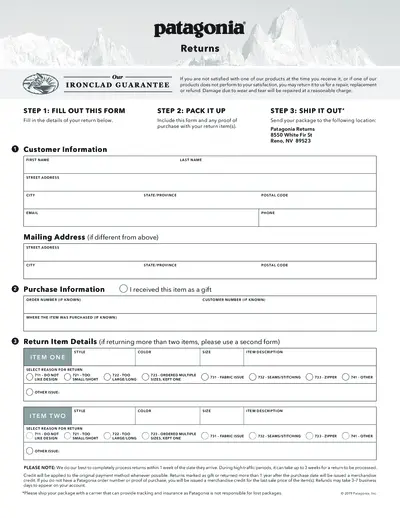

Patagonia Returns Instructions and Form Guide

This file contains detailed return instructions for Patagonia products. It includes a form for customer information and return item details. Users can follow the steps outlined to ensure a smooth return process.

Cross-Border Taxation

Pennsylvania Property Tax Rent Rebate Program 2022

This file contains essential information for the Pennsylvania Property Tax and Rent Rebate Program. It provides details on eligibility, application instructions, and important deadlines for rebates. Ideal for seniors, widows, and individuals with disabilities seeking financial assistance.