Tax Documents

Cross-Border Taxation

BIR Form 1701 - Annual Income Tax Return Guide

This guide covers the essentials of filling out BIR Form 1701 for self-employed individuals, estates, and trusts. It includes step-by-step instructions on using the interactive forms. Aimed at simplifying the tax return process in the Philippines.

Payroll Tax

Paperless Payroll Solutions from ITAC

ITAC Solutions has transitioned to paperless payroll for all employees. This document provides essential information regarding direct deposits and payroll options. Ensure a seamless experience with the Employee Portal for payroll access.

Cross-Border Taxation

Oregon Department of Revenue Personal Income Tax Forms

This document provides essential information for filing personal income tax forms in Oregon. It includes guidelines for residents and nonresidents, along with important form selection criteria. Understanding your residency status and the appropriate forms is crucial for accurate tax filing.

Tax Credits

Child Tax Credit and Working Tax Credit Assistance

This file provides information on tax credits and other assistance available for families and individuals. It covers eligibility, how to apply, and available support programs. Essential for those seeking financial help during challenging times.

Cross-Border Taxation

Child Tax Credit Publication 972 2014 Instructions

This publication provides details on how to claim the Child Tax Credit. It explains eligibility and gives instructions on fulfilling tax forms. Ideal for taxpayers seeking clarity on their tax benefits.

Cross-Border Taxation

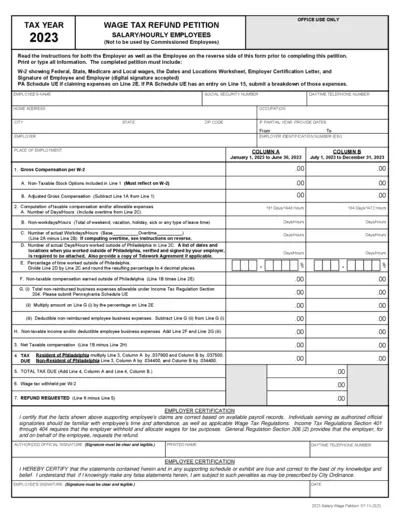

2023 Wage Tax Refund Petition Instructions

This document provides essential instructions for filling out the 2023 Wage Tax Refund Petition. It is designed for salary and hourly employees who are seeking a refund of over-withheld wage taxes. Follow the detailed guidelines to ensure your petition is completed correctly.

Cross-Border Taxation

Improvement Needed in Foreign Tax Credit Compliance

This report evaluates compliance efforts regarding unsupported claims for Foreign Tax Credits (FTC). It highlights findings from an audit conducted to assess IRS controls over FTC claims. Taxpayers should understand the implications of FTC to ensure accurate tax filings.

Cross-Border Taxation

Employment Issues Course Overview for 501(c)(3) Organizations

This document provides comprehensive instructions and information about taxation responsibilities for 501(c)(3) organizations. It covers employment classifications, tax withholdings, and employment tax forms. Ideal for organizations looking to remain compliant with tax regulations.

Cross-Border Taxation

Guidance on Employee Retention Credit Notice 2021

This file provides essential guidance on the Employee Retention Credit under Section 3134 of the Internal Revenue Code. It details the eligibility criteria, the extension of the credit, and instructions for employers. The document is vital for understanding tax credits and compliance for wages paid during specified periods.

Cross-Border Taxation

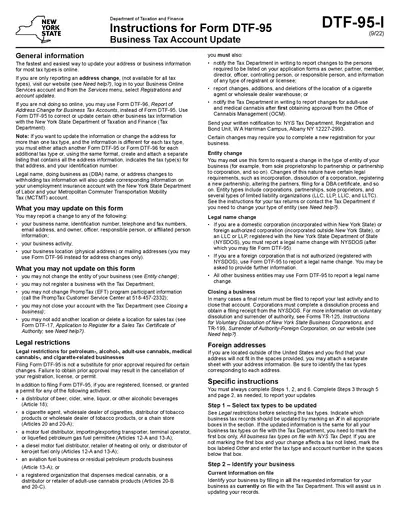

Instructions for New York Business Tax Account Update

This document provides instructions for updating business tax account information in New York State. It outlines how to correct or update various business details, including address changes. Use this guide to ensure your information remains accurate with the Tax Department.

Payroll Tax

Federal and State W-4 Filing Instructions

This document outlines the necessary steps to complete and submit Federal and State W-4 forms. It provides important deadlines and guidelines for employers regarding withholding exemptions. Understanding these forms is essential for compliance and accurate tax filing.

Tax Returns

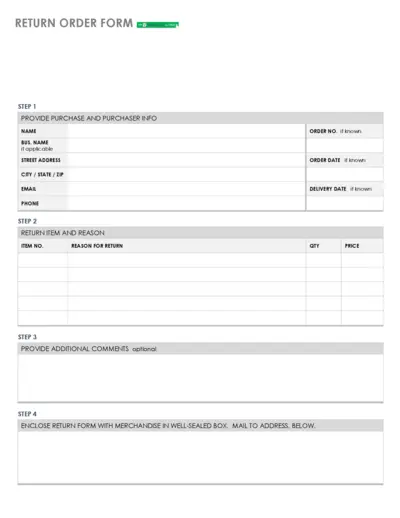

Smartsheet Return Order Form Instructions

This file contains detailed instructions for filling out the Smartsheet Return Order form. It covers steps for providing purchaser info, reasons for return, and the process for submitting the form. Utilize this guide to ensure a smooth return process.