Tax Documents

Cross-Border Taxation

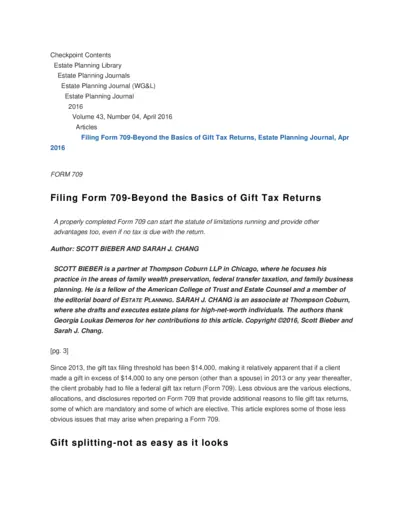

Essential Gift Tax Return Filing Insights

This file provides comprehensive guidance on filing Form 709, including crucial insights about gift splitting and tax implications. It is designed for tax professionals and individuals involved in estate planning. Enhance your understanding of gift tax returns and ensure compliance with tax regulations.

Cross-Border Taxation

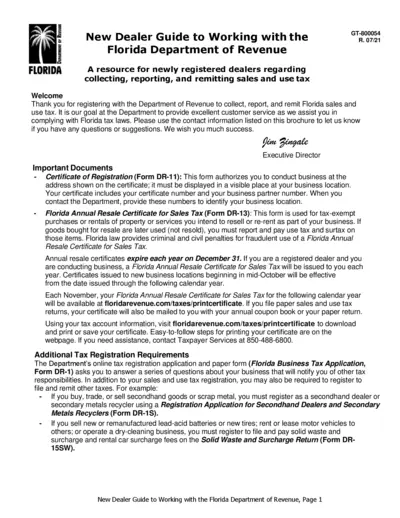

New Dealer Guide to Working with Florida Revenue

This guide provides essential information for newly registered dealers in Florida regarding their sales and use tax obligations. It includes contact details, important documents, and specific responsibilities to ensure compliance with tax laws. The guide serves as a resource for understanding registration requirements and filing processes.

Cross-Border Taxation

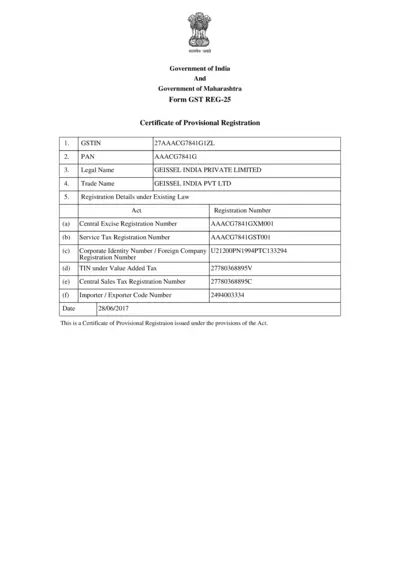

Certificate of Provisional Registration GST REG-25

This file is a certificate for provisional registration under GST. It includes essential details such as GSTIN and PAN. Businesses applying for GST registration must use this file.

Cross-Border Taxation

FAQs for Filing Form 3CA-3CD Tax Audit Report

This document provides detailed FAQs on filing Form 3CA-3CD for tax audit reports. It assists taxpayers and chartered accountants in understanding the filing process. Essential for anyone involved in Indian income tax e-filing.

Cross-Border Taxation

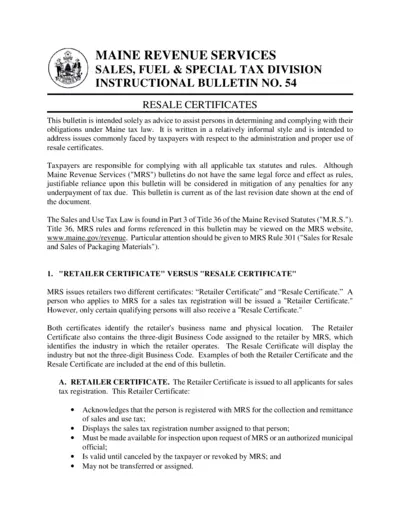

Maine Revenue Services Resale Certificate Guidelines

This file provides essential guidance about resale certificates issued by Maine Revenue Services. It includes information on how to properly use and renew these certificates. Taxpayers can find terms and responsibilities related to obtaining resale certificates here.

Payroll Tax

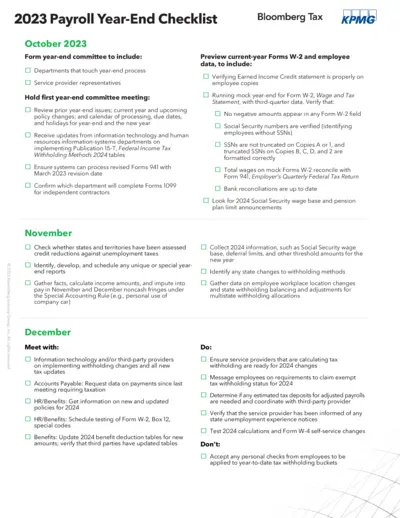

2023 Payroll Year-End Checklist Overview

This file provides a comprehensive checklist for year-end payroll processing, including important dates, tasks, and compliance measures. It aids employers in preparing required forms and making necessary updates for the year-end payroll close. Use this checklist to streamline your payroll processes and ensure compliance with tax regulations.

Cross-Border Taxation

Authorities Provided by Internal Revenue Code

This report outlines the inefficiencies in addressing erroneous refundable credits by the IRS. It evaluates the use of available tools to combat fraudulent claims. The findings call for improvements in IRS processes to protect taxpayer funds.

Cross-Border Taxation

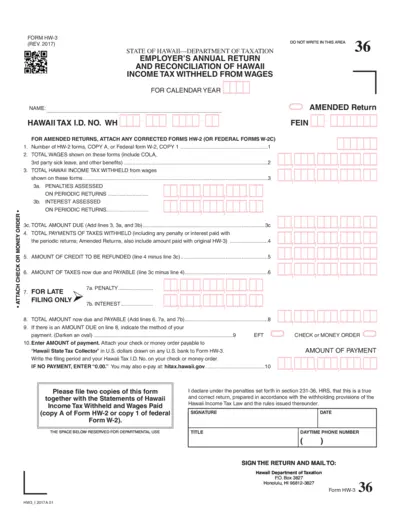

Hawaii Employer's Annual Tax Return Form HW-3

The HW-3 form is used by employers in Hawaii to report withheld income tax from their employees' wages. It captures total wages paid and tax withheld for the calendar year. This form must be filed annually to ensure compliance with Hawaii tax laws.

Tax Returns

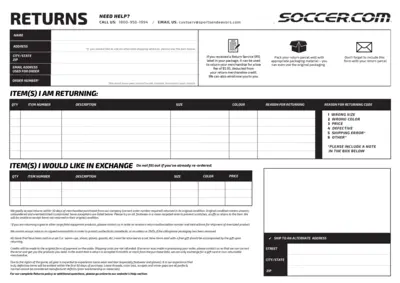

Easy Returns Process for Soccer.com

This file provides detailed instructions for returning purchased items to Soccer.com. It includes important information on how to fill out the return form, acceptable return conditions, and contact details for assistance. Use this document to help ensure a smooth and hassle-free return experience.

Cross-Border Taxation

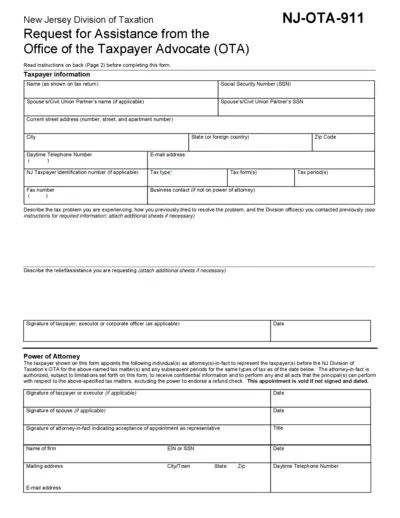

New Jersey Request for Assistance Form NJ-OTA-911

The New Jersey Division of Taxation's Request for Assistance is a form to seek help from the Office of the Taxpayer Advocate (OTA). It is designed for taxpayers facing unresolved issues or hardships related to state tax matters. Follow the detailed instructions to ensure your request is properly filled out for assistance.

Cross-Border Taxation

Guide to Wisconsin Wage Statements and Information Returns

This publication provides essential guidance for preparing Wisconsin wage statements and information returns for 2024. It outlines new requirements, filing deadlines, and necessary forms. Employers and payers will find the information crucial for compliance with Wisconsin's tax regulations.

Cross-Border Taxation

Merchant Card Reporting and FAQs Form 1099-K

This document provides essential information regarding Form 1099-K and the obligations of merchant acquiring entities. Understand your reporting requirements and avoid potential penalties. Consult your tax advisor for legal and tax advice.