Tax Documents

Cross-Border Taxation

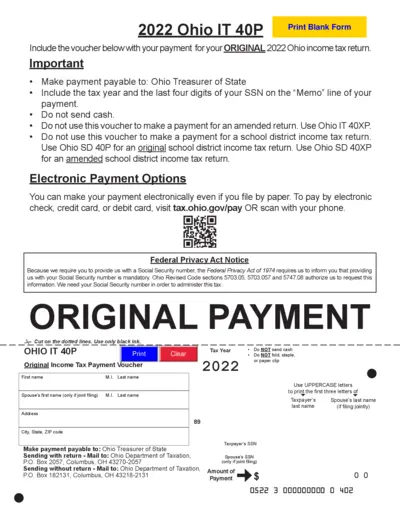

2022 Ohio IT 40P Income Tax Payment Voucher Form

The 2022 Ohio IT 40P form is essential for filing your original income tax return. It includes important payment instructions to ensure proper submission. Follow the provided guidelines to complete your voucher accurately.

Cross-Border Taxation

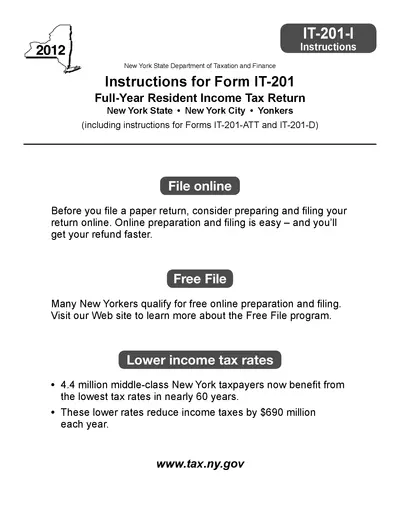

New York State IT-201-I Instructions for 2012

The IT-201-I provides essential instructions for completing the New York State IT-201 Full-Year Resident Income Tax Return. This document is vital for taxpayers to ensure proper filing and to maximize their returns. Access important deadlines and updates for a smooth filing process.

Cross-Border Taxation

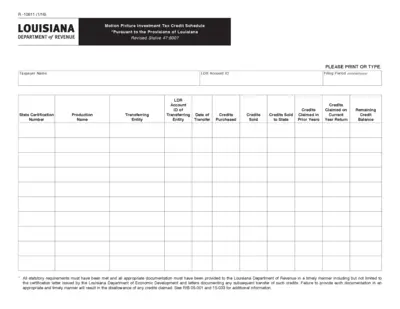

Louisiana Motion Picture Investment Tax Credit

This document is the Motion Picture Investment Tax Credit Schedule for Louisiana. It includes necessary fields for applicants to claim tax credits. Ensure you follow the guidelines and provide complete documentation for submission.

Cross-Border Taxation

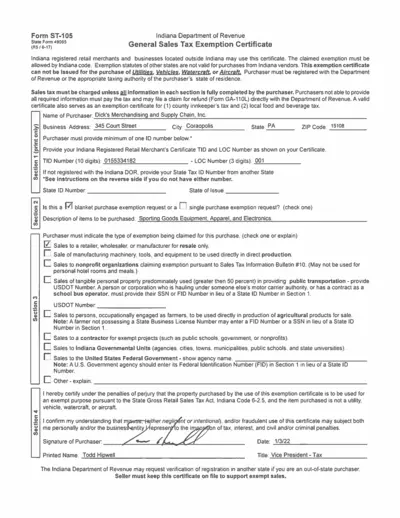

Indiana Sales Tax Exemption Certificate Form ST-105

The Indiana Sales Tax Exemption Certificate (Form ST-105) allows registered merchants to make exempt purchases. This form is essential for businesses to claim tax exemptions under Indiana law. Ensure all information is accurately completed to validate your exemption status.

Cross-Border Taxation

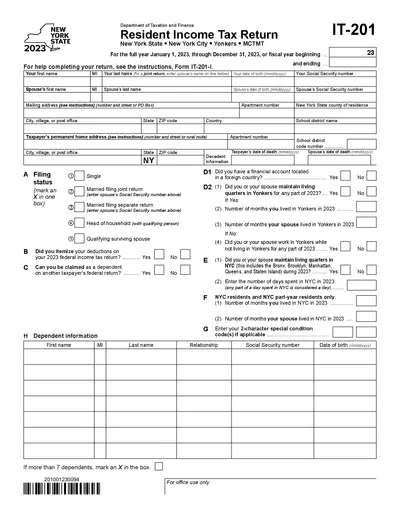

New York State Resident Income Tax Return 2023

This document is the New York State Resident Income Tax Return form for 2023. It is essential for individuals filing their state income taxes. This form includes detailed instructions and sections for reporting income and deductions.

Cross-Border Taxation

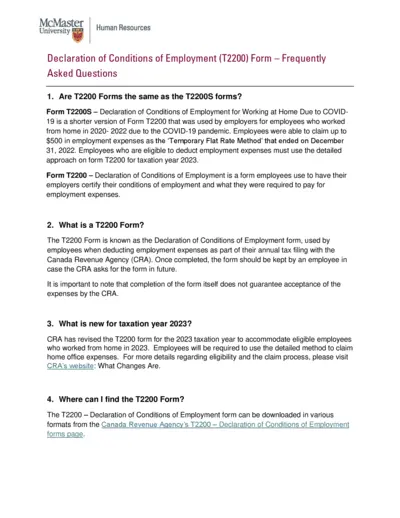

T2200 Employment Expense Claim Guidelines

This file provides essential information about the T2200 form, including how to complete it and who is eligible to use it. It also outlines the rules regarding home office expenses and offers guidance for employees during tax filing. Users will find answers to common questions about the form and its requirements.

Cross-Border Taxation

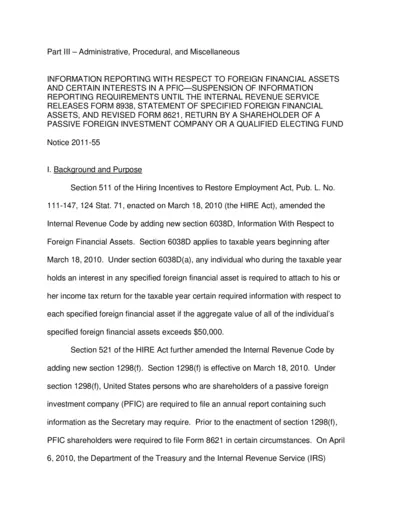

Information Reporting for Foreign Financial Assets

This document outlines critical information reporting requirements for U.S. individuals with foreign financial assets and passive foreign investment companies (PFICs). It contains necessary instructions and forms for compliance with tax regulations. Use this file to understand your reporting obligations and ensure timely submissions.

Payroll Tax

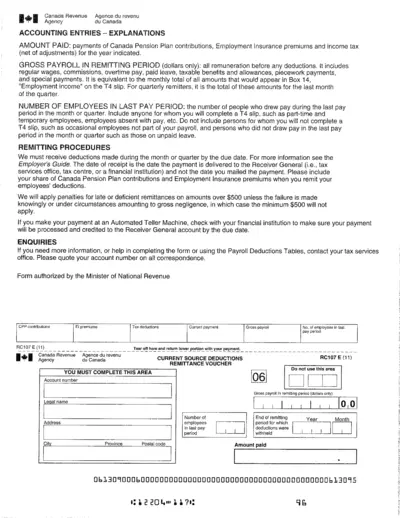

Canada Revenue Agency Accounting Entries Explanations

This file provides detailed explanations regarding accounting entries relevant to Canada Revenue Agency. It includes instructions for payroll remittances and how to report deductions. A must-have resource for employers handling payroll in Canada.

Payroll Tax

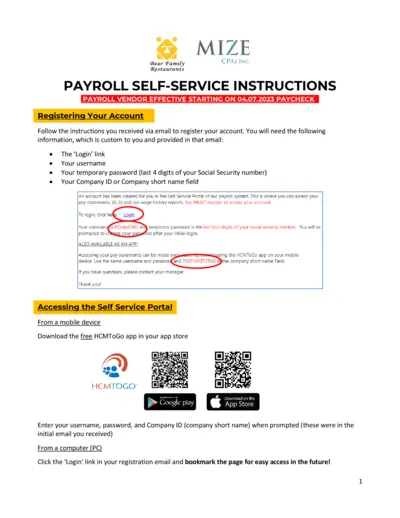

Payroll Self-Service Instructions for Employees

This document provides instructions for employees to register and access their payroll self-service account. It guides users on how to manage pay statements, tax withholdings, and direct deposit information. Essential for new and existing employees to navigate payroll processes smoothly.

Cross-Border Taxation

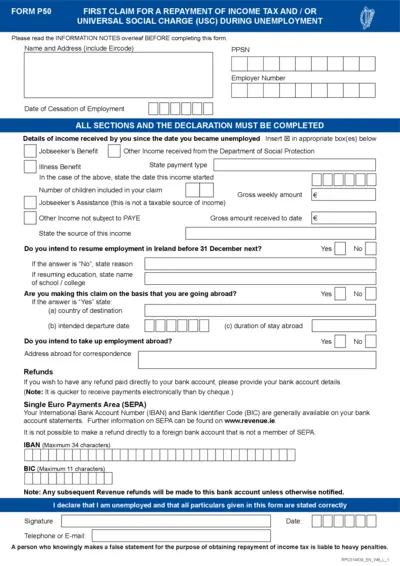

First Claim for Income Tax and USC Repayment

This file contains the FORM P50, essential for claiming refunds of income tax and Universal Social Charge during unemployment. It provides necessary guidelines on filling out the form correctly to ensure timely processing. Follow the instructions carefully to avoid delays in your claim.

Cross-Border Taxation

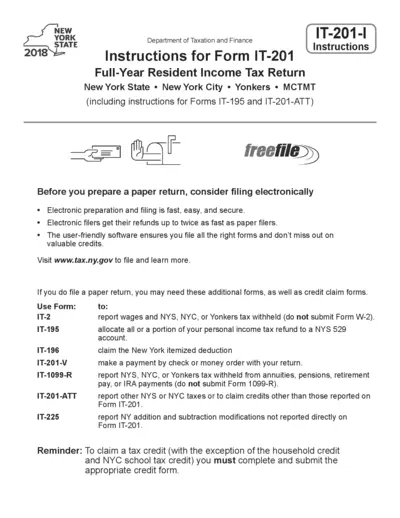

New York State 2018 IT-201-I Tax Filing Instructions

This document provides detailed instructions for filing the 2018 New York IT-201-I tax form. It includes essential information about credits and forms required for full-year resident taxpayers. Ideal for individuals seeking guidance on electronically or paper filing their tax returns.

Cross-Border Taxation

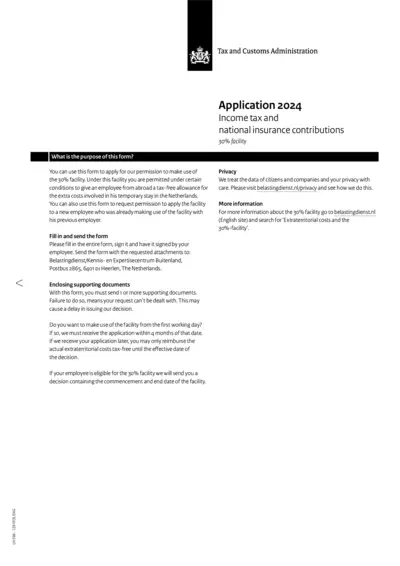

LH 598 30% Facility Form Instructions and Details

This form allows employers to apply for the tax-free 30% facility for expatriate employees in the Netherlands. It includes guidelines and requirements for submissions. Ensure that all supporting documents are included to avoid delays in processing.