Tax Documents

Cross-Border Taxation

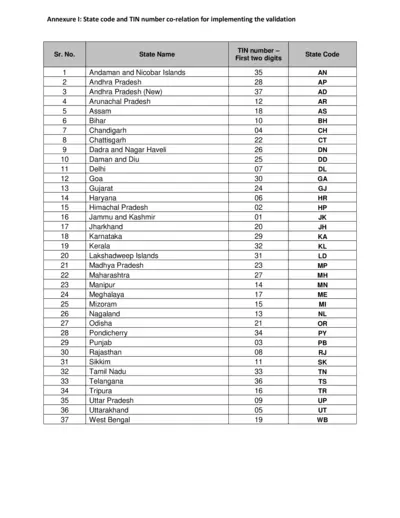

State Code and TIN Number Validation Guide

This file provides essential information on the correlation between state codes and TIN numbers in India. It serves as a reference for individuals and businesses to ensure proper validation. Use this guide to comply with regulatory requirements related to taxation.

Cross-Border Taxation

Illinois Department of Revenue IL-W-4 Filing Instructions

Form IL-W-4 is essential for Illinois employees to ensure the correct withholding of income tax. It helps claim allowances and exemptions effectively. Completing this form correctly can prevent under-withholding and potential tax penalties.

Cross-Border Taxation

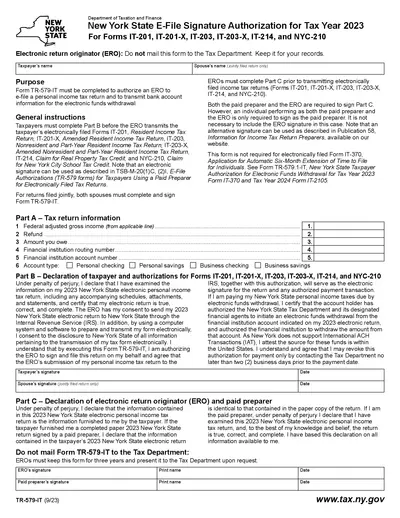

New York State E-File Signature Authorization 2023

This file is a New York State E-File Signature Authorization form for tax year 2023. It is required for taxpayers who are e-filing their personal income tax returns. Ensure to follow the instructions carefully to fill out the form correctly.

Cross-Border Taxation

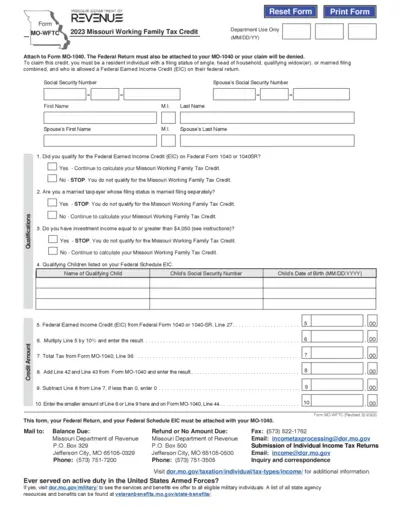

2023 Missouri Working Family Tax Credit Form MO-WFTC

The Missouri Working Family Tax Credit (MO-WFTC) is a tax credit for residents who qualify for the Federal Earned Income Credit. It is applicable to various filing statuses such as single, head of household, and married filing combined. Ensure to attach your Federal Return to your MO-1040 to claim the credit.

Tax Compliance

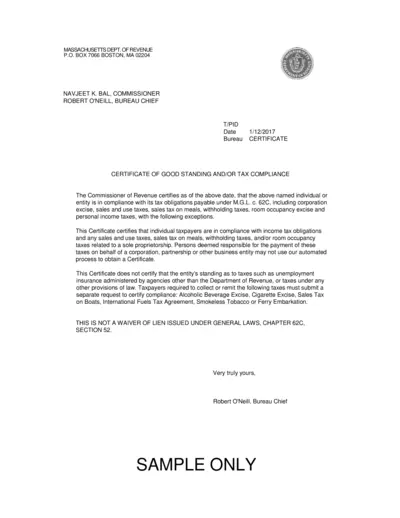

Massachusetts Certificate of Good Standing

This file provides a Certificate of Good Standing and Tax Compliance issued by the Massachusetts Department of Revenue. It certifies an individual's or entity's compliance with tax obligations. It includes important information regarding tax types and liabilities.

Cross-Border Taxation

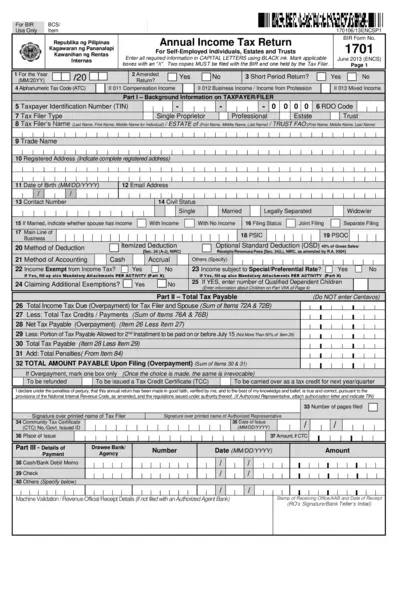

Annual Income Tax Return for Self-Employed Individuals

This file provides the necessary form for self-employed individuals, estates, and trusts to file their annual income tax return. It includes guidelines and specific fields that must be filled out accurately for compliance with tax regulations. Users can find essential instructions and information to assist them in the filing process.

Cross-Border Taxation

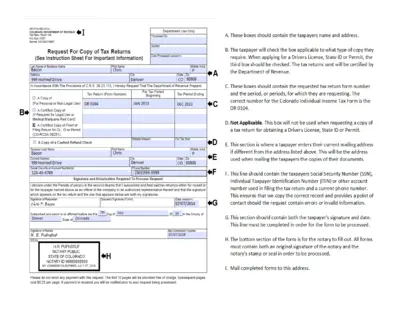

Request for Copy of Colorado Tax Returns

This document is a request form for obtaining copies of tax returns from the Colorado Department of Revenue. It includes necessary fields for personal and business tax information. Completing this form is essential for individuals who need copies of their tax documents for legal or personal use.

Cross-Border Taxation

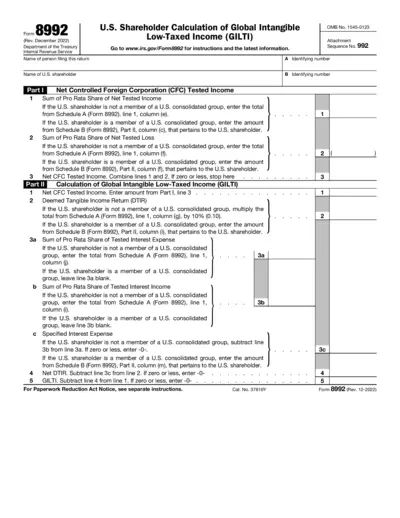

Global Intangible Low-Taxed Income (GILTI) Form 8992

Form 8992 is a crucial document for U.S. shareholders calculating their Global Intangible Low-Taxed Income (GILTI). It assists in reporting income from controlled foreign corporations. Understanding this form is vital for compliance with U.S. tax regulations.

Cross-Border Taxation

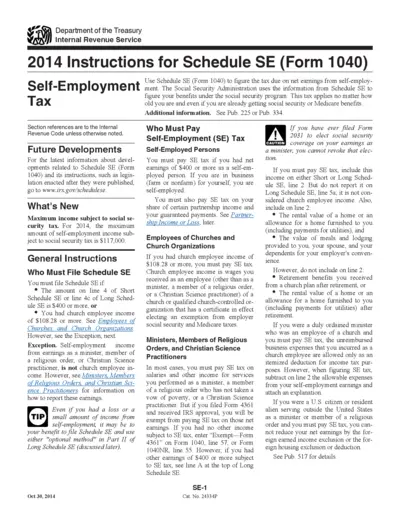

2014 Schedule SE Instructions for Self-Employment Tax

This document provides comprehensive instructions on how to fill out Schedule SE for self-employment tax. It covers who must file, how to report income, and the consequences of failing to file. Users can also learn about exemptions and special conditions applicable to different professions.

Tax Returns

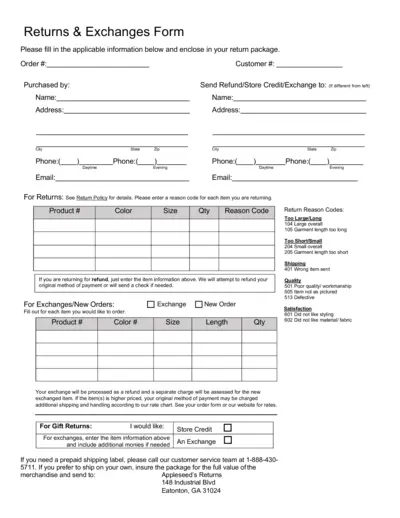

Returns and Exchanges Form Instructions and Details

This file contains detailed instructions for filling out a Returns and Exchanges form. Users can find guidelines on the necessary information to provide and how to process returns or exchanges. It's essential for managing your purchases efficiently and ensuring customer satisfaction.

Cross-Border Taxation

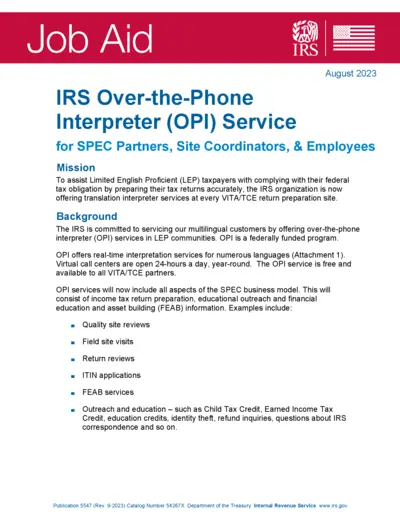

IRS Over-the-Phone Interpreter Service Job Aid

This job aid provides detailed instructions for IRS Over-the-Phone Interpreter (OPI) services. It is designed for SPEC partners, site coordinators, and employees who assist Limited English Proficient taxpayers. Learn how to accurately prepare tax returns and use translation services effectively.

Cross-Border Taxation

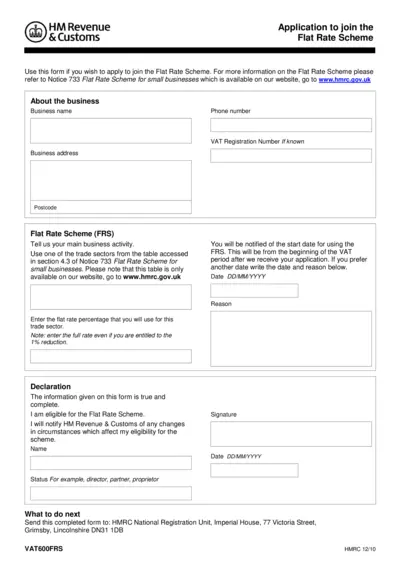

Application to Join the Flat Rate Scheme

This form allows businesses to apply for the Flat Rate Scheme with HM Revenue & Customs. It includes necessary details for eligibility and submission. Learn how to fill it out correctly to ensure timely processing.