Tax Documents

Cross-Border Taxation

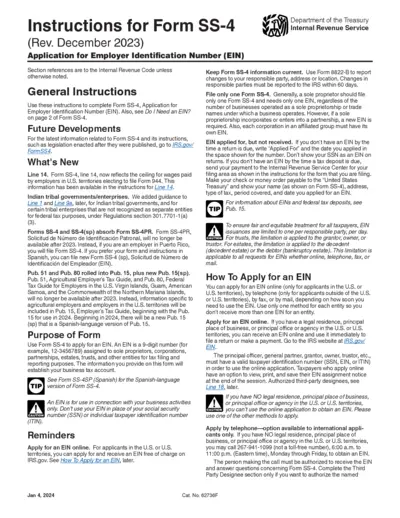

Form SS-4 Instructions for EIN Application

This PDF provides essential instructions for completing Form SS-4 to apply for an Employer Identification Number (EIN). It outlines eligibility, requirements, and recent updates relevant to the application process. Aimed at business owners and organizations, this document ensures proper filling for tax identification.

Payroll Tax

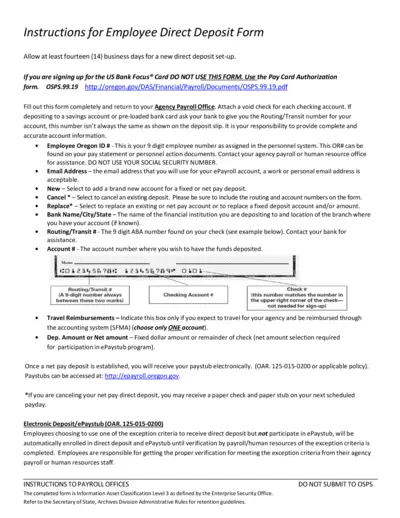

Employee Direct Deposit Form Instructions Oregon

The Employee Direct Deposit Form provides essential details for setting up direct deposits for employees in Oregon. It includes instructions for filling out the form and information required for successful processing. Follow the guidelines to ensure a smooth direct deposit experience.

Cross-Border Taxation

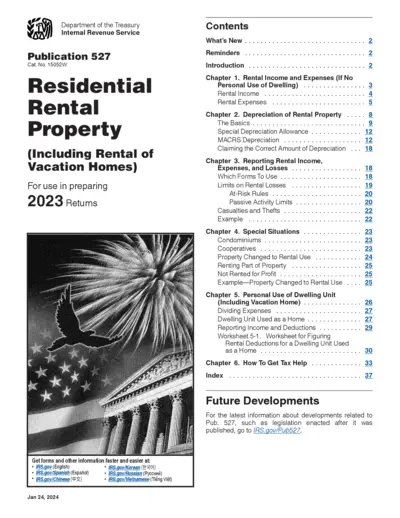

IRS Publication 527 Residential Rental Property 2023

This file contains essential information related to IRS Publication 527 for Residential Rental Property, including guidance on reporting income and expenses. Learn about deductions, depreciation, and special rental situations. It's a must-read for anyone involved in residential rental activities.

Tax Returns

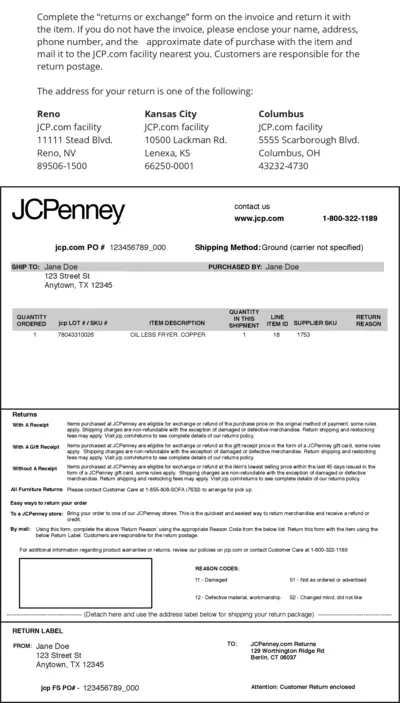

JCPenney Returns and Exchange Form Instructions

This file provides detailed instructions on how to complete returns or exchanges at JCPenney. It outlines the necessary information needed and the process to follow for a successful return. Use this guide to understand the return policy and your responsibilities.

Cross-Border Taxation

Employer Annual Declarations EMP501 Submission Guide

This file provides essential information about the EMP501 annual reconciliation declaration for employers. It outlines important deadlines, compliance requirements, and submission guidelines for 2023. Ensure your submissions are accurate to support your employees' tax compliance.

Cross-Border Taxation

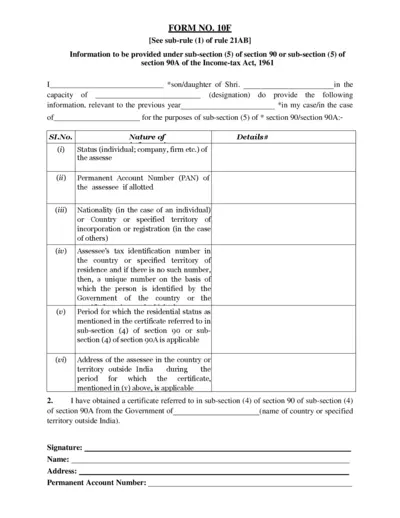

Form No. 10F: Income Tax Information Submission

Form No. 10F is required for providing tax information under sections 90 and 90A. Use this form to ensure compliance with tax regulations. Accurately filled forms help facilitate seamless processing of your tax-related matters.

Cross-Border Taxation

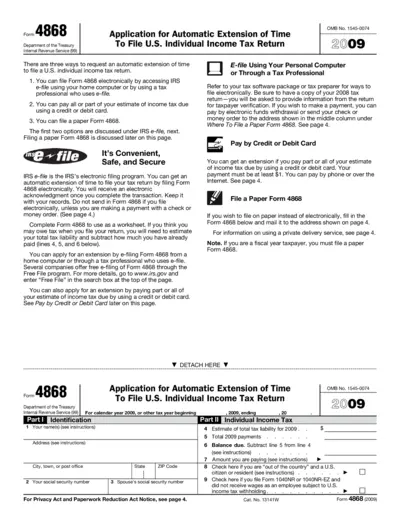

Form 4868 Automatic Extension Application 2009

Form 4868 allows U.S. individuals to request an automatic extension to file their tax returns. Users can apply for an additional six months to submit their returns. This document includes instructions for filling out and submitting the form.

Cross-Border Taxation

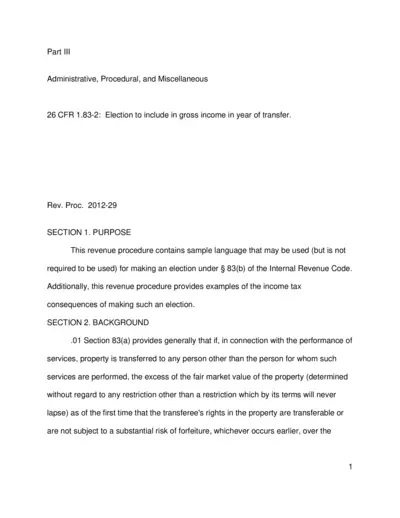

Election to Include in Gross Income under 83(b)

This document outlines the process of making an election under Section 83(b) of the Internal Revenue Code. It provides guidelines on the tax consequences and filing procedures necessary for individuals transferring property. Understanding these details is crucial for compliant tax reporting.

Cross-Border Taxation

Employer Tax Responsibilities for Disability Benefits

This document outlines essential tax information regarding employee disability benefits. It guides employers on taxation rules and reporting requirements. The file also details the taxability of benefits based on premium payments.

Sales Tax

DBA Sales Orders Guide for Small Business

The DBA Sales Orders Guide provides comprehensive instructions for managing sales orders. It is essential for small businesses looking to streamline their sales processes. This guide covers everything from order entry to invoicing.

Cross-Border Taxation

E-TDS Filing Process Explained Concisely

This file provides essential guidelines on E-TDS filing. It outlines the objective and importance of filing a tax return electronically. Perfect for taxpayers looking to understand their obligations.

Excise Tax

Maharashtra Excise Department Digital Services Guide

This file provides a comprehensive checklist and fee structure for various digital services offered by the Maharashtra Excise Department. It outlines the application processes for different types of licenses related to alcohol services. Users can find relevant forms and procedural details to facilitate their applications.