Tax Documents

Cross-Border Taxation

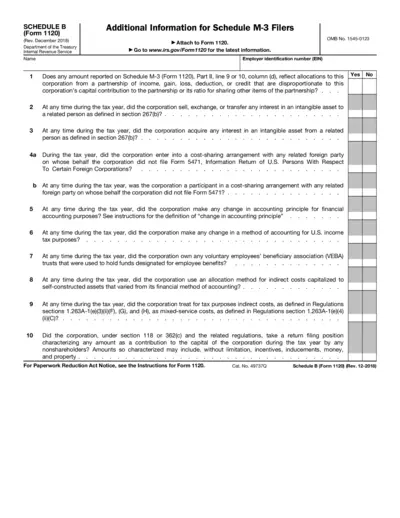

Schedule B Form 1120 Filing Instructions

This file contains essential Schedule B instructions for corporate tax reporting. It includes guidance on filing requirements, related forms, and compliance. Ideal for organizations needing to navigate complex tax regulations.

Tax Residency

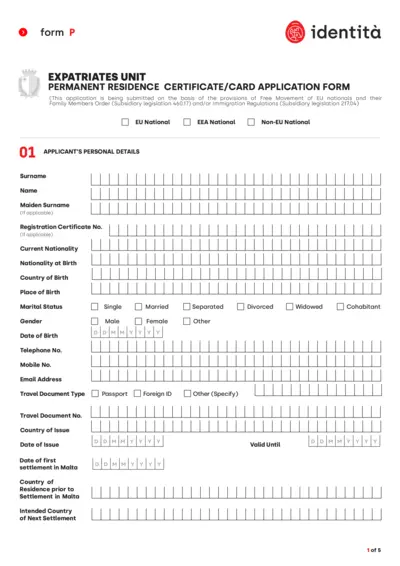

Permanent Residence Certificate Application Form

This document is for individuals applying for a Permanent Residence Certificate in Malta. It includes sections for personal details, residence information, and required supporting documents. Properly completing this form is essential for securing your residency rights.

Cross-Border Taxation

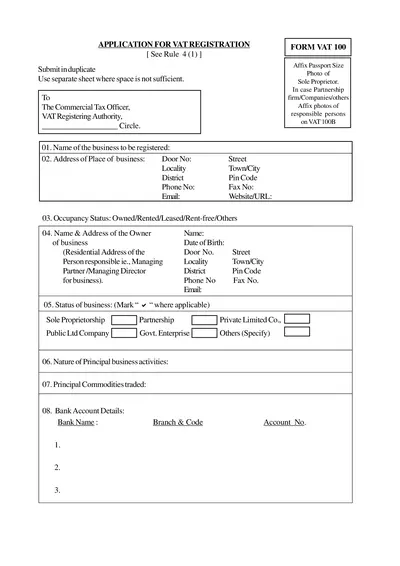

VAT Registration Application Form - Complete Guide

This VAT Registration Application Form is essential for businesses seeking to register for VAT. The form captures critical details such as business name and address. Follow the guidelines to ensure successful completion and submission.

Cross-Border Taxation

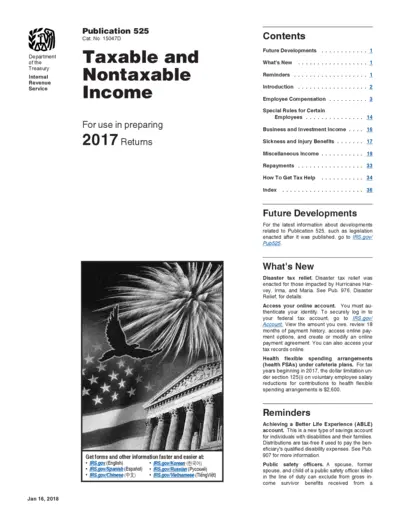

Taxable and Nontaxable Income Publication 525

This document provides comprehensive details on taxable and nontaxable income, including employee compensation and various nuances affecting individuals. It's essential for preparing accurate tax returns and understanding the implications of different income types. Utilize this guide to navigate your tax obligations effectively and ensure compliance with IRS regulations.

Cross-Border Taxation

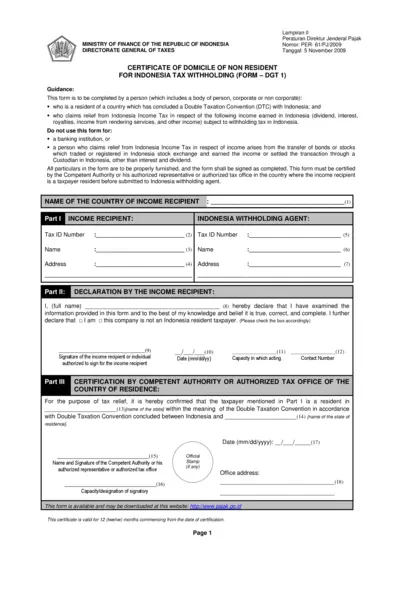

Certificate of Domicile for Indonesia Tax Withholding

This form is required for non-residents claiming income tax relief in Indonesia. It provides necessary information for tax withholding purposes. Completing this form ensures compliance with Indonesian tax regulations.

Cross-Border Taxation

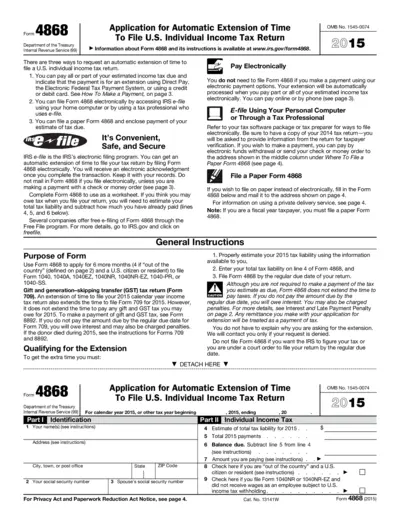

Form 4868 Application for Automatic Tax Extension

Form 4868 is used to apply for an automatic extension of time to file your U.S. Individual Income Tax Return. This form allows taxpayers to request an additional six months to file their returns. It's important to estimate your tax liability and submit the form before the original due date.

Cross-Border Taxation

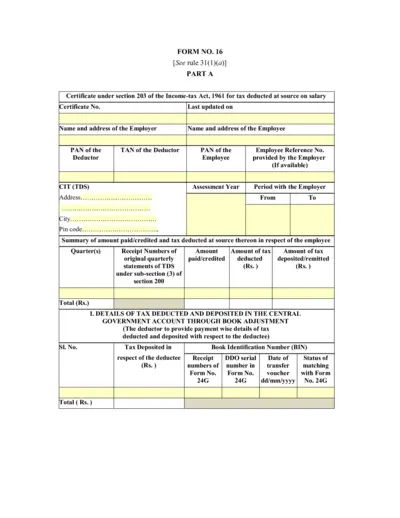

Form No. 16 - TDS Certificate for Salary Income

Form No. 16 is a tax deduction certificate generated under section 203 of the Income-tax Act, 1961. It provides details of tax deducted at source for salary income. This file is essential for employees to claim tax deductions and file income tax returns.

Cross-Border Taxation

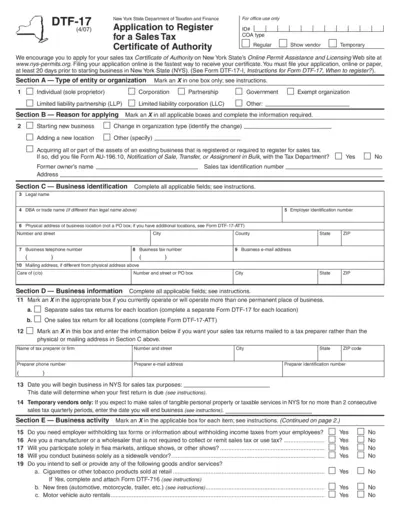

New York State Application for Sales Tax Authority

The New York State Application to Register for a Sales Tax Certificate of Authority is essential for businesses operating in NYS. This document enables companies to collect sales tax from customers legally. Ensure you complete and submit this form on time to avoid penalties.

Cross-Border Taxation

Fundamental Changes to Tax Return Filing and Processing

This document outlines fundamental changes to the tax return filing and processing system aimed at improving taxpayer assistance and reducing improper payments. It includes recommendations for an accelerated reporting system and benefits of real-time access to third-party data. The analysis balances the needs of stakeholders, including taxpayers and tax authorities.

Cross-Border Taxation

Alabama Corporation Income Tax Return Instructions

This file provides detailed instructions for preparing the Alabama Corporation Income Tax Return for 2021. It includes essential updates and requirements for compliance with the current laws. Users can find guidance on filing procedures and important tax information here.

Cross-Border Taxation

Wisconsin Revenue Extensions of Time to File

This publication provides detailed information on obtaining extensions to file various Wisconsin tax forms. It covers individual income tax returns, corporate franchise tax returns, and more. Essential for taxpayers seeking guidance on filing deadlines and extension procedures.

Cross-Border Taxation

India Tax Information on Permanent Account Number

This document provides essential information about the Permanent Account Number (PAN) in India, a key Tax Identification Number (TIN). It details the legal authority, application process, and structures associated with PAN. A valuable resource for individuals and entities needing to navigate India's tax identification requirements.