Tax Documents

Cross-Border Taxation

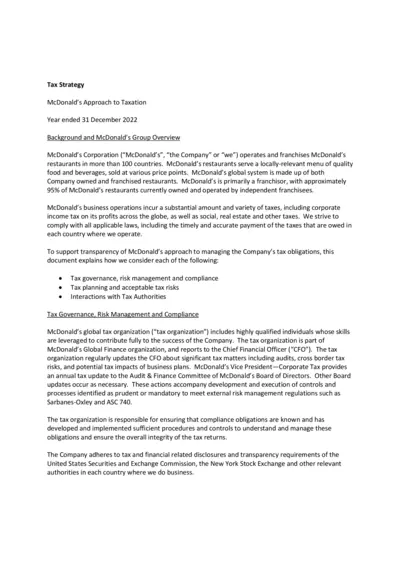

Tax Strategy McDonald's Approach to Taxation 2022

This document outlines McDonald's tax strategy and compliance approach. It provides information about tax governance, risk management, and interactions with tax authorities. Users can learn about the responsibilities and methodologies McDonald's uses in tax planning and management.

Cross-Border Taxation

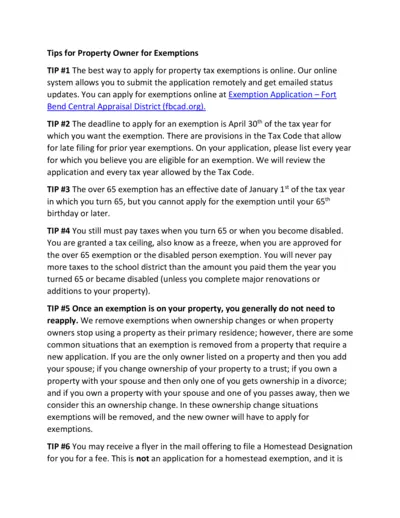

Essential Property Tax Exemption Tips

This file provides crucial tips for property owners regarding tax exemptions. It includes application procedures and important deadlines. Understanding these tips can help you maximize your tax savings effectively.

Cross-Border Taxation

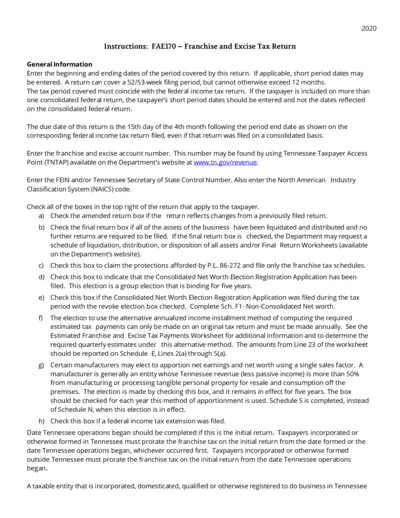

FAE170 - Franchise and Excise Tax Return Instructions

The FAE170 form provides essential instructions for filing Franchise and Excise Tax Returns in Tennessee. It includes detailed guidelines on filling out the form and important tax information. Utilize this file to ensure compliance with state tax regulations.

Cross-Border Taxation

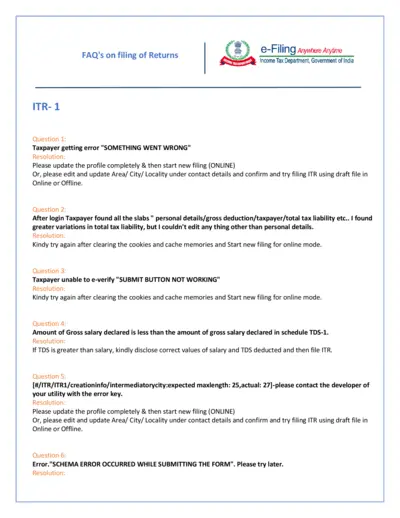

Income Tax e-Filing FAQs – Expert Guide

This document presents FAQs regarding the e-filing of income tax returns in India. It addresses common issues taxpayers may encounter during the filing process. Ideal for individuals and businesses needing assistance with their income tax return submissions.

Cross-Border Taxation

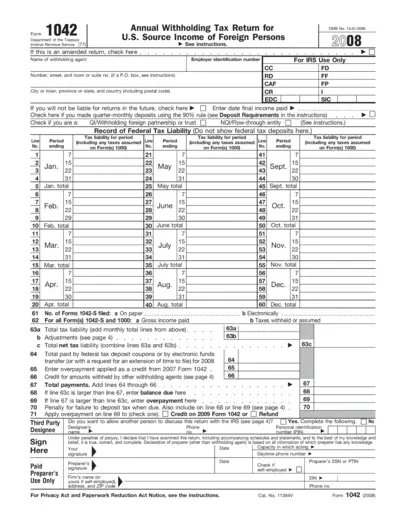

Annual Withholding Tax Return Form 1042 for 2008

This file contains the Annual Withholding Tax Return Form 1042 for U.S. source income of foreign persons. It provides instructions for completing and filing the form correctly. Ideal for withholding agents and foreign persons needing to report tax information.

Cross-Border Taxation

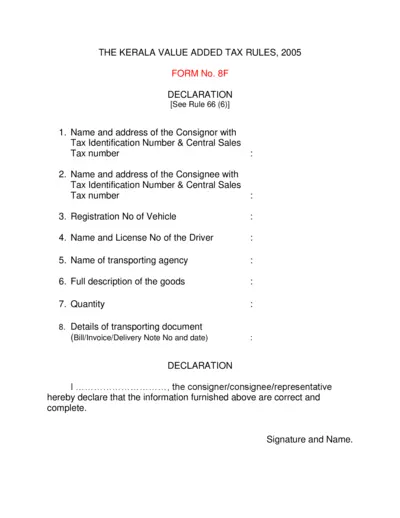

Kerala Value Added Tax Declaration Form

This file is the Kerala Value Added Tax Declaration, outlined under the rules established in 2005. It serves as an essential document for both consignors and consignees involved in the transport of goods, providing necessary tax identification and transport details. Users can complete this form to ensure compliance with local tax regulations.

Cross-Border Taxation

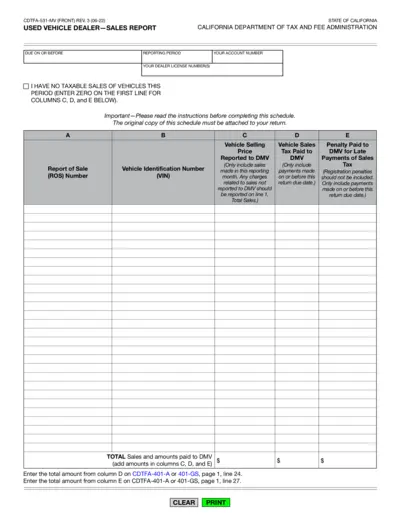

Used Vehicle Dealer-Sales Report California

The Used Vehicle Dealer-Sales Report is essential for reporting taxable vehicle sales in California. This document also helps dealers report sales tax paid to the DMV. Accurate completion ensures compliance with California Department of Tax and Fee Administration requirements.

Tax Returns

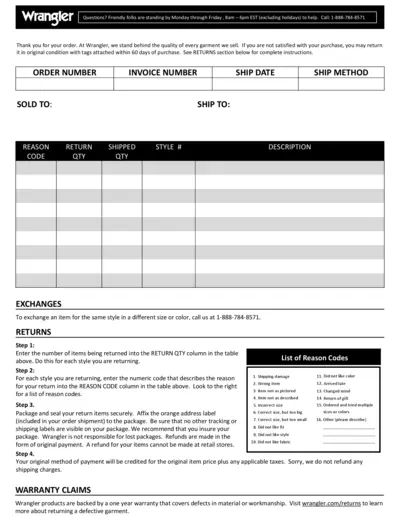

Wrangler Return Instructions and Warranty Information

This file provides essential instructions for returning Wrangler products and filing warranty claims. Users will find a comprehensive guide on filling out return forms and understanding the return process. It also lists reason codes for returns and important contact information.

Cross-Border Taxation

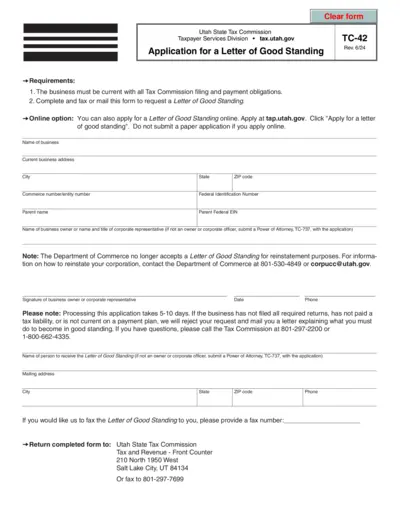

Application for a Letter of Good Standing

This document outlines the requirements and process to obtain a Letter of Good Standing from the Utah State Tax Commission. It is essential for businesses needing verification of their current status with tax obligations. Utilize this form to ensure compliance and maintain your business's good standing.

Cross-Border Taxation

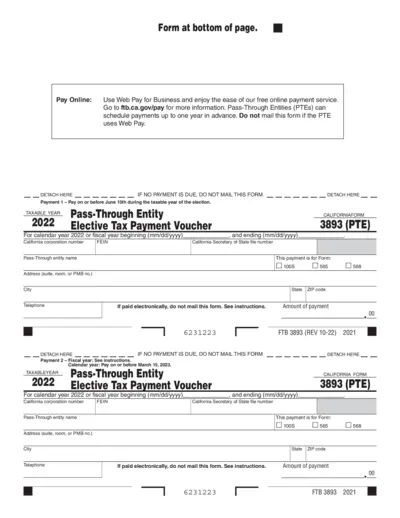

California Pass-Through Entity Tax Payment Voucher

This form is used for making elective tax payments for pass-through entities in California. It includes payment schedules and submission guidelines. Ensure to complete all fields accurately to avoid penalties.

Sales Tax

Catalog Based Sales Process Enhancements

This file provides detailed information about Dynavistics' Catalog Based Sales enhancements. It outlines features, benefits, and instructions for order entry processes. Ideal for professionals seeking to improve sales order accuracy and efficiency.

Payroll Tax

Payroll Processing Instructional and Informational Guide

This file provides detailed instructions and guidance on using Payroll4Free for payroll processing. Users will find essential information on batch entry, reports, and check management. It serves as a comprehensive resource for efficient payroll management.