Tax Documents

Cross-Border Taxation

HM Revenue and Customs Amendments to Tax Returns

This file discusses the HMRC's Call for Evidence for amendments to tax returns. It outlines the current processes and aims to modernize the taxpayer experience. Responses from various stakeholders will inform policy developments.

Payroll Tax

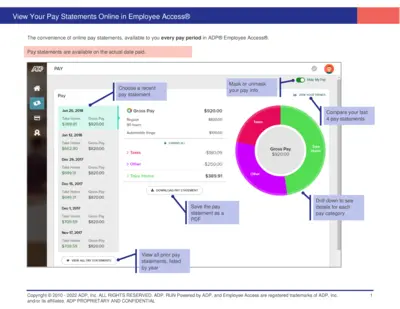

Learn to Access Your Pay Statements Online

This file provides a comprehensive guide on accessing online pay statements through ADP® Employee Access®. It includes detailed instructions, FAQs, and step-by-step guidance on managing your pay information. Perfect for employees looking to simplify their payroll processes.

Cross-Border Taxation

Enhancing Compliance with Early Retirement Tax Rules

This report outlines actions to improve taxpayer compliance with early retirement distribution tax requirements. It highlights findings from the TIGTA audit and recommendations for the IRS. Essential for taxpayers who have taken early distributions.

Cross-Border Taxation

HM Revenue and Customs P45 Online Form Instructions

This file provides essential guidance on completing the P45 online form correctly. It outlines important specifications, printing procedures, and submission details. Designed for employers, it ensures compliance with HMRC regulations.

Sales Tax

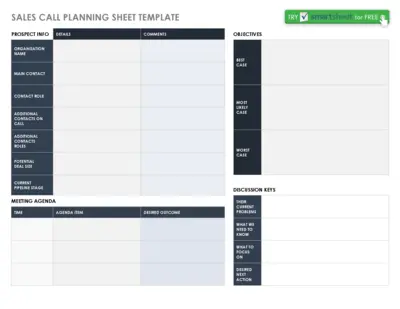

Sales Call Planning Sheet Template

This Sales Call Planning Sheet Template helps users effectively plan their sales calls. It includes sections for detailed prospect information and meeting agendas. Use it to organize your sales approach and achieve better results.

Cross-Border Taxation

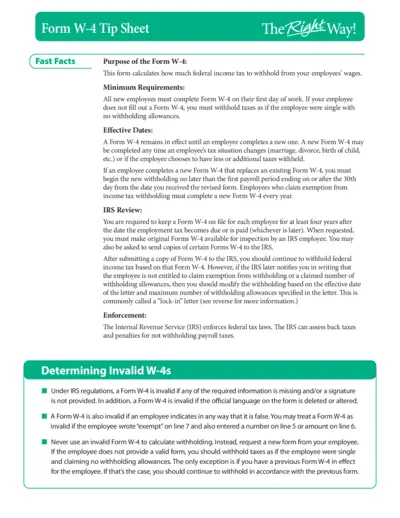

Form W-4 Guide for Employers: Withholding Tips

This file provides essential information on Form W-4, detailing requirements for employee tax withholding. It includes guidance on filling out the form, important deadlines, and compliance with IRS regulations. Employers can ensure proper tax withholding and avoid penalties by following the instructions outlined in this document.

Cross-Border Taxation

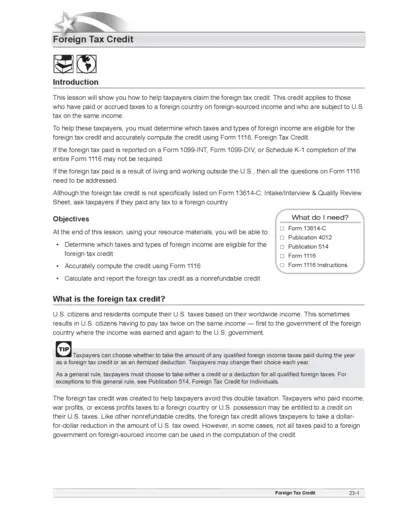

Claim Foreign Tax Credit Instruction Guide

This file provides comprehensive instructions on how to help taxpayers claim the foreign tax credit. It includes eligibility requirements, necessary forms, and detailed guidance on filling out the required documentation. Perfect for tax professionals and volunteers assisting taxpayers with foreign income.

Cross-Border Taxation

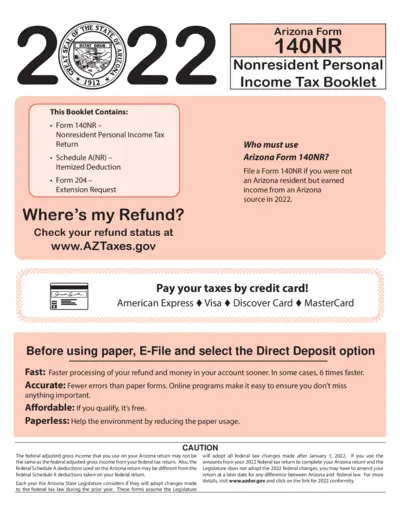

Arizona Nonresident Personal Income Tax Return Guide

This file is a comprehensive guide for nonresident individuals filing their Arizona income tax returns. It provides essential forms, instructions, and key deadlines to meet tax obligations. Perfect for those earning income from Arizona sources in 2022.

Payroll Tax

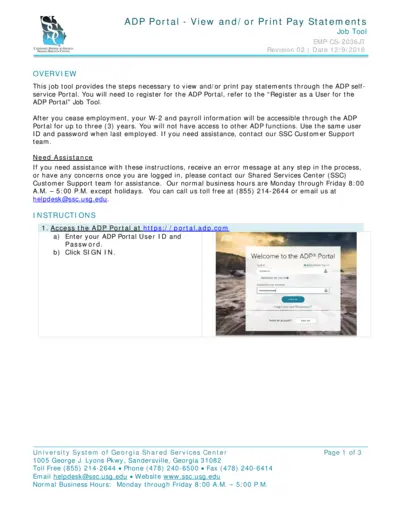

ADP Portal View and Print Pay Statements Guide

This file provides detailed instructions on how to view and print pay statements through the ADP Portal. It is essential for employees needing access to their payroll information. Follow the provided steps for a seamless experience.

Cross-Border Taxation

2023 New Jersey CBT-100 Corporation Tax Return

The 2023 CBT-100 form is the New Jersey Corporation Business Tax Return for corporations. It is essential for businesses operating in New Jersey for the tax year ending June 30, 2024. Accurate completion ensures compliance with state tax laws.

Tax Returns

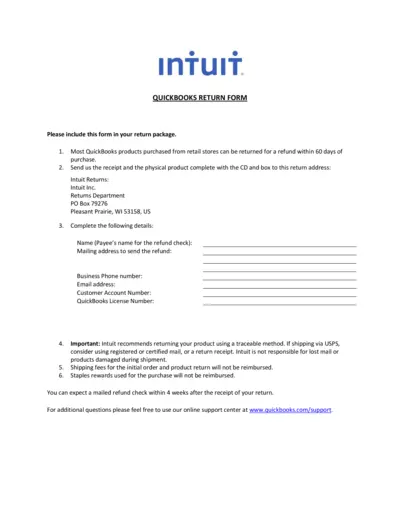

QuickBooks Return Form Instructions and Details

This file provides essential instructions for returning QuickBooks products. It details the steps for filling out the return form and submitting it correctly. Follow these guidelines to ensure a smooth return process.

Cross-Border Taxation

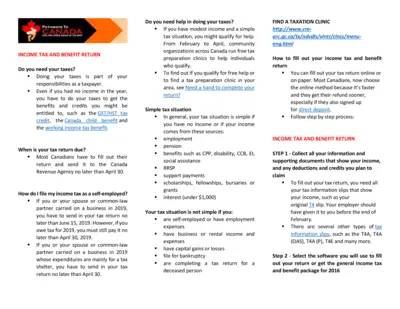

Income Tax and Benefit Return Instructions Canada

This file provides essential guidelines for completing your income tax and benefit return in Canada. It covers filing deadlines, eligibility for benefits, and how to proceed with tax return submissions. It's an invaluable resource for both employed and self-employed individuals.