Tax Documents

Payroll Tax

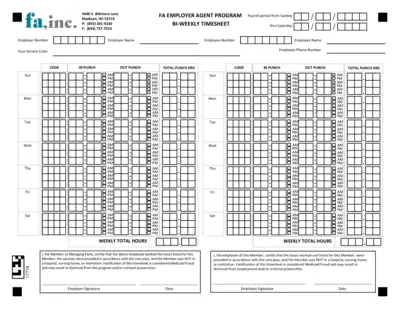

FA Employer Agent Program Bi-Weekly Timesheet

This bi-weekly timesheet is designed for use by employers in tracking employee working hours. It includes sections for inputting punch times and totals for payroll periods. Ensure accuracy to comply with Medicaid regulations.

Income Verification

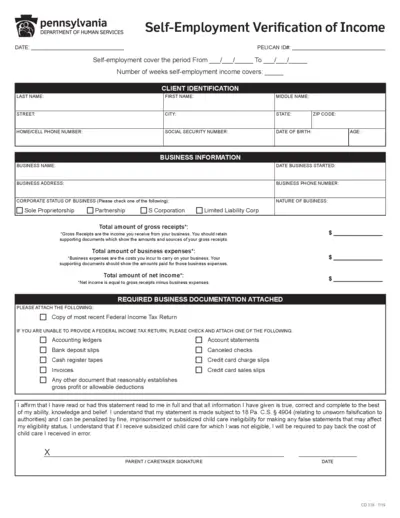

Self-Employment Verification of Income Form

This form is designed for individuals to verify their self-employment income for subsidy eligibility. It collects essential business and personal information. Users must submit supporting documents to complete the verification process.

Cross-Border Taxation

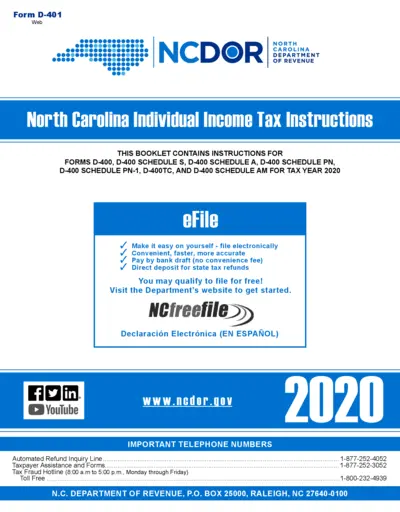

North Carolina Individual Income Tax Instructions 2020

This document provides detailed instructions for North Carolina Individual Income Tax Forms including D-400 and its schedules. It guides users through the filing process, eligibility requirements, and important updates for tax year 2020. Essential for anyone filing taxes in North Carolina.

Cross-Border Taxation

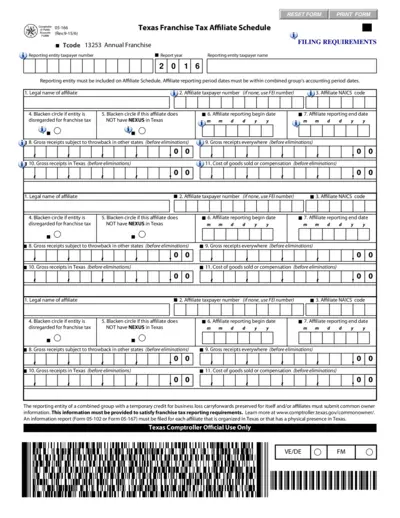

Texas Franchise Tax Affiliate Schedule Form 05-166

The Texas Franchise Tax Affiliate Schedule Form 05-166 is a crucial document for businesses involved in franchise taxation in Texas. It provides detailed instructions and requirements for affiliate reporting, helping companies stay compliant with state regulations. Utilize this form to accurately report affiliate information and ensure proper franchise tax handling.

Cross-Border Taxation

QuickBooks Online Payroll Printing T4 Information

This file provides detailed instructions on printing T4 slips using QuickBooks Online Payroll. It covers steps for preparing and verifying employee information before generating T4s. Essential for employers managing payroll and tax documentation.

Cross-Border Taxation

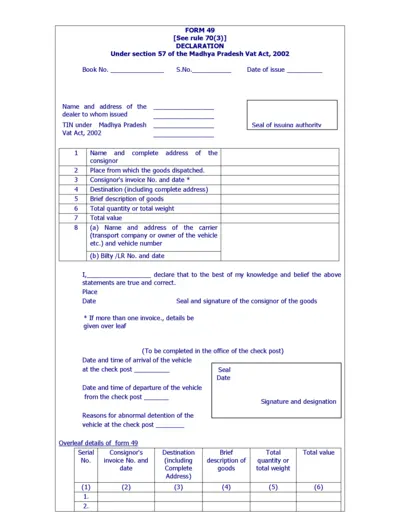

Madhya Pradesh VAT Form 49 Declaration Details

Form 49 is a declaration required under the Madhya Pradesh VAT Act, 2002 for consignors. It captures essential information regarding the goods dispatched including details about the dealer, consignor, and carrier. This form is crucial for compliance with tax regulations.

Cross-Border Taxation

E-File Your Federal Tax Return Efficiently

This file provides detailed information and resources on how to e-file your federal tax return. It highlights the advantages of e-filing and offers guidance on utilizing the IRS Free File program. Use this file to encourage effective filing practices among your customers.

Cross-Border Taxation

Withholding State Income Tax Guide for Employers

This brochure provides essential information about the withholding of state income tax by employers in Hawaii. It serves as a resource for understanding tax obligations and requirements. For detailed guidance, refer to the Employer's Tax Guide and contact the Department of Taxation for inquiries.

Tax Returns

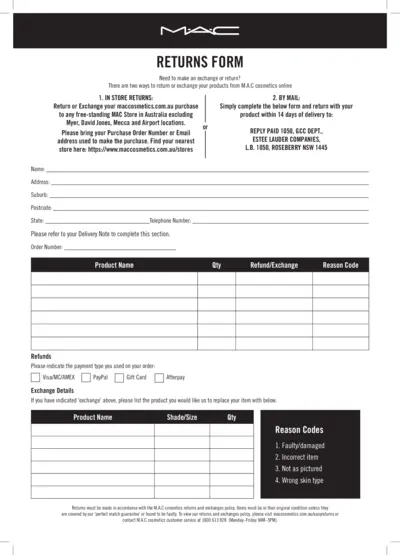

M.A.C Cosmetics Exchange and Return Form Instructions

This document outlines the instructions for returning or exchanging products purchased from M.A.C Cosmetics online. It includes detailed procedures for both in-store and mail returns, as well as necessary information to complete the return form. Users will also find guidance on filling out the form correctly.

Cross-Border Taxation

Form 8938 Instructions Statement of Foreign Assets

This document contains essential instructions for filling out Form 8938, which reports specified foreign financial assets. It is crucial for U.S. citizens and certain domestic entities for compliance with tax regulations. Ensure you understand the filing requirements and reporting thresholds outlined in this guidance.

Cross-Border Taxation

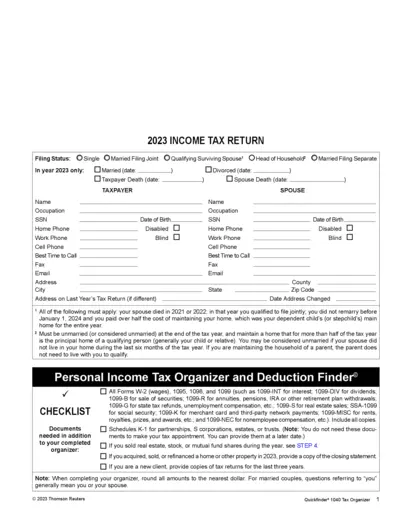

2023 Income Tax Return Filing Guide

This file provides comprehensive instructions and details regarding the 2023 Income Tax Return. It helps users understand their filing status and gather required documents. Ideal for individuals preparing their tax submissions.

Cross-Border Taxation

Kansas Sales and Use Tax Exemption Certificates Guide

This file is a comprehensive guide for businesses on using Kansas sales and use tax exemption certificates. It includes authorized exemptions and details on completing the certificates. Businesses can avoid costly errors by following the guidelines provided in this guide.