Guidelines for Active Solar Energy Systems Exclusion

This document outlines the guidelines for the new construction exclusion for active solar energy systems. It provides detailed instructions and criteria for assessors and interested parties. These guidelines aim to promote uniformity in the implementation of solar energy regulations.

Edit, Download, and Sign the Guidelines for Active Solar Energy Systems Exclusion

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out this form, gather all necessary property information related to the active solar energy system. Make sure to review the guidelines carefully to understand eligibility criteria. Once all information is compiled and reviewed, proceed to complete the form accurately.

How to fill out the Guidelines for Active Solar Energy Systems Exclusion?

1

Gather the necessary information regarding the solar energy system.

2

Review the guidelines to determine eligibility for the exclusion.

3

Complete the form with accurate information about the property.

4

Double-check all information before submission.

5

Submit the completed form as instructed in the guidelines.

Who needs the Guidelines for Active Solar Energy Systems Exclusion?

1

County Assessors: They need the guidelines to assess solar energy systems appropriately.

2

Property Owners: Homeowners with solar installations need this to understand tax exclusions.

3

Solar Companies: Businesses installing solar systems use this to explain benefits to clients.

4

Nonprofit Organizations: They need to understand how their solar installations affect property taxes.

5

Lawyers and Tax Advisors: They must reference these guidelines for clients considering solar properties.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Guidelines for Active Solar Energy Systems Exclusion along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Guidelines for Active Solar Energy Systems Exclusion online.

Editing this PDF on PrintFriendly is simple and intuitive. Users can modify any text directly within the document using our PDF editing tools. You can adjust, remove, or add sections to tailor the document to your needs.

Add your legally-binding signature.

Signing the PDF on PrintFriendly is quick and easy. You can add your electronic signature to the document with just a few clicks. This feature ensures that your signed documents are ready for submission without hassle.

Share your form instantly.

Sharing the PDF on PrintFriendly is straightforward. Use the sharing options to send the document via email or link to others instantly. This allows for easy collaboration and ensures everyone has access to the latest version.

How do I edit the Guidelines for Active Solar Energy Systems Exclusion online?

Editing this PDF on PrintFriendly is simple and intuitive. Users can modify any text directly within the document using our PDF editing tools. You can adjust, remove, or add sections to tailor the document to your needs.

1

Open the PDF in PrintFriendly's editor.

2

Click on the text you wish to edit and enter your changes.

3

Utilize additional editing tools to adjust the layout as needed.

4

Review your changes for accuracy.

5

Download or share the edited PDF once you're satisfied.

What are the instructions for submitting this form?

To submit this form, email it to your local County Assessor’s office or fax it to 916-285-0134. You can also submit the completed form via physical mail to PO Box 942879, Sacramento, California 94279-0064. Ensure that all information is filled out correctly to avoid processing delays.

What are the important dates for this form in 2024 and 2025?

Important dates for the new construction exclusion will vary by county and local regulations. Typically, the filing deadlines align with the general property tax assessment timeline. It's advised to consult local county assessors for specific dates relevant to solar energy system exclusions.

What is the purpose of this form?

The purpose of this form is to provide a structured guideline for assessing eligibility for the new construction exclusion for active solar energy systems. This ensures that both property owners and assessors have a clear understanding of the criteria and requirements for tax exemptions. The guidelines aim to promote the use of solar energy by making the associated financial implications as transparent as possible.

Tell me about this form and its components and fields line-by-line.

- 1. Property Information: Details about the property where the solar energy system is installed.

- 2. System Specifications: Information related to the type and capacity of the solar energy system.

- 3. Cost Information: Details regarding the costs associated with the solar installation.

- 4. Owner Information: Contact details of the property owner or representative.

- 5. Exclusion Eligibility: Checklist confirming eligibility for the new construction exclusion.

What happens if I fail to submit this form?

If you fail to submit this form, you may miss out on potential tax savings associated with your solar energy system. It could also lead to improper assessments of property tax.

- Lost Tax Benefits: Failure to submit may result in losing eligible tax exclusions for your solar installation.

- Inaccurate Property Assessments: Unsubmitted forms can lead to incorrect property tax assessments, costing more over time.

- Delays in Approval: Delays in processing your solar energy system adjustments due to missing paperwork may hinder installation appointments.

How do I know when to use this form?

- 1. New Installations: If you are installing a new solar energy system, complete this form.

- 2. System Modifications: Use this form when making modifications to existing solar energy systems.

- 3. Eligibility Queries: Property owners seeking exclusion benefits must fill out this form for review.

Frequently Asked Questions

How do I edit this PDF?

To edit the PDF, simply open it in PrintFriendly's editor and make your changes directly.

Can I sign the PDF digitally?

Yes, you can add your signature using our signing tool available on PrintFriendly.

What formats can I share the PDF in?

You can share the PDF via email or generate a shareable link directly from PrintFriendly.

Is there a way to save my edits?

You can download the edited PDF after making changes in PrintFriendly.

What if I want to revert my changes?

You can always start over by reopening the original PDF and editing it again.

Can anyone access the PDF I share?

Yes, anyone with the link you share can access the PDF.

How do I contact support for issues?

For assistance, please use the contact options available on the PrintFriendly website.

Are there templates available for this document?

Currently, we focus on enabling you to edit existing documents rather than providing templates.

Can I combine multiple PDFs into one?

At this time, PrintFriendly focuses on editing single PDF documents.

Is there a limit to the size of the PDF I can edit?

PrintFriendly allows a wide range of PDF sizes, but very large files may take longer to process.

Related Documents - Solar Energy Guidelines

Potbelly Corporation 2019 Annual Report on Form 10-K

This is the annual report for Potbelly Corporation for the fiscal year ended December 29, 2019. It includes sections on business, risk factors, financial data, and corporate governance. The report provides a comprehensive overview of the company's performance and strategy.

Home Energy Rebates Program Instructions and Requirements

This document provides detailed information about the Home Energy Rebates Program, including requirements, application instructions, and program modifications. It is essential for applicants to understand the eligibility criteria and how to properly submit their applications. This file is updated with the latest regulations and guidelines from the U.S. Department of Energy.

Requirement to Use Multiple Single-Sheet DEA Form 222s

This file provides guidance for DEA registrants on the requirement to use multiple single-sheet DEA Form 222s when transferring schedule I or II controlled substances upon the termination or transfer of a DEA registration or when discontinuing business altogether.

Application for Freight Forwarder Authority Instructions

This document provides detailed instructions on how to complete Form OP-1(FF) for obtaining freight forwarder authority. It includes steps on how to apply, the costs involved, and the necessary forms required. Additionally, it outlines who needs to obtain operating authority and the process involved.

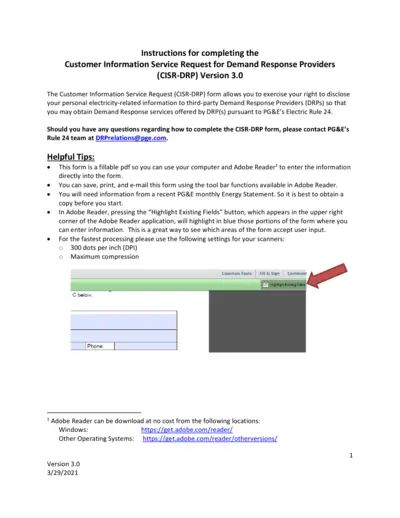

Customer Information Service Request for Demand Response

The Customer Information Service Request (CISR-DRP) form allows users to disclose their personal electricity-related information to third-party DRPs for obtaining Demand Response services under PG&E's Electric Rule 24. This document provides detailed instructions for completing the CISR-DRP form. Make sure to have a recent PG&E monthly Energy Statement before you start.

Servicemembers Civil Relief Act Examination Guide

This document provides guidelines and examination procedures for the Servicemembers Civil Relief Act (SCRA) as applicable to national banks, federal savings associations, and branches of foreign banking organizations.

Authorization Amendment Form for Waste Discharge Permit

This file contains the final application form required for amendment of authorization to discharge waste under the Environmental Management Act. It includes instructions, necessary components, and declaration conditions. Ensure all mandatory fields are filled for successful submission.

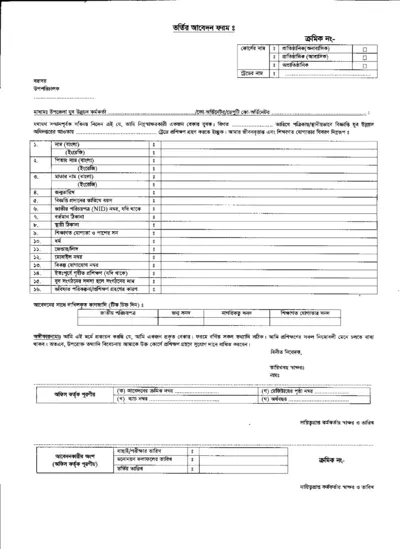

Detailed Instructional Document for Users

This document provides comprehensive guidelines on filling out the form. It includes important sections, required information, and steps for submission. Perfect for individuals and businesses looking to complete important documentation efficiently.

Liquor Licensee Rules and FAQs

This document provides essential information and answers frequently asked questions about liquor licensee regulations. It covers areas such as permissible sale hours, minor's presence at the bar, sale of drinks, happy hour rules, and more. Perfect for those working in licensed establishments in Pennsylvania.

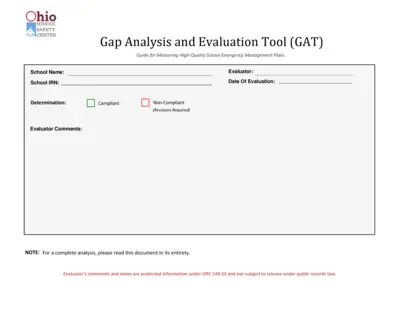

Ohio School Safety Center's Emergency Plan Evaluation Tool

This file is a guide for evaluating a school's Emergency Management Plan (EMP) using the Gap Analysis and Evaluation Tool (GAT). It ensures all required documents are compliant with Ohio regulations. This tool is essential for maintaining school safety and preparedness.

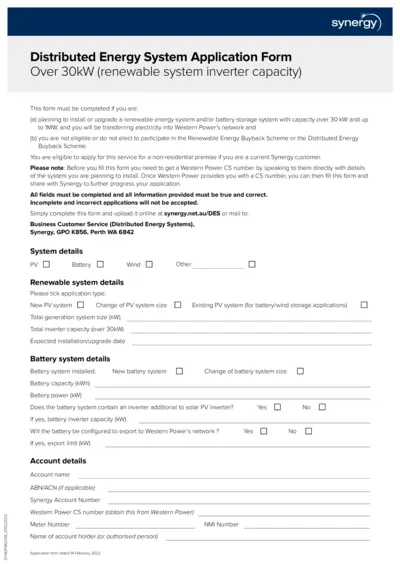

Synergy Distributed Energy System Application Form Over 30kW

This file is used for applying to install or upgrade a renewable energy system and/or battery storage system with capacity over 30 kW up to 1MW, and transferring electricity into Western Power's network. It is required if ineligible for the Renewable Energy Buyback Scheme or Distributed Energy Buyback Scheme. Ensure you obtain a CS number from Western Power before filling out the form.

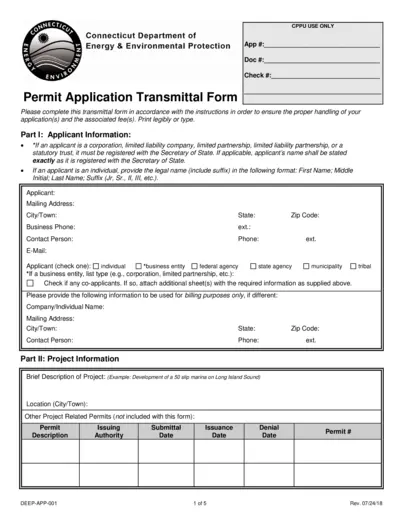

Connecticut Department of Energy & Environmental Protection Permit Application

This permit application transmittal form is for the Connecticut Department of Energy & Environmental Protection. It includes applicant information, project details, and permit application and fee information. It is essential for regulatory compliance.