Tax Forms Documents

Tax Forms

1040A Instructions for 2017 Tax Filing

This file provides detailed instructions for filing Form 1040A. It includes updates for the 2017 tax year, essential information for taxpayers, and guidelines from the IRS. Use this guide to navigate tax filing requirements effectively.

Tax Forms

Filling Instructions for Form 26QB Submission

This file provides detailed instructions on filling out Form 26QB, which is essential for TDS payment on property purchases. Follow the steps outlined to ensure accurate submission and compliance with tax regulations. Ideal for property buyers who need to submit TDS details efficiently.

Tax Forms

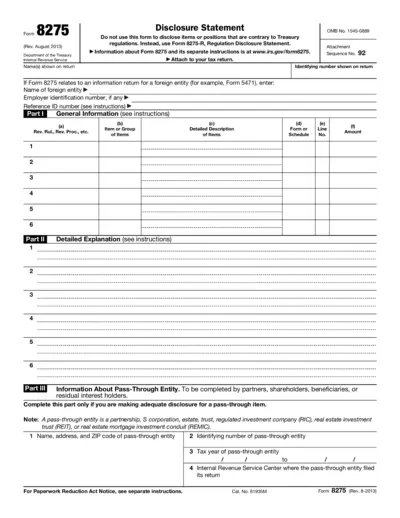

Form 8275 Disclosure Statement for Accurate Tax Filing

Form 8275 is used to disclose items or positions taken on a tax return. It ensures transparency with the IRS and helps prevent penalties. This form is essential for taxpayers seeking to clarify their tax positions.

Tax Forms

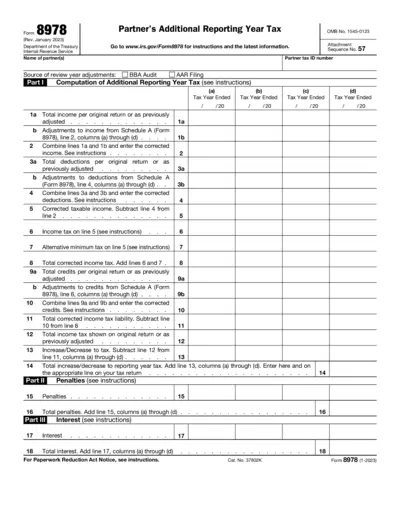

Form 8978 Additional Reporting Year Tax Instructions

Form 8978 provides detailed instructions for partners regarding Additional Reporting Year Tax. It outlines the necessary steps for computation and submission. This form is essential for ensuring accurate reporting during tax assessments.

Tax Forms

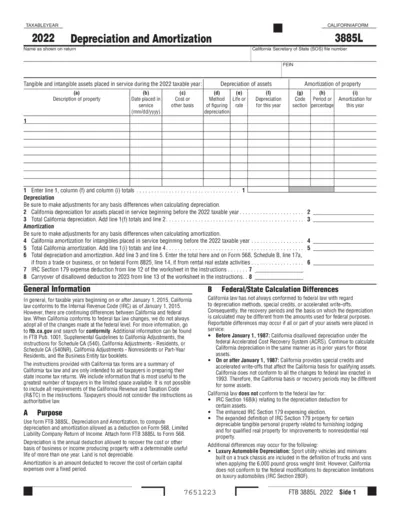

California Form 3885L - Depreciation and Amortization

California Form 3885L is used for computing depreciation and amortization deductions for the 2022 taxable year. This form assists businesses in calculating allowable deductions for tangible and intangible assets. It provides guidance on how to report these deductions accurately on the tax return.

Tax Forms

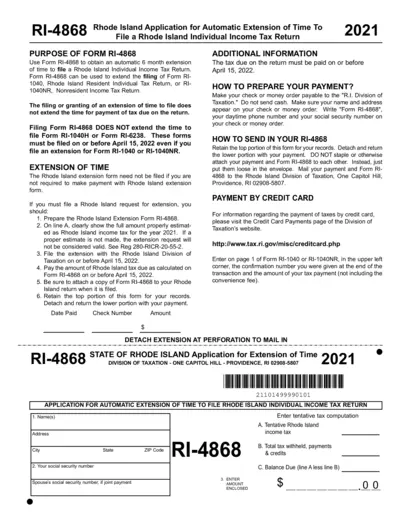

Rhode Island Automatic Extension Form RI-4868

Form RI-4868 allows taxpayers in Rhode Island to request an automatic six-month extension for filing their individual income tax return. It is essential for anyone needing additional time to prepare their tax documents while ensuring tax payments are made on time. Proper completion and submission of this form can help avoid late fees and penalties.

Tax Forms

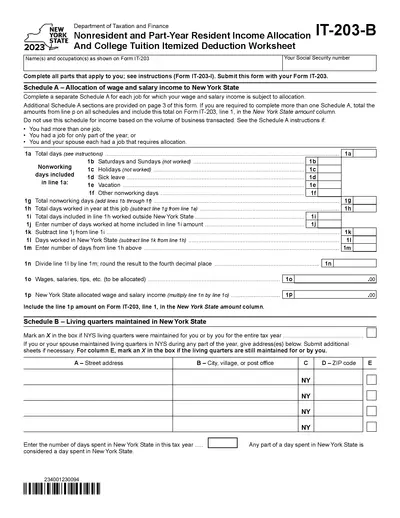

Nonresident Part-Year Resident Income Allocation Worksheet

This document provides guidelines for nonresident and part-year residents on income allocation in New York State. It includes details necessary for claiming college tuition itemized deductions. Complete the form accurately and submit with your income tax return to ensure compliance.

Tax Forms

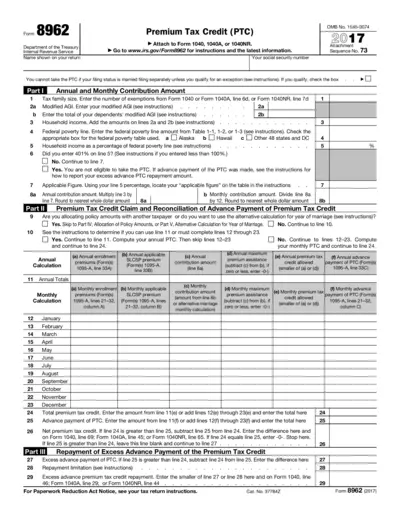

Form 8962: Premium Tax Credit Instructions 2017

This file contains essential information and instructions for filling out IRS Form 8962, which is used for the Premium Tax Credit. It guides taxpayers in determining eligibility for the credit and provides details for reporting amounts accurately. Perfect for individuals needing to reconcile the advance premium tax credit received.

Tax Forms

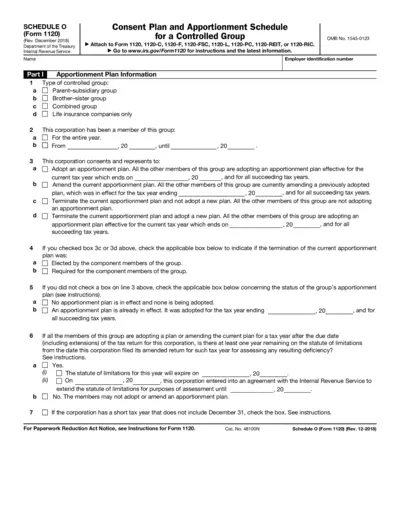

Schedule O Form 1120 Apportionment Plan 2018

Schedule O (Form 1120) provides a Consent Plan and Apportionment Schedule for a Controlled Group. This form is essential for corporations to outline their apportionment strategies for tax purposes. Proper completion and submission of this form ensure compliance with IRS regulations.

Tax Forms

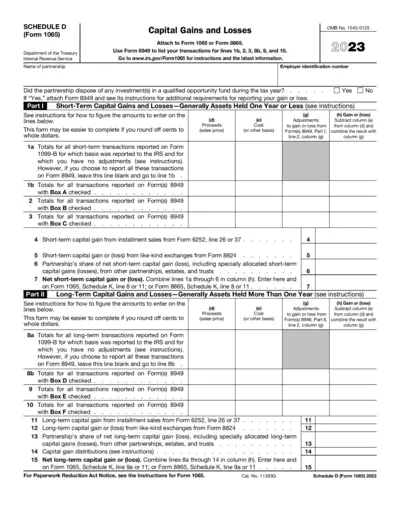

Schedule D Form 1065 Capital Gains Losses Instructions

Schedule D (Form 1065) provides essential information for partnerships to report capital gains and losses. This form is crucial for accurately reporting transactions and tax obligations. Use this guide to navigate the filling of this important IRS document.

Tax Forms

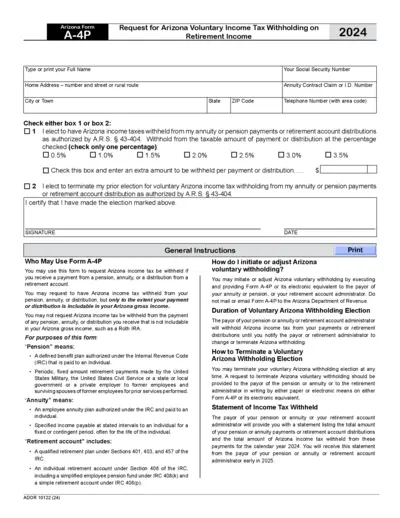

Arizona Form A-4P Voluntary Income Tax Withholding

This form is used to request Arizona income tax withholding on retirement income. It allows individuals to elect withholding from annuity or pension payments. The form details the necessary information and instructions for making this request.

Tax Forms

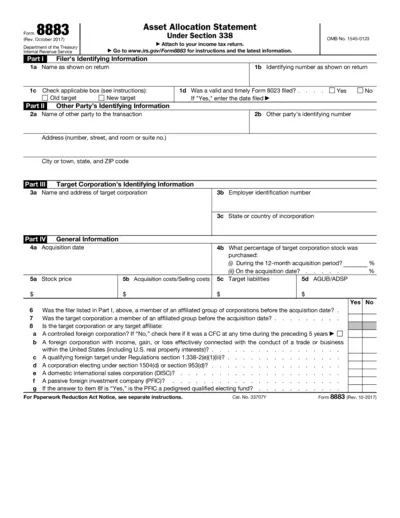

Form 8883 Asset Allocation Statement for IRS Tax Filing

Form 8883 is the Asset Allocation Statement required by the IRS for reporting asset transfers in transactions under Section 338. It helps users accurately allocate the selling price and assess tax implications. Properly filling out this form ensures compliance with IRS regulations.