Tax Forms Documents

Tax Forms

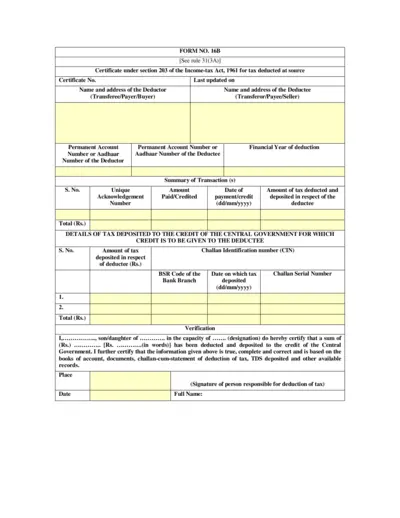

FORM NO. 16B Certificate for Tax Deducted at Source

FORM NO. 16B serves as a certificate for tax deducted at source under the Income-tax Act of 1961. This document is essential for taxpayers to claim deductions. It provides crucial details about tax amounts and identification of both deductor and deductee.

Tax Forms

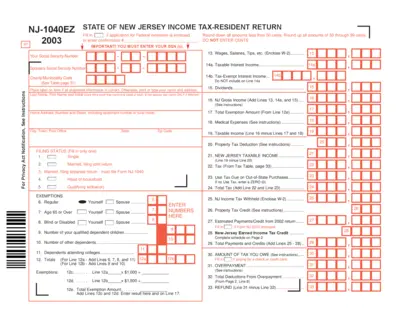

New Jersey 2003 Income Tax Resident Return

This PDF form is the NJ-1040EZ for filing income taxes as a resident in New Jersey for the year 2003. It includes details on income, exemptions, and credits, and must be filled out accurately for tax purposes. Use this document to report your income and determine any tax refund or amount owed.

Tax Forms

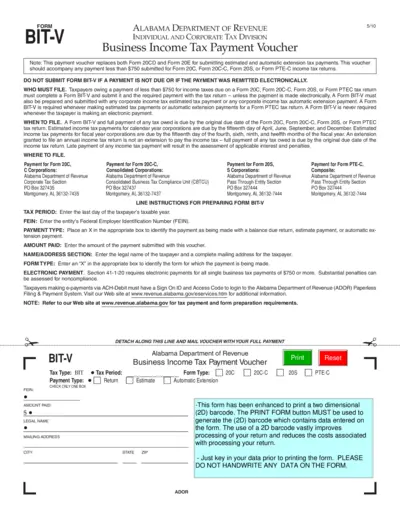

Alabama Business Income Tax Payment Voucher Form

This file contains the Business Income Tax Payment Voucher for Alabama taxpayers. It is essential for submitting payments for various tax returns. Follow the instructions carefully to ensure proper submission.

Tax Forms

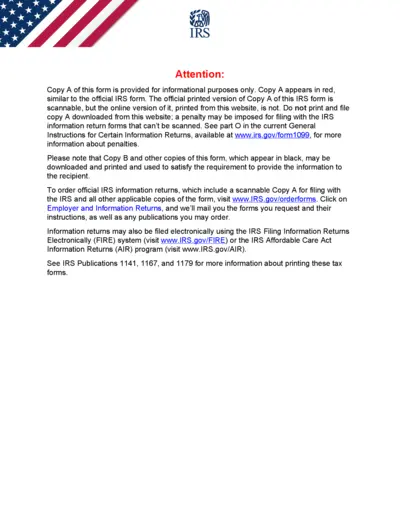

IRS Form 5498 Instructions and Information

This document provides detailed information on IRS Form 5498, which is used for reporting IRA contributions. It includes guidance on filling out the form and the necessary steps for submission. Users can learn about who needs this form and how to effectively use it.

Tax Forms

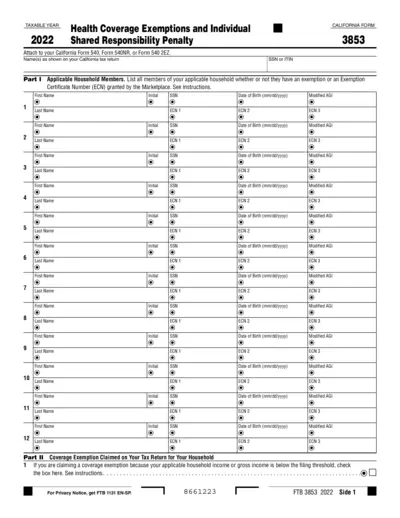

Health Coverage Exemptions Form California 2022

This form is essential for Californian residents to report health coverage exemptions. It helps ensure compliance with shared responsibility penalties. Use this form to claim exemptions for individuals in your household for the tax year 2022.

Tax Forms

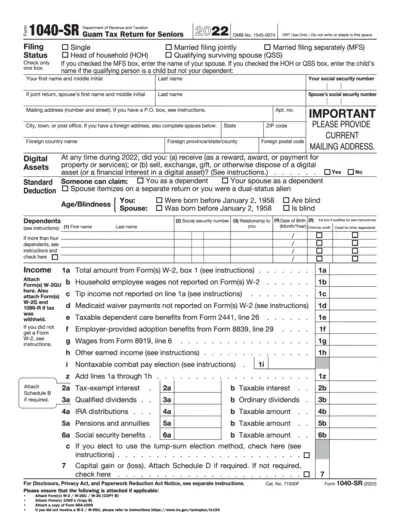

Guam Tax Return for Seniors 2022 Form 1040-SR

This file contains the Guam Tax Return for Seniors for the year 2022. It includes detailed filing instructions, eligibility criteria, and necessary fields to complete the tax return. Ideal for seniors in Guam who need to file their taxes this year.

Tax Forms

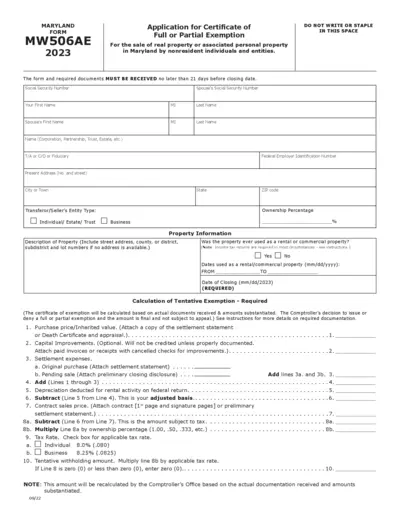

Maryland Form MW506AE Application for Exemption

The Maryland Form MW506AE is an application used for seeking a certificate of full or partial exemption for the sale of real property. This form is crucial for nonresident individuals and entities engaging in property sales in Maryland. Ensure you follow the guidelines to submit your application on time.

Tax Forms

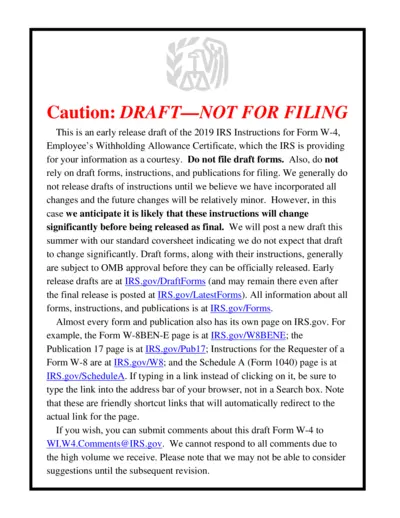

2019 IRS Instructions for Form W-4 Employee Withholding

This document provides comprehensive instructions for completing Form W-4, which is used by employees to determine their federal income tax withholding. It contains essential guidelines, worksheets, and tips for accurate filing. Understanding these instructions is crucial for ensuring proper tax deductions from your income.

Tax Forms

IRS Schedule 3 2021 Tax Form Instructions

This document includes detailed instructions for IRS Schedule 3 for tax year 2021. It provides essential information on claiming additional credits and payments. Ideal for individuals preparing their taxes or tax professionals assisting clients.

Tax Forms

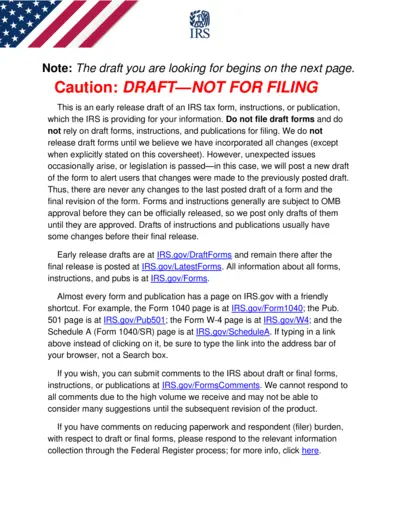

New York State Electronic Funds Withdrawal Form 2022

This document is the New York State Authorization for Electronic Funds Withdrawal. It is meant for electronic return originators (EROs) to facilitate corporation tax extensions. Users must complete this form when making an electronic payment for specified tax forms.

Tax Forms

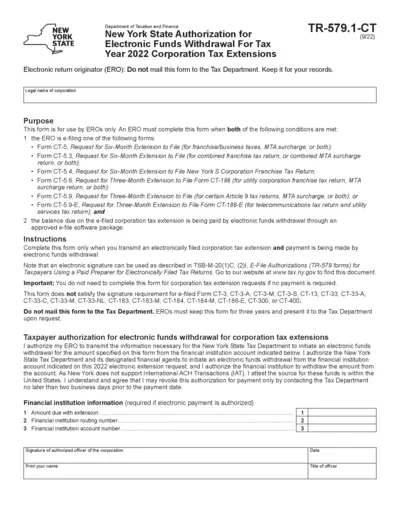

Illinois ST-556-X Amended Sales Tax Instructions

This file provides essential instructions for amending the Sales Tax Transaction Return (Form ST-556-X) in Illinois. Users can learn about filing requirements, deadlines, and submission procedures. It is a crucial resource for retailers and leasing companies dealing with sales tax.

Tax Forms

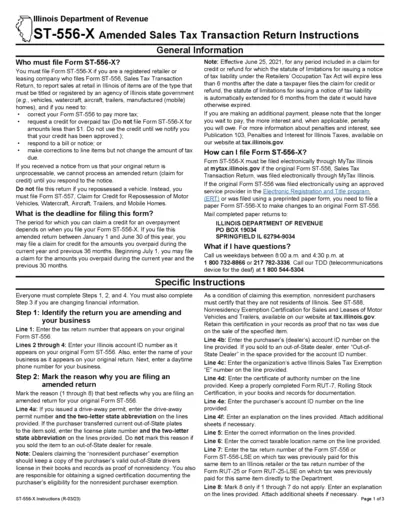

IRS W-9 Form Submission Instructions

This document provides instructions for completing the IRS W-9 form. It outlines the necessary information required to avoid backup withholding tax. Ensure correct submission to the Town of Rehoboth for timely processing.