Tax Forms Documents

Tax Forms

Illinois Department of Revenue IL-1065 Instructions

The IL-1065 Instructions provide essential guidance for partnerships in Illinois regarding their Replacement Tax Return submission process. This document outlines important updates, general information, and specific instructions to ensure accurate filing. It serves as a crucial tool for compliance with Illinois tax laws.

Tax Forms

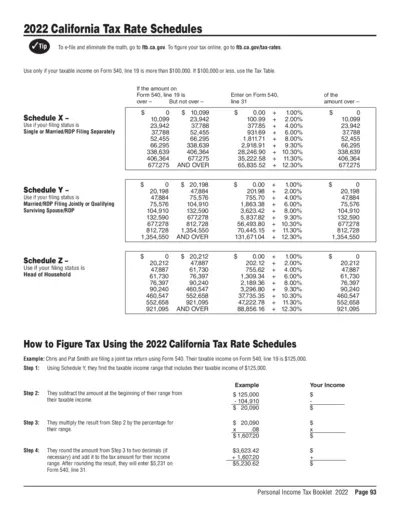

2022 California Tax Rate Schedules Overview

This file contains the California tax rate schedules for 2022, helping individuals calculate their income tax obligations accurately and efficiently. It includes detailed instructions and examples for completing Form 540. Essential for taxpayers and tax preparers in California.

Tax Forms

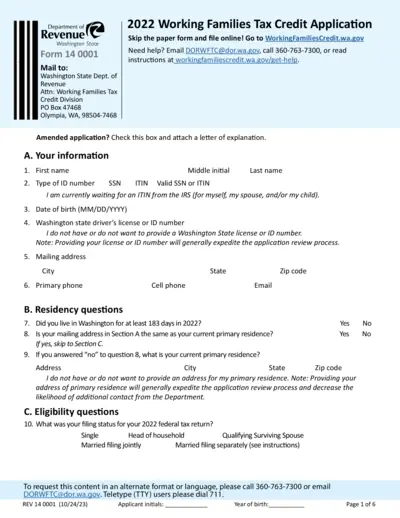

2022 Washington State Working Families Tax Credit Application

The 2022 Working Families Tax Credit Application lets eligible residents apply for tax credits. This form is essential for individuals seeking financial assistance. Complete and submit the form to access potential tax benefits.

Tax Forms

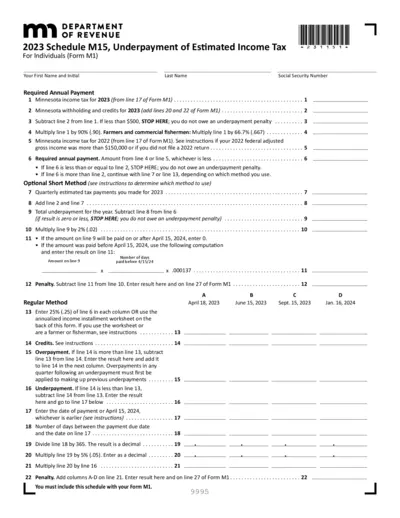

2023 Schedule M15 Underpayment of Estimated Income Tax

This file provides essential details about the 2023 Schedule M15, which determines underpayment penalties for estimated income tax. It is crucial for individuals who may owe taxes and want to ensure compliance. Follow the provided instructions for accurate completion.

Tax Forms

General Instructions for Forms W-2 and W-3

This file contains essential instructions for completing IRS Forms W-2 and W-3. It provides insights into new developments, common errors, and special reporting situations. Suitable for employers and tax professionals navigating wage reporting requirements.

Tax Forms

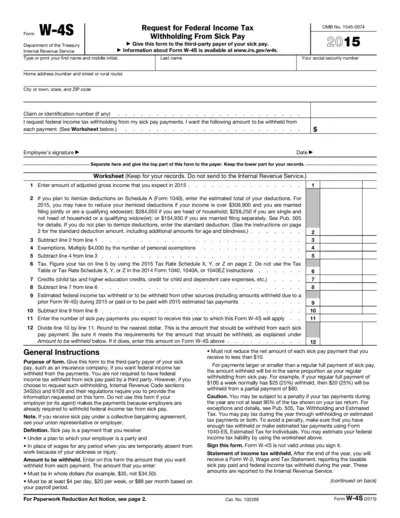

Form W-4S Federal Income Tax Withholding Instructions

Form W-4S is used to request federal income tax withholding from sick pay. This form is essential for individuals receiving sick payments who wish to have taxes withheld. Proper completion ensures compliance with IRS regulations.

Tax Forms

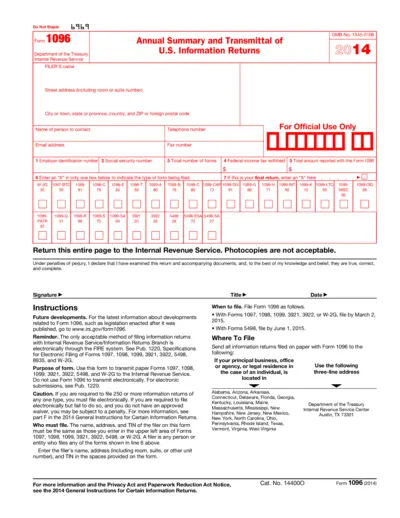

Annual Summary and Transmittal of U.S. Information Returns

This document outlines essential information for completing Form 1096 for U.S. Information Returns. It provides guidance on proper filing procedures, deadlines, and details required for submission. Understanding this form is crucial for compliance with IRS regulations.

Tax Forms

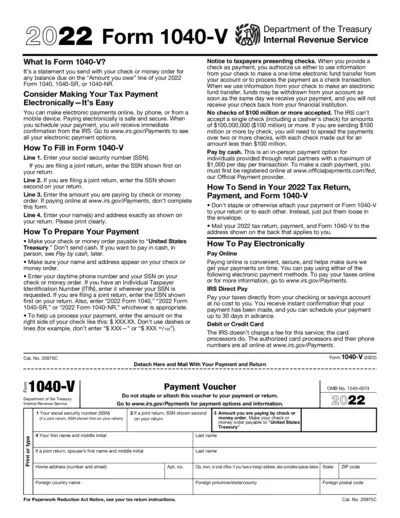

2022 Form 1040-V Payment Voucher Instructions

2022 Form 1040-V is a payment voucher to accompany your tax payments. It includes instructions on how to fill it out and make your payment effectively. Useful for taxpayers looking to fulfill their state and federal tax obligations.

Tax Forms

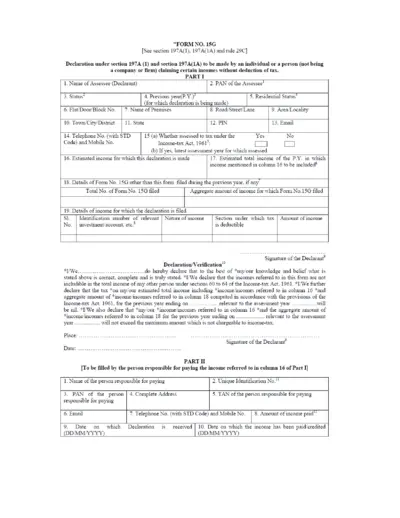

Form No. 15G Declaration for Income without Tax Deduction

Form No. 15G allows individuals to declare their income to avoid TDS deductions. This form is essential for those whose estimated income is below the taxable limit. Proper submission ensures compliant taxation while availing eligible exemptions.

Tax Forms

Current Non-Profit Entities Filing IRS Tax Form 990

This file contains comprehensive details about non-profit entities filing IRS Tax Form 990 with the Attorney General. Users can access contributions, revenue figures, and other essential information regarding each entity. The data is updated regularly to ensure accurate information for stakeholders and the public.

Tax Forms

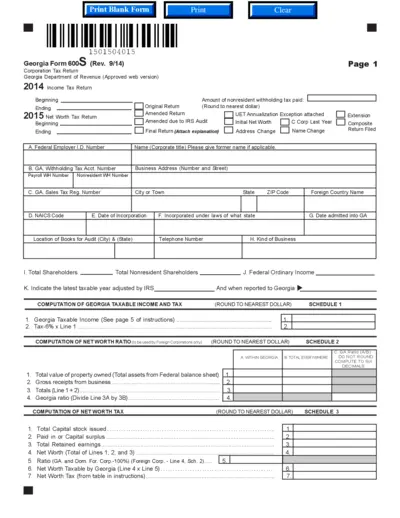

Georgia Form 600S Corporation Tax Return

The Georgia Form 600S is a Corporation Tax Return required for filing by corporations in Georgia. This form aids in reporting income, tax liabilities, and other pertinent financial information. Proper completion is essential to avoid issues with the Georgia Department of Revenue.

Tax Forms

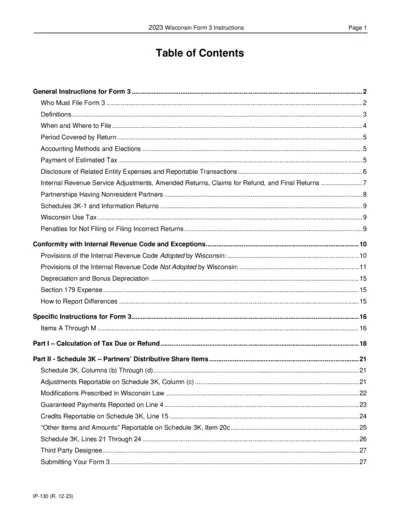

2023 Wisconsin Form 3 Instructions and Guidelines

This document provides detailed instructions for completing Wisconsin Form 3, intended for partnerships and LLCs. It includes information on filing requirements, definitions, and calculations relevant to the form. Users will find guidance on necessary schedules and what to expect when filing.