Tax Forms Documents

Tax Forms

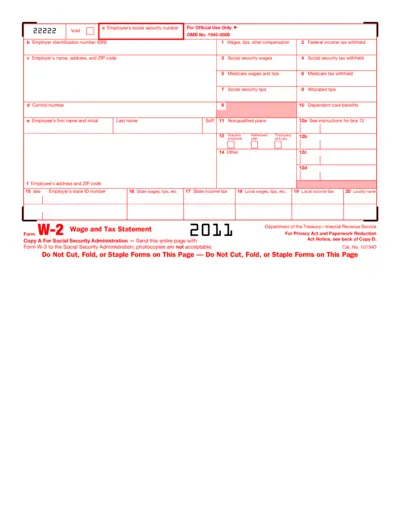

W-2 Wage and Tax Statement Instructions

This file contains detailed information regarding the W-2 Wage and Tax Statement. It includes necessary fields information for both employees and employers. Essential for accurate income reporting and tax filing.

Tax Forms

1095 Forms: Essential Information for Tax Filers

This file provides essential information on Form 1095 required for tax filing under the Affordable Care Act. It details who needs the form, how to fill it out, and important deadlines. Ensure you understand your obligations to avoid issues with your tax return.

Tax Forms

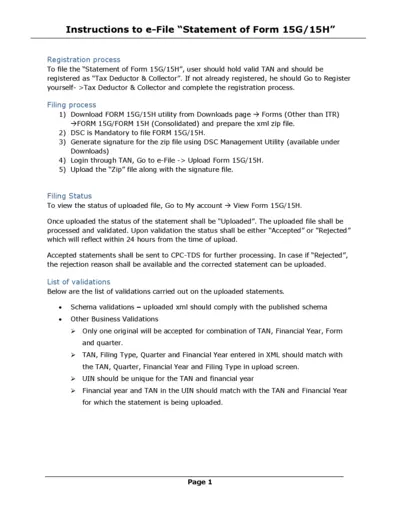

Instructions for e-Filing Form 15G/15H - 2024

This file provides essential instructions for e-filing Form 15G and 15H. It includes the registration process and detailed filing procedures. Users can also find validation checks and filing status information.

Tax Forms

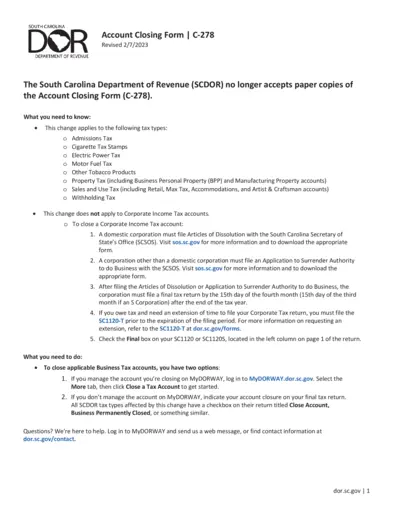

South Carolina Account Closing Form C-278 Instructions

The South Carolina Account Closing Form (C-278) is essential for businesses looking to close their tax accounts. This form ensures compliance with state regulations set by the Department of Revenue. Learn about the steps and requirements for submitting this important form.

Tax Forms

IRS Schedule C Form 1040 Instructions

The IRS Schedule C (Form 1040) provides profit or loss information for business proprietors. Learn how to accurately complete this tax form for the 2024 tax year. Essential guidelines for filing correctly and meeting regulatory requirements.

Tax Forms

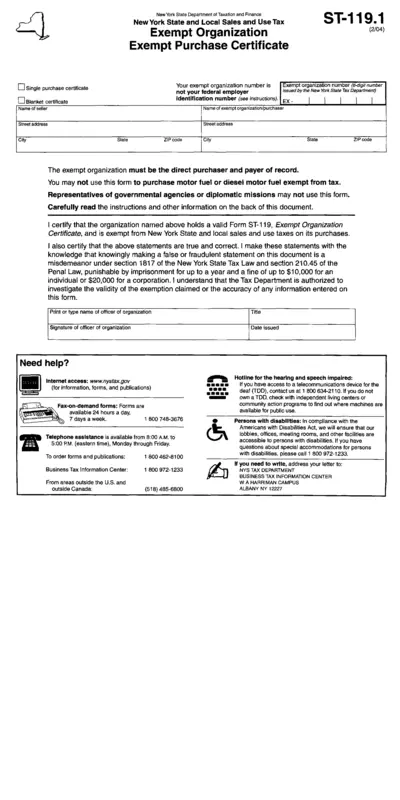

New York Sales Tax Exempt Purchase Certificate ST-119.1

This file is the New York Sales Tax Exempt Purchase Certificate ST-119.1. It is designed for exempt organizations to make tax-exempt purchases in New York State. Complete this form to certify your exemption status and ensure compliance with state tax laws.

Tax Forms

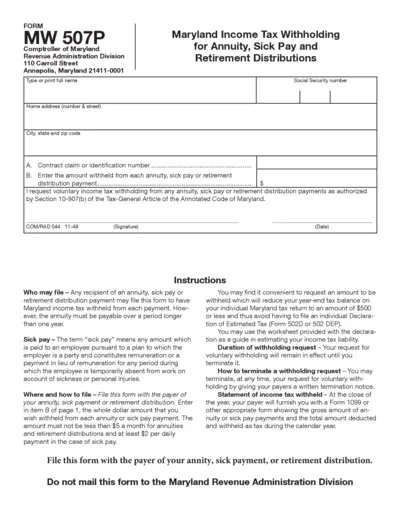

Maryland Income Tax Withholding Request Form

The Maryland Income Tax Withholding Request Form allows recipients of annuity, sick pay, or retirement distributions to withhold state income tax. This form ensures that the correct amount is deducted from payments to avoid balance due at year-end. It is essential for managing tax obligations efficiently.

Tax Forms

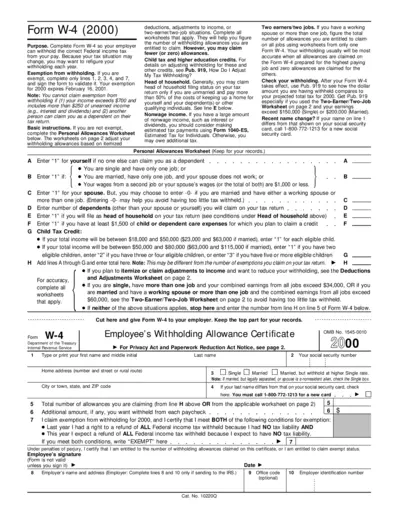

Form W-4 2000 Employee Withholding Allowance Certificate

Form W-4 is essential for employees to inform their employer of the correct federal income tax withholding. It helps in calculating the number of allowances eligible for claim based on individual tax situations. Proper completion ensures correct tax deductions from paychecks.

Tax Forms

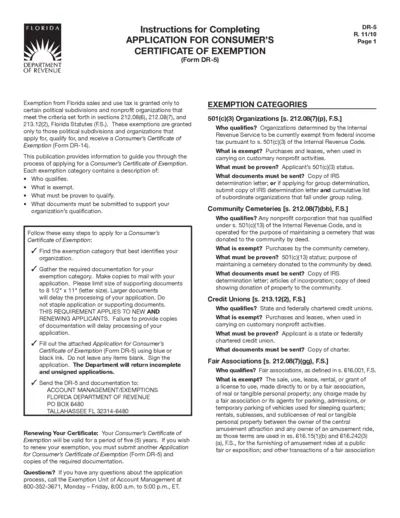

Florida Consumer's Certificate of Exemption Instructions

This file provides guidance on applying for the Florida Consumer's Certificate of Exemption. It details exemption categories and required documentation. Follow the outlined steps to ensure your application is processed efficiently.

Tax Forms

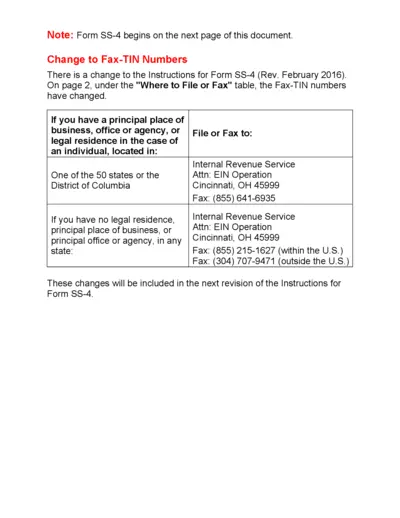

Employer Identification Number Application Form

This file contains the instructions and details for the application process to obtain an Employer Identification Number (EIN). It outlines the necessary steps and information required for both individuals and entities. Ideal for businesses, trusts, and estates seeking to comply with tax regulations.

Tax Forms

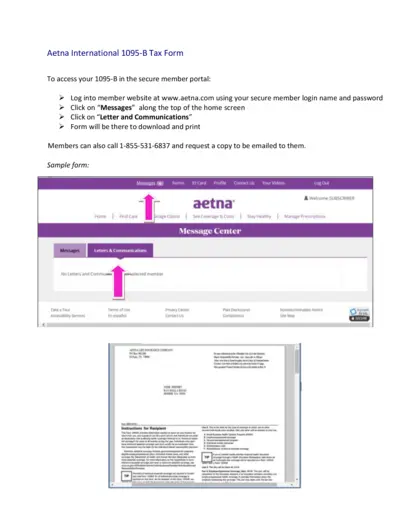

Aetna International 1095-B Tax Form Instructions

Access the Aetna International 1095-B Tax Form through our secure member portal. This guide provides step-by-step instructions for obtaining your tax form. Learn how to fill out and submit the form efficiently.

Tax Forms

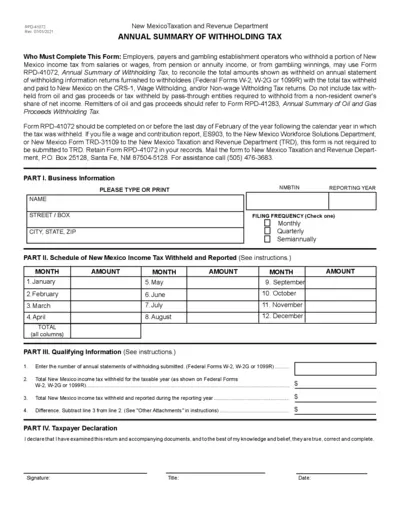

Annual Summary of Withholding Tax for New Mexico

This file is the Annual Summary of Withholding Tax prepared by the New Mexico Taxation and Revenue Department. It is essential for employers, payers, and gambling establishments to reconcile the total income tax withheld. Ensure timely completion and submission of this form to avoid penalties.