Tax Forms Documents

Tax Forms

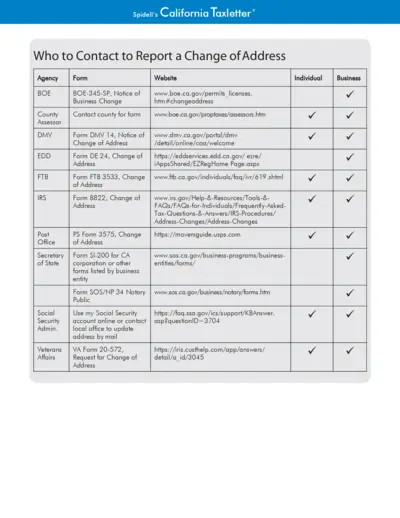

California Taxletter Change of Address Instructions

This file provides comprehensive details about reporting a change of address for California taxpayers. It includes forms, agencies, and contact information necessary for filing. Utilize this guide to ensure a smooth transition when updating your address.

Tax Forms

Instructions for 2016 IRS Form 1040

This file provides detailed instructions on how to fill out IRS Form 1040 for 2016 tax filing. It encompasses relevant tax changes, filing requirements, and important information from the IRS. Ideal for individuals preparing their tax returns.

Tax Forms

Form 8880 Credit for Retirement Savings Contributions

Form 8880 helps you calculate your retirement savings contributions credit, also known as the saver's credit. This form is intended for individuals who made eligible contributions to retirement plans. By utilizing this form, you can potentially reduce your tax burden while saving for retirement.

Tax Forms

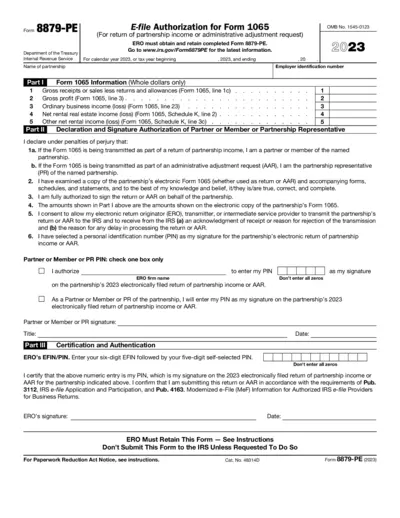

Form 8879-PE E-file Authorization Guide

Form 8879-PE is essential for partnerships to authorize electronic filing of Form 1065. This form allows partners to sign using a personal identification number (PIN). Ensure compliance with IRS requirements for seamless tax submission.

Tax Forms

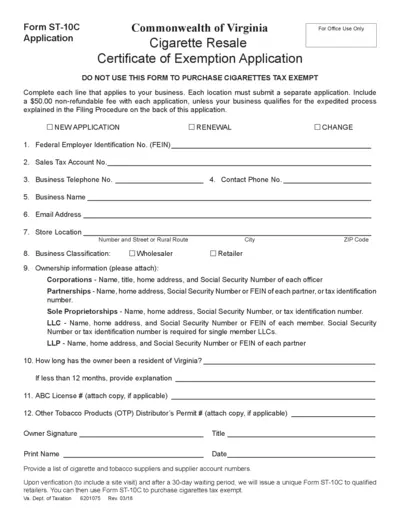

Virginia Cigarette Resale Certificate ST-10C

The Form ST-10C is the Cigarette Resale Certificate of Exemption Application for businesses in Virginia. It is required to purchase cigarettes tax exempt for resale. This form includes all necessary details for compliant filing and processing.

Tax Forms

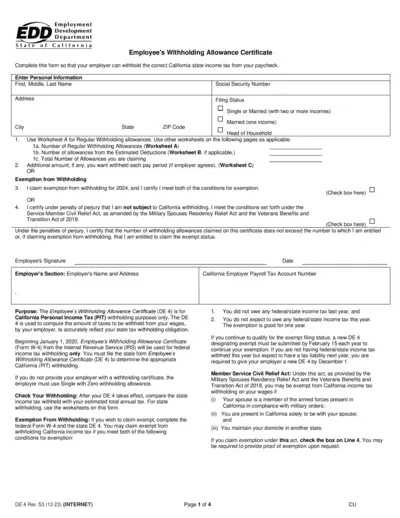

California Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate (DE 4) helps employees determine the appropriate California state income tax withholding. It's crucial for accurate payroll tax deductions based on your personal tax situation. Complete this form to ensure your employer withholds the correct amount from your paycheck.

Tax Forms

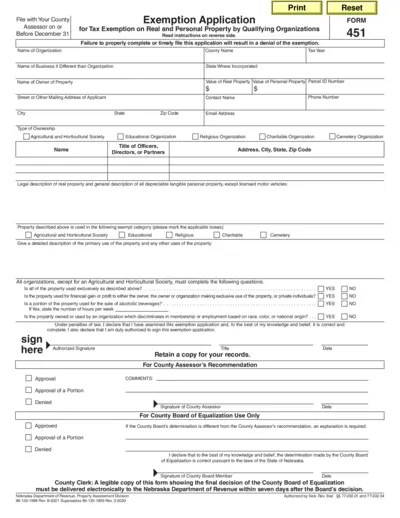

Exemption Application for Tax Exemption Real Personal Property

This file contains the Exemption Application for Tax Exemption on Real and Personal Property by Qualifying Organizations. Organizations must complete this form to apply for property tax exemption. Detailed instructions and eligibility criteria are provided for proper completion.

Tax Forms

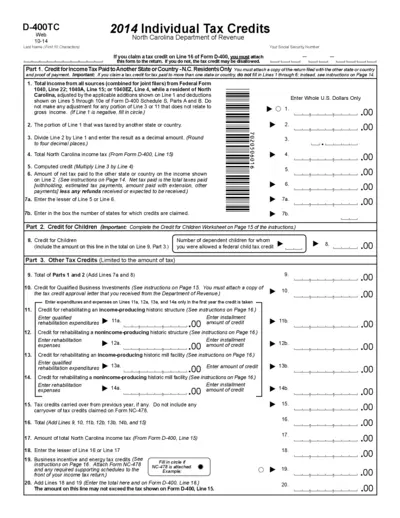

North Carolina D-400TC Tax Credit Form Instructions

The D-400TC tax credit form is essential for individuals claiming tax credits in North Carolina. This form outlines the necessary information for tax credits including those for children, business investments, and tax paid to other states. Follow the instructions carefully to ensure your credits are applied correctly.

Tax Forms

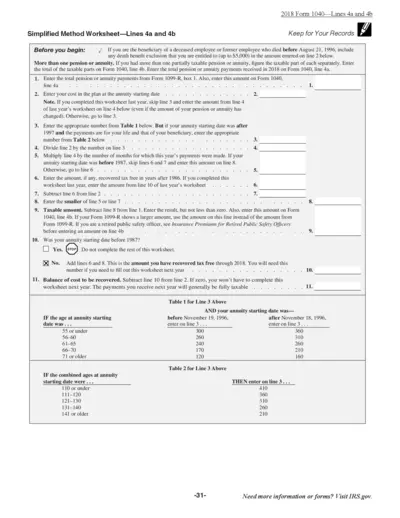

2018 Form 1040 Simplified Method Worksheet

This document provides detailed instructions for completing the 2018 Form 1040's Simplified Method Worksheet. It includes guidelines for calculating pension and annuity amounts for tax reporting. Ensure accurate completion if you are dealing with pension or annuity benefits.

Tax Forms

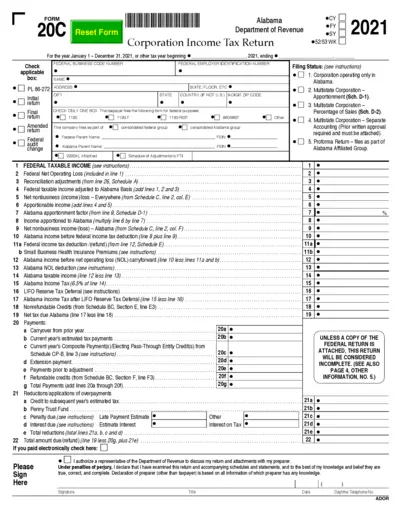

Alabama Corporation Income Tax Return Guide 2021

This file provides detailed instructions for completing the Alabama Corporation Income Tax Return for the tax year 2021. It includes sections for federal business codes, employer identification numbers, and tax calculation methods. Users can reference this document for accurate reporting and compliance with state tax obligations.

Tax Forms

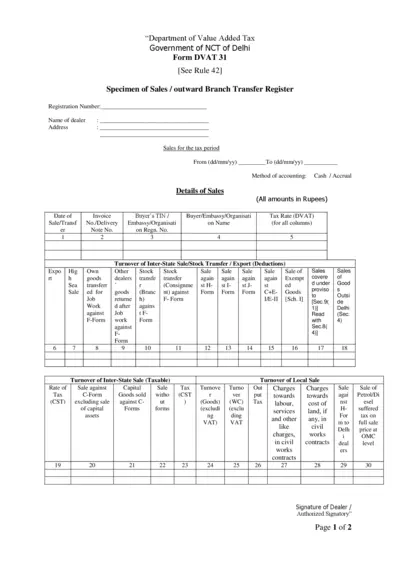

DVAT 31 and DVAT 31A Forms Submission Instructions

This document outlines the DVAT 31 and DVAT 31A forms used for reporting sales and local sales registers. It serves as a guideline for dealers in Delhi on how to accurately complete these forms. Proper completion ensures compliance with local tax regulations.

Tax Forms

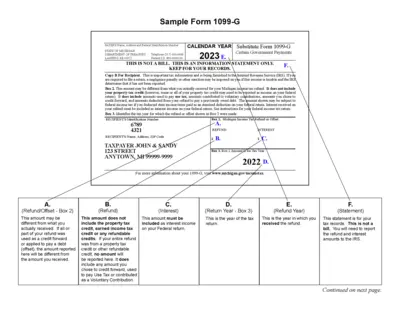

Sample Form 1099-G for Michigan Tax Reporting

This file contains essential information for filing Michigan Form 1099-G. It helps taxpayers report income tax refunds or offsets accurately. Understanding this form is crucial for compliance with IRS regulations.