Tax Forms Documents

Tax Forms

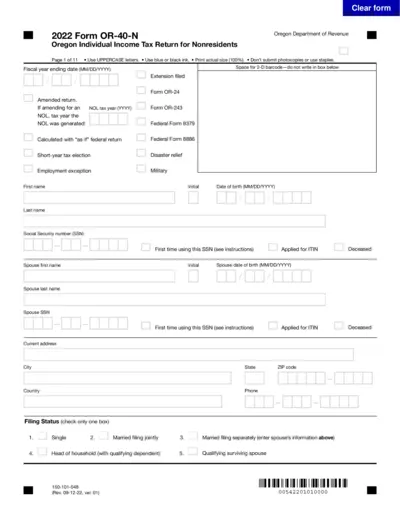

Oregon Individual Income Tax Return for Nonresidents

The 2022 Form OR-40-N is an essential document for nonresidents filing their Oregon Individual Income Tax Return. This form guides users through reporting their income, exemptions, and credits accurately. Ensure compliance with state tax laws by completing this form correctly.

Tax Forms

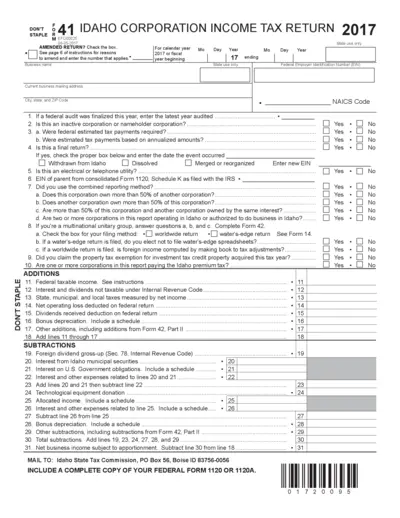

Idaho Corporation Income Tax Return Instructions

The Idaho Corporation Income Tax Return for the year 2017 provides detailed instructions for filing taxes. This document includes essential information for businesses operating in Idaho. It is crucial for accurate tax reporting and compliance.

Tax Forms

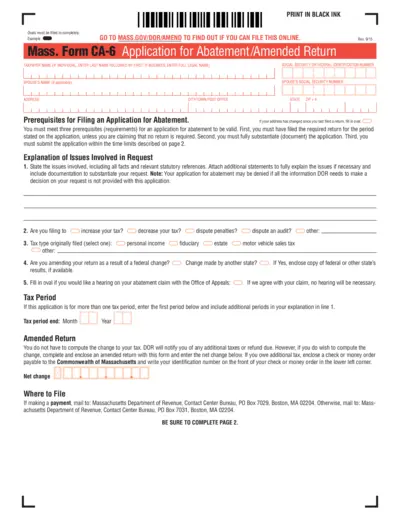

Massachusetts Form CA-6 Abatement Application Instructions

This file provides detailed information about filing a Form CA-6 for tax abatement in Massachusetts. Users will learn about the prerequisites and required documentation. It also outlines the process of claiming a tax refund or amendment.

Tax Forms

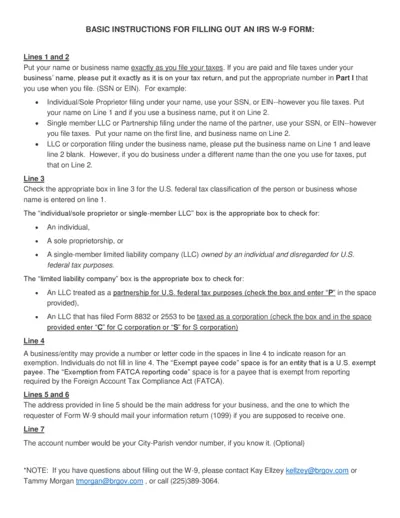

Basic Instructions for Filling Out an IRS W-9 Form

This document provides essential guidance on how to complete the IRS W-9 form. It's designed for individuals and businesses that need to fill out this crucial tax document accurately. By following these instructions, you can ensure compliance and proper tax filings.

Tax Forms

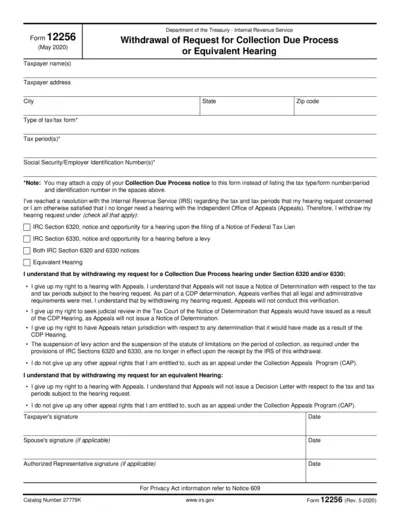

Withdrawal of Collection Due Process Request Form

Form 12256 is used by taxpayers to withdraw their request for a Collection Due Process hearing with the IRS. This form is essential for taxpayers who have reached a resolution or no longer need a hearing. It helps ensure that all parties are aware of the withdrawal and any implications.

Tax Forms

New York City School Tax Credit Instructions 2023

This document outlines the instructions for filing Form NYC-210 to claim the New York City School Tax Credit. It provides essential information for residents who lived in NYC during 2023. Follow the guidelines to ensure proper submission and eligibility.

Tax Forms

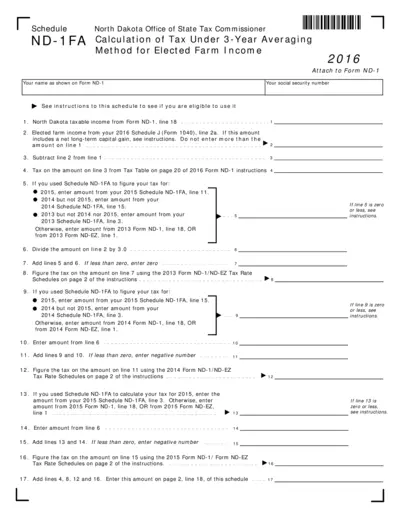

North Dakota Schedule ND-1FA Tax Calculation Guide

This file provides detailed instructions for calculating tax using the North Dakota Schedule ND-1FA for the year 2016. It is essential for individuals who utilized Schedule J (Form 1040) for their federal income taxes. Ensure you follow the eligibility and calculation steps carefully.

Tax Forms

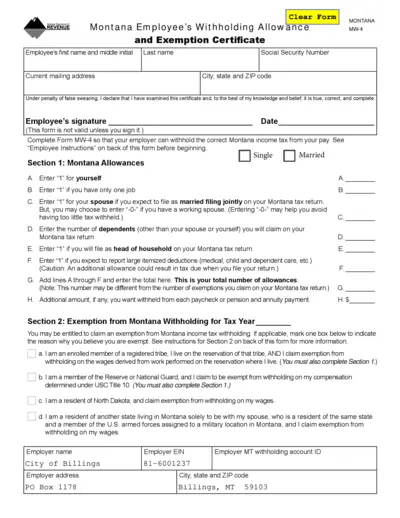

Montana Employee's Withholding Allowance Certificate

The Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) is designed for employees in Montana to accurately declare withholding allowances. This form ensures that the correct amount of state income tax is withheld from your paycheck. Completing the MW-4 helps prevent tax liabilities when filing your annual tax return.

Tax Forms

Form W-11 Employee Affidavit for HIRE Act Benefits

This file contains the Form W-11, which is used to confirm that an employee is a qualified employee under the HIRE Act. It outlines the necessary requirements and instructions for completion. Retain this form for your records and do not submit it to the IRS.

Tax Forms

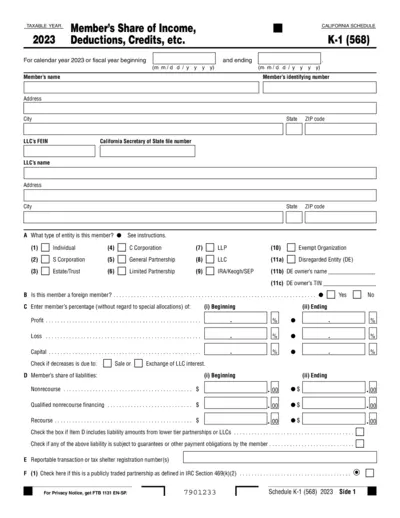

California Schedule K-1 Tax Report Form 2023

This file contains the California Schedule K-1 tax details for the year 2023. It includes individual member information and financial data. Use this form for correctly reporting your LLC income and deductions.

Tax Forms

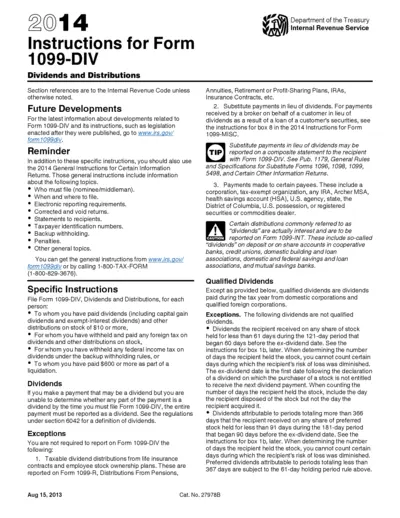

Instructions for Form 1099-DIV Dividends and Distributions

This document provides essential instructions for filling out Form 1099-DIV related to dividends and distributions. It is crucial for taxpayers to understand the requirements to report dividends accurately. Users will find specific guidelines on who must file, when to file, and how to complete this form.

Tax Forms

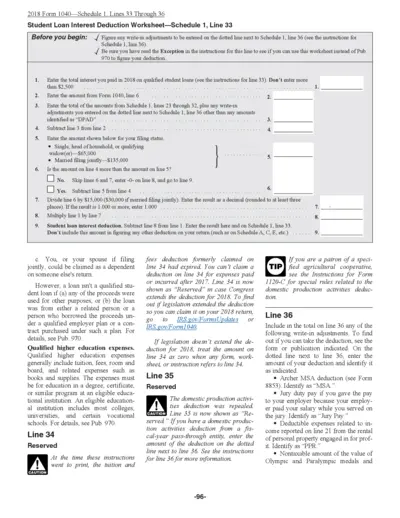

2018 Student Loan Interest Deduction Worksheet

This file contains the 2018 Form 1040-Schedule 1 for calculating student loan interest deductions. It guides users through the worksheet and provides essential details for eligibility and amounts. Useful for taxpayers seeking to maximize their deductions.