Tax Forms Documents

Tax Forms

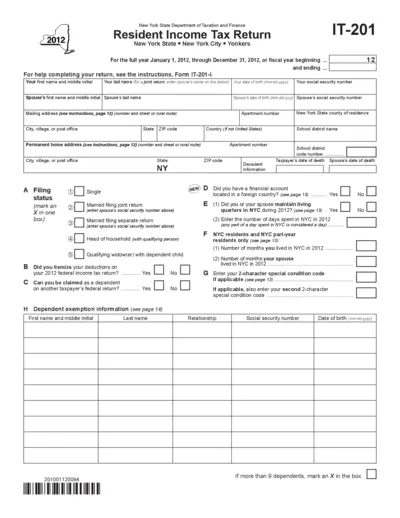

New York Resident Income Tax Return 2012

This document is the New York State Resident Income Tax Return for the year 2012. It provides the necessary forms and instructions for filing taxes for residents. Ensure accurate completion to avoid any penalties.

Tax Forms

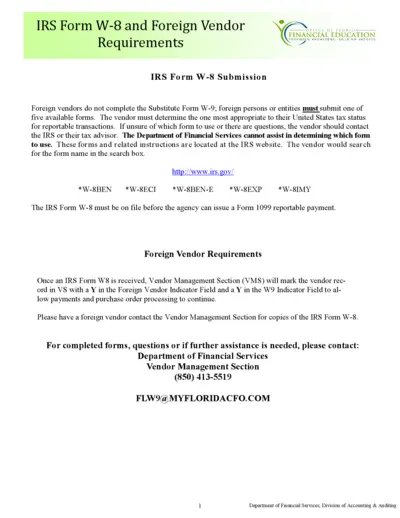

IRS Form W-8 for Foreign Vendor Requirements

This document outlines the requirements for foreign vendors to submit IRS Form W-8. It provides essential information and guidance on selecting the correct form. Ensure compliance with U.S. tax regulations by understanding your filing obligations.

Tax Forms

Official IRS Form 1098-T Tuition Statement Guidance

This file provides essential guidance for filling out IRS Form 1098-T. It includes details on payments for qualified tuition and related expenses. Perfect for students and educational institutions alike.

Tax Forms

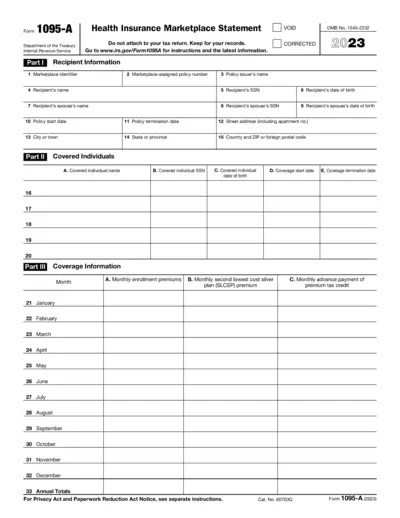

Form 1095-A Health Insurance Marketplace Statement

Form 1095-A is essential for individuals enrolled in health insurance through the Health Insurance Marketplace. It provides crucial information for completing Form 8962, Premium Tax Credit. Ensure to keep this document for your records and verify all information carefully.

Tax Forms

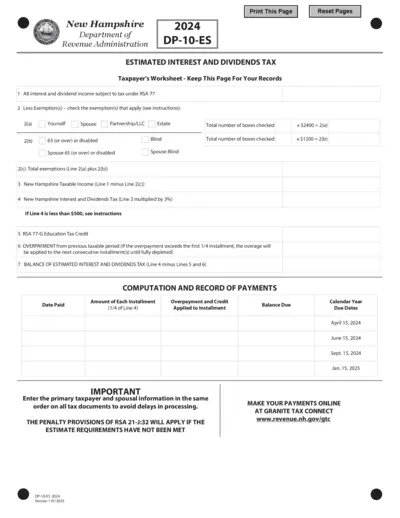

New Hampshire Estimated Interest and Dividends Tax Worksheet 2024

This document is the Estimated Interest and Dividends Tax Worksheet for New Hampshire for 2024. It provides instructions for taxpayers on how to calculate and report their interest and dividend income. The worksheet helps individuals and entities to comply with New Hampshire tax laws effectively.

Tax Forms

2022 Missouri Partnership Return of Income Form

The Missouri Partnership Return of Income form, MO-1065, is essential for partnerships operating in Missouri. This form helps ensure accurate reporting of partnership income and tax obligations. Use this guide to understand how to fill it out effectively.

Tax Forms

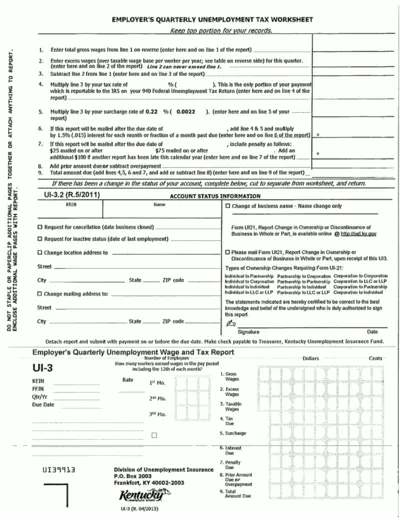

Employer Quarterly Unemployment Tax Worksheet

This worksheet is designed for employers to report quarterly unemployment taxes in Kentucky. It guides users through calculating gross wages, excess wages, and total tax due. Essential for compliance with IRS regulations.

Tax Forms

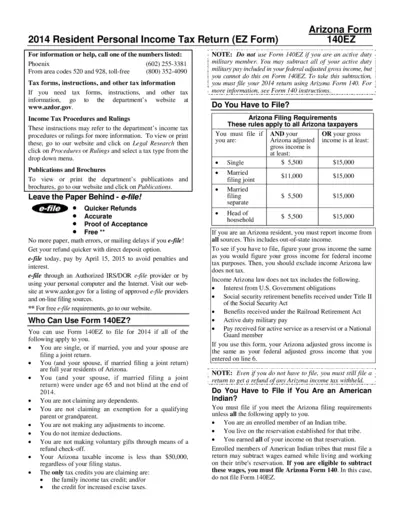

Arizona Form 140EZ 2014 Personal Income Tax Return

The Arizona Form 140EZ is designed for residents to file their 2014 personal income tax returns simply and efficiently. This simplified form is perfect for eligible taxpayers who meet specific criteria. Use this form to ensure accurate and timely filing, maximizing your potential refund.

Tax Forms

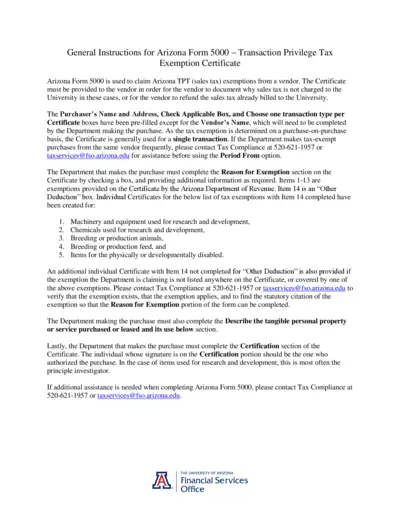

Arizona Form 5000 Transaction Privilege Tax Exemption

Arizona Form 5000 is utilized to claim sales tax exemptions for vendors. This certificate must be provided to vendors by departments to ensure correct tax handling. For frequent tax-exempt purchases, departments should consult Tax Compliance for guidance.

Tax Forms

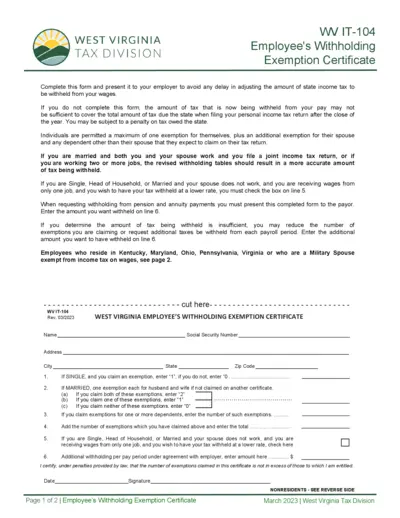

West Virginia Employee's Withholding Exemption Certificate

This file contains the Employee's Withholding Exemption Certificate for West Virginia. It provides essential information on how to fill out tax withholding exemptions. Use this form to inform your employer about your tax withholding preferences.

Tax Forms

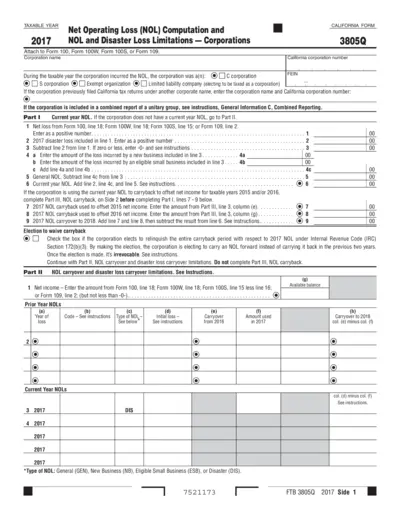

California 2017 NOL Computation and Limitations Form

This file contains the 2017 Net Operating Loss (NOL) Computation details for California corporations. It provides essential guidelines for completing Form 100, Form 100W, Form 100S, or Form 109. Utilize this form to compute NOL and understand disaster loss limitations effectively.

Tax Forms

Instructions for Form 8606 Nondeductible IRAs

This file provides essential instructions for filling out Form 8606 concerning nondeductible contributions to IRAs. It includes guidelines on eligibility and important deadlines. Users will find detailed information on how to correctly report contributions and distributions.