Tax Forms Documents

Tax Forms

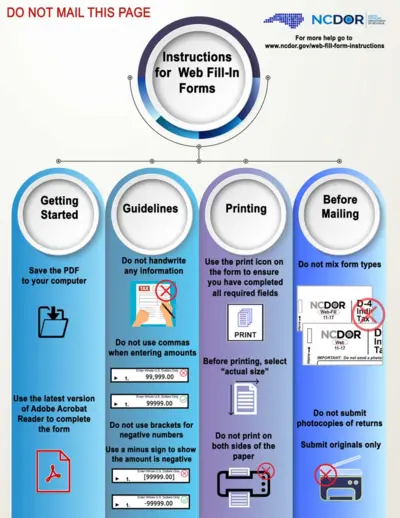

North Carolina D-400 Form Instructions 2024

This PDF provides detailed instructions on how to fill out the North Carolina D-400 form. It also includes guidelines for part-year residents and nonresidents for state tax purposes. Essential for ensuring proper tax filing in North Carolina.

Tax Forms

IRS Publication 1141 General Rules for Substitute Forms

IRS Publication 1141 provides essential guidelines on the specifications and rules for Substitute Forms W-2 and W-3. This document is crucial for employers and tax professionals to ensure accurate filing. It includes important updates about submission processes and mailing addresses.

Tax Forms

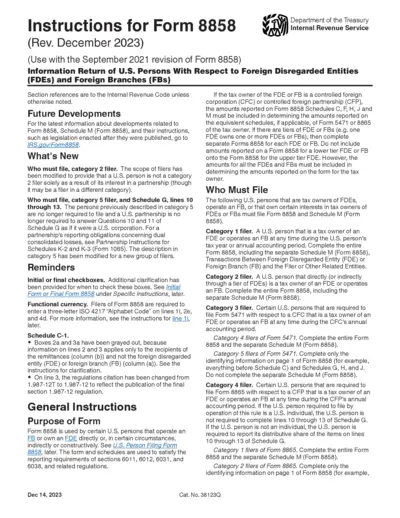

Instructions for Form 8858 - U.S. Persons.

This file provides essential instructions for U.S. persons regarding the filing of Form 8858, related to Foreign Disregarded Entities and Foreign Branches. It outlines the filing requirements, who must file, and necessary steps for compliance.

Tax Forms

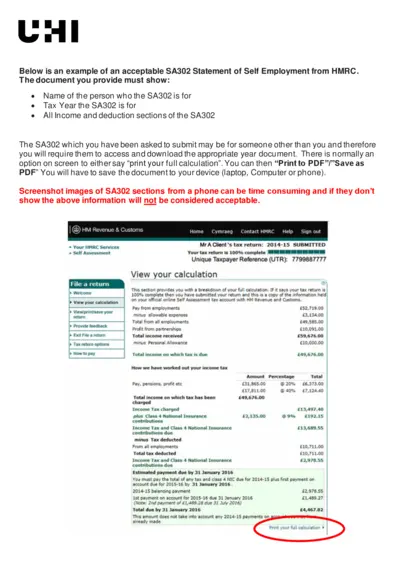

SA302 Statement of Self Employment Instructions

This document outlines the SA302 Statement of Self Employment from HMRC. It provides important details on how to fill it out accurately. Users can benefit from understanding its components and requirements.

Tax Forms

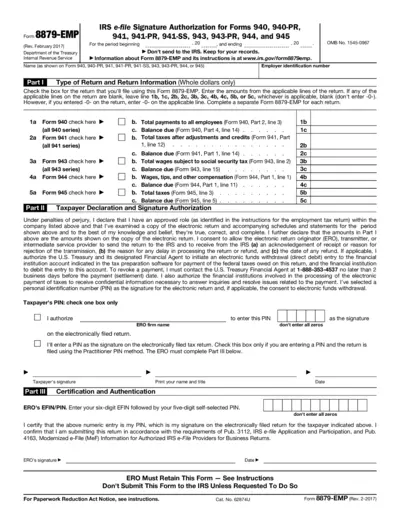

Form 8879-EMP IRS e-file Signature Authorization

Form 8879-EMP is used for the IRS e-file signature authorization of employment tax returns. This form allows taxpayers to electronically sign their returns with a PIN. It serves as an important document for employers to ensure compliance with federal tax regulations.

Tax Forms

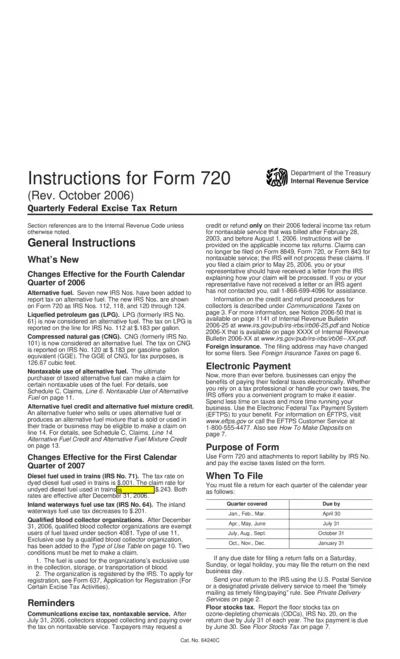

Instructions for Form 720 Quarterly Federal Excise Tax Return

Form 720 provides essential instructions for reporting quarterly federal excise taxes. This guide covers tax liabilities, filing deadlines, and eligibility criteria. Ensure compliance with IRS requirements by following these instructions closely.

Tax Forms

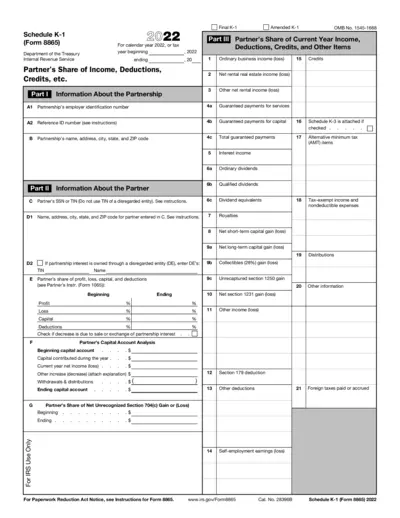

2022 Schedule K-1 Form 8865 Instructions and Details

This file is the 2022 Schedule K-1 (Form 8865) for tax reporting purposes.

Tax Forms

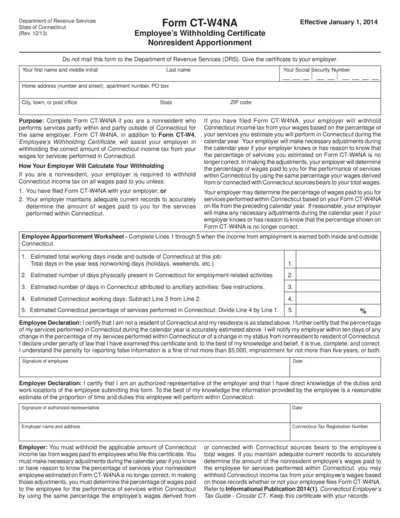

CT-W4NA Employee Withholding Certificate Form

Form CT-W4NA is essential for nonresidents performing services in Connecticut. It helps employers with accurate tax withholding. Ensure you complete it to report your Connecticut income tax correctly.

Tax Forms

California Real Estate Withholding Statement 2022

The California Form 593 is essential for reporting real estate transactions where withholding is applicable. This form provides details for remitters and sellers regarding potential withholding exemptions. Complete the form accurately to ensure compliance with California tax laws.

Tax Forms

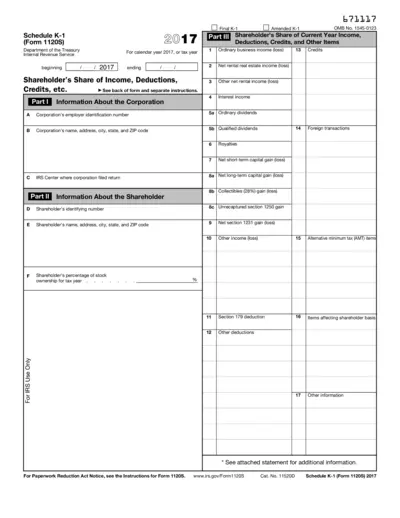

Schedule K-1 Form 1120S Tax Information 2017

This file is the Schedule K-1 form for S Corporations for the tax year 2017. It provides shareholders with a breakdown of their shares of income, deductions, and credits. Use this form to accurately report your taxes and ensure compliance with IRS regulations.

Tax Forms

California Installment Agreement Request Form

This document is the California Franchise Tax Board Installment Agreement Request form, used for requesting a payment plan for tax liabilities. It outlines the conditions for installment agreements and necessary taxpayer agreements. Use this form if you are unable to pay your tax liability in full immediately.

Tax Forms

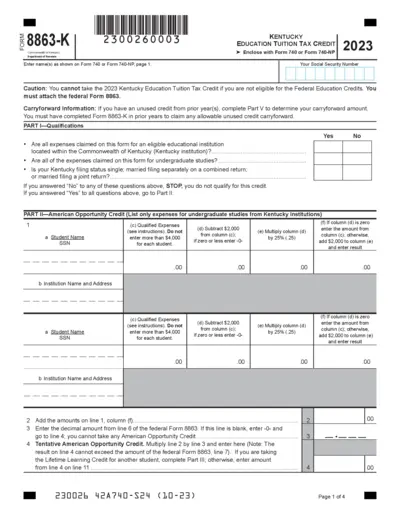

Kentucky Education Tuition Tax Credit Form 8863-K

Form 8863-K is essential for claiming the Kentucky Education Tuition Tax Credit. It details guidelines and qualifications for eligible taxpayers. Complete this form to potentially reduce your tax liability in Kentucky.