Tax Forms Documents

Tax Forms

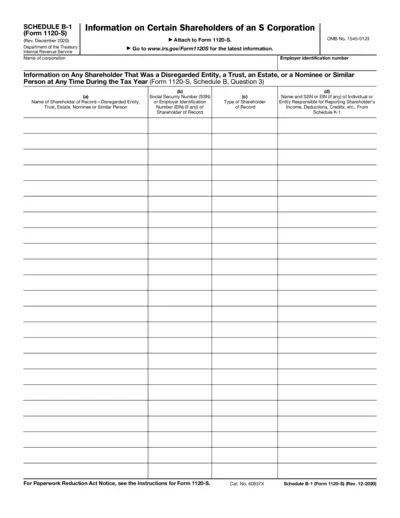

Form 1120-S Schedule B-1 Details and Instructions

Form 1120-S Schedule B-1 provides essential instructions for S corporations regarding certain shareholders. It details the necessary information required for filing and the specific conditions applicable to various types of shareholders. This document is crucial for ensuring compliance with IRS regulations.

Tax Forms

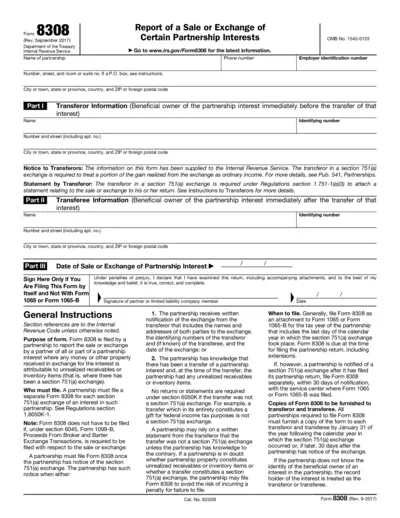

Form 8308 Report of Sale or Exchange of Partnership Interests

Form 8308 is utilized by partnerships to report the sale or exchange of partnership interests that may involve unrealized receivables or inventory items. It is essential for proper tax reporting and compliance with IRS regulations. This form requires detailed information about transferors, transferees, and the specifics of the transaction.

Tax Forms

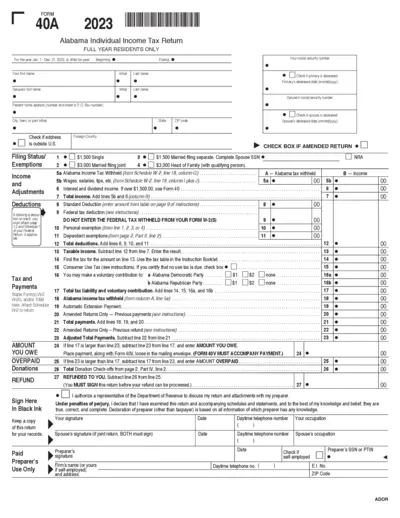

Alabama Individual Income Tax Return 2023

This file provides essential information for filing the Alabama Individual Income Tax Return for the year 2023. It guides residents through necessary steps such as income reporting and deductions. Follow the instructions to ensure a smooth filing process.

Tax Forms

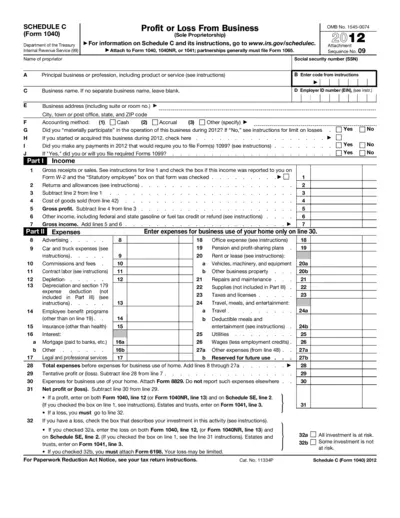

Schedule C Form 1040 Profit or Loss Business

This file is essential for sole proprietors to report income and expenses from their business. Sectioned into parts, it includes detailed calculations on profits and losses. Easily download and fill out this IRS form to ensure accurate tax filings.

Tax Forms

2023 Massachusetts Resident Income Tax Form 1

This file contains the 2023 Massachusetts Resident Income Tax Form 1 for filing your state tax return. It provides essential information and instructions for taxpayers in Massachusetts. Learn how to file electronically and understand the major tax changes for this year.

Tax Forms

IRS W-2 and W-3 Filing Instructions and Forms

This file provides essential instructions for filing Forms W-2 and W-3 with the Social Security Administration. It includes details on how to electronically file and the penalties for improper submissions. Essential for employers to ensure compliance with IRS regulations.

Tax Forms

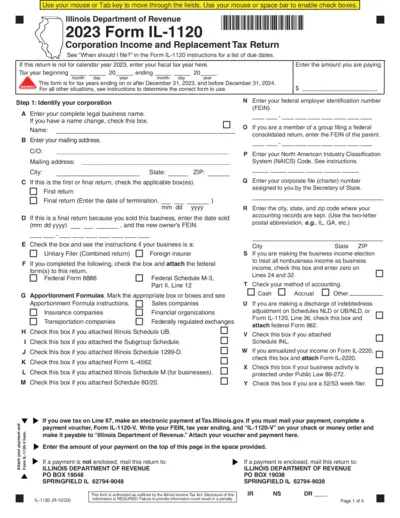

Illinois Corporation Income and Replacement Tax Return

The 2023 Form IL-1120 is designed for corporations to report their income and pay the appropriate taxes to the state of Illinois. This form is essential for businesses operating within Illinois for the tax year ending before December 31, 2024. Ensure that all required sections are filled out accurately for timely processing.

Tax Forms

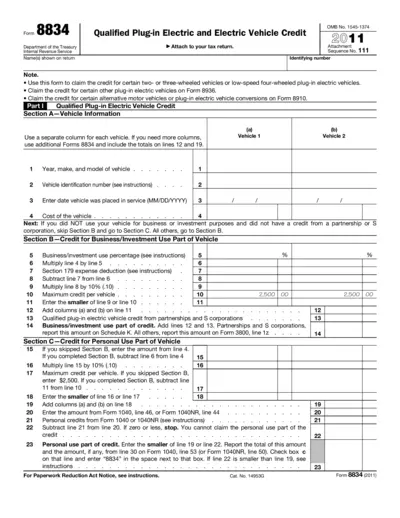

Qualified Plug-in Electric Vehicle Credit Form 8834

Form 8834 allows taxpayers to claim credits for qualified plug-in electric vehicles. It provides guidance on eligible vehicles and credit calculations. Use this form to successfully file your tax return and maximize your credits.

Tax Forms

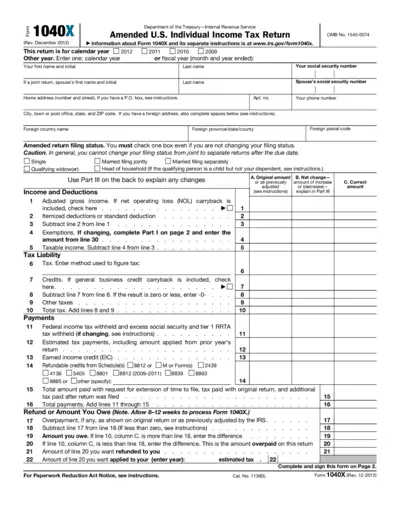

Instructions for Completing Form 1040X Amended Tax Return

Form 1040X is used to amend previously filed individual income tax returns. It allows taxpayers to correct errors, claim deductions or credits they may have missed, and ensure accurate tax filings. This guide provides essential information on how to effectively complete and submit the form.

Tax Forms

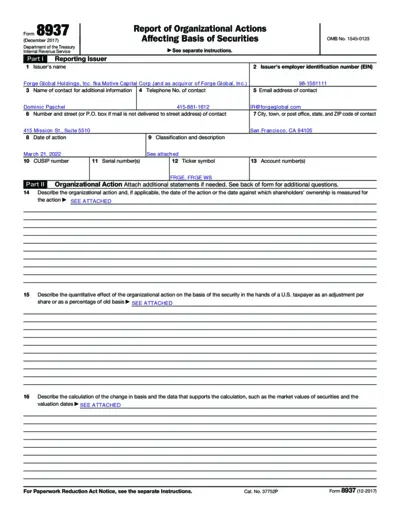

Form 8937 Organizational Actions Report

Form 8937 provides critical information about organizational actions affecting the basis of securities. It is essential for U.S. taxpayers to accurately report their adjustments to the security basis. Familiarity with the filing requirements ensures compliance and accurate tax reporting.

Tax Forms

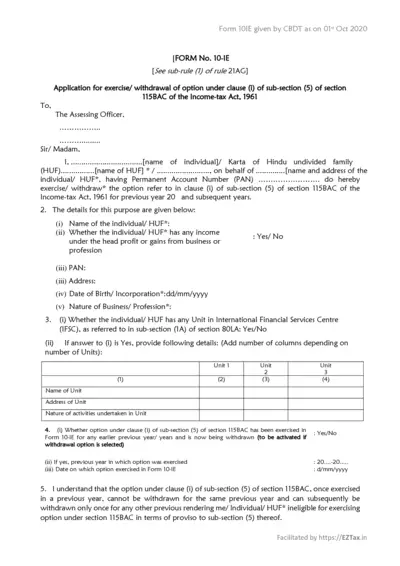

Form 10IE CBDT Income Tax Option Application

Form 10IE is an application for exercising or withdrawing an option under section 115BAC. It is essential for individuals and Hindu Undivided Families (HUF) for tax purposes. Complete this form accurately to ensure compliance with the Income Tax Act.

Tax Forms

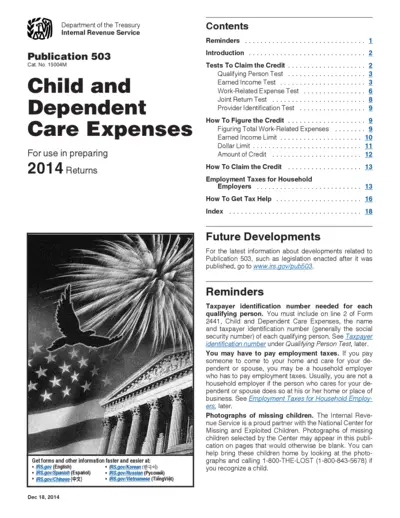

Child and Dependent Care Expenses 2014 IRS Publication

This IRS document provides essential information for claiming child and dependent care expenses credits. It outlines the qualifications necessary to receive the credit, along with specific tests to determine eligibility. Understand how to fill out the accompanying forms to maximize your tax benefits.