Tax Forms Documents

Tax Forms

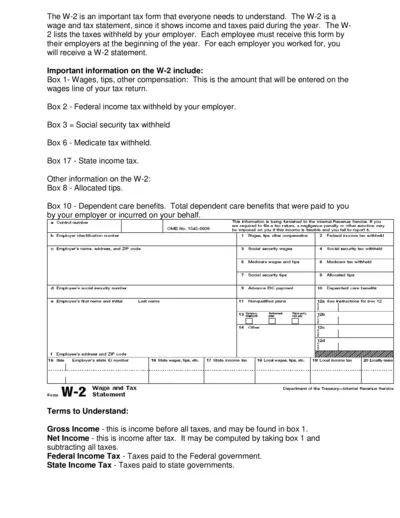

Understanding the W-2 Wage and Tax Statement

The W-2 form is essential for employees to report their annual income and taxes withheld. It provides crucial information for accurate tax filing. Make sure to keep this document for your records as it's needed by the IRS.

Tax Forms

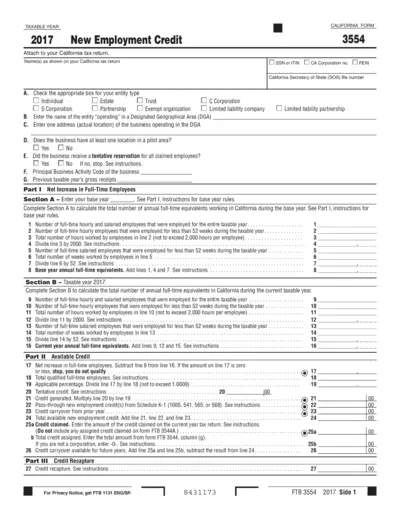

California New Employment Credit Form 2017

This California form provides details on the New Employment Credit for 2017. It guides users through eligibility criteria and the application process. Essential for businesses seeking to claim relevant employment credits.

Tax Forms

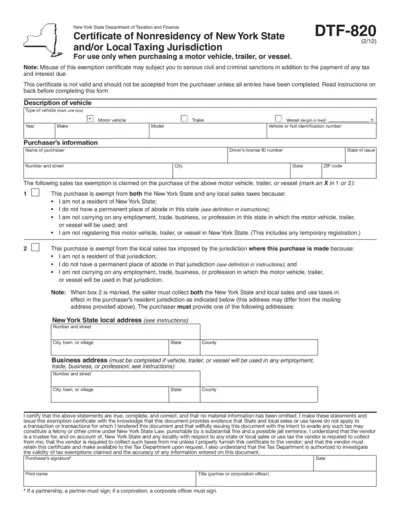

Certificate of Nonresidency for Vehicle Purchase

This file is a Certificate of Nonresidency for New York State and Local Taxing Jurisdiction. It is used for claiming exemption from sales taxes when purchasing a motor vehicle, trailer, or vessel. Ensure to fill it correctly to avoid legal consequences.

Tax Forms

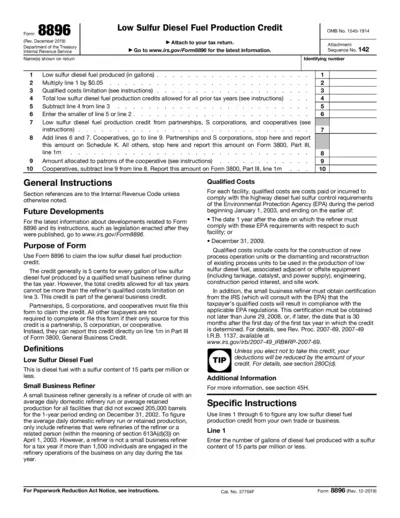

Low Sulfur Diesel Fuel Production Credit Form 8896

Form 8896 allows small business refiners to claim a low sulfur diesel fuel production credit. This credit, valued at $0.05 per gallon, supports compliance with EPA regulations. Ensure accurate completion to optimize tax benefits.

Tax Forms

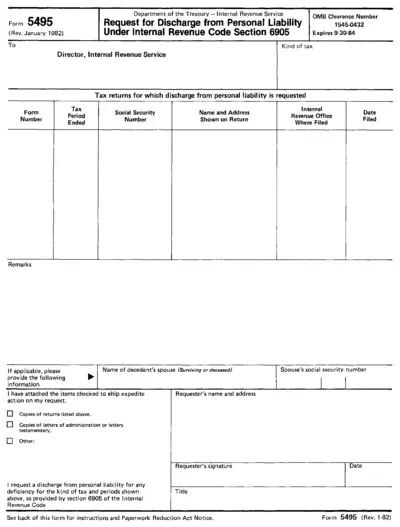

IRS Form 5495 Discharge from Personal Liability

Form 5495 is a request for discharge from personal liability under IRS Section 6905. It is used by individuals seeking to relieve themselves of tax liability. The form must be accompanied by necessary documentation.

Tax Forms

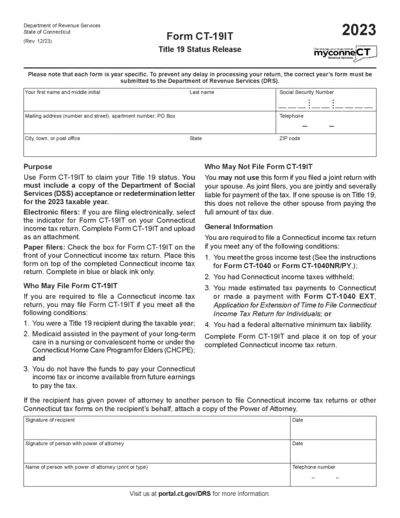

Form CT-19IT Title 19 Status Release 2023

Form CT-19IT is utilized for claiming Title 19 status in Connecticut. It is essential for individuals requiring tax assistance due to their Medicaid status. Completing this form properly ensures compliance with the Connecticut Department of Revenue Services.

Tax Forms

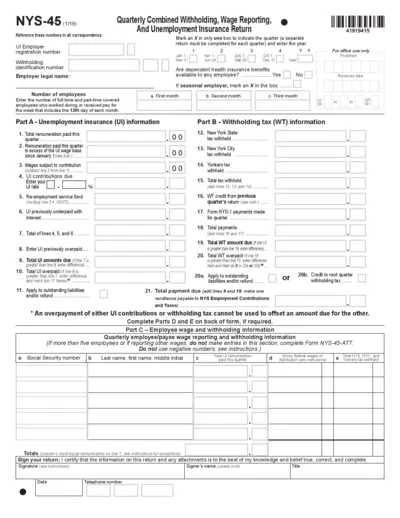

NYS-45 Quarterly Combined Withholding and Wage Return

The NYS-45 form is essential for New York employers to report combined withholding, wage information, and unemployment insurance return for employees. It provides detailed instructions on reporting remuneration, taxes due, and employee wages for a specific quarter. Completing this form accurately ensures compliance with state regulations and helps avoid potential penalties.

Tax Forms

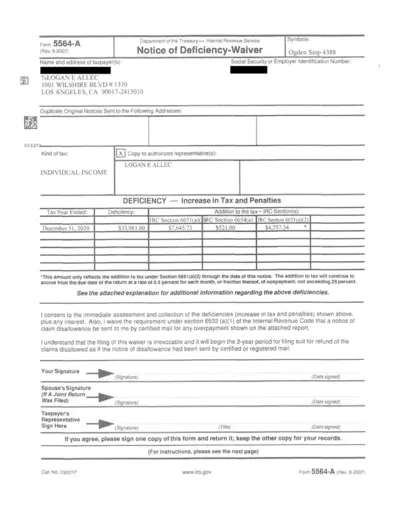

Form 5564-A Notice of Deficiency Waiver IRS

Form 5564-A is utilized to waive the notice of deficiency from the IRS. This form allows taxpayers to consent to the immediate assessment of deficiencies. Proper completion ensures a streamlined communication regarding tax discrepancies.

Tax Forms

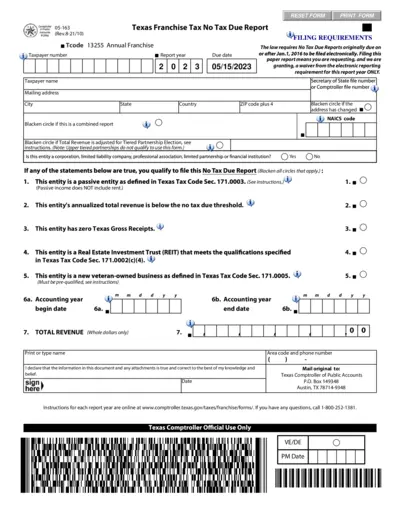

Texas Franchise Tax No Tax Due Report

This form is used to report no tax due for Texas Franchise Tax filers. It provides essential details for tax compliance in Texas. Ensure that you provide accurate information to avoid any penalties.

Tax Forms

IRS Earned Income Credit Schedule EIC Form 1040

The IRS Schedule EIC is essential for claiming the Earned Income Credit. This form is specifically for taxpayers with qualifying children. Ensure accurate completion to maximize your tax benefits.

Tax Forms

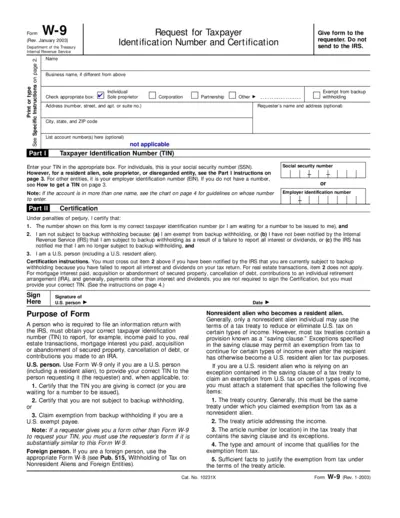

Form W-9 Instructions for Taxpayer Identification

Form W-9 is used for providing your taxpayer identification number (TIN) to requesters. This form is important for reporting income, mortgage interest, and real estate transactions to the IRS. Ensure to complete it accurately to avoid penalties.

Tax Forms

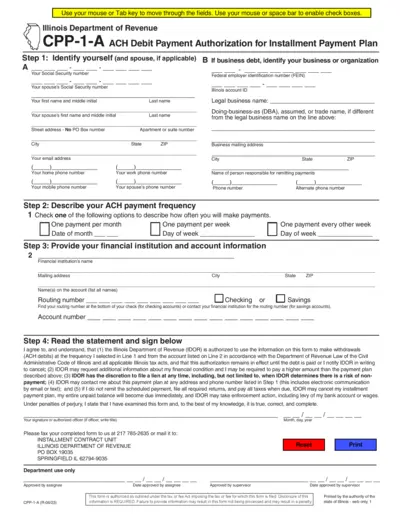

CPP-1-A ACH Debit Payment Authorization Form

This form is used to authorize ACH debit payments for installment payment plans to the Illinois Department of Revenue. It captures personal and financial information to facilitate automatic payments. Ensure to provide accurate details for a smoother processing experience.