Tax Forms Documents

Tax Forms

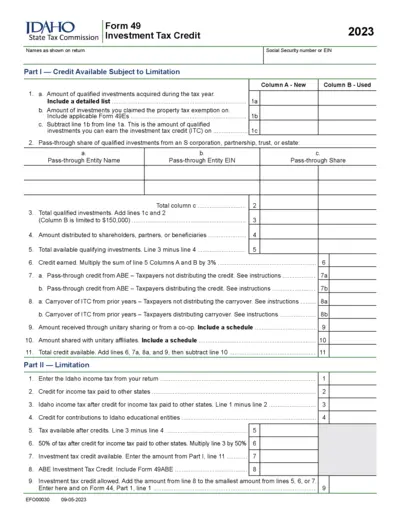

Idaho State Tax Commission Form 49 Investment Tax Credit

Form 49 enables individuals and businesses to calculate the Investment Tax Credit. This tax form provides guidelines on eligible investments and how to apply for credits. It's crucial for maximizing tax benefits associated with investments in Idaho.

Tax Forms

Shareholder Instructions for Schedule K-3 Form 1120-S

This document provides shareholders with essential instructions to complete Schedule K-3 (Form 1120-S). It details the necessary information regarding foreign income, deductions, and credits for tax reporting. Ensure compliance with the IRS regulations by following the outlined guidelines.

Tax Forms

Instructions for Form 8889 Health Savings Accounts

This file contains detailed instructions for filling out Form 8889 related to Health Savings Accounts (HSAs). It explains eligibility, contributions, distributions, and deductions. Follow the guidelines to ensure compliance with tax regulations.

Tax Forms

California Nonresident or Part-Year Resident Tax Return

This file contains the California 540NR income tax return form for 2022. It is essential for nonresidents or part-year residents filing their taxes. Use this form to report your income and calculate your California tax obligations.

Tax Forms

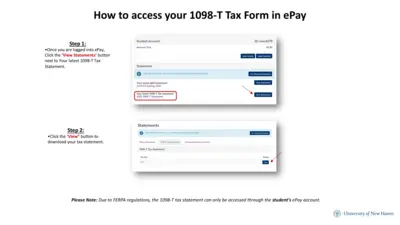

Accessing Your 1098-T Tax Form Instructions

This file provides step-by-step instructions for accessing your 1098-T Tax Form using ePay and Banner Self-Service. It is essential for students needing their tax documents for filing. Follow the guidelines to ensure efficient retrieval of your tax information.

Tax Forms

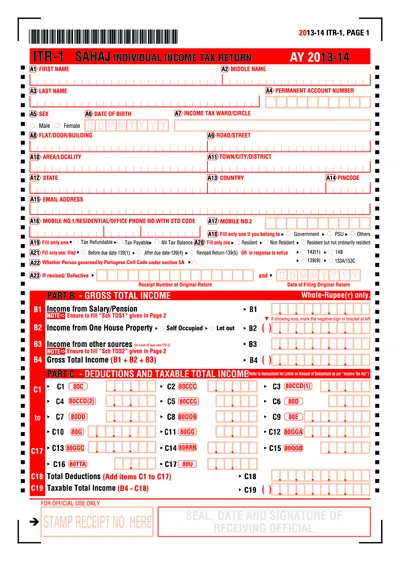

ITR-1 Income Tax Return Filing Guide 2013-14

The ITR-1 form is for individuals to file their income tax returns. This file provides the necessary details and instructions for completing the form accurately. Ensure to follow the guidelines outlined to avoid errors in your submission.

Tax Forms

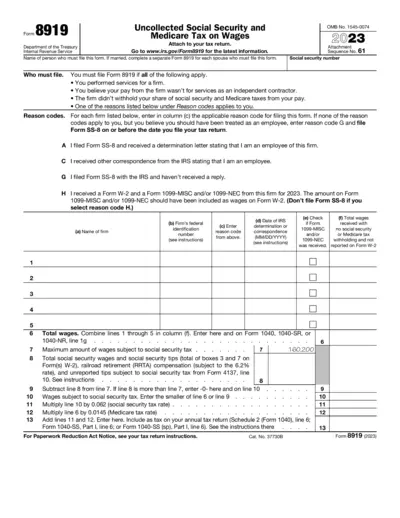

Form 8919 IRS Uncollected Social Security Medicare Tax

Form 8919 is used to report uncollected Social Security and Medicare taxes on wages. This form is applicable for individuals treated as independent contractors but qualify as employees. Ensure to file according to IRS guidelines for proper crediting.

Tax Forms

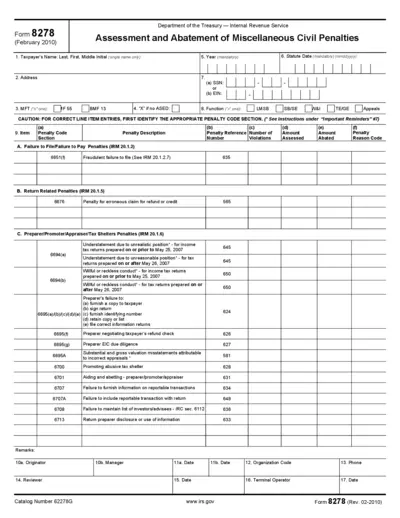

Form 8278 Assessment Abatement Civil Penalties

Form 8278 is used to assess and abate miscellaneous civil penalties by the IRS. It is essential for taxpayers seeking to resolve issues related to penalties. Understanding this form can help facilitate compliance with tax regulations.

Tax Forms

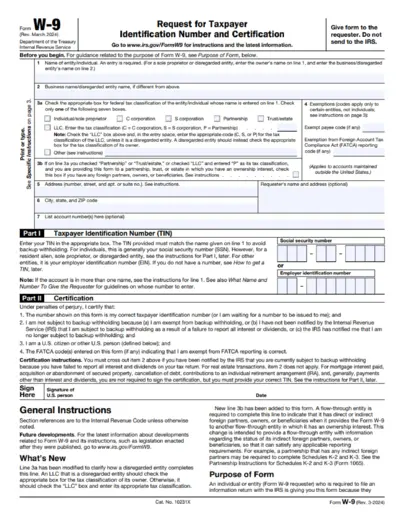

W-9 Tax Form Instructions and Information

The W-9 form is a request for taxpayer identification number and certification. It is used by individuals and entities to provide their taxpayer identification information to a requester. Completing this form accurately helps to avoid issues with backup withholding.

Tax Forms

IRS Form W-2 and W-3 Filing Instructions

This document provides detailed instructions for filing IRS Forms W-2 and W-3 electronically. It includes information on ordering official IRS forms and common penalties for incorrect submissions. Follow these guidelines to ensure compliance with IRS regulations.

Tax Forms

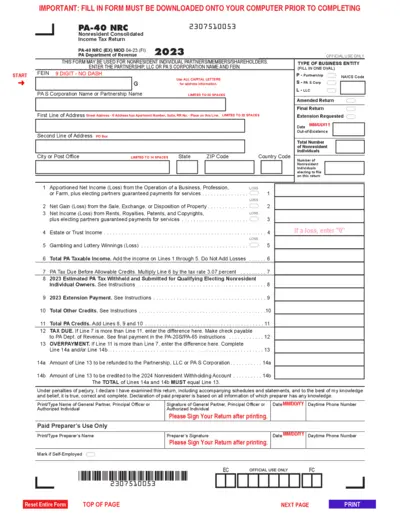

PA-40 NRC Nonresident Consolidated Income Tax Form

The PA-40 NRC form is for nonresident individuals to report their income. This form allows partnerships and LLCs to consolidate tax reporting. Ensure correct completion to avoid penalties.

Tax Forms

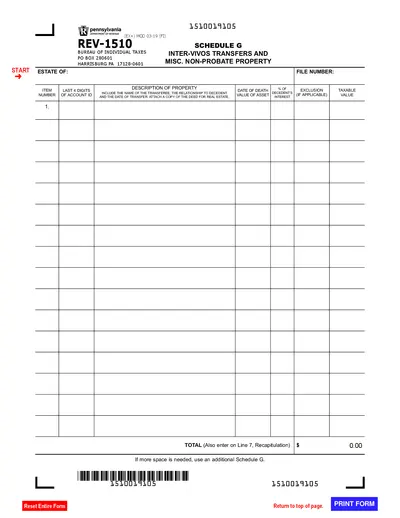

Pennsylvania REV-1510 Schedule G Tax Form Details

The Pennsylvania REV-1510 Schedule G form reports inter vivos transfers and miscellaneous non-probate property. The form provides essential information on property transfers made by a decedent before their passing. It also outlines instructions for reporting taxable values and exclusions pertinent to inheritance tax.