Tax Forms Documents

Tax Forms

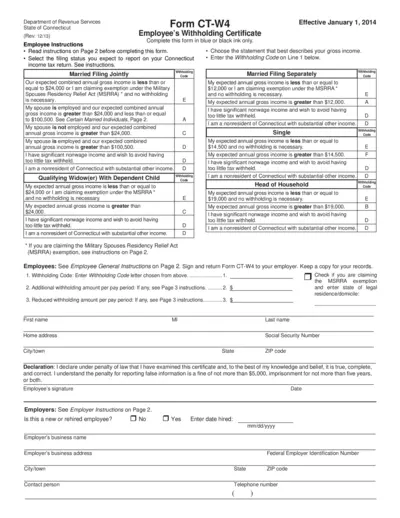

CT-W4 Employee Withholding Certificate Instructions

The CT-W4 form is essential for Connecticut employees to ensure correct state income tax withholding. This form helps determine your filing status and expected gross income for tax purposes. Complete the form accurately to facilitate proper withholding and avoid underpayment issues.

Tax Forms

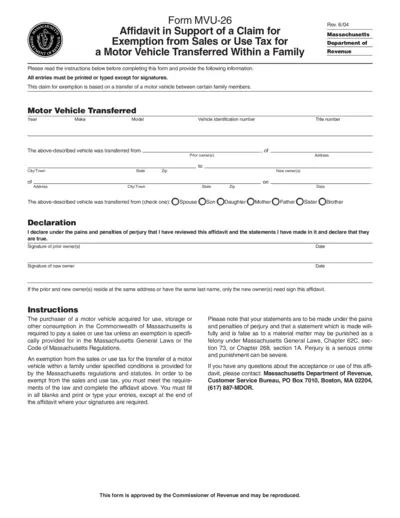

Massachusetts MVU-26 Tax Exemption Affidavit

This file contains the MVU-26 Affidavit for claiming exemption from sales or use tax for a motor vehicle transferred between family members in Massachusetts. It provides the necessary forms and instructions to support your tax exemption claim. Be sure to fill it out correctly to avoid any issues with the Massachusetts Department of Revenue.

Tax Forms

IRS W-2 and W-3 Filing Instructions and Information

This file contains important instructions regarding the filing of IRS Forms W-2 and W-3. It outlines how to fill out these forms, where to file them, and the penalties for improper filing. Ensure compliance with IRS guidelines to avoid penalties.

Tax Forms

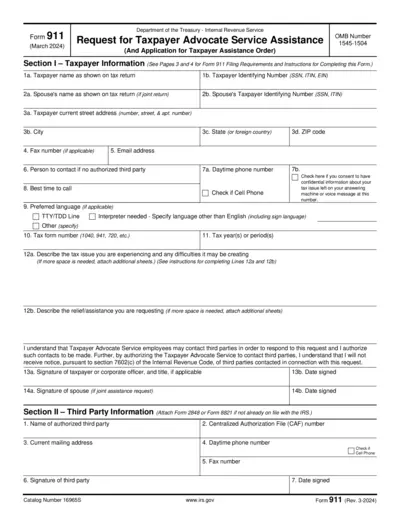

Request for Taxpayer Advocate Service Assistance

Form 911 is designed for taxpayers seeking assistance from the Taxpayer Advocate Service. It provides an avenue for individuals facing tax-related issues to request support. Complete the form accurately to ensure timely assistance.

Tax Forms

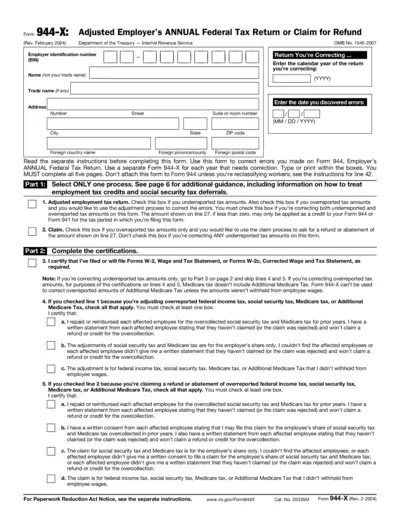

Form 944-X Adjusted Employer Tax Return Instructions

The Form 944-X is used for correcting errors made on Form 944, the Employer's Annual Federal Tax Return. It provides guidance on how to amend your tax return, ensuring accurate reporting and compliance. This form is essential for employers who discovered errors in their previously filed tax returns.

Tax Forms

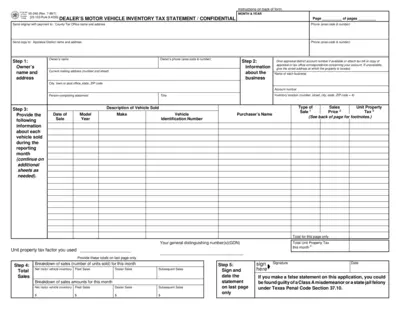

Dealer's Motor Vehicle Inventory Tax Statement

This file serves as the official declaration for dealers to report their motor vehicle sales. It provides necessary instructions for completion and submission of the inventory tax statement. Ensure accuracy to avoid potential penalties.

Tax Forms

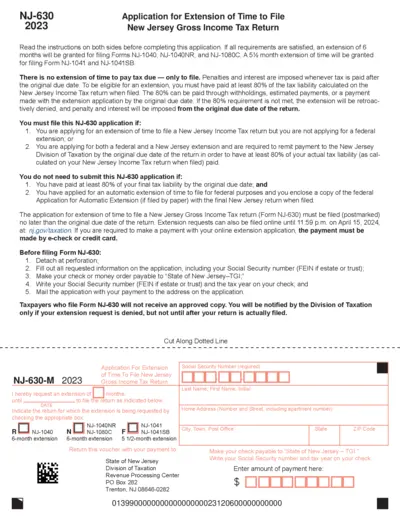

NJ-630 Application for Extension of Time to File

This form is used to apply for an extension of time to file your New Jersey Gross Income Tax Return. Eligible taxpayers can receive a 6-month or 5 1/2-month extension. Ensure you meet all requirements to avoid penalties.

Tax Forms

IRS Form 1098-F Fines Penalties Instructions

This file contains details about IRS Form 1098-F, including fines and penalties guidelines. Find the instructions necessary for filling out and submitting this form. Essential for compliance with IRS regulations.

Tax Forms

P800 End of Year Tax Calculation Notice Guide

This document provides essential information regarding the P800 End of Year Tax Calculation Notice issued by HM Revenue & Customs. It explains the purpose, how to fill it out, and who requires this notice. Users can learn the main findings and get insights into the communication processes involved.

Tax Forms

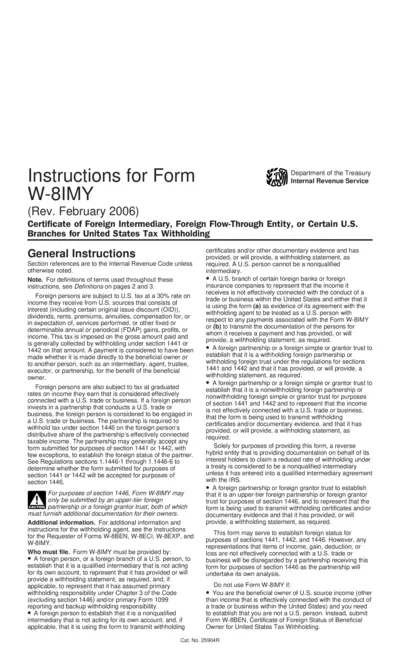

W-8IMY Instructions: Certificate of Foreign Intermediary

This file contains essential instructions for completing Form W-8IMY, which is used by foreign intermediaries for U.S. tax withholding purposes. It outlines who must file the form and provides guidance on filling it out correctly. This document is vital for ensuring compliance with U.S. tax regulations for foreign entities.

Tax Forms

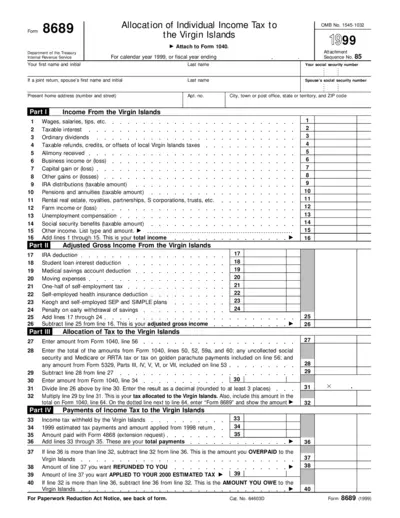

Form 8689 Instructions for Virgin Islands Tax Allocation

This file contains Form 8689, which is used to allocate individual income tax to the Virgin Islands. It provides detailed instructions and necessary information for taxpayers with income from the Virgin Islands. Completing this form ensures accurate tax filings and compliance with tax laws.

Tax Forms

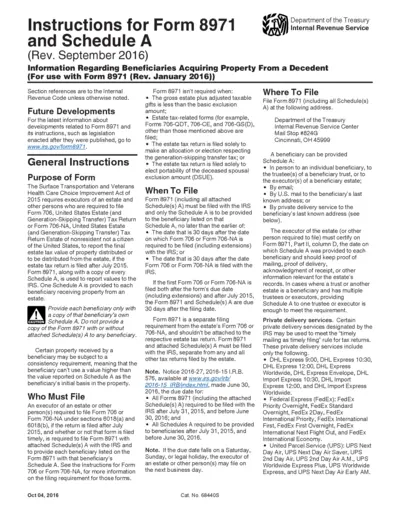

Instructions for Form 8971 and Schedule A

This document provides instructions for the IRS Form 8971, detailing the necessary steps for reporting estate property values. It is essential for executors and estate representatives to ensure compliance with tax laws. Understanding this form helps beneficiaries and executors accurately handle estate distributions.