Tax Forms Documents

Tax Forms

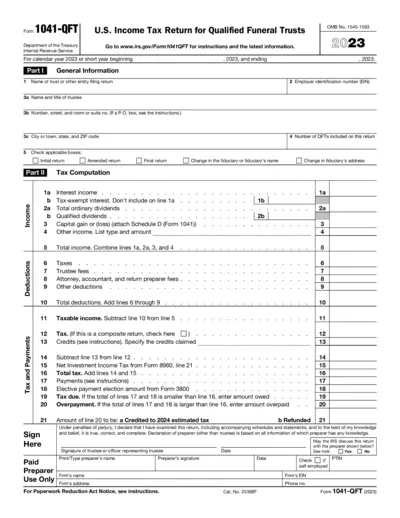

Form 1041-QFT US Income Tax Return for Funeral Trusts

Form 1041-QFT is the U.S. Income Tax Return for Qualified Funeral Trusts. This form is essential for the trustees of qualified funeral trusts to report income, deductions, and tax. Follow the instructions carefully to ensure compliance with IRS regulations.

Tax Forms

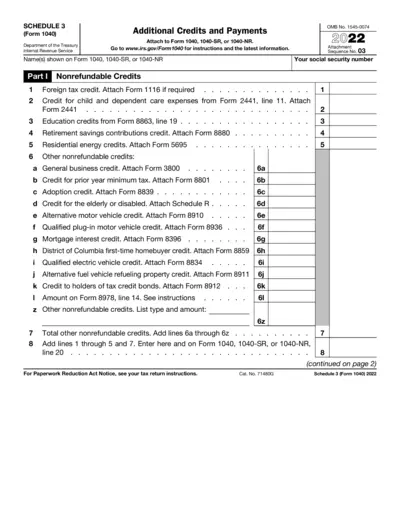

IRS Schedule 3 Form 2022 Additional Credits Payments

This file provides essential information regarding tax credits and payments applicable to Form 1040 for the year 2022. It includes detailed guidance on nonrefundable credits and payments. Utilize this form to ensure you maximize your eligible credits.

Tax Forms

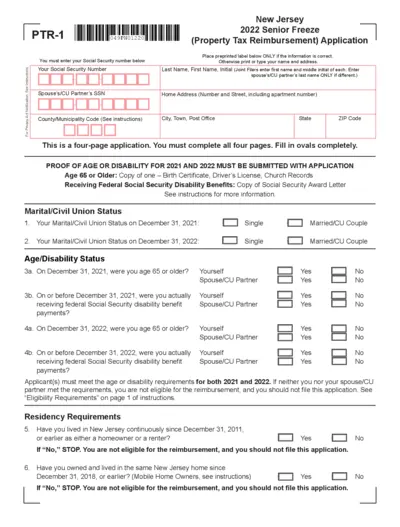

New Jersey 2022 Property Tax Reimbursement Application

This is the application form for the 2022 New Jersey Senior Freeze Property Tax Reimbursement program. Complete the application to secure your tax reimbursement benefits. Ensure to provide accurate and complete information to facilitate the processing of your application.

Tax Forms

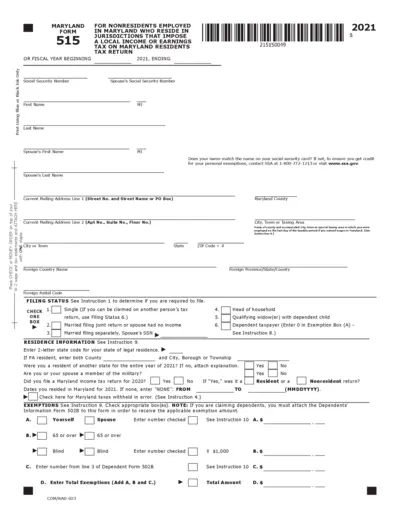

Maryland Form 515 Nonresidents 2021 Tax Return

The Maryland Form 515 is designed for nonresidents employed in Maryland. This form allows individuals residing in jurisdictions with local income taxes to report their earnings for the tax year. It includes sections for personal information, income details, exemptions, and tax calculations.

Tax Forms

IRS Schedule SE Self-Employment Tax Form 2024

This document is an early release draft of the IRS Schedule SE form for self-employment tax for the year 2024. It contains detailed instructions for completing the form and eligibility criteria for different methods of reporting income. Users should be aware that this is a draft and not for filing.

Tax Forms

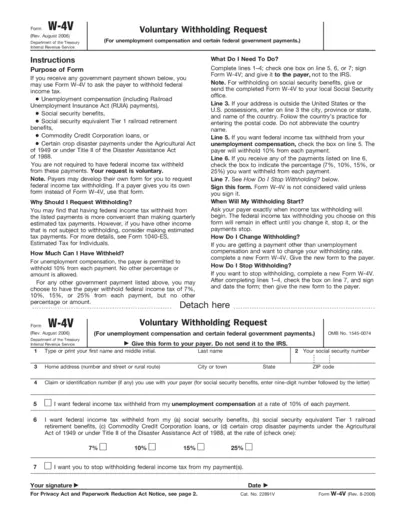

W-4V Voluntary Withholding Request Form

The W-4V Form allows individuals to request federal income tax withholding from unemployment compensation and certain government payments. It simplifies tax management by enabling recipients to opt for withholding instead of making estimated tax payments. Understanding this form can help ensure you meet your tax obligations effectively.

Tax Forms

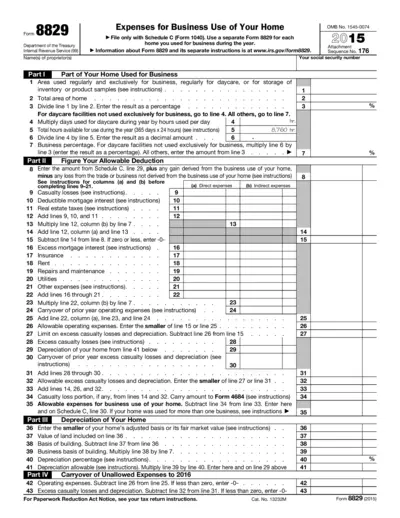

Form 8829 Instructions for Business Use of Home

Form 8829 is essential for homeowners claiming business use of their home. This IRS form allows you to calculate your deductible expenses for home use. Ensure accurate reporting to maximize your deductions and comply with tax laws.

Tax Forms

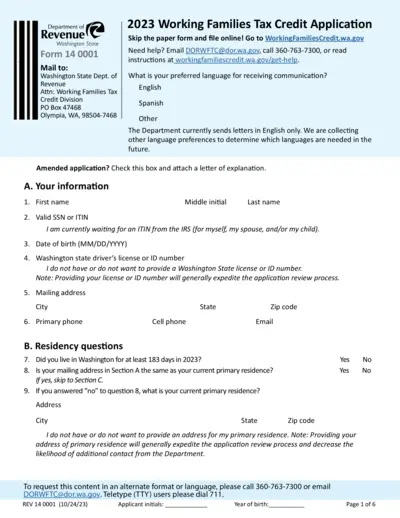

2023 Washington Working Families Tax Credit Application

The 2023 Working Families Tax Credit Application is a form provided by the Washington State Department of Revenue. It allows eligible families to apply for tax credits designed to support low-and moderate-income households. The application must be filled out accurately to ensure timely processing.

Tax Forms

Guide to eFiling Monthly Employer Declaration

Access the new features of the EMP201 form for monthly employer declarations. Simplify your tax submissions and ensure compliance with SARS regulations. Follow our comprehensive instructions to file your EMP201 smoothly.

Tax Forms

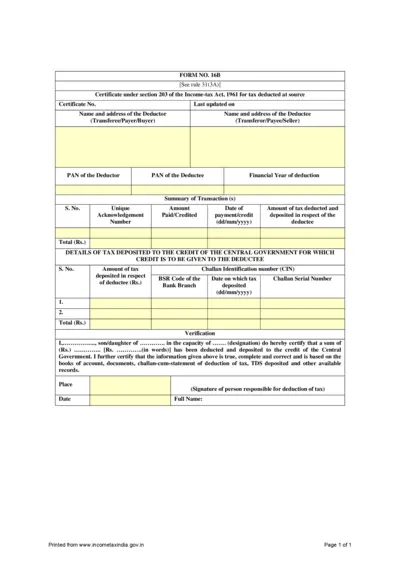

FORM NO. 16B - Income Tax TDS Certificate

This form is a Certificate under section 203 of the Income-tax Act for tax deducted at source. It provides details about the deductor, deductee, and transaction summary. This certificate is essential for taxpayers to claim TDS credit.

Tax Forms

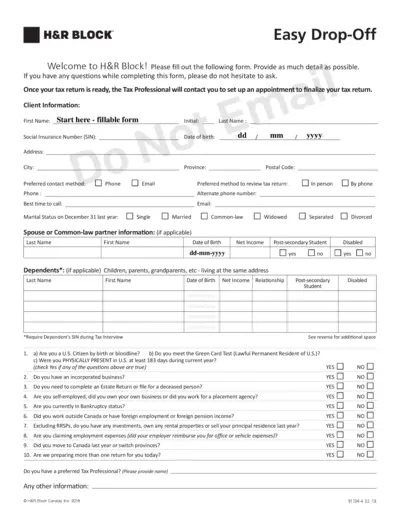

H&R Block Easy Drop-Off Tax Form Instructions

This file contains detailed instructions for the H&R Block Easy Drop-Off tax form. It guides clients through providing necessary information for tax returns efficiently. Perfect for first-time and returning users seeking assistance with tax documentation.

Tax Forms

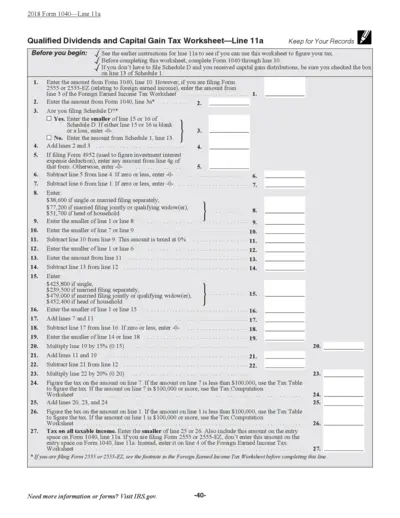

2018 Form 1040 Qualified Dividends Tax Worksheet

This document provides instructions for calculating qualified dividends and capital gains tax. It is essential for accurate tax filing. Use this worksheet to ensure compliance with IRS regulations.