Tax Forms Documents

Tax Forms

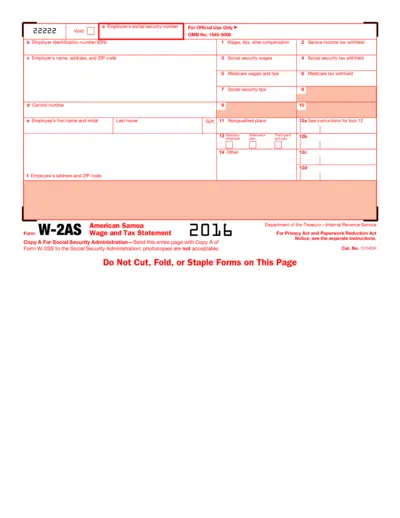

Employee Wage and Tax Statement Form W-2AS Instructions

This document provides detailed information about the Wage and Tax Statement Form W-2AS. It contains necessary employee and employer details, along with tax withholding information. Use this form to report wages and taxes for employees in American Samoa.

Tax Forms

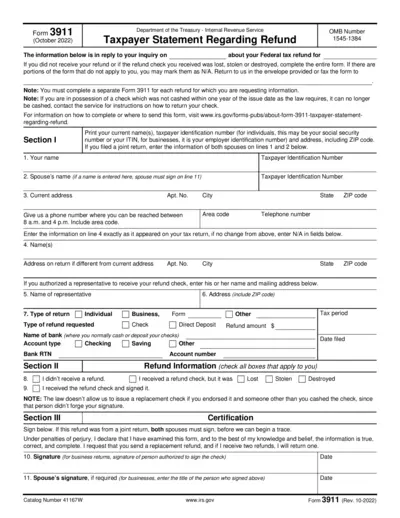

Taxpayer Statement Regarding Refund Form 3911

Form 3911 allows taxpayers to address issues regarding their federal tax refunds. It is essential for individuals who did not receive their expected refund. This document helps in requesting a replacement refund or tracing the original one.

Tax Forms

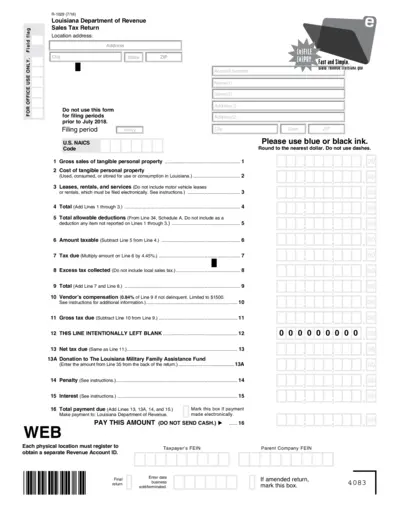

Louisiana Sales Tax Return R-1029 Instructions

This file contains the comprehensive instructions for filling out the Louisiana Sales Tax Return, R-1029. It provides detailed guidelines on allowable deductions, tax due calculations, and necessary account information. Perfect for businesses understanding their tax obligations in Louisiana.

Tax Forms

California Resident Income Tax Return Form 540

The California Resident Income Tax Return Form 540 is essential for filing your state taxes. This form helps determine your taxable income and calculates the taxes owed or refunds. Ensure you have all the necessary information to complete it correctly.

Tax Forms

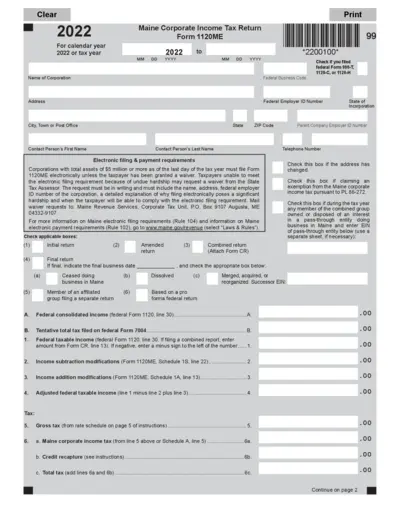

Maine Corporate Income Tax Return – Form 1120ME 2022

This document is the 2022 Maine Corporate Income Tax Return, Form 1120ME. It provides guidelines for corporations filing state income taxes. Ensure you complete all sections accurately to comply with state regulations.

Tax Forms

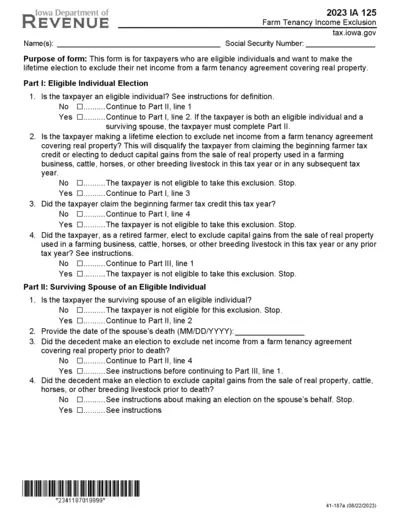

2023 IA 125 Farm Tenancy Income Exclusion Form

The 2023 IA 125 form is designated for eligible taxpayers. This form facilitates the lifetime election to exclude farm tenancy income. It offers guidance specifically tailored for farmers navigating their income exclusion options.

Tax Forms

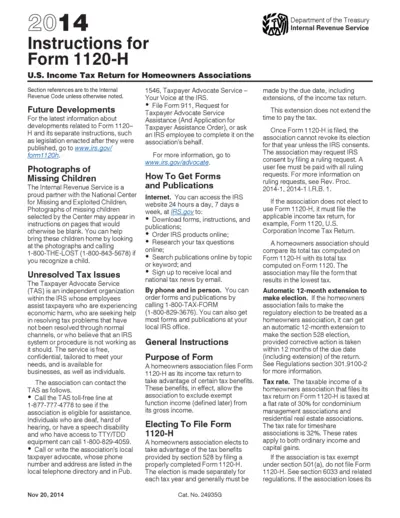

Instructions for Form 1120-H U.S. Income Tax Return

This document provides detailed instructions for completing Form 1120-H, specifically designed for homeowners associations. It outlines eligibility requirements, filing procedures, and essential tax information for associations. Proper understanding and completion of this form can lead to significant tax benefits.

Tax Forms

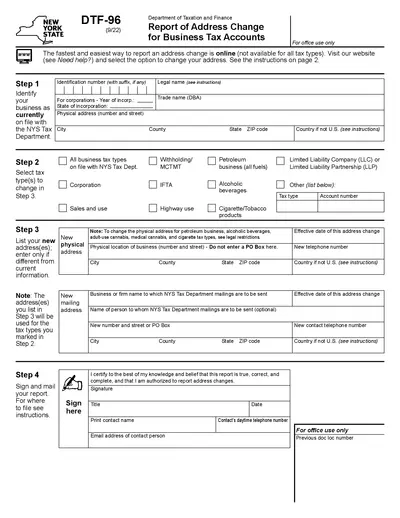

Report of Address Change for Business Tax Accounts

This form is essential for businesses needing to update their address with the New York State Department of Taxation and Finance. It is crucial for maintaining accurate business records. Completing this form correctly ensures compliance with tax regulations.

Tax Forms

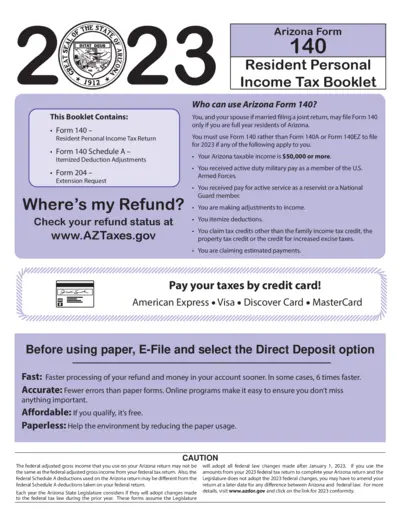

Arizona Form 140 Resident Personal Income Tax Instructions

This document provides the essential guidelines for completing Arizona Form 140, the Resident Personal Income Tax Return. It includes information on important dates, filing requirements, and deductions. Follow these instructions to ensure accurate and timely submission of your tax return.

Tax Forms

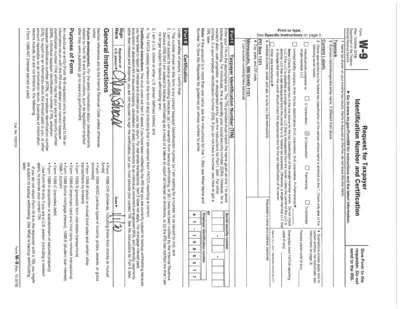

Form W-9 Taxpayer Identification Number and Certification

Form W-9 is a request for taxpayer identification number and certification. It is essential for U.S. individuals and entities to report income received. This form helps ensure accurate reporting to the IRS.

Tax Forms

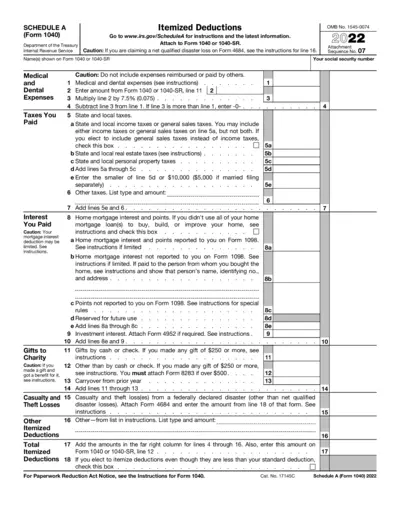

Schedule A Itemized Deductions Form 1040 Instructions

This file contains the Schedule A (Form 1040) for itemized deductions. It helps taxpayers understand allowable deductions such as medical expenses and charitable contributions. Essential for those itemizing deductions on their tax filings.

Tax Forms

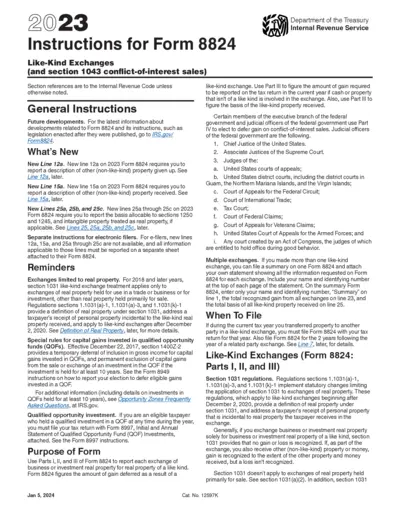

2023 Instructions for Form 8824 Like-Kind Exchanges

This document provides detailed instructions for filing Form 8824, which pertains to like-kind exchanges. It covers essential updates and regulations to facilitate accurate and compliant tax reporting. Users can find guidance on completing the form and understanding related requirements.