Tax Forms Documents

Tax Forms

Louisiana Corporation Income Tax and Franchise Tax 2023

This file provides essential instructions for filing the Louisiana Corporation Income Tax and Corporation Franchise Tax. It includes guidelines for completing the CIFT-620 form, eligibility criteria, and important filing deadlines. It serves as a comprehensive resource for corporations operating in Louisiana.

Tax Forms

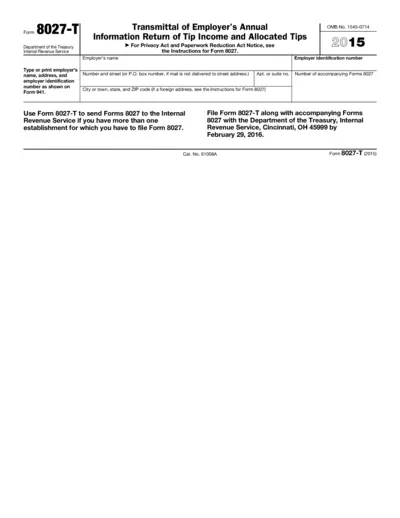

Form 8027-T Transmittal of Employer's Return Tips

Form 8027-T is a critical document used for reporting tip income and allocated tips for employers with multiple establishments. This form must be submitted to the IRS alongside Form 8027. Ensure compliance by accurately completing and submitting the form by the due date.

Tax Forms

Form No. 15G Declaration for Income Tax Exemptions

Form No. 15G is a declaration for individuals seeking tax exemptions on certain incomes. It helps to ensure that no tax is deducted at source for low-income earners. This form simplifies the income declaration process under the Income Tax Act.

Tax Forms

Noncash Charitable Contributions Form 8283

This document outlines the instructions and details for Form 8283, which is used for reporting noncash charitable contributions. It is essential for taxpayers claiming deductions over $500 for donated property. Ensure to follow the guidelines to complete the form accurately.

Tax Forms

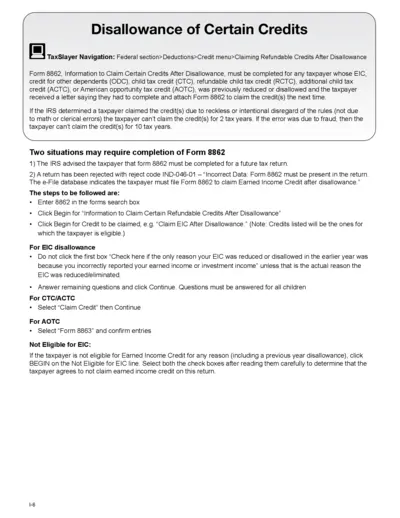

Claim Refundable Credits After Disallowance Form

This file is essential for taxpayers who have had refundable credits disallowed in the past. It provides step-by-step instructions on how to reclaim these credits using Form 8862. Completing this form correctly is crucial for successfully claiming credits such as the EIC, CTC, and more.

Tax Forms

Kansas Withholding Form K-4 Instructions and Info

The Kansas Withholding Form K-4 is essential for employees in Kansas to accurately report their withholding allowances. Ensure compliance with state tax laws by completing this form as soon as employment begins. This guide provides all necessary details for filling out the form and understanding its implications.

Tax Forms

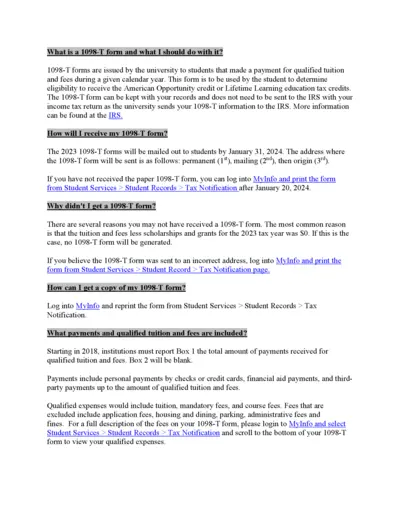

Understanding the 1098-T Tax Form for Students

The 1098-T form is an essential document for students who have paid qualified tuition and fees. It helps students determine their eligibility for education tax credits. This guide will provide detailed information on how to manage and utilize your 1098-T form for tax purposes.

Tax Forms

Instructions for Form W-8BEN-E Tax Certification

This document provides detailed instructions for filling out Form W-8BEN-E. It's essential for foreign entities to establish their status for U.S. tax purposes. Understanding these instructions will help ensure compliance with tax withholding requirements.

Tax Forms

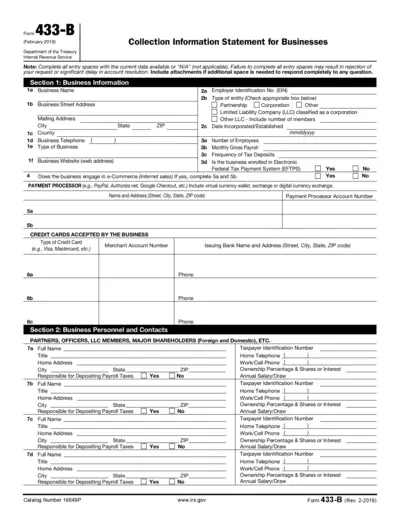

Collection Information Statement for Businesses

This file is a Form 433-B from the IRS and is used to provide detailed financial information about your business. It is essential for individuals seeking tax resolutions or requesting payment plans. Completing this form accurately ensures timely processing.

Tax Forms

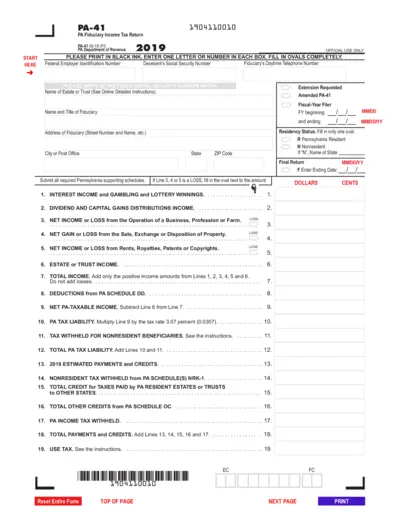

PA Fiduciary Income Tax Return Instructions 2019

The PA-41 Fiduciary Income Tax Return is used to report the income and expenses of an estate or trust in Pennsylvania. It helps in determining the tax liability based on the income earned by the estate or trust. Proper filling of this form ensures compliance with Pennsylvania tax laws.

Tax Forms

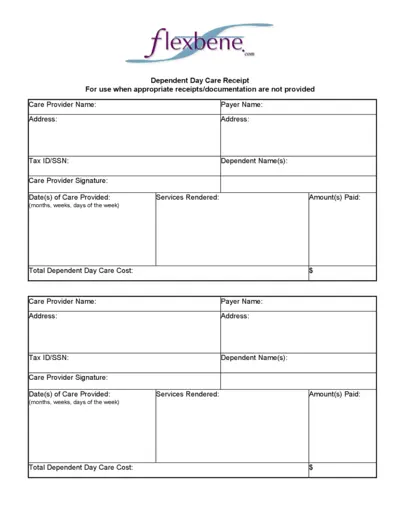

Dependent Day Care Receipt Documentation Form

This file is a Dependent Day Care Receipt for use when appropriate receipts are not provided. It allows users to document care provider details and services rendered. Essential for claiming tax deductions on dependent care expenses.

Tax Forms

Form 8883 Instructions Asset Allocation Statement

This document provides detailed instructions on how to fill out Form 8883, Asset Allocation Statement Under Section 338. It outlines filing requirements, the purpose of the form, and essential details required for submission. Ideal for corporations involved in acquisitions and stock purchases.