Tax Forms Documents

Tax Forms

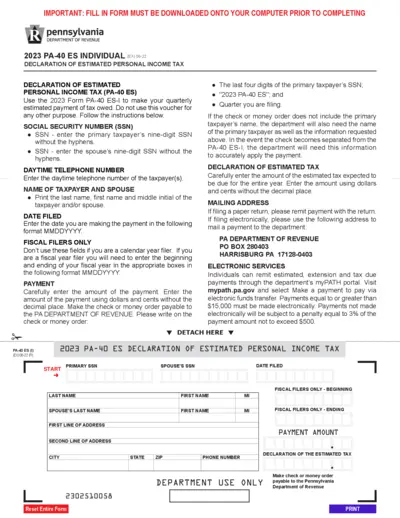

2023 PA-40 ES Declaration of Estimated Income Tax

The 2023 PA-40 ES form is used for making estimated payments for personal income tax. It is crucial for taxpayers in Pennsylvania to fill it accurately. Follow the detailed instructions to ensure compliance with tax regulations.

Tax Forms

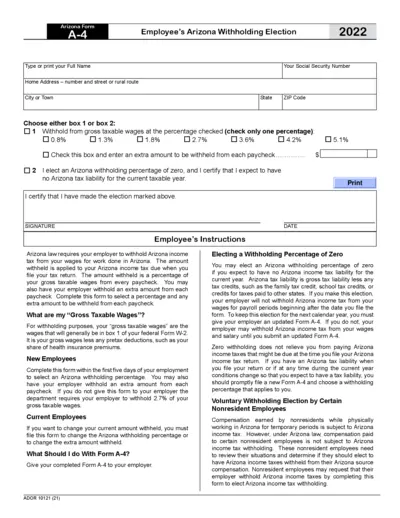

Arizona Form A-4 Employee Withholding Election 2022

The Arizona Form A-4 is essential for employees in Arizona to declare their state income tax withholding preferences. This form allows for selecting a withholding percentage or opting for zero withholding if no tax liability is expected. Completing this form accurately ensures proper tax deductions from wages.

Tax Forms

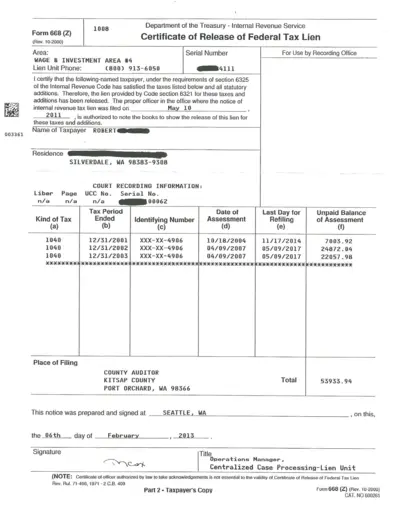

Certificate of Release of Federal Tax Lien Form 668

This file provides essential information regarding the Certificate of Release of Federal Tax Lien. It outlines the process for releasing a tax lien and important details related to the taxpayer. Use this file to understand your obligations and rights concerning federal tax liens.

Tax Forms

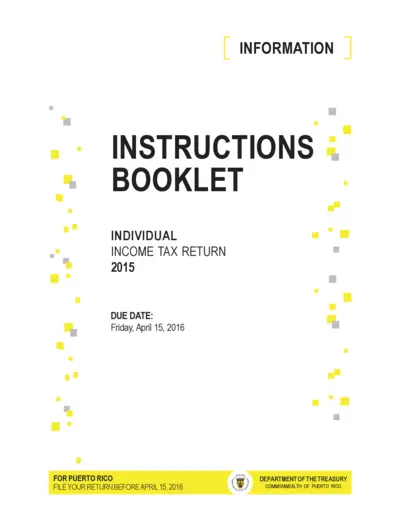

Individual Income Tax Return Instructions 2015

This file provides essential instructions for filing the Individual Income Tax Return for Puerto Rico in 2015. It includes helpful tips on the tax process and related forms. Users will find important deadlines and detailed filing requirements to ensure compliance with tax laws.

Tax Forms

Form 926 Instructions for US Citizens and Corporations

This file contains crucial instructions for filing Form 926 for U.S. citizens forming Puerto Rican corporations. It outlines who needs to file, how to complete the form, and the consequences of non-compliance. Essential for understanding tax obligations related to foreign corporations.

Tax Forms

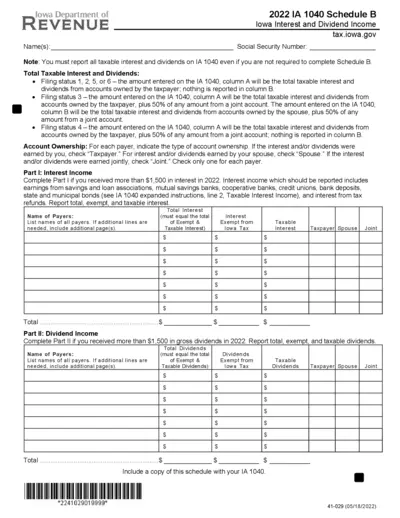

2022 IA 1040 Schedule B Guide for Interest and Dividends

The 2022 IA 1040 Schedule B is essential for reporting Iowa interest and dividend income. It details how to report all taxable interest and dividends. This file is necessary for proper tax filing in Iowa for the year 2022.

Tax Forms

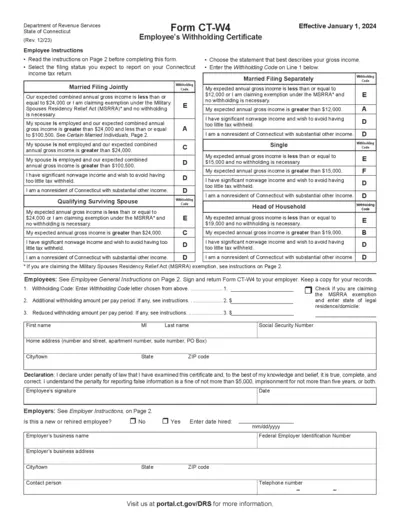

Connecticut Employee's Withholding Certificate (CT-W4)

The Connecticut Employee's Withholding Certificate (CT-W4) is essential for employees to accurately report their income tax withholding. It ensures the correct amount of state income tax is withheld from wages based on filing status and projected income. Accurate completion helps avoid underwithholding or overwithholding of taxes.

Tax Forms

IRS Form 8894 Partnership Revocation Request

Form 8894 is used by small partnerships to request the revocation of a tax treatment election. It is necessary for partnerships with tax years beginning before January 1, 2018. Ensure all partners sign the form for it to be valid.

Tax Forms

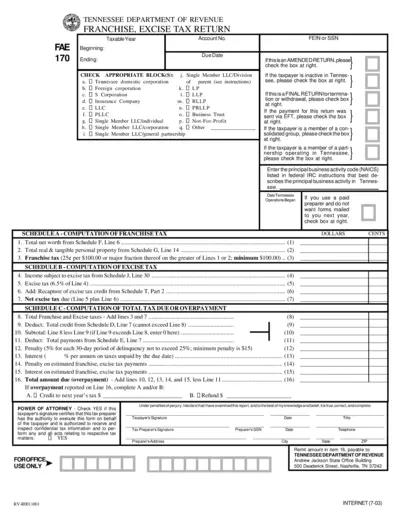

Tennessee Franchise Excise Tax Return Instructions

This file outlines the details for the Tennessee Franchise and Excise Tax Return. It includes guidelines on how to fill out the return along with necessary schedules. This document serves as a crucial resource for individuals and businesses required to file taxes in Tennessee.

Tax Forms

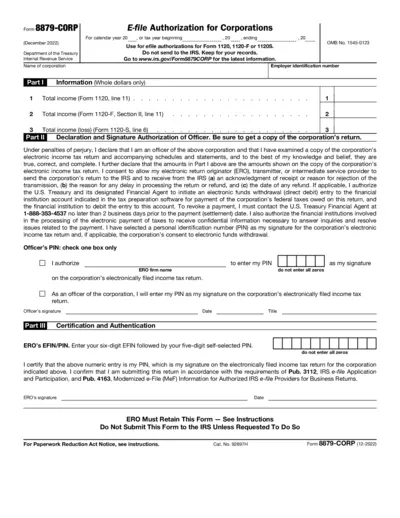

Form 8879-CORP E-file Authorization for Corporations

Form 8879-CORP is essential for corporate officers who want to electronically sign the corporation’s income tax return. It enables the use of a personal identification number (PIN) for e-file authorization. This form must be retained for record-keeping and is not submitted to the IRS.

Tax Forms

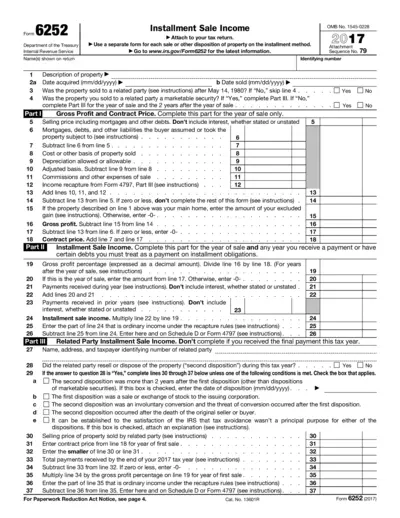

Form 6252 Instructions for Income Reporting

This file contains the official instructions for completing Form 6252, used to report income from installment sales. It outlines the necessary steps, calculations, and relevant details required for accurate filing. Taxpayers and preparers should reference this document for compliance with IRS regulations.

Tax Forms

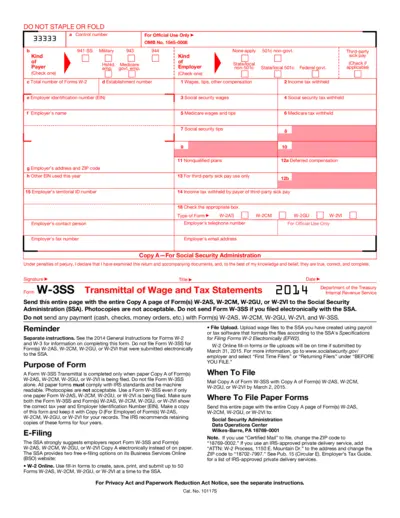

Form W-3SS Transmittal for Wage and Tax Statements

This form is used to transmit Forms W-2 to the Social Security Administration. Employers need to fill out this form when reporting wage and tax information. Ensure all entries are accurate and complete for proper processing.