Tax Forms Documents

Tax Forms

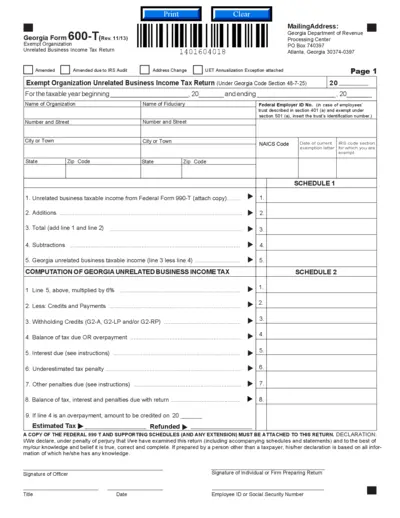

Georgia Form 600-T Exempt Org UBIT Tax Return

The Georgia Form 600-T is an Exempt Organization Unrelated Business Income Tax Return. This form is necessary for exempt organizations with unrelated business income in Georgia. It is essential for compliance with state tax laws.

Tax Forms

Form 1099-MISC Instructions and Details

This file provides essential details about the IRS Form 1099-MISC, including filing instructions and requirements. It is important for individuals and businesses reporting various types of income. Ensure you follow the guidelines to avoid penalties.

Tax Forms

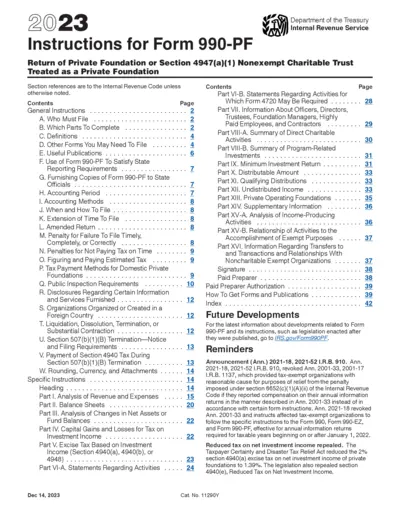

Instructions for Form 990-PF for 2023

This document provides detailed instructions and guidelines for completing Form 990-PF, which is used by private foundations. It includes essential information about filing requirements, tax calculations, and important deadlines. It's an invaluable resource for organizations looking to comply with their tax obligations efficiently.

Tax Forms

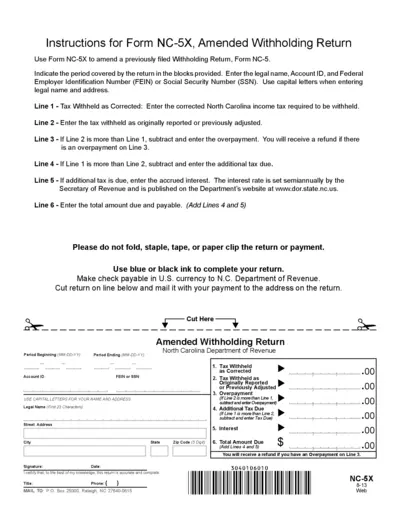

Form NC-5X Amended Withholding Return Instructions

This file provides detailed instructions for completing the NC-5X Amended Withholding Return. It includes necessary guidelines for entering data accurately. Use this guide to ensure proper submission of your amended return.

Tax Forms

IRS Form 1096 Instructions for Information Return Filing

Form 1096 is an annual summary and transmittal form for U.S. information returns. It is required to transmit various forms to the IRS. Ensure proper filing to avoid potential penalties.

Tax Forms

U.S. Income Tax Return for Estates and Trusts Form 1041

Form 1041 is essential for estates and trusts to report income. It ensures beneficiaries are accurately accounted for. File electronically to simplify the process.

Tax Forms

Form 1040-V Payment Voucher Instructions - 2014

This file provides the instructions for completing Form 1040-V, a payment voucher for submitting your federal tax payments. It's essential for anyone filing taxes to ensure their payments are processed correctly. Follow the guidelines to fill it out easily.

Tax Forms

Instructions for Form 8594 Asset Acquisition Statement

This file provides essential instructions for Form 8594, which is necessary for reporting asset acquisitions under Section 1060. It outlines the general requirements, exceptions, and filing guidelines for both sellers and purchasers involved in a trade business asset transfer. Understanding these instructions is crucial for compliant tax reporting and avoiding potential penalties.

Tax Forms

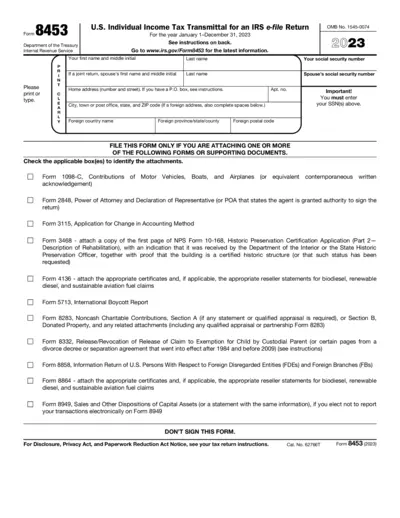

Form 8453 IRS Transmittal for e-file Return 2023

Form 8453 is used for transmitting paper documentation when filing an IRS e-file return. It includes specific requirements for federal tax submissions. This form is essential for ensuring that all necessary attachments are included.

Tax Forms

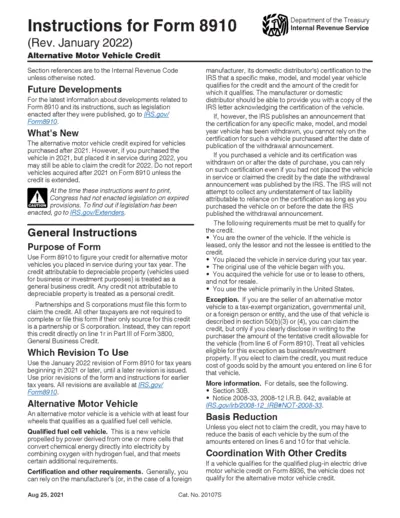

Form 8910 Instructions for Alternative Motor Vehicle Credit

This file provides detailed instructions for Form 8910 related to the Alternative Motor Vehicle Credit. Users can learn about eligibility, submission, and guidelines. It is essential for tax year 2022 and beyond for certain vehicle owners.

Tax Forms

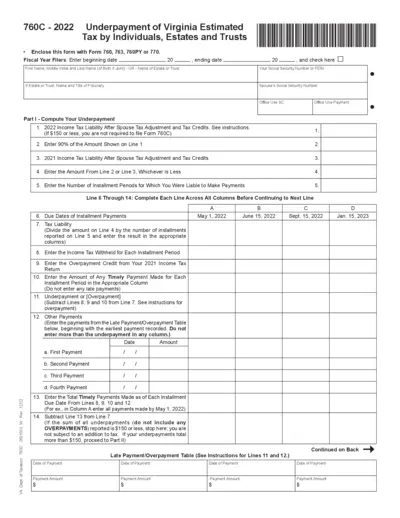

Virginia Estimated Tax Underpayment Form 760C

The Virginia Estimated Tax Underpayment Form 760C is essential for individuals, estates, and trusts that have underpaid their estimated taxes. This form helps in determining the underpayment and calculates any potential additions to tax. It provides detailed instructions for accurate filling.

Tax Forms

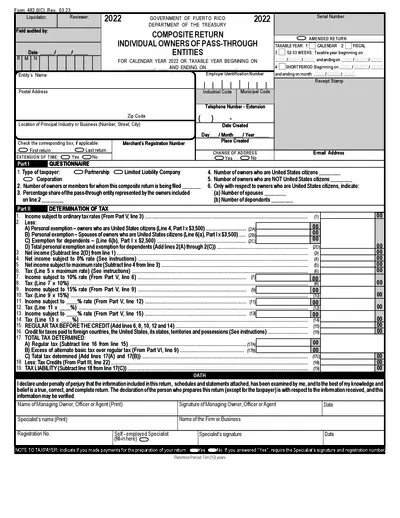

Form 482.0(C) for 2022 Tax Filing

Form 482.0(C) is the composite return for individual owners of pass-through entities for the taxable year 2022. This document assists in reporting income, deductions, and credits accurately. Ideal for partnerships and corporations aiming for tax compliance in Puerto Rico.