Tax Forms Documents

Tax Forms

Brand Advantage Group 2019 Tax Form Brochure

This file offers essential tax form printing information for software customers, highlighting products like W-2s, 1099s, and ACA forms. It includes contact information for assistance and encourages users to reach out for their tax form needs. Perfect for businesses looking to order their necessary tax forms efficiently.

Tax Forms

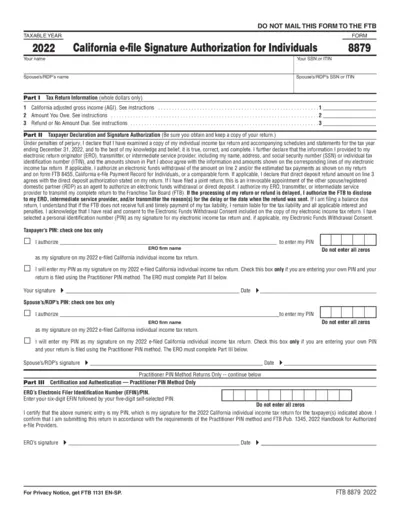

California e-file Signature Authorization 2022

The California e-file Signature Authorization form 8879 is essential for taxpayers who wish to electronically file their individual income tax returns. It ensures that your return is processed correctly and swiftly by the Franchise Tax Board (FTB). This form must be carefully completed and signed to authorize submission and electronic funds withdrawal.

Tax Forms

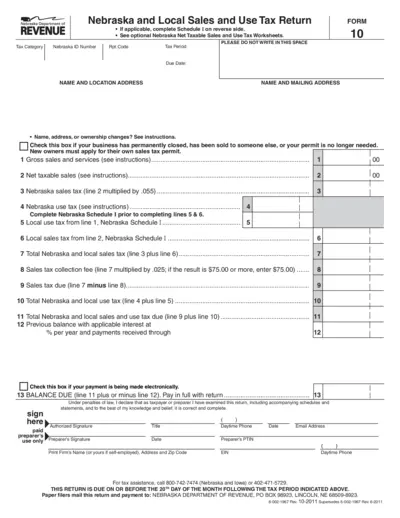

Nebraska Sales and Use Tax Return Instructions

This document provides detailed instructions for completing the Nebraska Sales and Use Tax Return. It includes essential tax worksheet information and guidelines for both individuals and businesses. Users are guided on how to correctly report sales and use tax obligations to remain compliant.

Tax Forms

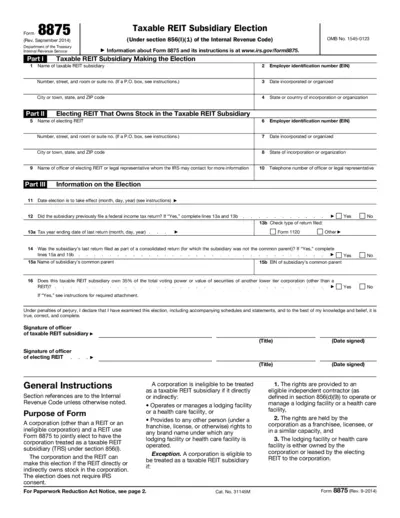

Taxable REIT Subsidiary Election Form 8875 Instructions

This document provides essential information and instructions for completing Form 8875, the Taxable REIT Subsidiary Election. It outlines the required details and filing process for eligible corporations and REITs. Ensure compliance with internal revenue code requirements with this comprehensive guide.

Tax Forms

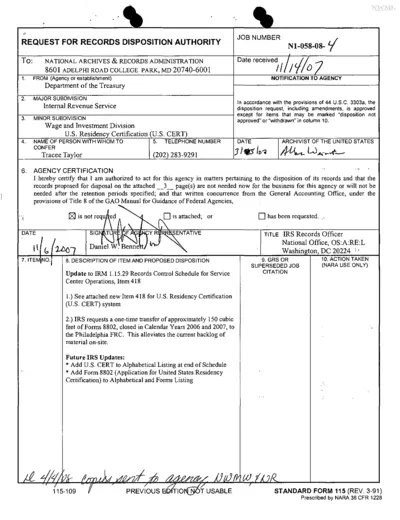

Request for IRS Residency Certification Records

This file contains the Request for Records Disposition Authority for the U.S. Residency Certification (U.S. CERT) process as managed by the Department of the Treasury. It outlines the procedures, forms required, and disposition schedules for records related to tax residency certification. This document is essential for understanding how to properly submit and manage residency certification requests.

Tax Forms

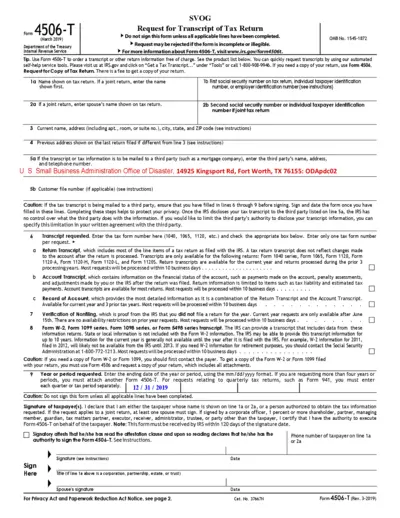

Request for Tax Return Transcript Form 4506-T

Form 4506-T allows individuals and businesses to request tax return transcripts from the IRS. This form is essential for obtaining tax information necessary for various financial processes. Ensure all lines are completed to prevent rejection of your request.

Tax Forms

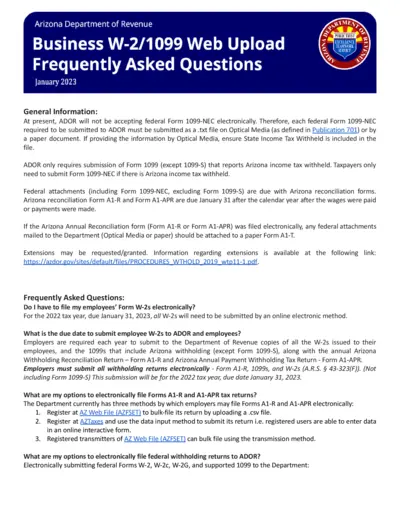

Arizona Department of Revenue W-2/1099 Web Upload

This document contains essential information about the Arizona Department of Revenue's W-2 and 1099 filing procedures. It includes FAQs and important deadlines that employers must follow for accurate tax reporting. Use this guide to ensure compliance with state regulations.

Tax Forms

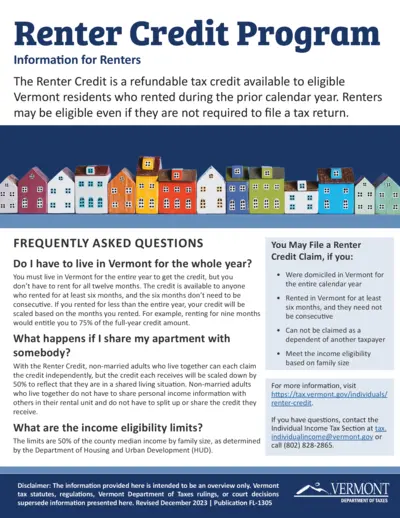

Vermont Renter Credit Program Information and Instructions

Discover essential details about Vermont's Renter Credit program, a refundable tax credit aiding eligible renters. Learn about eligibility, income limits, and how to claim your credit. This guide ensures you understand all requirements and how to benefit from this program.

Tax Forms

IRS Form 4952 Investment Interest Expense Deduction

IRS Form 4952 provides instructions for claiming the investment interest expense deduction. This early release draft is for informational purposes only. Review the guidelines thoroughly before filing.

Tax Forms

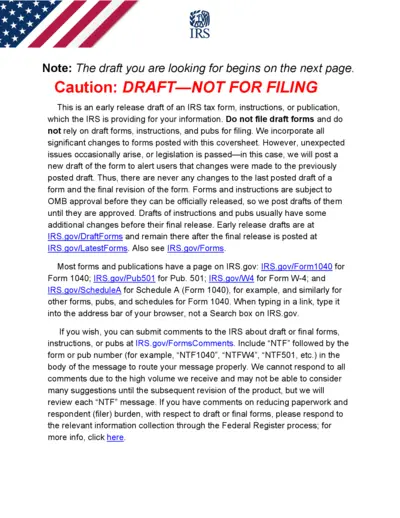

Application for Identity Protection PIN Form 15227

The IP PIN application form is essential for taxpayers seeking to secure their identity. This form is designed for individuals who need an Identity Protection Personal Identification Number. Follow the guidelines to ensure prompt processing of your application.

Tax Forms

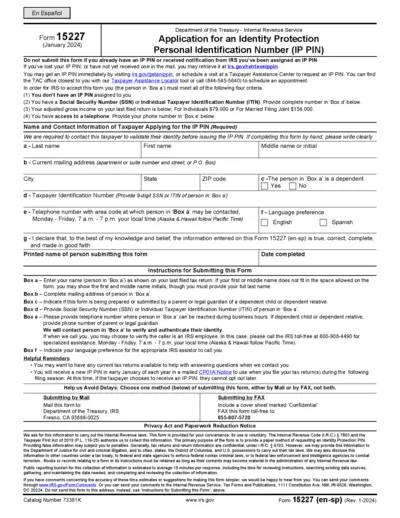

NYC Unincorporated Business Tax Return Information

This file contains important information regarding the NYC Unincorporated Business Tax Return for individuals, estates, and trusts. It provides detailed instructions for filling out the return and explains the various components involved. Understanding this document is essential for accurate tax reporting in New York City.

Tax Forms

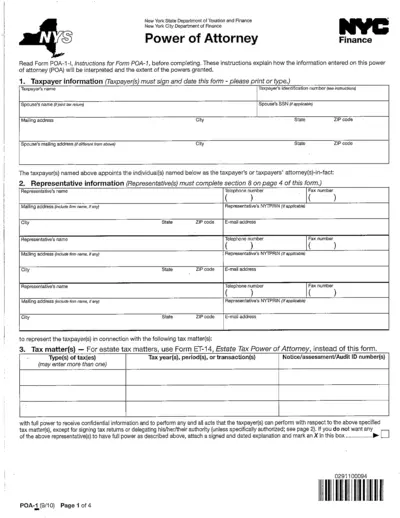

New York State Power of Attorney Form Guidelines

This file provides detailed instructions for completing the New York State Power of Attorney Form (POA-1). It includes essential information regarding taxpayer and representative requirements. Ensure you follow the guidelines carefully to avoid any issues in your filing.