Tax Forms Documents

Tax Forms

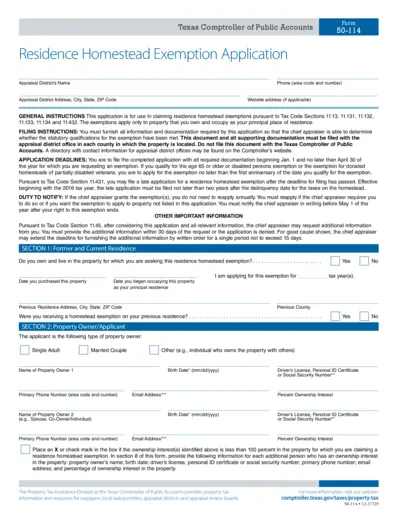

Residence Homestead Exemption Application Form

This form is used to apply for residence homestead exemptions in Texas. It contains instructions for filing, eligibility criteria, and necessary documentation. It is essential for homeowners seeking tax relief on their primary residence.

Tax Forms

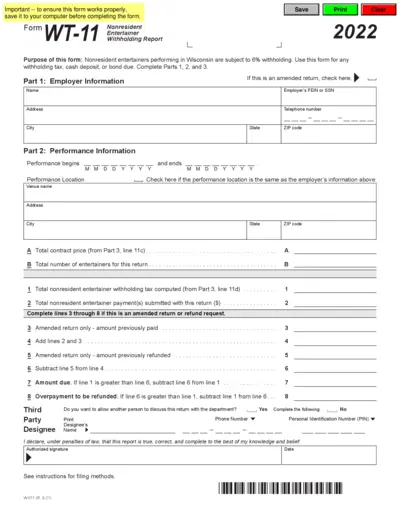

WT-11 Nonresident Entertainer Withholding Report

The WT-11 form is designed for nonresident entertainers performing in Wisconsin. It enables users to report withholding tax accurately. This essential document ensures compliance with state tax laws.

Tax Forms

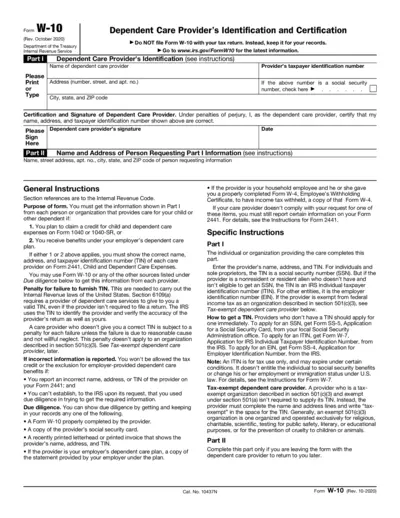

Form W-10 Dependent Care Provider Certification

Form W-10 is necessary for parents claiming dependent care tax credits. This form collects information from your dependent care provider. Fill this out to ensure compliance with IRS requirements.

Tax Forms

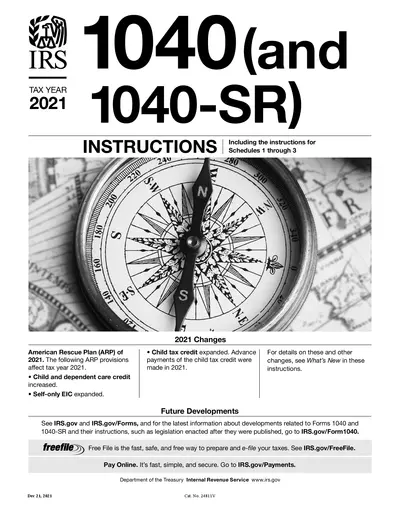

IRS 1040 Tax Form Instructions for 2021

This file contains the IRS instructions for tax form 1040 and 1040-SR for the tax year 2021. It includes updates from the American Rescue Plan and provides essential filing requirements. Users will find detailed sections on filling out the form, necessary schedules, and important information for tax preparation.

Tax Forms

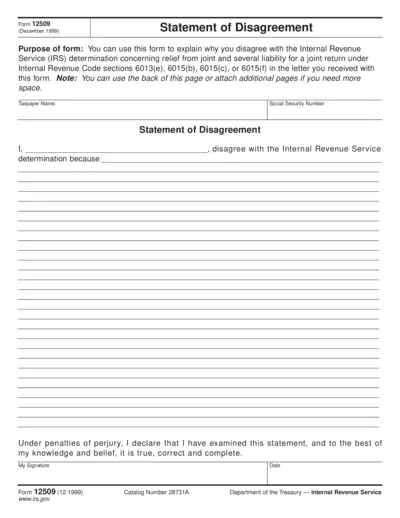

Form 12509 Statement of Disagreement for IRS

Form 12509 allows taxpayers to contest IRS determinations regarding joint return liability. Use this form to present your explanation clearly. It's essential for those seeking relief under IRS regulations.

Tax Forms

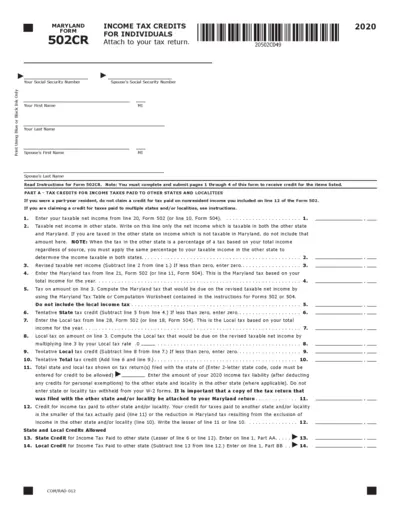

Maryland Form 502CR Income Tax Credits 2020

Maryland Form 502CR provides individuals with essential income tax credits applicable for the year 2020. This form assists in determining credits for taxes paid to other states and localities, child and dependent care expenses, and more. Ensure to attach this form to your tax return for proper credit assessment.

Tax Forms

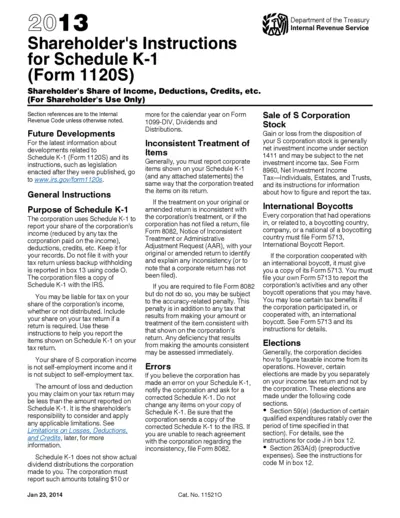

Shareholder's Instructions for Schedule K-1 (Form 1120S)

This file provides detailed instructions for shareholders on how to fill out Schedule K-1 (Form 1120S). It includes vital information regarding reporting your share of a corporation's income, deductions, and credits. Designed for S corporations, this guide ensures accurate tax reporting for shareholders.

Tax Forms

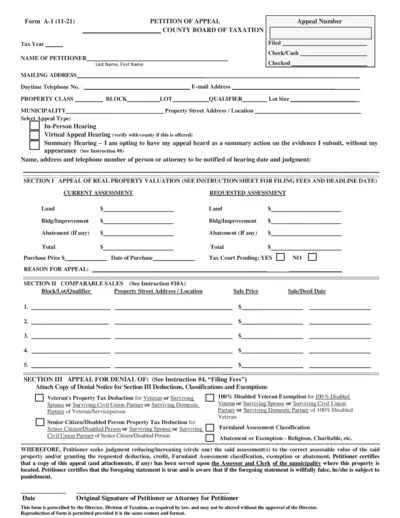

Petition of Appeal Form A-1 Instructions for Taxation

The Petition of Appeal Form A-1 is designed for taxpayers seeking to challenge property assessments through their county board of taxation. This form outlines the steps necessary for filing an appeal, including required documentation and filing fees. It is crucial for both business users and individuals to understand the process of submitting this form accurately to ensure their appeal is considered.

Tax Forms

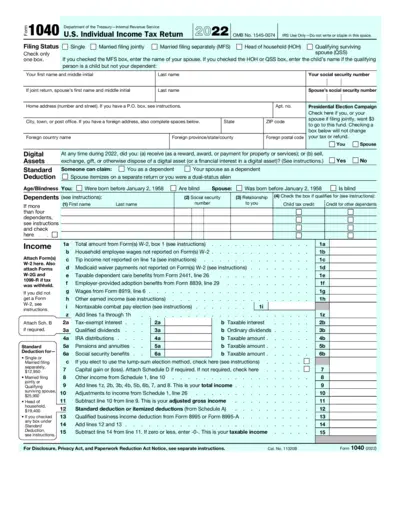

U.S. Individual Income Tax Return Form 1040 2022

The U.S. Individual Income Tax Return Form 1040 for the year 2022 is essential for individuals reporting their annual income to the IRS. This form determines filing status, calculates tax obligations, and claims deductions. Proper completion is vital to ensure accurate tax processing and compliance.

Tax Forms

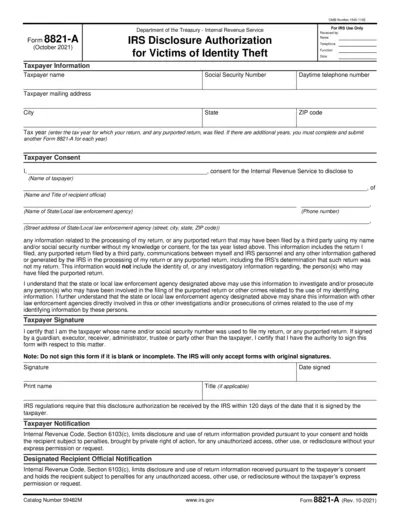

IRS Form 8821-A Identity Theft Disclosure Authorization

This form allows taxpayers to authorize the IRS to disclose their tax return information to law enforcement due to identity theft. It is specifically designed for individuals who have been victims of identity theft. Ensure to complete and submit this form within the given timeframe for it to be valid.

Tax Forms

FATCA and CRS Self-Certification Form Guidance

This file provides essential information and instructions for completing the FATCA and CRS Self-Certification Form. It outlines tax residency requirements and where to find assistance. Users should read through the guidance before filling out the form.

Tax Forms

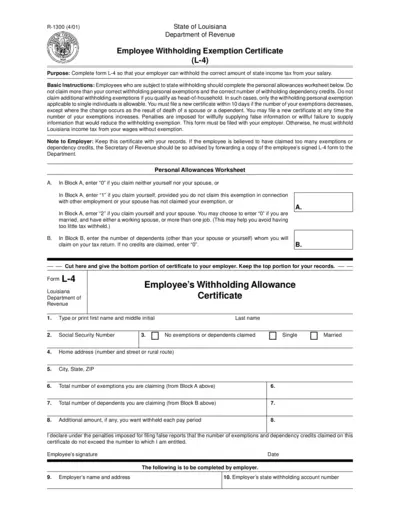

Employee Withholding Exemption Certificate L-4

The Employee Withholding Exemption Certificate (L-4) is essential for Louisiana workers. Fill this form to ensure correct state income tax withholding. It's crucial for employees to claim appropriate exemptions and dependency credits.