Tax Forms Documents

Tax Forms

Form 540-V Payment Voucher for 540 Returns

Form 540-V is a payment voucher for individuals filing California Resident Income Tax Returns. This form should be used to remit payments if you have a balance due. Follow the included instructions to ensure proper filing and timely payment.

Tax Forms

Tax Forms Outlet Program Order Blank 2006

This file provides the order blank for the Tax Forms Outlet Program (TFOP) by the IRS. It includes detailed instructions for ordering tax forms and necessary contact information. Use this document to ensure you get the tax products you need delivered to the correct address.

Tax Forms

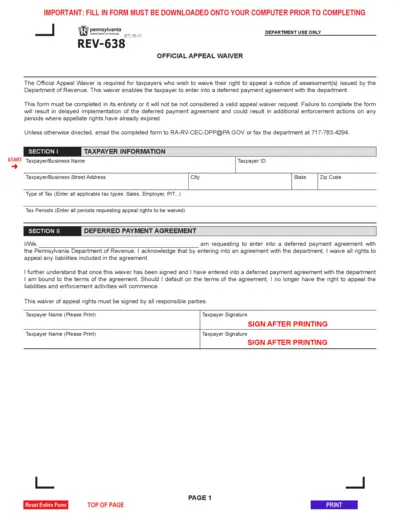

Official Appeal Waiver for Pennsylvania Taxes

This file contains the Official Appeal Waiver form required by the Pennsylvania Department of Revenue. It enables taxpayers to waive their right to appeal a notice of assessment and enter a deferred payment agreement. Complete the form accurately to ensure valid processing.

Tax Forms

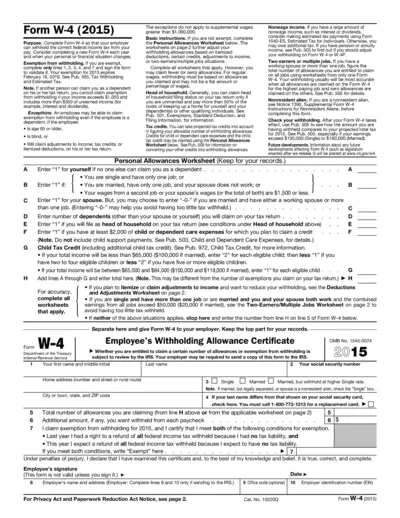

IRS Form W-4 2015 Instructions and Guidelines

Form W-4 (2015) provides essential guidelines on how employees should complete their withholding certificates. This document outlines the steps for determining federal income tax withholding based on personal financial situations. Familiarizing yourself with this form helps you manage tax liabilities effectively.

Tax Forms

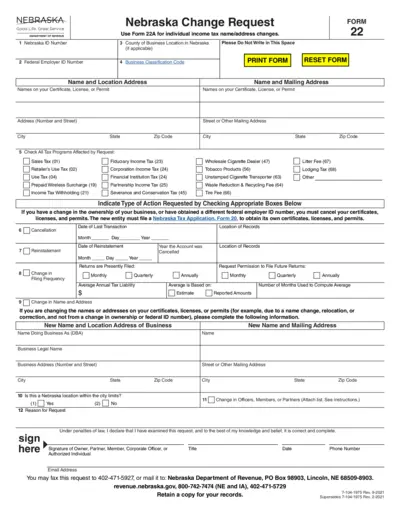

Nebraska Change Request Form for Tax Updates

This file contains the Nebraska Change Request Form, which is used to report changes in business information for tax purposes. This form is essential for individuals and businesses in Nebraska that need to modify their tax certificates and permits. Ensure to fill out the appropriate sections accurately to maintain compliance with state regulations.

Tax Forms

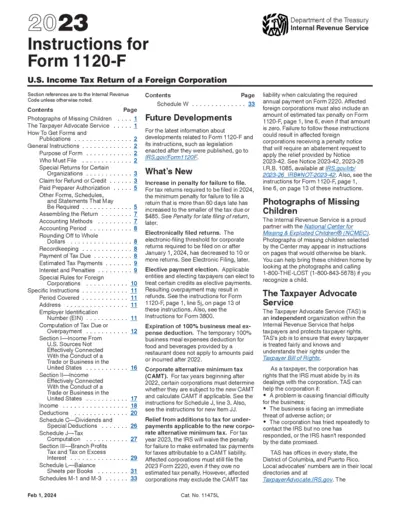

Form 1120-F U.S. Income Tax Return Foreign Corporation

This form is used by foreign corporations to report their income, deductions, and U.S. income tax liability. It allows them to claim refunds and fulfill their tax obligations. Understanding this form is crucial for compliance with U.S. tax regulations.

Tax Forms

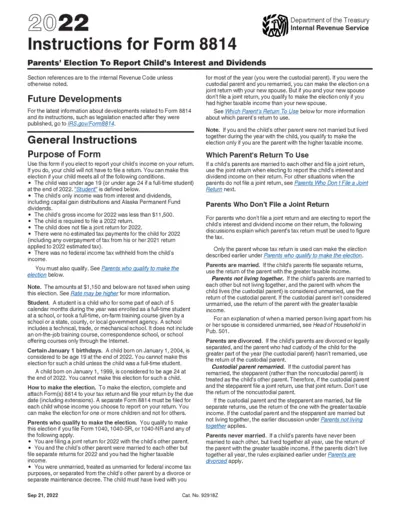

Instructions for Form 8814 Reporting Child Income

Form 8814 allows parents to report their child's interest and dividends on their tax return. This ensures simplicity by eliminating the need for the child to file a separate return. It is beneficial for qualifying parents who want to efficiently manage their child's income tax reporting.

Tax Forms

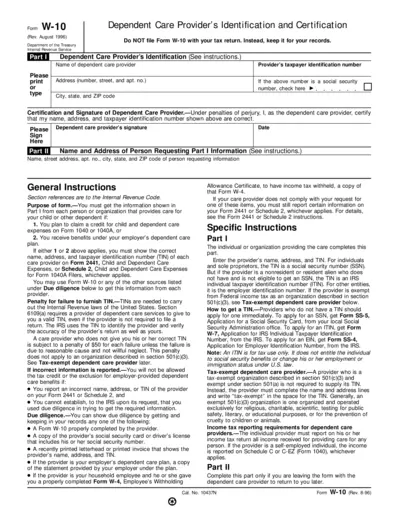

Dependent Care Provider Identification Certification

Form W-10 is essential for parents claiming child care credits. It helps identify dependent care providers for tax purposes. Keep this form for your records and do not submit it with your tax return.

Tax Forms

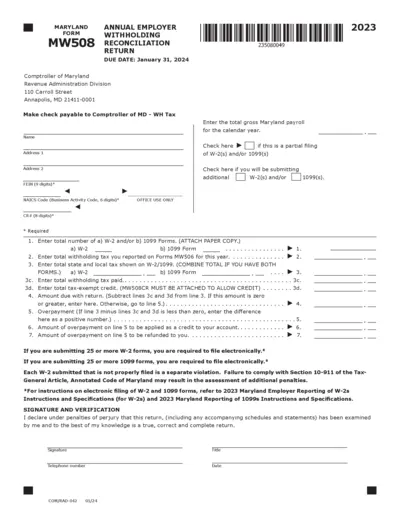

Maryland MW508 2023 Annual Employer Tax Return

The MW508 is a vital document for Maryland employers. It serves as the annual reconciliation of withholding tax and ensures compliance with state tax regulations. Timely submission is crucial to avoid penalties.

Tax Forms

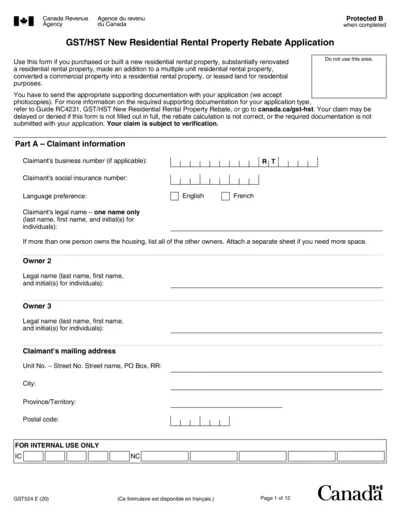

GST/HST New Residential Rental Property Rebate

This form is used to apply for the GST/HST New Residential Rental Property Rebate. It is intended for individuals and businesses that have purchased, built, or substantially renovated a new residential rental property. Ensure to include all necessary documentation to avoid delays or denials.

Tax Forms

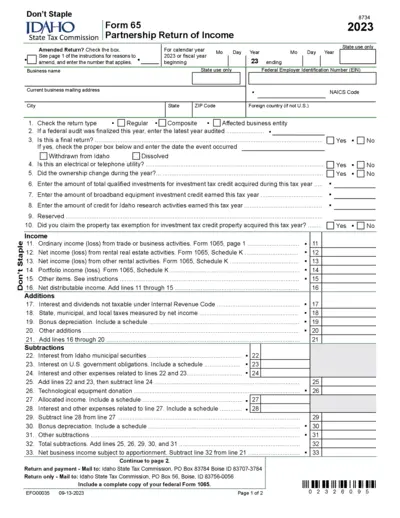

IDAHO State Tax Commission Form 65 Partnership Return

This file contains the Idaho Form 65, used for Partnership Returns for the fiscal year 2023. It provides guidelines for amending the return and necessary instructions for business tax filing.

Tax Forms

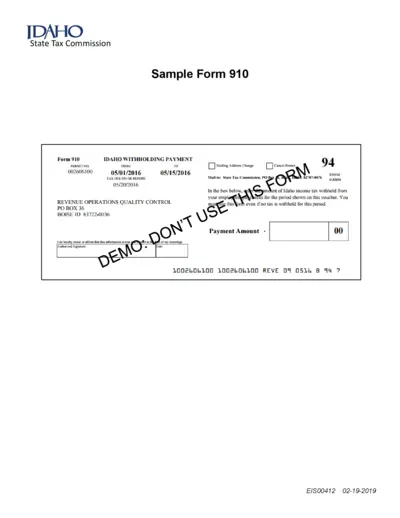

Idaho State Tax Commission Withholding Payment

This file is the Idaho State Tax Commission's Sample Form 910 for withholding payments. It provides instructions for taxpayers to report and remit withheld income taxes. Completing this form accurately ensures compliance with state tax requirements.