Tax Forms Documents

Tax Forms

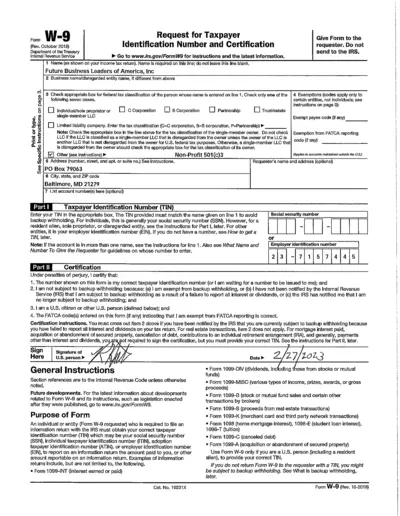

W-9 Request for Taxpayer Identification Form

The W-9 form is essential for providing your taxpayer identification number to requesters. It is required for tax reporting purposes and valid for U.S. persons and entities. Complete this form to avoid backup withholding.

Tax Forms

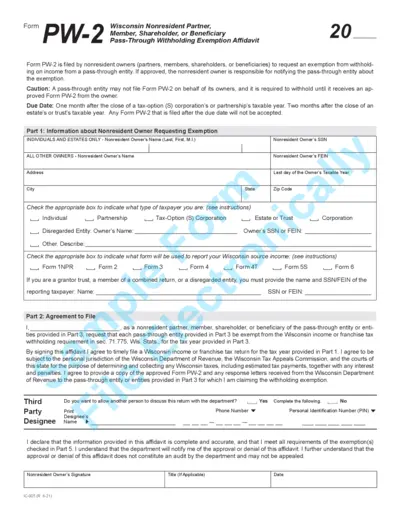

Wisconsin Nonresident Partner Pass-Through Exemption Form

The PW-2 form is designed for nonresident partners, shareholders, or beneficiaries to request an exemption from Wisconsin's income tax withholding. Through this form, individuals can ensure they are not unfairly taxed on income they receive from pass-through entities. The exemption is crucial for those who qualify based on their specific tax situations.

Tax Forms

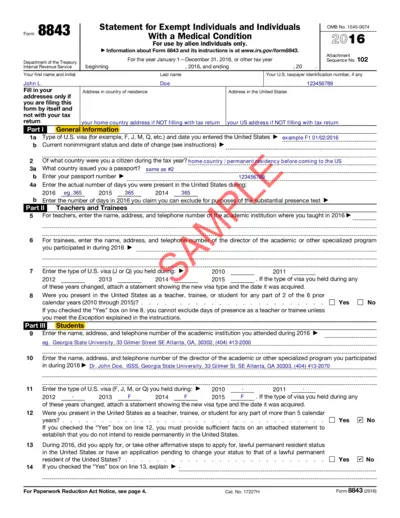

Form 8843 Instructions for Exempt Individuals in 2016

Form 8843 is essential for alien individuals to explain their claim for exclusion of days of presence in the U.S. It is specifically for those who qualify as exempt individuals or have medical conditions preventing departure. This file provides guidance on filling out the form correctly and the necessary details to include.

Tax Forms

Estimated Payment for Individual Income Tax D-40ES

This file provides detailed instructions for filing the D-40ES form. It's essential for those expecting to owe more than $100 in District of Columbia taxes. Use this guide to navigate your estimated payment process easily.

Tax Forms

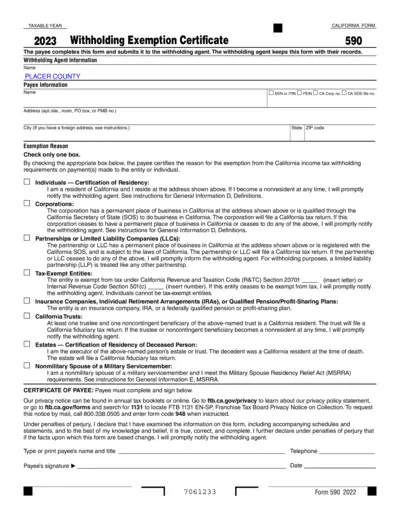

California Withholding Exemption Certificate Form 590

The California Withholding Exemption Certificate (Form 590) allows payees to certify their exemption from withholding on California source income. It is essential for individuals and entities wanting to avoid unnecessary tax withholding for California sourced income. Ensure all fields are completed accurately to avoid issues with the Franchise Tax Board.

Tax Forms

Form 1099-PATR Instructions and Details

This file contains detailed instructions and information for filling out Form 1099-PATR. It is primarily intended for cooperatives making distributions to patrons. Follow the guidelines carefully to ensure accurate reporting.

Tax Forms

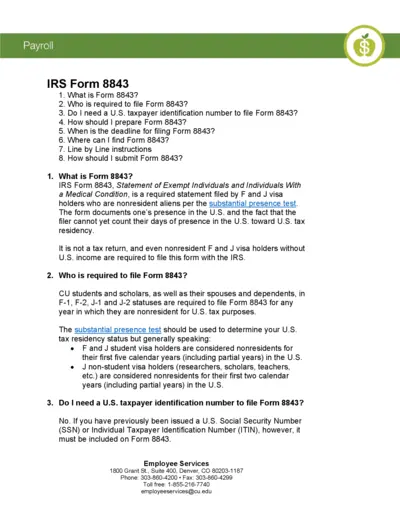

IRS Form 8843 Instructions and Details

IRS Form 8843 is essential for nonresident alien F and J visa holders in the U.S. It verifies their presence and compliance with tax regulations. This document outlines filing requirements, deadlines, and submission methods.

Tax Forms

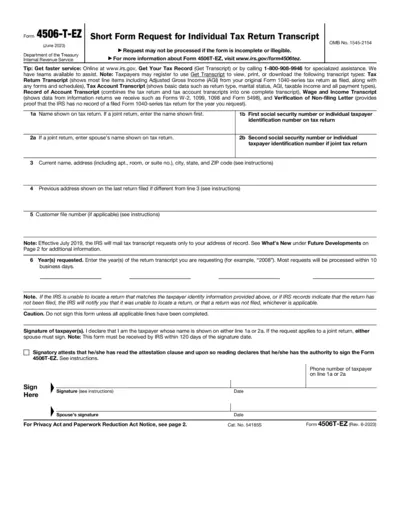

Form 4506-T-EZ Short Request for Tax Transcript

Form 4506-T-EZ is a simplified request for individuals to obtain their tax return transcript. This form is essential for those requiring their tax data for various purposes, including loans and personal records. Ensure the form is completed accurately for swift processing by the IRS.

Tax Forms

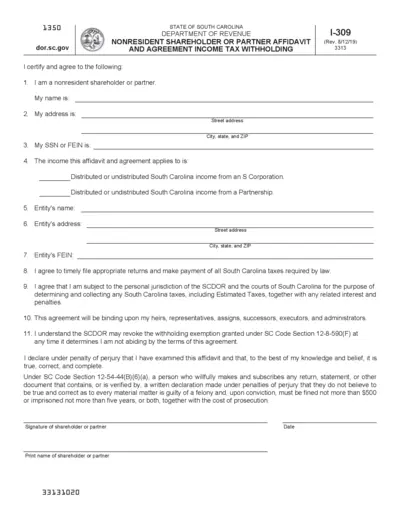

Nonresident Shareholder or Partner Affidavit

This form is essential for nonresident shareholders or partners to declare their status for tax withholding. It ensures compliance with South Carolina tax laws. Proper completion of this form can prevent unnecessary tax withholding.

Tax Forms

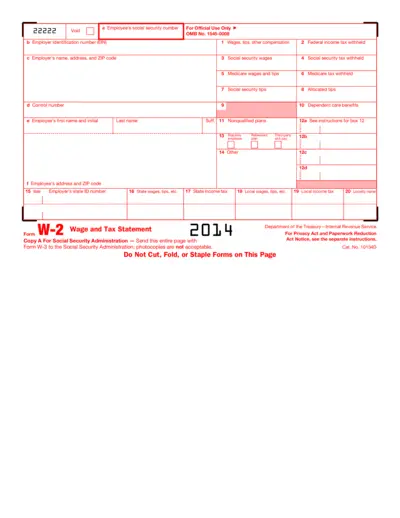

Employee Wage and Tax Statement W-2 Form

The W-2 form is essential for reporting an employee's annual wages and taxes withheld. This form is required for accurate tax filing and reflects earnings to both the employee and the Internal Revenue Service (IRS). It includes critical information such as Social Security wages, Medicare wages, and other compensation details.

Tax Forms

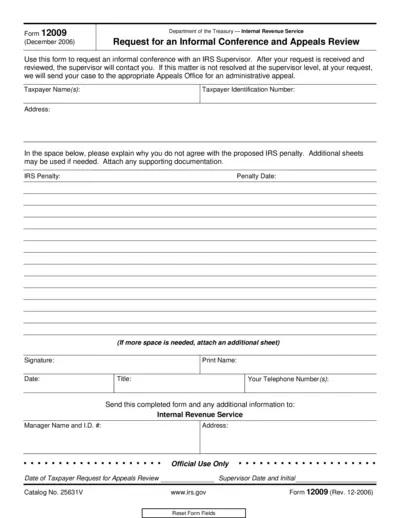

Form 12009 Request for IRS Conference and Review

Form 12009 is used to request an informal conference with an IRS Supervisor. It allows taxpayers to contest an IRS penalty and seek resolution. Utilize this form to initiate an administrative appeal if needed.

Tax Forms

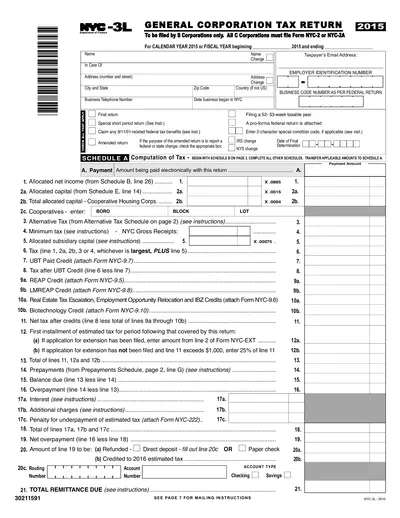

NYC Department of Finance Form NYC-3L 2015 Instructions

This file provides essential instructions for filling out the NYC-3L tax return form for S Corporations in New York City. It includes details on deductions, credits, and necessary fields. Perfect for business owners seeking to comply with NYC taxation requirements.