Tax Forms Documents

Tax Forms

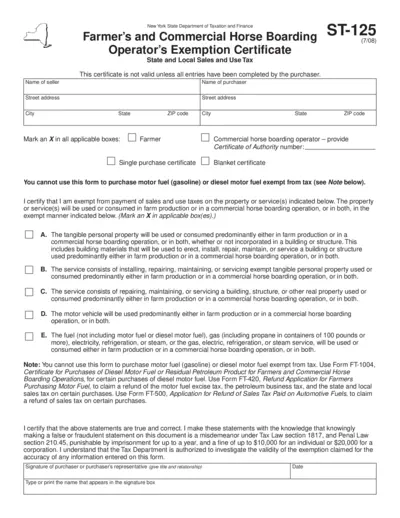

Farmers and Commercial Horse Boarding Tax Exemption

This certificate allows farmers and commercial horse boarding operators in New York to claim sales and use tax exemptions. It must be filled out and presented to sellers. The exemption applies to property and services used predominantly in farm production or boarding operations.

Tax Forms

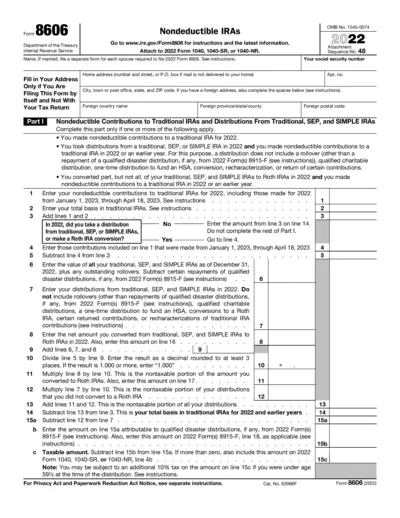

Form 8606: Nondeductible IRAs Instructions for 2022

Form 8606 is used to report nondeductible contributions to traditional IRAs and distributions from traditional, SEP, and SIMPLE IRAs. This form is essential for taxpayers who have made nondeductible contributions in 2022. Accurate completion ensures compliance with IRS regulations.

Tax Forms

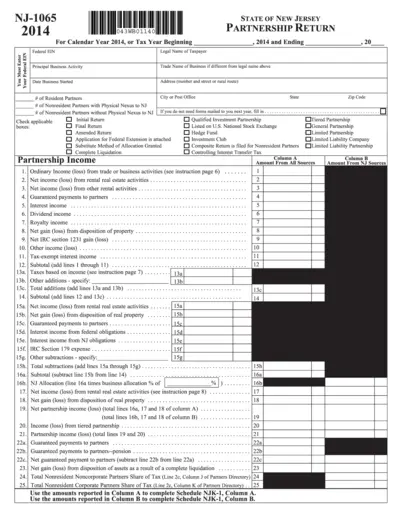

New Jersey Partnership Return NJ-1065 Form

The NJ-1065 form is essential for partnerships operating in New Jersey. This document facilitates the reporting of income, deductions, and credits for partnerships. It is crucial for ensuring compliance with state tax regulations.

Tax Forms

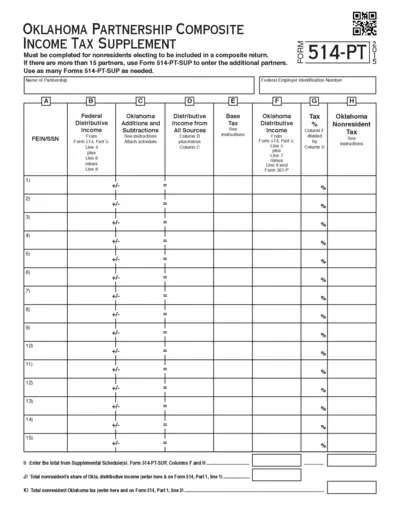

Oklahoma Partnership Composite Income Tax Supplement

This form is essential for nonresidents electing to be part of a composite return for Oklahoma income tax purposes. It helps report distributive income accurately and ensures compliance with state regulations. Use this form if there are over 15 partners to streamline the filing process.

Tax Forms

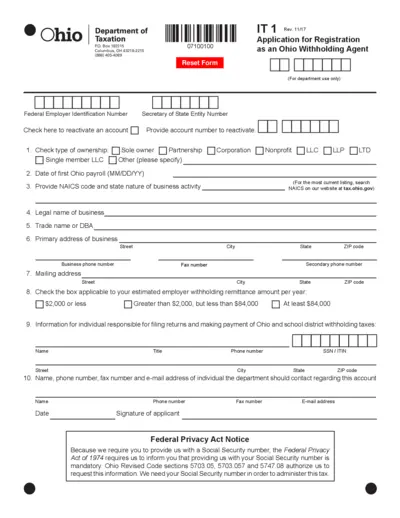

Ohio Withholding Agent Registration Application

This file contains the application for registering as an Ohio withholding agent. It provides essential information needed for tax compliance and withholding in Ohio. Users must complete it accurately to ensure proper processing of payroll taxes.

Tax Forms

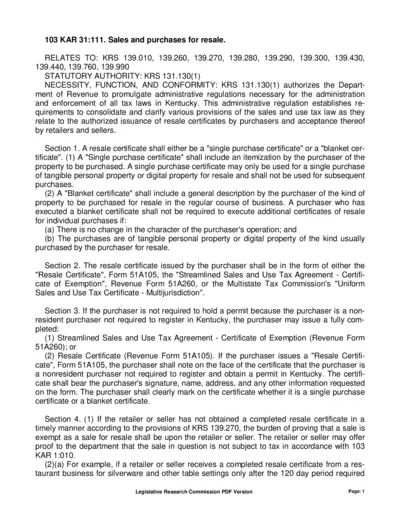

Sales and Purchases for Resale Instructions

This file provides detailed instructions on the use of resale certificates in Kentucky. It helps businesses understand the requirements for purchasing goods for resale. Essential for retailers and sellers in compliance with tax laws.

Tax Forms

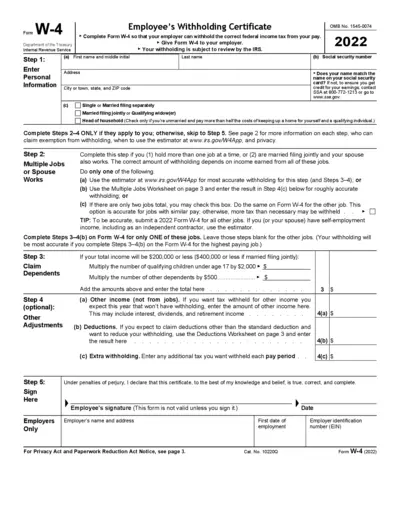

IRS Employee Withholding Certificate Form W-4

The Employee's Withholding Certificate, Form W-4 is essential for employees to inform their employers on withholding federal income tax from their paychecks. This form aids in calculating the correct amount of federal tax to withhold based on personal circumstances. Continue updating your W-4 when your personal or financial situation changes.

Tax Forms

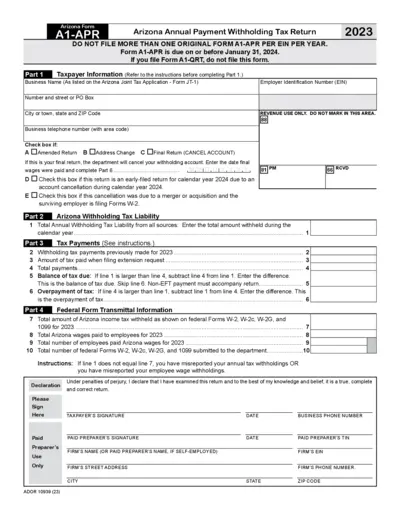

Arizona A1-APR Annual Payment Withholding Tax Return 2023

The Arizona A1-APR form is essential for businesses to report their annual payment withholding tax. This form must be filed by January 31, 2024. Ensure accurate information to avoid penalties.

Tax Forms

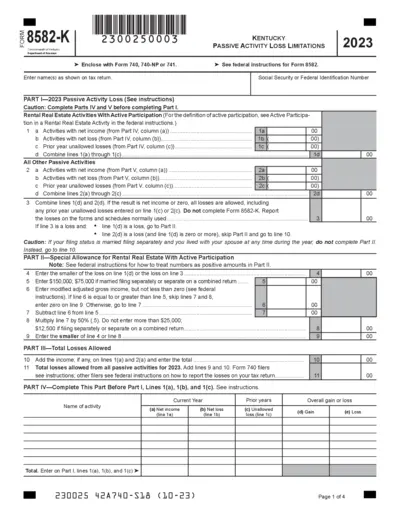

Passive Activity Loss Limitations Form 8582-K Kentucky

The Form 8582-K is essential for reporting passive activity losses in Kentucky. This document assists individuals in accurately calculating allowable losses. Utilize this form to fulfill state requirements for tax submissions related to passive activities.

Tax Forms

IRS Form 1099-S Proceeds From Real Estate Transactions

The IRS Form 1099-S is used to report proceeds from real estate transactions. This form is essential for both filers and transferors to correctly report tax information to the IRS. Ensure you have all necessary details when preparing this form.

Tax Forms

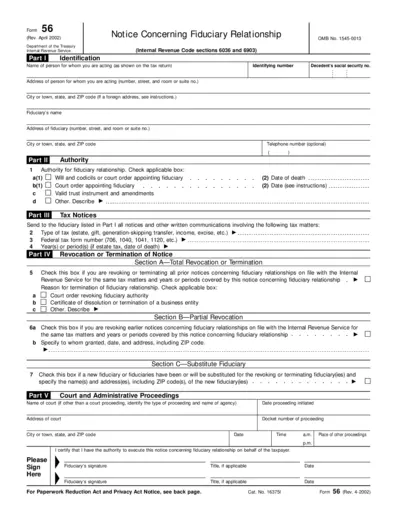

Notice Concerning Fiduciary Relationship Form

This form allows fiduciaries to notify the IRS of the creation or termination of a fiduciary relationship. It is essential for managing tax responsibilities for estates, trusts, and other entities. Completing this form ensures proper notification and compliance with IRS regulations.

Tax Forms

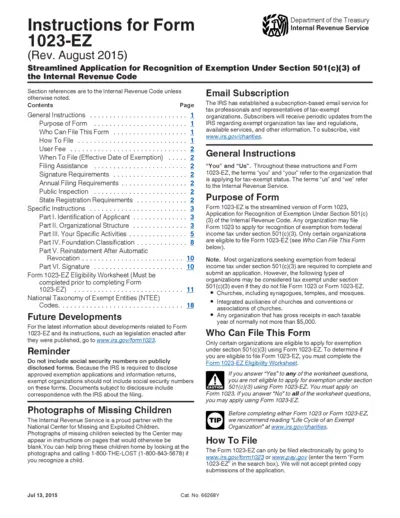

Form 1023-EZ Instructions for Tax Exemption

This file provides detailed instructions for completing Form 1023-EZ, the streamlined application for 501(c)(3) tax exemption. It includes eligibility requirements and filing procedures. Essential guidance for organizations seeking exempt status.