Tax Forms Documents

Tax Forms

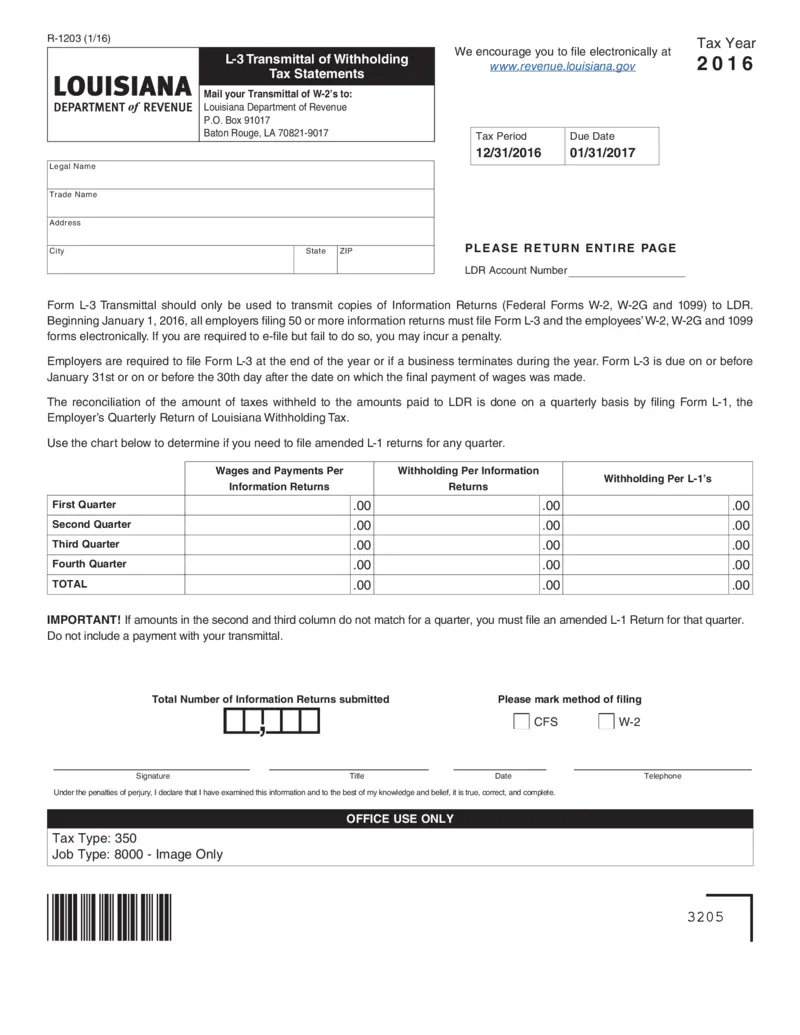

L-3 Transmittal of Withholding Tax Statements

The L-3 form is essential for Louisiana employers who need to transmit W-2 and 1099 forms to the Department of Revenue. Filing electronically is mandatory for those reporting 50 or more information returns. Ensure timely submission to avoid penalties and maintain compliance.

Tax Forms

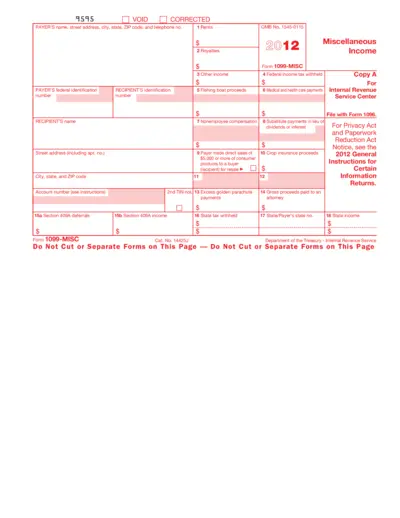

Form 1099-MISC Instructions and Details

This file contains important instructions and information on filling out Form 1099-MISC. It is essential for reporting various types of income to the IRS. Ensure you follow the guidelines provided for accurate submission.

Tax Forms

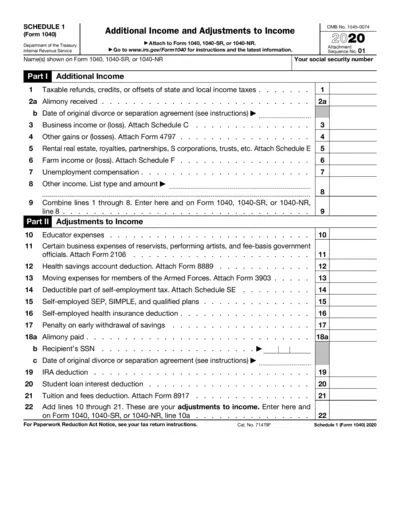

Schedule 1 Form 1040 Additional Income Instructions

This file provides essential instructions and information for filling out Schedule 1 of Form 1040. It is crucial for taxpayers to report additional income and adjustments. Completing this form accurately helps ensure proper tax compliance.

Tax Forms

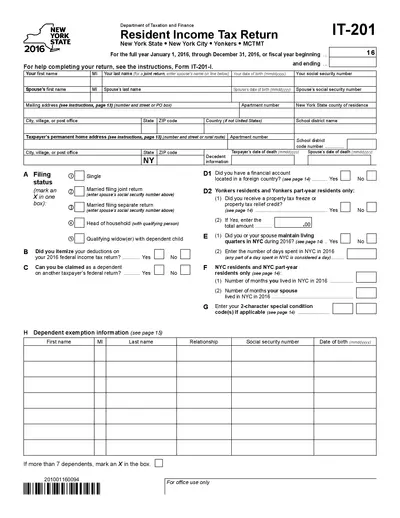

New York State Resident Income Tax Return 2016

This file is a New York State Resident Income Tax Return form for the year 2016. It includes comprehensive instructions and requirements for filing your taxes. Use this form to report your income and calculate your tax obligations accurately.

Tax Forms

General Instructions for Forms W-2 and W-3

This file provides essential instructions for completing Forms W-2 and W-3 needed for employee wage reporting. It outlines important updates, deadlines, and penalties related to tax filings. Employers and accountants will benefit from this comprehensive guide.

Tax Forms

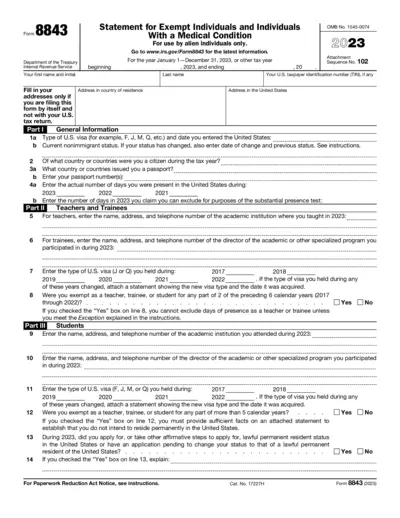

Form 8843 Instructions for Exempt Individuals 2023

Form 8843 is a statement for exempt individuals and individuals with a medical condition for the tax year 2023. It facilitates the declaration of presence in the U.S. and specific circumstances for exemptions. Ensure to follow the guidelines to complete your filing accurately.

Tax Forms

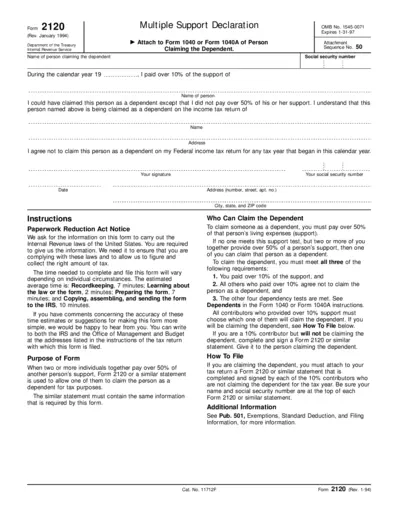

Form 2120 - Multiple Support Declaration for Dependents

Form 2120 allows individuals to declare dependents for tax purposes when two or more people contribute to their support. It outlines the requirements for claiming a dependent based on support percentages. This essential form helps clarify tax responsibility among contributors.

Tax Forms

IRS Tax Form Draft 1099-QA Instructions

This document provides early release draft instructions for filling out Form 1099-QA related to distributions from ABLE accounts. It serves as a guide to ensure correct reporting and compliance with IRS regulations. Users should refer to this draft for informational purposes and wait for the final version for filing.

Tax Forms

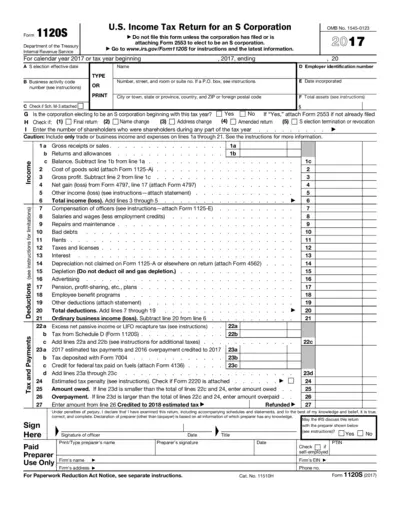

US Income Tax Return for S Corporation Form 1120S

This file is the official U.S. Income Tax Return for S Corporations (Form 1120S). It provides essential guidelines and fields for accurate tax reporting. Use this form to file taxes for S Corporations, ensuring compliance with IRS regulations.

Tax Forms

Fidelity Investments Form 1099-SA Distributions HSA

This document is your Form 1099-SA for Health Savings Account (HSA) distributions. It contains essential information for reporting your total HSA distributions and any associated earnings. Ensure you adhere to IRS regulations when using this form for tax purposes.

Tax Forms

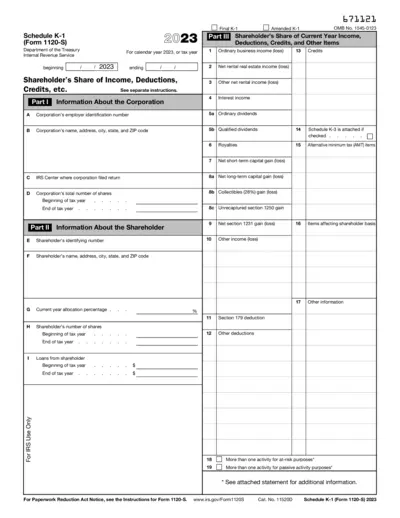

Schedule K-1 Form 1120-S 2023 Detailed Guide

Schedule K-1 (Form 1120-S) is used to report each shareholder's share of income, deductions, and credits for tax year 2023. This form is essential for S corporations to ensure accurate tax reporting. Understanding how to properly fill out this form is crucial for compliance with IRS regulations.

Tax Forms

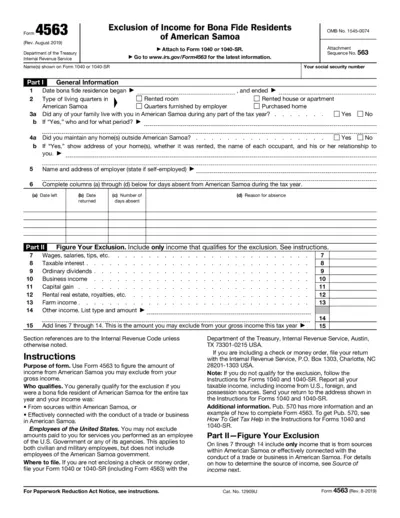

Form 4563 Exclusion of Income for American Samoa

Form 4563 is used to determine the exclusion of income for bona fide residents of American Samoa. It helps individuals exclude qualifying income from their gross income for tax purposes. Follow the instructions provided on the form for accurate filing.